Student Loan Tax Form

The student loan tax form is an essential document that plays a crucial role in the financial lives of countless individuals pursuing higher education. As the cost of education continues to rise, understanding the intricacies of this form and its implications becomes increasingly vital. In this comprehensive guide, we will delve into the world of student loan tax forms, exploring their purpose, significance, and the impact they have on both borrowers and the education system as a whole.

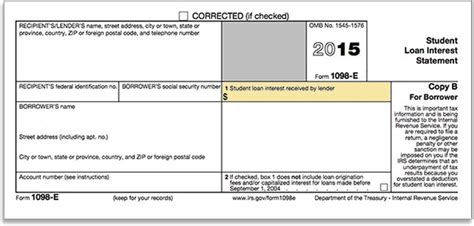

The student loan tax form, often referred to as the IRS Form 1098-E, is a critical component of the financial journey for students and graduates. It serves as a record of the interest paid on eligible federal and private student loans during a given tax year. This form holds significant importance for taxpayers, as it can potentially unlock valuable tax benefits and deductions, easing the financial burden of education.

Understanding the Student Loan Tax Form

The student loan tax form is a standardized document issued by financial institutions and loan servicers to borrowers who have made qualifying interest payments on their student loans. It provides a detailed breakdown of the interest paid throughout the tax year, allowing individuals to claim deductions or credits when filing their federal income tax returns.

One of the key advantages of the student loan tax form is its potential to reduce the overall tax liability for borrowers. By accurately reporting the interest paid, individuals can claim a deduction on their taxable income, effectively lowering the amount of tax they owe. This deduction can provide much-needed financial relief, especially for recent graduates or those with high student loan balances.

Furthermore, the student loan tax form serves as a vital tool for financial planning and budgeting. It provides borrowers with a clear understanding of their interest expenses, helping them assess their financial situation and make informed decisions regarding loan repayment strategies. By analyzing the interest paid, individuals can explore options such as refinancing or consolidating their loans to potentially reduce interest costs and manage their debt more effectively.

Eligibility and Requirements

To be eligible for the student loan tax deduction, individuals must meet certain criteria. The IRS sets specific guidelines regarding the types of loans and interest payments that qualify for this benefit. Generally, eligible loans include federal student loans, such as Direct Loans, Stafford Loans, and PLUS Loans, as well as certain private student loans.

Additionally, the interest paid must exceed a certain threshold to be deductible. The IRS adjusts this threshold annually, and it is important for borrowers to stay updated on the latest requirements. It is worth noting that the deduction is limited to the amount of interest paid, and it is not applicable to the principal amount of the loan.

| Loan Type | Eligible for Deduction |

|---|---|

| Federal Student Loans | Yes |

| Private Student Loans | Varies (Check with lender/servicer) |

| Parent PLUS Loans | Yes (if borrower is the student) |

| Consolidated Loans | Yes (if original loans were eligible) |

Maximizing the Benefits: Strategies and Tips

To make the most of the student loan tax form and its associated benefits, borrowers should consider the following strategies and tips:

-

Stay Organized: Keep track of all your student loan documents, including the tax form, throughout the year. This ensures you have the necessary information when it comes time to file your taxes.

-

Understand the Deduction Rules: Familiarize yourself with the IRS guidelines regarding the student loan interest deduction. This includes understanding the eligibility criteria, the maximum deductible amount, and any phase-out limitations based on your income.

-

Explore Tax Software: Utilizing tax preparation software or seeking professional assistance can simplify the process of claiming the deduction. These tools often guide you through the necessary steps and ensure accurate reporting.

-

Optimize Your Repayment Strategy: The student loan tax form can provide valuable insights into your interest expenses. Consider using this information to explore options such as refinancing or consolidating your loans to potentially reduce interest costs and optimize your repayment plan.

-

Take Advantage of Education Tax Credits: In addition to the student loan interest deduction, there are other education-related tax credits available, such as the American Opportunity Tax Credit or the Lifetime Learning Credit. Research and consider whether you qualify for these credits to further reduce your tax liability.

Case Study: Real-Life Impact

Let’s illustrate the impact of the student loan tax form with a real-life example. Meet Sarah, a recent graduate with a student loan balance of 50,000. During her first year of repayment, Sarah paid 2,000 in interest on her loans. By claiming the student loan interest deduction, she was able to reduce her taxable income by 2,000, resulting in a substantial tax savings of approximately 600 (assuming a 30% marginal tax rate). This relief provided Sarah with extra financial breathing room and helped her manage her student loan burden more effectively.

The Future of Student Loan Tax Benefits

As the landscape of higher education and student loan debt evolves, the role of the student loan tax form and its associated benefits may also undergo changes. Policy shifts and legislative reforms could impact the availability and structure of these tax incentives. It is essential for borrowers and taxpayers to stay informed about any updates or modifications to ensure they can maximize the advantages offered by the student loan tax form.

Furthermore, the growing awareness of the student debt crisis and its impact on individuals and the economy has sparked discussions about potential reforms. Some advocates propose expanding the eligibility criteria for the student loan interest deduction or introducing new tax credits specifically targeted at student loan borrowers. These developments could shape the future of student loan tax benefits and provide additional support for individuals navigating the complex world of student debt.

Conclusion

The student loan tax form is a powerful tool that can provide much-needed financial relief to borrowers. By understanding its purpose, eligibility requirements, and the strategies for maximizing its benefits, individuals can effectively navigate the complex world of student loan taxation. As the education system continues to evolve, staying informed about tax benefits and advocating for further support can contribute to a more sustainable and equitable higher education landscape.

Can I claim the student loan interest deduction if I am a dependent on my parent’s tax return?

+The eligibility for the student loan interest deduction depends on various factors, including your dependency status. If you are a dependent on your parent’s tax return, your parents may be able to claim the deduction if they paid the interest on your behalf and meet other eligibility criteria. It is recommended to consult a tax professional to determine your specific eligibility.

Are there any income limitations for claiming the student loan interest deduction?

+Yes, there are income limitations for claiming the student loan interest deduction. The deduction begins to phase out for modified adjusted gross incomes above a certain threshold, which varies based on your filing status. It is important to review the latest IRS guidelines to determine if your income falls within the eligible range.

Can I claim the deduction if I made payments on a parent’s student loan?

+Generally, you can only claim the student loan interest deduction if the loan is in your name. However, if you are the borrower of a Parent PLUS Loan, you may be eligible to claim the deduction as long as you meet the other eligibility criteria. It is essential to consult the IRS guidelines or a tax professional for specific details regarding your situation.