Seattle Washington Tax Rate

When discussing tax rates in the United States, it's important to consider the diverse tax landscapes that exist across different states and localities. Seattle, Washington, is no exception, offering a unique tax environment that impacts both residents and businesses. In this comprehensive guide, we will delve into the intricacies of Seattle's tax system, exploring the various taxes levied and how they affect the city's vibrant economy.

Understanding Seattle’s Tax Structure

Seattle’s tax structure is a combination of federal, state, and local taxes, each with its own set of rules and regulations. The city’s tax system is designed to support public services, infrastructure development, and community initiatives, contributing to the overall well-being of its residents.

Federal Taxes

As a resident of the United States, individuals and businesses in Seattle are subject to federal taxes. The Internal Revenue Service (IRS) oversees the collection of these taxes, which primarily consist of income taxes, payroll taxes, and excise taxes. The federal tax rate varies depending on income brackets and other factors, and it plays a crucial role in funding national programs and initiatives.

State Taxes

Washington State imposes several taxes to generate revenue for state-level operations and services. These taxes include:

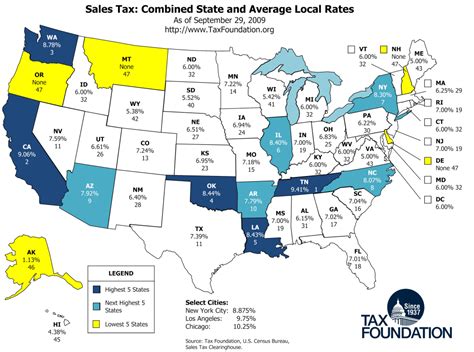

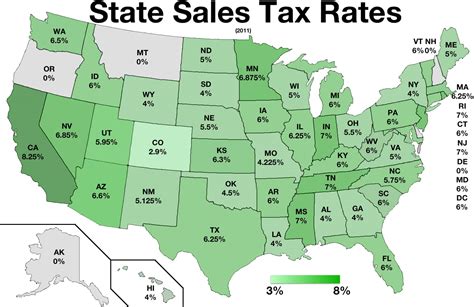

- Sales and Use Tax: A percentage-based tax applied to the sale of tangible goods and some services. The state sales tax rate is 6.5%, but local jurisdictions may add additional sales tax, resulting in a combined rate of up to 10.1% in certain areas.

- Business and Occupation (B&O) Tax: This tax is levied on businesses based on their gross revenue. It is a privilege tax for the right to do business in the state and is calculated using different methods depending on the type of business activity.

- Property Tax: Real estate and personal property owners in Washington pay property taxes, which are used to fund local services such as schools, fire departments, and public safety.

- Excise Taxes: These taxes are applied to specific activities or transactions, such as fuel, tobacco, and vehicle purchases. The rates vary depending on the type of excise tax.

Local Taxes in Seattle

In addition to state taxes, Seattle has its own set of local taxes to support city-specific initiatives and projects. These taxes include:

- Seattle Business Tax: All businesses operating within Seattle city limits are subject to this tax, which is based on the business's gross receipts. The tax rate varies depending on the type of business and its revenue.

- Seattle Resident Tax: Seattle residents pay a local income tax, which is calculated as a percentage of their federal adjusted gross income. This tax contributes to the city's general fund and supports various public services.

- Seattle Sales Tax: On top of the state sales tax, Seattle adds its own local sales tax, bringing the combined sales tax rate in the city to 10.1%. This additional revenue is used for specific projects and initiatives, such as transportation improvements and community development.

- Residential Parking Permits: Residents of certain Seattle neighborhoods are required to purchase parking permits, contributing to the management and improvement of on-street parking spaces.

Tax Benefits and Incentives

While Seattle’s tax rates may seem extensive, the city also offers various tax benefits and incentives to promote economic growth and attract businesses. These incentives can significantly reduce the overall tax burden for eligible individuals and companies.

Business Tax Incentives

Seattle provides several tax incentives for businesses, including:

- Business and Occupation Tax Deferral: Eligible businesses can defer a portion of their B&O tax payments for up to five years, helping them manage cash flow during the initial stages of operation.

- Research and Development Tax Credit: Businesses engaged in qualified research and development activities can claim a tax credit, reducing their overall tax liability.

- Job Creation Incentives: Seattle offers tax breaks and incentives for businesses that create new jobs, particularly in targeted industries such as technology and clean energy.

Individual Tax Benefits

Individuals in Seattle can take advantage of various tax benefits, such as:

- Low-Income Tax Credits: Seattle's Low-Income Housing Tax Credit program encourages the development of affordable housing by providing tax credits to eligible developers.

- Senior Citizen and Disabled Citizen Property Tax Exemption: Qualified seniors and disabled individuals may be eligible for a property tax exemption, reducing their tax burden on their primary residences.

