Tn Sales Tax Rate

When it comes to sales tax, Tennessee has a unique system in place, offering a complex landscape for both businesses and consumers. The state sales tax rate in Tennessee is a fundamental component of the state's revenue generation, playing a crucial role in funding various public services and infrastructure projects. Understanding the intricacies of this tax rate is essential for businesses operating within the state, as well as for consumers making purchasing decisions.

Understanding the Tennessee Sales Tax Rate

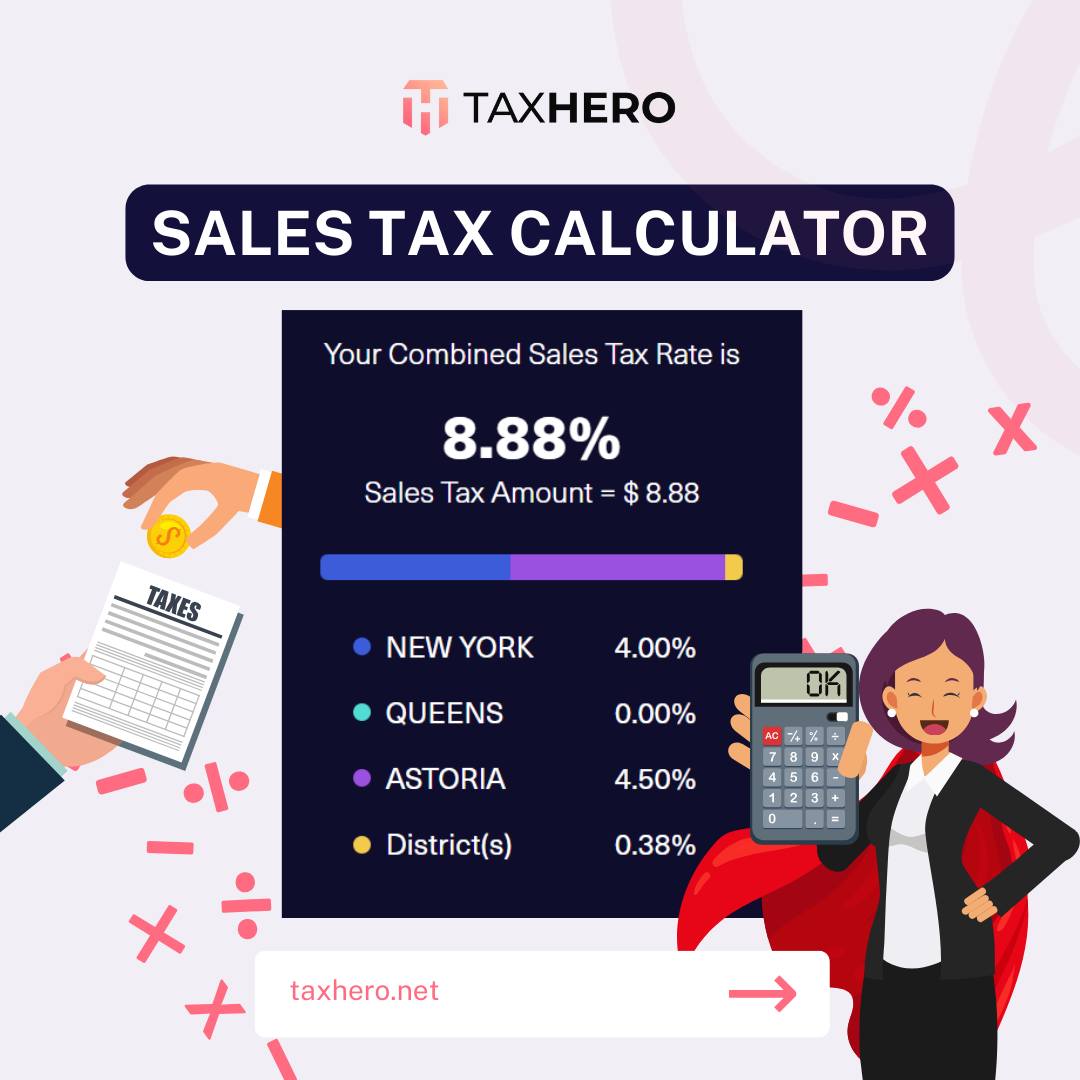

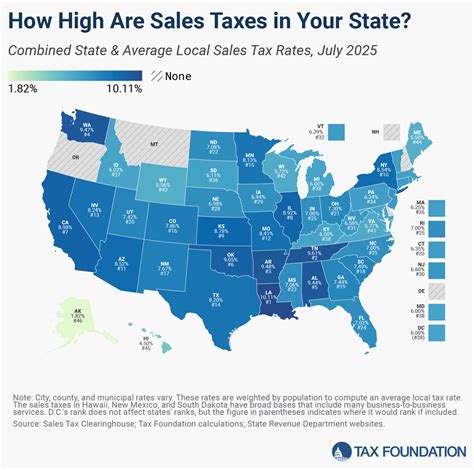

The Tennessee sales tax rate is a combination of both state and local taxes, creating a unique tax environment across the state. As of [current date], the state sales tax rate stands at 7%, which is applied uniformly across the state. However, it is important to note that this is not the only tax rate consumers and businesses need to consider.

