Dupage County Property Tax Lookup

Discovering property tax information in DuPage County, Illinois, is an essential aspect of homeownership and investment. This comprehensive guide will delve into the process of conducting a DuPage County property tax lookup, offering a step-by-step approach and valuable insights to assist homeowners, buyers, and investors alike. We'll explore the online tools available, the impact of tax assessments on property values, and the various factors that influence tax rates in this county.

The Comprehensive Guide to DuPage County Property Tax Lookup

Understanding property taxes and their implications is crucial for anyone involved in the real estate market. In DuPage County, property taxes play a significant role in the local economy and directly impact the financial obligations of homeowners. This guide aims to provide a clear and concise understanding of how to access and interpret property tax information, empowering individuals to make informed decisions regarding their properties.

Step 1: Utilizing the DuPage County Property Tax Lookup Tool

DuPage County offers a user-friendly online platform for property tax inquiries. The DuPage County Property Tax Lookup Tool is a valuable resource for residents and property owners. To access this tool, follow these steps:

- Visit the DuPage County Property Tax Search website.

- Enter the property's address, including the street name, number, and city. Alternatively, you can search by parcel ID or property owner's name.

- Click on the "Search" button to initiate the lookup process.

- The system will display detailed property tax information, including the current tax year, assessed value, and tax amounts.

This online tool provides a convenient and efficient way to obtain accurate and up-to-date property tax data, eliminating the need for manual calculations or visits to government offices.

Step 2: Understanding Property Tax Assessments and Their Impact

Property tax assessments are a critical component of the tax calculation process. In DuPage County, the DuPage County Assessor's Office is responsible for determining the assessed value of each property. This value is based on several factors, including:

- Market Value: The current market value of the property is a key consideration. It reflects the property's worth based on recent sales of comparable properties in the area.

- Improvement Factors: Any improvements or additions made to the property can influence its assessed value. These may include renovations, expansions, or upgrades.

- Economic Conditions: The overall economic climate of the county and its impact on property values play a role in assessments.

- Assessment Ratio: DuPage County uses a specific assessment ratio, which is the percentage of the property's market value that is subject to taxation. This ratio is applied uniformly across the county.

Understanding the assessment process and its impact on tax obligations is essential for property owners. It allows them to anticipate and plan for their financial responsibilities accurately.

