Tax Of Alcohol

Welcome to a comprehensive exploration of the intricate world of taxation on alcohol, a topic that impacts not just consumers but also shapes the economic landscape for governments and industries alike. The taxation of alcohol is a multifaceted issue, with implications ranging from revenue generation to public health and social welfare. This article delves into the depths of this complex subject, offering a detailed analysis that sheds light on the current practices, their implications, and potential future directions.

The Alcohol Taxation Landscape: Global Perspectives

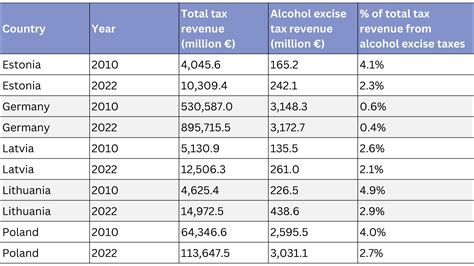

Alcohol taxation is a global phenomenon, with countries employing various strategies to regulate and derive revenue from the sale of alcoholic beverages. These strategies can significantly influence consumer behavior, industry practices, and government revenues. Here, we delve into the diverse approaches adopted worldwide.

Specific Excise Duties: A Common Practice

Many countries opt for specific excise duties, which are taxes levied based on the quantity of the product, often per liter or per unit. This approach is particularly common for beverages like beer, wine, and spirits. For instance, the European Union has a harmonized system of excise duties, with rates varying across member states but generally higher for spirits than for beer and wine.

Consider the case of France, a country renowned for its wine culture. Here, the excise tax on wine is significantly lower compared to spirits, reflecting a societal and cultural preference. In contrast, countries like Sweden have higher excise duties on all alcoholic beverages, aiming to reduce consumption and generate substantial revenue.

| Country | Excise Duty (per liter) |

|---|---|

| France (Wine) | €0.28 |

| Sweden (Beer, Wine, Spirits) | SEK 15-50 (approx. €1.40-4.70) |

Ad Valorem Taxes: A Percentage-Based Approach

In contrast to specific excise duties, some countries employ ad valorem taxes, which are levied as a percentage of the product’s value. This method is often used for luxury goods, including high-end alcoholic beverages. Countries like Australia and New Zealand utilize this approach, with tax rates varying based on the alcohol content and the product’s value.

For instance, in Australia, the Wine Equalisation Tax is an ad valorem tax applied to wine, ensuring that the tax paid is proportionate to the wine's value. This approach differs from the Excise Tax applied to other alcoholic beverages, which is a fixed rate per liter.

Minimum Unit Pricing: A Public Health Measure

Some jurisdictions have implemented minimum unit pricing strategies, primarily as a public health measure to reduce harmful drinking. This approach sets a minimum price per unit of alcohol, ensuring that cheap, high-strength alcohol becomes less affordable. The United Kingdom has been at the forefront of this strategy, with Scotland implementing the first minimum unit pricing policy in 2020.

In Scotland, the minimum price is set at 50 pence per unit, which has led to a significant reduction in the availability of cheap, high-strength alcohol. This policy has been praised for its potential to reduce alcohol-related harm, especially among vulnerable populations.

Alcohol Taxation: Impact and Implications

The strategies employed in alcohol taxation have far-reaching implications, influencing not just the alcohol industry and government revenues but also public health, social welfare, and the broader economy.

Revenue Generation and Economic Impact

Alcohol taxation is a significant source of revenue for governments worldwide. For instance, in the United States, the federal government collected over $10 billion in excise taxes on alcohol in 2021. This revenue often funds various public services, infrastructure, and social programs.

However, the economic impact of alcohol taxation extends beyond revenue generation. It can influence industry growth, employment, and even tourism. For example, countries with renowned wine regions often balance taxation strategies to support the local industry while generating revenue. The French wine industry, with its global reputation, illustrates this delicate balance.