In addition to the state sales tax, Tennessee allows for local sales taxes to be levied by municipalities and counties. These local sales tax rates can vary significantly, adding an extra layer of complexity to the overall tax landscape. While some areas may have no additional local tax, others can have rates as high as 2.75%, bringing the total sales tax rate to 9.75% in certain locations.

This variability in local sales tax rates means that the effective sales tax rate can differ significantly depending on where a purchase is made within the state. For instance, while the state capital, Nashville, has a combined rate of 9.25%, the city of Memphis has a higher rate of 9.75%.

Impact on Business and Consumer Decisions

The Tennessee sales tax rate structure has a notable impact on both business operations and consumer behavior. For businesses, particularly those with multiple locations or online sales, managing and remitting the correct sales tax can be a complex task. The varying local tax rates mean that businesses must ensure they are aware of the specific tax rates applicable to each of their sales locations or shipping destinations.

Consumers, on the other hand, may find themselves making purchasing decisions based on the sales tax rate. For instance, a consumer might opt to make a large purchase in a lower tax rate area, especially if they are near a border and have the option to shop across state lines. This behavior can have a significant impact on local economies and tax revenues, highlighting the importance of a well-understood and transparent sales tax system.

| Location | Combined Sales Tax Rate |

|---|---|

| Nashville | 9.25% |

| Memphis | 9.75% |

| Chattanooga | 9.25% |

| Knoxville | 9.75% |

Exemptions and Special Considerations

While the Tennessee sales tax rate applies broadly to most goods and services, there are certain exemptions and special considerations that businesses and consumers should be aware of.

Exempt Items

Certain items are exempt from sales tax in Tennessee. These include most groceries, prescription drugs, and certain medical devices. Additionally, certain services, such as legal and accounting services, are also exempt. Understanding these exemptions is crucial for businesses to ensure they are not overcharging customers and for consumers to make informed purchasing decisions.

Special Tax Districts

Tennessee also has several special tax districts, which are areas with additional sales taxes levied for specific purposes. These districts often fund local projects or initiatives, such as infrastructure development or community improvement programs. While these districts can add an extra layer of complexity, they also demonstrate the flexibility and adaptability of Tennessee’s sales tax system to meet local needs.

Compliance and Enforcement

Ensuring compliance with the Tennessee sales tax rate is a shared responsibility between businesses and the Tennessee Department of Revenue. Businesses are required to register for a sales tax permit, collect the correct tax rates, and remit these taxes to the state on a regular basis. Failure to comply can result in penalties and interest charges.

The Tennessee Department of Revenue has various tools and resources available to assist businesses in understanding and complying with sales tax laws. These include online guides, webinars, and direct support from tax professionals. Additionally, the department conducts regular audits to ensure businesses are correctly calculating and remitting sales tax.

Future Outlook and Potential Changes

The Tennessee sales tax rate is subject to potential changes, both at the state and local levels. These changes can be driven by various factors, including economic conditions, political decisions, and the need to fund specific initiatives or projects.

Currently, there are ongoing discussions about potential sales tax reform in Tennessee. Some proposals suggest simplifying the tax structure by reducing or eliminating local sales taxes, while others advocate for increasing the state sales tax rate to fund specific programs. The outcome of these discussions could significantly impact the overall sales tax landscape in the state.

Furthermore, the rise of e-commerce has presented new challenges and opportunities for sales tax collection. Tennessee, like many other states, is exploring ways to ensure fair taxation of online sales, particularly from out-of-state sellers. This includes potential changes to the way sales tax is calculated and collected for online purchases, which could have a significant impact on both businesses and consumers.

Conclusion

Understanding the Tennessee sales tax rate is essential for anyone doing business in the state or making significant purchases. The combination of state and local taxes, along with various exemptions and special considerations, creates a complex but flexible tax system. As the state continues to evaluate and potentially reform its sales tax structure, staying informed about these changes will be crucial for businesses and consumers alike.

How often are sales tax rates updated in Tennessee?

+Sales tax rates in Tennessee are updated periodically, typically as a result of legislative changes or local initiatives. While there is no set schedule, it is advisable for businesses and consumers to stay informed about any updates through official state resources or tax professional networks.

Are there any online tools to help calculate sales tax in Tennessee?

+Yes, the Tennessee Department of Revenue provides an online Sales Tax Calculator tool. This tool allows users to input the location and sale amount to calculate the total sales tax due. It’s a valuable resource for businesses and consumers to ensure accurate tax calculations.

What happens if a business undercharges or overcharges sales tax?

+If a business undercharges sales tax, they are responsible for remitting the correct amount to the state, along with any applicable penalties. If a business overcharges, they should refund the excess amount to the customer and adjust their sales tax collection practices.