- Homeowner's Exemption: Homeowners in Seattle can apply for a homeowner's exemption, which reduces the assessed value of their property for tax purposes, resulting in lower property taxes.

Tax Compliance and Reporting

Navigating Seattle’s tax landscape requires careful compliance and accurate reporting. Businesses and individuals must adhere to specific tax regulations to avoid penalties and ensure a smooth tax experience.

Business Tax Registration and Filing

Businesses operating in Seattle must register with the Washington Department of Revenue and obtain the necessary business licenses and permits. Depending on the nature of the business, additional registrations may be required at the local level. Businesses must then file their tax returns and make payments by the specified deadlines.

Individual Tax Filing

Seattle residents are required to file federal, state, and local tax returns annually. The filing process involves calculating income, deductions, and credits, and determining the appropriate tax liability. Residents can choose to file their taxes independently or seek professional assistance from tax preparers or accountants.

Impact on the Local Economy

Seattle’s tax system plays a pivotal role in shaping the city’s economic landscape. The revenue generated from taxes funds essential services, infrastructure projects, and community initiatives, contributing to the overall prosperity and livability of the city.

Infrastructure Development

Tax revenues are invested in various infrastructure projects, including transportation networks, public transit systems, and utility improvements. These investments enhance connectivity, accessibility, and the overall quality of life for Seattle residents and businesses.

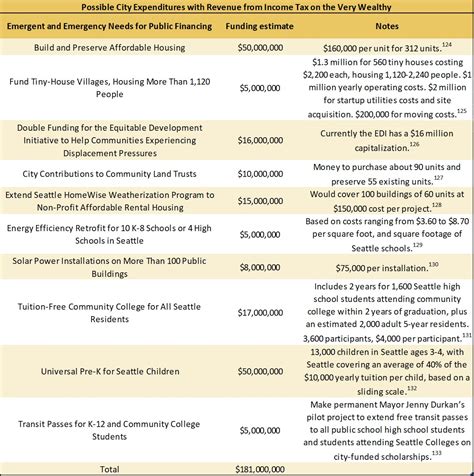

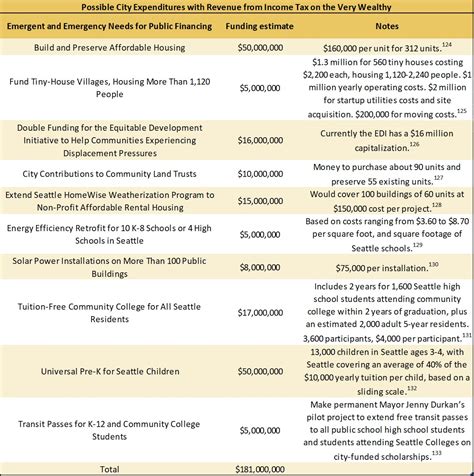

Community Initiatives

The city’s tax structure supports community initiatives such as affordable housing programs, education initiatives, and social services. By allocating tax revenue to these areas, Seattle aims to create a more equitable and inclusive environment for all its residents.

Economic Growth and Business Support

Seattle’s tax incentives and benefits attract businesses and foster economic growth. The city’s commitment to supporting entrepreneurship and innovation has contributed to its reputation as a hub for technology, biotechnology, and sustainable industries.

| Tax Type | Rate |

|---|---|

| State Sales Tax | 6.5% |

| Local Sales Tax (Seattle) | 3.6% |

| Business and Occupation Tax | Varies by business type |

| Property Tax | Varies by location and property value |

| Seattle Resident Tax | 1.1% - 2.7% |

Frequently Asked Questions

What is the overall tax rate in Seattle for businesses?

+The total tax rate for businesses in Seattle varies depending on the type of business and its revenue. On average, businesses can expect to pay a combined rate of around 1.4% to 4.8% for the Seattle Business Tax, on top of state and federal taxes.

Are there any tax breaks for small businesses in Seattle?

+Yes, Seattle offers several tax incentives for small businesses, including B&O tax deferrals, research and development tax credits, and job creation incentives. These programs aim to support small businesses and encourage economic growth.

How do I register my business for taxes in Seattle?

+To register your business for taxes in Seattle, you must obtain a Business License from the Seattle Department of Finance and Administrative Services. Additionally, you may need to register with the Washington Department of Revenue and obtain specific licenses or permits based on your business activities.

What are the deadlines for filing taxes in Seattle?

+The deadlines for filing taxes in Seattle align with federal and state tax deadlines. Generally, individual tax returns are due by April 15th, while business tax returns may have different deadlines depending on the type of business and its revenue.

Are there any tax benefits for homeowners in Seattle?

+Yes, Seattle offers several tax benefits for homeowners, including the Homeowner’s Exemption, which reduces the assessed value of a property for tax purposes. Additionally, low-income homeowners may qualify for property tax exemptions or reduced rates.