Vehicle Sales Tax Calculator

Welcome to this comprehensive guide on understanding and calculating vehicle sales tax, a crucial aspect of the automotive industry and an essential consideration for both buyers and sellers. In this article, we will delve into the intricacies of vehicle sales tax, exploring the various factors that influence it, the calculation methods, and the practical implications for consumers and businesses alike. By the end of this piece, you'll have a clear understanding of how sales tax is applied to vehicle purchases and the steps you can take to ensure accurate calculations and compliance with tax regulations.

The Complex World of Vehicle Sales Tax

Vehicle sales tax is a critical component of the automotive sales process, varying widely across different jurisdictions and often presenting a complex landscape for both buyers and sellers. It is a key revenue source for governments, contributing significantly to public finances and infrastructure development. Understanding the nuances of vehicle sales tax is essential for making informed purchasing decisions and ensuring compliance with legal obligations.

Jurisdictional Differences

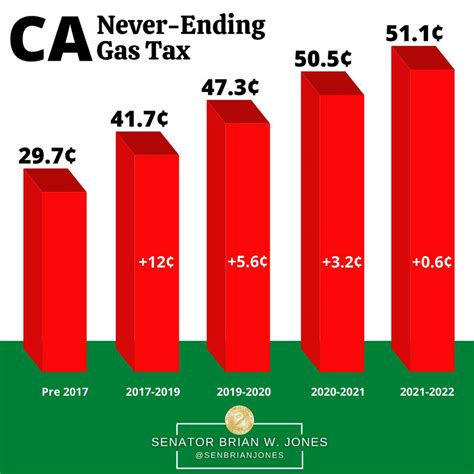

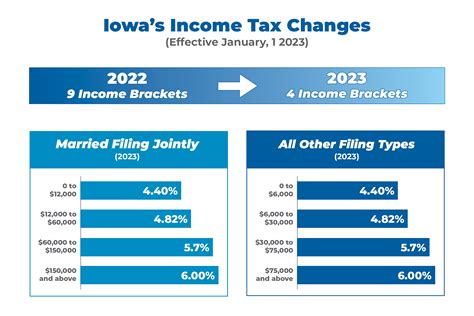

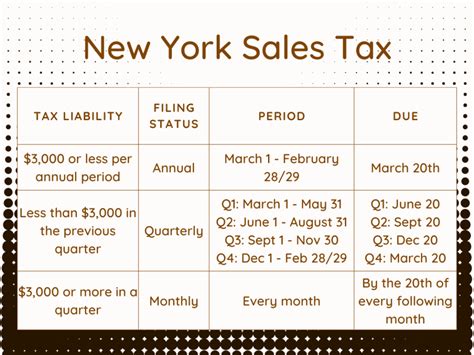

One of the primary challenges in vehicle sales tax is the significant variations across different regions and countries. Tax rates, applicable rules, and calculation methods can differ drastically, making it a complex and dynamic aspect of the automotive industry. For instance, in the United States, sales tax is typically levied at the state level, with some states even allowing local jurisdictions to impose additional taxes. This creates a patchwork of tax rates and regulations, making it essential for buyers and sellers to be well-informed about the specific tax requirements in their area.

| State | Sales Tax Rate (%) |

|---|---|

| Alabama | 4.0 |

| Alaska | 0.0 (No State Sales Tax) |

| Arizona | 5.6 |

| Arkansas | 6.5 |

| ... | ... |

Taxable Amount and Calculation Methods

The taxable amount for vehicle sales tax is not always straightforward. It often includes the base vehicle price, additional options and accessories, and in some cases, fees such as destination charges and dealer preparation costs. The calculation method can vary, with some jurisdictions using a simple percentage-based approach, while others may employ more complex formulas that consider factors like vehicle weight or engine size. This complexity arises from the diverse tax structures and the desire of governments to align tax obligations with the value and specifications of the vehicle.

Exemptions and Special Cases

Vehicle sales tax is not a one-size-fits-all concept. There are various exemptions and special cases that can impact the tax liability of a vehicle purchase. For instance, certain states offer sales tax exemptions for specific types of vehicles, such as electric or hybrid cars, as an incentive to promote environmentally friendly transportation. Additionally, some jurisdictions provide tax breaks for certain consumer groups, such as veterans or individuals with disabilities. Understanding these exemptions is vital for both buyers and sellers to ensure they are applying the correct tax rates and complying with relevant regulations.

The Impact of Vehicle Sales Tax on Buyers and Sellers

Vehicle sales tax has a significant impact on both buyers and sellers, influencing their decision-making processes and overall financial obligations. For buyers, understanding the sales tax component is crucial for budgeting and making informed choices. It directly affects the total cost of the vehicle, and with the complex nature of tax rates and regulations, it can be a substantial financial consideration.

Buyer’s Perspective

When purchasing a vehicle, buyers must carefully consider the sales tax implications. The tax amount can vary based on the vehicle’s price, location, and applicable tax rates. For example, a high-end luxury car in a state with a high sales tax rate could result in a substantial tax liability, potentially thousands of dollars. Buyers must factor this into their purchasing decision, ensuring they have a clear understanding of the total cost, including tax, to avoid any financial surprises.

