Work From Home Tax Deductions

The concept of working from home has gained significant traction in recent years, with many individuals embracing the flexibility and convenience it offers. However, one often overlooked aspect is the potential tax benefits that come with maintaining a home office. Understanding the tax deductions available can significantly impact your overall financial situation, especially when navigating the complex world of tax laws. This comprehensive guide will delve into the intricacies of work-from-home tax deductions, providing you with the knowledge to maximize your savings.

Eligible Work-from-Home Expenses: A Comprehensive Overview

When it comes to claiming tax deductions for work-from-home expenses, it’s essential to understand which costs are eligible and how to properly document them. The Internal Revenue Service (IRS) has specific guidelines for what constitutes a deductible expense, and staying informed about these regulations is crucial for maximizing your tax benefits.

One of the primary deductions many remote workers are eligible for is the home office deduction. This deduction allows you to claim a portion of your home's operating and maintenance costs based on the percentage of your home used exclusively for business purposes. For instance, if you have a dedicated home office space that takes up 10% of your home's total square footage, you can potentially claim 10% of certain expenses such as mortgage interest, property taxes, insurance, utilities, and maintenance costs.

Beyond the home office deduction, there are numerous other work-related expenses that can be claimed. These include internet and phone costs (if used primarily for business), office supplies like stationery and printer ink, computer equipment and software, furniture specifically for your home office, and mileage for any business-related travel outside your home, such as client meetings or trips to the post office.

It's important to note that the IRS requires proper documentation for all claimed expenses. This means keeping detailed records of your expenses, including receipts, invoices, and a log of business mileage. Additionally, you'll need to maintain a clear distinction between personal and business use for certain items, such as internet and phone services, to ensure you're claiming only the business portion.

| Expense Category | Eligible Deductions |

|---|---|

| Home Office | Mortgage interest, property taxes, insurance, utilities, maintenance |

| Communication | Internet and phone costs (business portion) |

| Office Supplies | Stationery, printer ink, etc. |

| Equipment | Computers, software, furniture |

| Travel | Mileage for business-related travel |

Maximizing Your Deductions: Strategies and Best Practices

To make the most of your work-from-home tax deductions, it’s essential to employ strategic planning and organization. Here are some key strategies and best practices to help you maximize your savings:

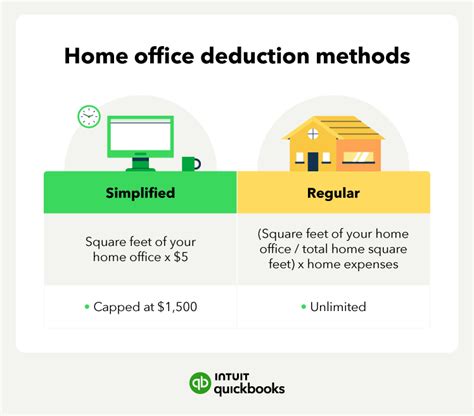

1. Understand the Simplified Option vs. Regular Method

The IRS offers two methods for claiming the home office deduction: the simplified option and the regular method. The simplified option provides a standard deduction of $5 per square foot of your home office space, up to 300 square feet. This method is straightforward and requires minimal documentation, making it an attractive choice for many remote workers.

However, if your expenses exceed the standard deduction or you want to claim additional deductions beyond the home office, you'll need to use the regular method. This approach involves calculating your deductions based on the percentage of your home used for business and documenting all eligible expenses. While more complex, the regular method can lead to significant savings for those with higher expenses or specific business needs.

2. Deducting Equipment and Supplies: A Detailed Approach

When it comes to equipment and supplies, it’s important to understand the different approaches to claiming these expenses. For computer equipment and software, you can either deduct the full cost in the year of purchase or spread the cost over multiple years using depreciation. Depreciation allows you to deduct a portion of the cost each year, which can be beneficial for more expensive items.

For office supplies, you have the option to either deduct the cost in the year of purchase if it's under a certain threshold (typically $2,500), or you can track and deduct these expenses as you incur them. Keeping detailed records of supply purchases and usage will ensure you're maximizing your deductions.

3. Tracking Business Travel and Mileage

If you travel for business purposes outside your home office, it’s crucial to track these trips and the associated mileage. The IRS allows you to deduct mileage at a standard rate, which changes annually. Keep a detailed log of your business travel, including dates, destinations, and purposes, and ensure you’re using the correct mileage rate for the tax year in question.

Additionally, consider tracking other travel-related expenses such as parking fees, tolls, and public transportation costs. These can be deducted along with your mileage, providing additional savings.

4. Documenting and Organizing Your Records

Proper documentation is key to a successful tax deduction strategy. Keep detailed records of all your work-from-home expenses, including receipts, invoices, and any other supporting documentation. Consider using digital tools or apps specifically designed for expense tracking to simplify this process.

Organize your records by category and ensure you have a clear understanding of which expenses are deductible and why. This not only helps with your tax preparation but also provides valuable insights into your business spending habits, allowing you to make more informed financial decisions.

Common Pitfalls and Frequently Asked Questions

Navigating the world of work-from-home tax deductions can be complex, and it’s natural to have questions and concerns. Here are some common pitfalls to avoid and answers to frequently asked questions to help guide you through the process:

Can I deduct my entire mortgage or rent if I work from home?

+No, you cannot deduct your entire mortgage or rent. The IRS requires that you calculate the percentage of your home used exclusively for business and deduct only that portion of your housing expenses. For example, if your home office occupies 10% of your home, you can deduct 10% of your mortgage interest, property taxes, and other eligible expenses.

What if I use my personal phone for business calls? Can I deduct the entire cost?

+It's important to distinguish between personal and business use when claiming phone expenses. You can deduct the business portion of your phone costs, which is calculated based on the percentage of business calls you make. Keep a record of your business calls and ensure you're only claiming the relevant portion.

Are there any limitations on the home office deduction for renters?

+Renters can claim the home office deduction just like homeowners. However, instead of claiming mortgage interest and property taxes, renters can deduct a portion of their rent and utility costs based on the percentage of their home used for business purposes.

Can I deduct the cost of my morning coffee if I work from home?

+Unfortunately, personal expenses like coffee or snacks are not deductible. The IRS allows deductions for business-related expenses only. However, if you have a dedicated coffee station in your home office that you use exclusively for business (e.g., for client meetings), you may be able to deduct a portion of those expenses as part of your home office deduction.

How often should I update my records for work-from-home deductions?

+It's a good practice to update your records regularly, ideally on a monthly basis. This helps you stay organized and ensures you're accurately tracking your expenses throughout the year. Regular updates also make tax preparation less daunting when it's time to file your return.

By understanding the eligible expenses, employing strategic planning, and avoiding common pitfalls, you can maximize your work-from-home tax deductions. Remember, proper documentation and organization are key to a successful tax strategy, so stay diligent and take advantage of the benefits available to you as a remote worker.