State Of Iowa Property Taxes

The property tax system in Iowa is a crucial aspect of the state's revenue generation, with local governments relying heavily on these taxes to fund essential services and infrastructure. Understanding how property taxes work in Iowa is essential for both homeowners and prospective buyers, as it directly impacts their financial obligations and overall cost of living.

Understanding Iowa’s Property Tax System

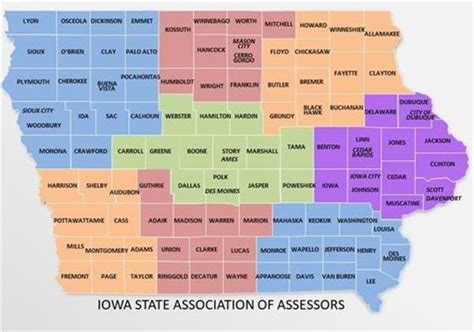

Iowa’s property tax system is primarily based on the assessed value of real estate properties, which includes land and improvements such as buildings and structures. This value is determined by the county assessor’s office, who conducts regular assessments to ensure fair and accurate taxation.

The assessment process involves a comprehensive evaluation of the property's features, such as size, location, improvements, and comparable sales in the area. This data is then used to calculate the property's taxable value, which is subject to certain exemptions and limitations set by the state and local authorities.

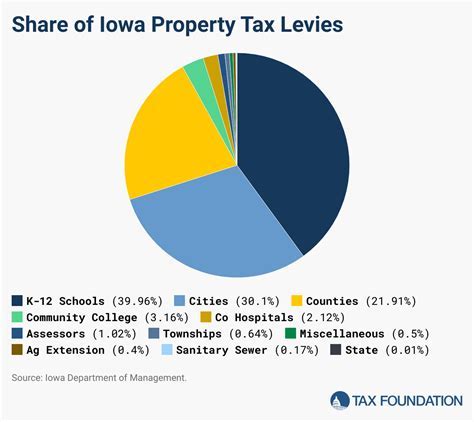

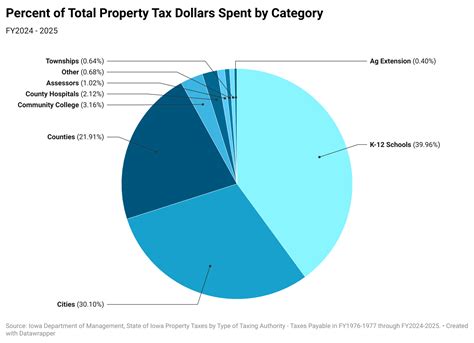

Once the taxable value is determined, it is multiplied by the applicable tax rate, which varies across Iowa's counties and municipalities. These tax rates are set by local governing bodies, including school districts, cities, and counties, and are used to fund their respective budgets.

It's important to note that Iowa does not have a statewide property tax, and each local government sets its own tax rates. This means that property tax rates can vary significantly from one area to another, even within the same county.

Key Components of Iowa’s Property Tax System

- Assessed Value: This is the value assigned to a property by the county assessor, which forms the basis for calculating property taxes. The assessed value takes into account factors such as the property’s condition, location, and market trends.

- Taxable Value: The taxable value is derived from the assessed value and is subject to state-mandated limitations and exemptions. In Iowa, the taxable value cannot exceed the assessed value, providing a cap on property tax liabilities.

- Tax Rates: Tax rates are established by local governments and can vary significantly. These rates are expressed as a percentage and are applied to the taxable value to determine the annual property tax amount.

- Exemptions and Credits: Iowa offers several exemptions and credits to reduce property tax burdens for specific groups, such as senior citizens, disabled veterans, and homeowners with low incomes. These provisions can significantly impact the final tax liability.

| County | Average Tax Rate (%) |

|---|---|

| Polk County | 7.15 |

| Linn County | 6.89 |

| Scott County | 6.69 |

| Black Hawk County | 7.29 |

| Johnson County | 6.94 |

The Impact of Property Taxes on Homeowners

Property taxes are a significant financial obligation for homeowners in Iowa, impacting their monthly budgets and overall cost of homeownership. Understanding how property taxes are calculated and their potential impact is crucial for both current and prospective homeowners.

Factors Affecting Property Tax Liability

- Property Value: As mentioned earlier, the assessed value of a property is a key determinant of property taxes. Higher-valued properties generally incur higher taxes.

- Tax Rates: The tax rate set by the local government has a direct impact on the property tax liability. Higher tax rates result in higher property taxes, all else being equal.

- Exemptions and Credits: Taking advantage of available exemptions and credits can significantly reduce property tax burdens. For example, Iowa’s Homestead Credit provides a credit for owner-occupied homes, reducing the taxable value of the property.

- Special Assessments: In some cases, local governments may levy special assessments on properties to fund specific projects or improvements. These assessments are typically added to the regular property tax bill and can increase the overall tax liability.

It's important for homeowners to stay informed about changes in property values, tax rates, and available exemptions to ensure they are not overpaying on their property taxes. Regularly reviewing assessment notices and tax bills can help identify potential errors or opportunities for savings.