Public Health and Social Welfare Considerations

The taxation of alcohol is also a public health tool, with the potential to reduce harmful drinking and its associated social and health costs. Higher taxes on alcohol can lead to reduced consumption, especially among heavy drinkers, thereby decreasing alcohol-related harm. Studies have shown that increases in alcohol taxes can lead to significant reductions in alcohol-related injuries and deaths.

For instance, in Canada, a study found that a 10% increase in alcohol prices led to a 3% reduction in alcohol-related motor vehicle fatalities. This highlights the potential for alcohol taxation to be a powerful tool in public health strategies.

Industry Adaptation and Innovation

The alcohol industry is often impacted by taxation strategies, leading to adaptation and innovation. Companies may reformulate products to reduce tax liabilities, invest in research and development to create new, lower-tax products, or explore alternative distribution channels to minimize tax impacts.

For example, the craft beer movement in the United States has gained traction partly due to consumers' desire for unique, lower-taxed products. This has led to a surge in small breweries, offering a diverse range of beers that often face lower excise taxes compared to larger breweries.

The Future of Alcohol Taxation: Trends and Predictions

As we look ahead, several trends and predictions emerge that shape the future landscape of alcohol taxation.

Growing Focus on Public Health

There is a growing global trend towards utilizing alcohol taxation as a public health measure. The success of minimum unit pricing in Scotland and other countries has sparked interest in this strategy worldwide. Additionally, there is a push for taxes to be based on alcohol content, ensuring that stronger beverages face higher taxes, thus potentially reducing harmful drinking.

Technological Innovations in Tax Collection

The advancement of technology is set to revolutionize alcohol taxation. From blockchain-based supply chain tracking to advanced analytics for tax evasion detection, technology will play a pivotal role in ensuring tax compliance and efficient collection.

For instance, Australia has implemented a sophisticated excise system, Excisenet, which utilizes digital technologies to track and manage alcohol excise. This system ensures real-time visibility and control over alcohol production and distribution, enhancing tax collection efficiency.

International Harmonization and Cooperation

With the global nature of the alcohol industry, there is a growing need for international harmonization and cooperation in taxation strategies. This includes efforts to combat illicit trade, ensure fair competition, and harmonize tax rates to prevent tax avoidance.

The World Customs Organization and the World Trade Organization are playing key roles in facilitating international discussions and agreements on alcohol taxation, aiming to create a more cohesive and effective global system.

Conclusion: A Complex and Ever-Evolving Landscape

The taxation of alcohol is a complex and dynamic field, with a myriad of strategies, implications, and future possibilities. From specific excise duties to public health-focused measures like minimum unit pricing, the approaches adopted by governments worldwide reflect a delicate balance between revenue generation, public health, and industry considerations.

As we've explored, alcohol taxation has a profound impact on consumer behavior, industry practices, and government policies. The future promises further innovation, with technology and international cooperation set to play pivotal roles. With a growing focus on public health and a need for sustainable revenue generation, the landscape of alcohol taxation is set to evolve, shaping the industry and its impact on society for years to come.

How does alcohol taxation impact consumer behavior?

+Alcohol taxation can significantly influence consumer behavior. Higher taxes often lead to reduced consumption, especially among price-sensitive consumers. This can result in consumers opting for cheaper alternatives or reducing their overall alcohol intake.

What are the main challenges in alcohol tax collection?

+Challenges in alcohol tax collection include tax evasion and fraud, which can be facilitated by the complex supply chain in the alcohol industry. Additionally, the diversity of alcoholic beverages and their pricing strategies can make tax administration complex.

How do alcohol taxes impact the industry’s innovation and sustainability?

+Alcohol taxes can stimulate innovation as companies strive to reduce tax liabilities. This can lead to the development of new, lower-tax products or the exploration of alternative distribution channels. However, high taxes can also make it challenging for smaller producers to survive, impacting the industry’s overall sustainability.