Additionally, buyers should be aware of any available tax incentives or exemptions. These can significantly reduce the overall cost of the vehicle and make certain types of vehicles more attractive from a financial perspective. For instance, the federal government in the United States offers tax credits for the purchase of electric vehicles, providing a financial incentive to promote eco-friendly transportation.

Seller’s Perspective

For sellers, accurately calculating and collecting sales tax is a critical aspect of their business operations. They must ensure compliance with tax regulations to avoid legal consequences and maintain a positive relationship with customers. Sellers often work with a range of vehicles and locations, which can make sales tax management a complex task. They need robust systems in place to calculate tax accurately, collect the correct amount, and remit it to the appropriate tax authorities.

Sellers also have an opportunity to leverage sales tax as a strategic tool. By understanding the tax landscape and offering vehicles in areas with lower tax rates, they can make their offerings more competitive and potentially attract more buyers. Additionally, providing clear and transparent information about sales tax to customers can build trust and enhance the overall buying experience.

Strategies for Accurate Calculation and Compliance

Ensuring accurate calculation and compliance with vehicle sales tax regulations is essential for both buyers and sellers. Here are some strategies to achieve this:

- Research Local Tax Rates and Regulations: Buyers and sellers should thoroughly research the tax rates and regulations applicable to their specific location. This information is often available on government websites or through tax authorities. Understanding the tax landscape is the first step towards accurate calculations and compliance.

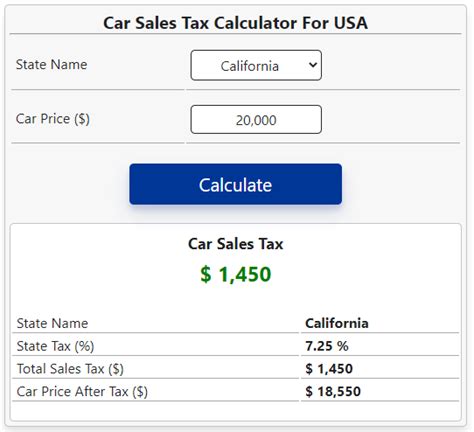

- Utilize Sales Tax Calculators: Online sales tax calculators can be a valuable tool for both buyers and sellers. These calculators take into account the vehicle's price, location, and applicable tax rates to provide an accurate estimate of the sales tax liability. While these tools are not a substitute for professional advice, they can be a useful starting point for understanding the potential tax cost.

- Consult Tax Professionals: For complex transactions or in cases of uncertainty, consulting a tax professional or accountant is advisable. They can provide expert advice tailored to your specific circumstances, ensuring compliance and accuracy in tax calculations.

- Maintain Detailed Records: Keeping detailed records of vehicle sales, including the base price, options, accessories, and any applicable fees, is crucial for accurate tax calculations. These records can also be beneficial in the event of an audit or for future reference.

The Future of Vehicle Sales Tax

The landscape of vehicle sales tax is evolving, driven by technological advancements, changing consumer preferences, and government initiatives. Here are some key trends and future implications to consider:

Online Sales and E-commerce

The rise of online vehicle sales and e-commerce platforms has introduced new complexities to the sales tax landscape. With the ability to purchase vehicles across state lines or even internationally, the tax implications become more intricate. Governments are adapting their tax regulations to accommodate these changes, often introducing new rules and guidelines for online sales. Buyers and sellers must stay informed about these developments to ensure compliance.

Electric and Alternative Fuel Vehicles

The increasing popularity of electric and alternative fuel vehicles is leading to a shift in tax structures. Many governments are introducing incentives and tax breaks to promote the adoption of these environmentally friendly vehicles. For instance, some states offer reduced or waived sales tax for electric cars, making them more attractive to consumers. This trend is likely to continue, shaping the future of vehicle sales tax and influencing consumer choices.

Tax Simplification and Automation

There is a growing movement towards simplifying and automating sales tax calculations and compliance. Governments and industry stakeholders are exploring technologies like blockchain and AI to streamline the tax process, making it more efficient and accurate. This could lead to reduced administrative burdens for businesses and consumers, while also improving tax collection efficiency for governments.

Conclusion

Understanding and navigating the complex world of vehicle sales tax is essential for both buyers and sellers in the automotive industry. By staying informed about tax rates, regulations, and the latest trends, individuals and businesses can make informed decisions, ensure compliance, and contribute to the efficient functioning of the automotive marketplace. As the industry continues to evolve, so too will the landscape of vehicle sales tax, presenting both challenges and opportunities for all stakeholders involved.

How do I calculate vehicle sales tax accurately?

+Accurate vehicle sales tax calculation involves understanding your local tax rates and regulations. You can use online calculators or consult tax professionals for precise results. Ensure you factor in the vehicle’s base price, options, and any applicable fees.

Are there any tax incentives for purchasing electric vehicles?

+Yes, many governments offer tax incentives and exemptions for electric vehicles to promote their adoption. These incentives can include reduced or waived sales tax, making electric vehicles a more affordable option.

What happens if I don’t pay the correct sales tax on my vehicle purchase?

+Failure to pay the correct sales tax can result in legal consequences, including fines and penalties. It’s essential to ensure accurate tax calculations and compliance to avoid these issues.

How can I stay updated on changes to vehicle sales tax regulations?

+Stay informed by regularly checking government websites and tax authority resources for updates. You can also subscribe to industry newsletters or follow reputable automotive news sources for the latest developments in vehicle sales tax.