New York State Transfer Tax

The New York State Transfer Tax is a crucial aspect of real estate transactions within the state, impacting both buyers and sellers. This tax, often overlooked by those unfamiliar with the local market, can significantly affect the financial aspects of a property deal. Understanding the intricacies of the New York State Transfer Tax is essential for anyone navigating the state's real estate landscape.

Understanding the New York State Transfer Tax

The New York State Transfer Tax is a tax levied on the transfer of real property within the state. It is distinct from the more commonly known real estate transfer tax, as it specifically targets transfers of ownership, whether through sale, gift, or inheritance. This tax is a significant revenue generator for the state and plays a crucial role in shaping the real estate market.

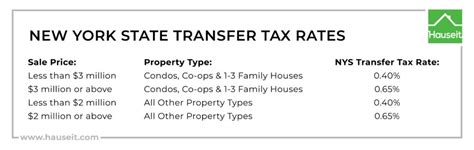

The tax is calculated based on the value of the property being transferred. The rate varies depending on the type of transaction and the location of the property. For instance, residential properties in New York City have a higher tax rate compared to other parts of the state. Additionally, there are exemptions and deductions available for certain types of transfers, such as those involving primary residences or transfers between family members.

Calculating the Tax

The calculation of the New York State Transfer Tax involves a complex formula that takes into account various factors. The tax rate is applied to the value of the property, which is determined by the assessed value or the purchase price, whichever is higher. This value is then subject to a series of deductions and exemptions, which can reduce the overall tax liability.

For example, consider a scenario where a homeowner in Manhattan decides to sell their primary residence. The assessed value of the property is $1.5 million, but the recent sale price is $2 million. The tax rate for residential properties in Manhattan is 0.4% of the sale price. Applying this rate to the higher value of $2 million, the initial tax liability would be $8,000. However, the homeowner is eligible for a primary residence exemption of $250,000, reducing the taxable value to $1.75 million. Thus, the final tax liability would be $7,000.

| Property Value | Tax Rate | Taxable Value | Transfer Tax |

|---|---|---|---|

| $1.5 million | 0.4% | $2 million | $8,000 |

| Primary Residence Exemption | N/A | $250,000 | -$250,000 |

| Final Taxable Value | N/A | $1.75 million | $7,000 |

Impact on Real Estate Transactions

The New York State Transfer Tax has a significant impact on the real estate market within the state. For buyers, it adds to the overall cost of purchasing a property, potentially affecting their ability to afford a particular home. Sellers, on the other hand, must consider the tax as a potential negotiation point, as it can influence the final sale price.

Real-world examples illustrate the practical implications of this tax. Take, for instance, a couple looking to buy their first home in Brooklyn. The property they desire is listed at $600,000, and they have saved up a substantial down payment. However, the transfer tax for residential properties in Brooklyn is 0.5% of the sale price. This means they will need to factor in an additional $3,000 for the tax, which can affect their budget and the overall financial feasibility of the purchase.

Strategies for Navigating the Transfer Tax

Given the complexity and financial implications of the New York State Transfer Tax, it’s essential to develop effective strategies for managing this tax. Here are some approaches to consider:

Exemptions and Deductions

Understanding the various exemptions and deductions available is crucial. For instance, primary residences, transfers between family members, and certain types of charitable transfers may qualify for reduced tax rates or exemptions. Familiarizing oneself with these provisions can significantly impact the overall tax liability.

Timing and Planning

The timing of a real estate transaction can influence the transfer tax. For example, if a property is held for a longer period, it may qualify for certain long-term ownership exemptions. Additionally, planning the transaction strategically, such as aligning it with other financial goals or tax years, can help optimize the tax implications.

Seeking Professional Guidance

Given the complexity of the New York State Transfer Tax, seeking guidance from tax professionals or real estate experts is advisable. These professionals can provide tailored advice based on individual circumstances, ensuring compliance with tax regulations and optimizing the financial aspects of the transaction.

Future Outlook and Potential Changes

The New York State Transfer Tax is subject to periodic reviews and potential revisions. As the state’s economy and real estate market evolve, so too might the tax regulations. Staying informed about any proposed changes or updates is essential for anyone involved in the real estate market.

Additionally, the state may consider implementing new initiatives or programs that impact the transfer tax. For instance, there have been discussions about introducing a transfer tax surcharge for certain types of properties or transactions. Keeping abreast of these developments is crucial for making informed decisions and staying compliant with the ever-changing tax landscape.

Conclusion

The New York State Transfer Tax is a vital component of the state’s real estate market, impacting both buyers and sellers. Understanding its intricacies, calculating the tax accurately, and employing effective strategies can significantly affect the financial outcome of a real estate transaction. By staying informed and seeking professional guidance, individuals can navigate the complexities of this tax and make informed decisions.

What is the current rate of the New York State Transfer Tax for residential properties in Manhattan?

+

As of the last update, the rate for residential properties in Manhattan is 0.4% of the sale price. However, it’s important to note that tax rates can change, so it’s advisable to check with the New York State Department of Taxation and Finance for the most current information.

Are there any exemptions or deductions available for the New York State Transfer Tax?

+

Yes, there are several exemptions and deductions available. These include exemptions for primary residences, transfers between family members, and certain types of charitable transfers. It’s important to consult with a tax professional to understand which exemptions or deductions may apply to your specific situation.

How does the timing of a real estate transaction impact the New York State Transfer Tax?

+

The timing of a transaction can influence the tax in several ways. For example, holding a property for a longer period may qualify it for certain long-term ownership exemptions. Additionally, strategic timing can align with other financial goals or tax years, potentially optimizing the tax implications. It’s advisable to consult with a tax professional to understand the specific impact of timing on your transaction.

Are there any proposed changes or initiatives regarding the New York State Transfer Tax?

+

The state regularly reviews and proposes changes to its tax regulations, including the New York State Transfer Tax. While there are no specific initiatives announced as of the last update, it’s essential to stay informed about any potential changes or updates. Subscribing to official state newsletters or consulting with tax professionals can help keep you updated on any developments.

Where can I find more information about the New York State Transfer Tax?

+

For the most accurate and up-to-date information, it’s recommended to refer to the official guidelines provided by the New York State Department of Taxation and Finance. Their website typically contains detailed information about tax rates, exemptions, and other relevant details. Additionally, consulting with tax professionals or real estate experts can provide valuable insights tailored to your specific circumstances.