Managing Property Tax Obligations

Homeowners have several options to manage their property tax obligations effectively:

- Appealing Assessments: If a homeowner believes their property has been overvalued, they can file an appeal with the county assessor’s office. This process involves providing evidence and justifications for a lower valuation, which could result in reduced property taxes.

- Taking Advantage of Exemptions: Homeowners should explore available exemptions and credits to reduce their taxable value. For instance, senior citizens and disabled veterans may be eligible for reduced assessments or tax credits.

- Considering Refinancing: In some cases, refinancing a mortgage can lead to a lower property tax bill, especially if the new loan amount is lower than the previous one. This is because property taxes are often based on the loan-to-value ratio.

- Budgeting and Planning: Property taxes are typically due once or twice a year, so homeowners should plan their finances accordingly. Budgeting for these expenses and setting aside funds can help ensure timely payments and avoid penalties.

Property Taxes and the Real Estate Market

Property taxes play a significant role in Iowa’s real estate market, influencing buying decisions and overall housing affordability. Potential buyers must consider property taxes when evaluating the financial feasibility of a property, as these taxes can significantly impact their long-term financial commitments.

Considering Property Taxes in Home Buying Decisions

When evaluating a property, potential buyers should consider the following aspects related to property taxes:

- Historical Tax Records: Reviewing the property’s tax history can provide valuable insights into potential tax liabilities. This information is typically available through the county assessor’s office or online tax databases.

- Tax Rates and Trends: Understanding the local tax rates and their historical trends can help buyers estimate their potential tax obligations. It’s essential to consider not only the current rate but also any recent changes or proposed increases.

- Assessed Value vs. Market Value: The assessed value of a property may not always align with its market value. Buyers should be aware of this discrepancy and consider the potential impact on their property taxes.

- Exemptions and Credits: Buyers should research available exemptions and credits they may be eligible for, as these can reduce their tax liabilities. For instance, first-time homebuyers or homeowners with certain disabilities may qualify for specific tax benefits.

The Impact on Housing Affordability

Property taxes are a significant component of a homeowner’s financial obligations, and they can significantly impact housing affordability. High property taxes can make it challenging for some buyers to afford a home, especially in areas with higher tax rates or rapidly increasing property values.

To address this issue, Iowa offers several programs and initiatives to promote housing affordability, including tax credits, down payment assistance, and first-time homebuyer programs. These initiatives aim to reduce the financial burden on homeowners and make homeownership more accessible.

Future Outlook and Potential Changes

The property tax system in Iowa is subject to ongoing discussions and potential reforms, with various stakeholders advocating for changes to address concerns and improve the system’s fairness and efficiency.

Proposed Reforms and Their Impact

Some of the proposed reforms include:

- Assessed Value Reform: There are proposals to adjust the way assessed values are calculated to ensure greater fairness and accuracy. This could involve updating assessment methods or introducing new factors to account for market trends and property characteristics.

- Tax Rate Limits: Some advocate for implementing tax rate limits or caps to prevent excessive tax burdens on homeowners. This could involve setting maximum tax rates or limiting the rate increases that local governments can impose.

- Homestead Credit Expansion: Expanding the Homestead Credit or introducing new credits could provide additional relief to homeowners, especially those with limited incomes or specific needs, such as senior citizens or veterans.

These reforms aim to address concerns related to fairness, accuracy, and affordability, ensuring that the property tax system remains sustainable and equitable for all Iowans.

Potential Challenges and Opportunities

Implementing these reforms may face challenges, such as resistance from local governments reliant on property tax revenues or the need for additional funding sources. However, these changes also present opportunities to improve the system’s effectiveness and ensure it meets the needs of Iowa’s diverse communities.

As the property tax system evolves, it is essential for homeowners, buyers, and stakeholders to stay informed and engaged, advocating for changes that promote fairness, accuracy, and affordability.

How often are property taxes assessed in Iowa?

+Property taxes in Iowa are typically assessed annually. The county assessor’s office conducts regular assessments to determine the property’s value and calculate the taxable amount.

Are there any online resources to estimate property taxes in Iowa?

+Yes, several online tools and websites provide estimates of property taxes based on the property’s location and value. These can be useful for buyers and homeowners to get a rough idea of their potential tax obligations.

What happens if I don’t pay my property taxes on time in Iowa?

+Late payment of property taxes in Iowa can result in penalties and interest charges. In some cases, non-payment can lead to tax liens being placed on the property, which could impact the homeowner’s credit and financial standing.

Can I appeal my property taxes in Iowa if I think they are too high?

+Yes, Iowa allows homeowners to appeal their property taxes if they believe the assessed value is inaccurate or too high. The appeal process involves providing evidence and justifications for a lower valuation. It’s recommended to consult with a tax professional or the county assessor’s office for guidance.

How can I stay informed about changes to property tax rates and exemptions in Iowa?

+Staying informed about property tax changes in Iowa is crucial. You can subscribe to updates from your county assessor’s office, follow local news sources, and keep an eye on official government websites and publications. Additionally, attending local government meetings can provide insights into potential changes and their impact.