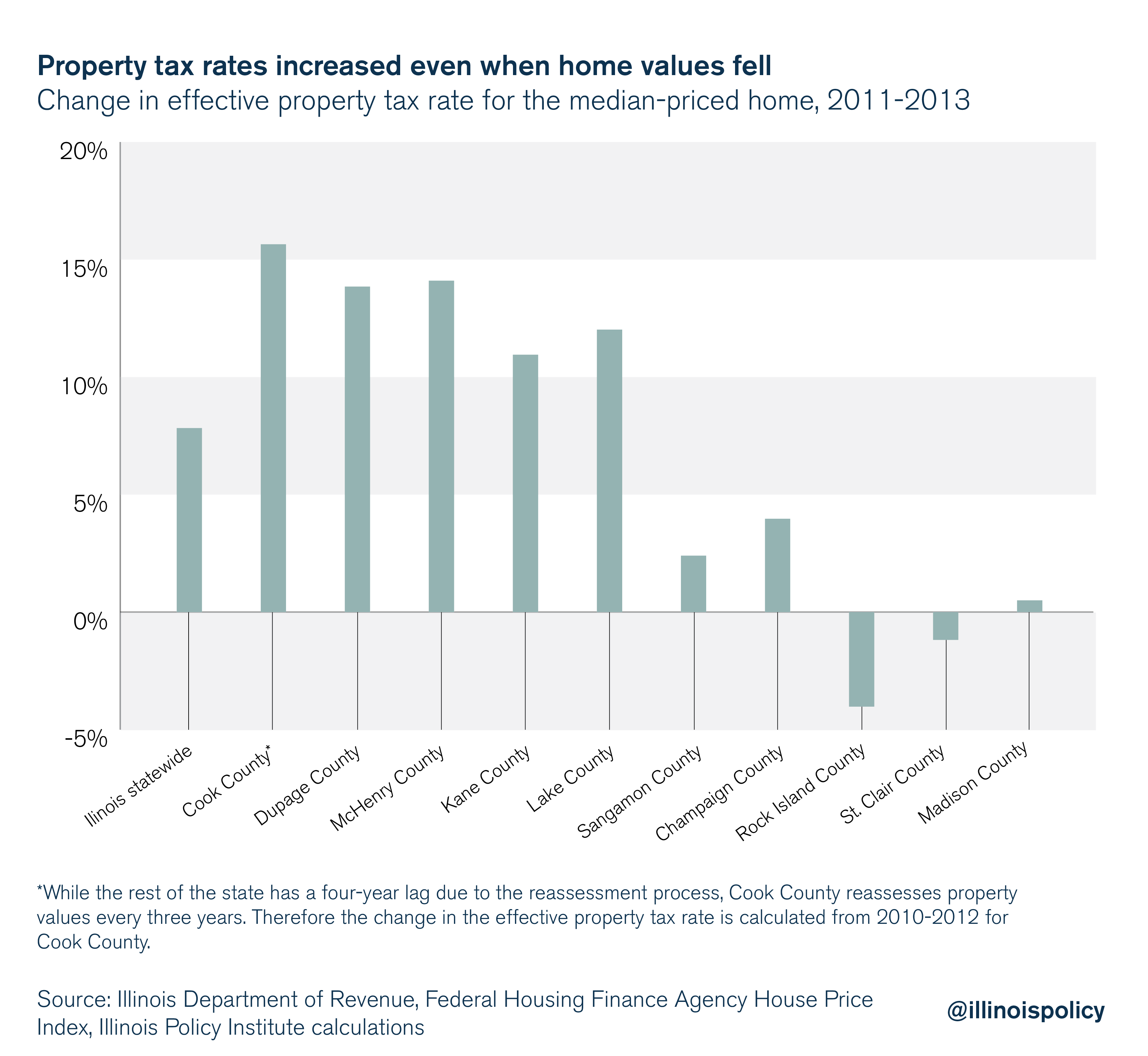

Step 3: Factors Influencing Property Tax Rates in DuPage County

Property tax rates in DuPage County are determined by a combination of factors, including:

- Assessed Value: As mentioned earlier, the assessed value of a property is a crucial determinant of tax rates. Higher assessed values generally result in higher tax obligations.

- Taxing Authorities: DuPage County is home to various taxing authorities, such as school districts, municipalities, and special taxing districts. Each authority sets its own tax rate, which is applied to the assessed value of the property.

- Budgetary Needs: The financial requirements of taxing authorities, including funding for schools, infrastructure, and public services, influence tax rates. Higher budgetary needs may lead to increased tax rates.

- Tax Exemptions and Incentives: DuPage County offers certain tax exemptions and incentives to promote economic development or support specific groups, such as senior citizens or veterans. These can reduce tax obligations for eligible property owners.

By considering these factors, property owners can gain a deeper understanding of the dynamics behind their property tax rates and make informed decisions regarding their financial planning.

Step 4: Analyzing Property Tax Records for Investment Purposes

For investors and prospective homebuyers, analyzing property tax records is an essential step in evaluating potential real estate investments. Here's how this analysis can be beneficial:

- Historical Trends: Property tax records provide a historical perspective on tax assessments and rates. This information can help investors identify patterns and trends, such as consistent increases or decreases in tax obligations over time.

- Comparison with Similar Properties: By comparing the tax records of similar properties in the same area, investors can assess the fairness of tax assessments and identify potential discrepancies.

- Budgetary Impact: Understanding the tax obligations associated with a property is crucial for investors to accurately forecast their potential returns. High tax rates may impact the profitability of an investment, especially for rental properties.

- Negotiation Leverage: In certain cases, investors can use property tax records as leverage during negotiations with sellers. If the tax assessments seem excessive or inconsistent, it may provide an opportunity to negotiate a better deal.

A thorough analysis of property tax records can assist investors in making well-informed decisions and avoiding potential pitfalls.

Step 5: Challenging Property Tax Assessments and Appeals Process

In some cases, property owners may believe that their tax assessment is unfair or inaccurate. DuPage County provides a formal process for challenging assessments and seeking tax relief. Here's an overview of the appeals process:

- Review the Assessment Notice: Upon receiving the annual assessment notice, property owners should carefully review the details, including the assessed value and any changes from the previous year.

- Identify Discrepancies: If the owner believes the assessment is incorrect, they should gather evidence to support their claim. This may include recent sales data, appraisals, or comparative market analyses.

- File an Appeal: To initiate the appeals process, property owners must submit a formal request to the DuPage County Board of Review. This request should include a detailed explanation of the discrepancy and supporting documentation.

- Hearing and Decision: The Board of Review will schedule a hearing to review the appeal. During this hearing, the property owner can present their case and provide evidence. The Board will then make a decision, which may result in a reduction of the assessed value.

- Further Appeals: If the property owner is dissatisfied with the Board's decision, they have the option to appeal to the Illinois Property Tax Appeal Board, which provides an independent review of the case.

Understanding the appeals process and exercising one's rights is essential for ensuring fair and accurate property tax assessments.

Step 6: Strategies for Managing Property Tax Obligations

Property tax obligations can be a significant financial burden for homeowners. Here are some strategies to help manage these obligations effectively:

- Budgeting and Planning: Incorporate property tax payments into your annual budget. By setting aside funds specifically for taxes, you can avoid financial strain when tax bills arrive.

- Exploring Tax Exemptions: Research and apply for applicable tax exemptions, such as those for seniors, veterans, or individuals with disabilities. These exemptions can provide significant savings on property taxes.

- Payment Options: DuPage County offers various payment options, including online payments, credit card payments, and automatic bank drafts. Choose the option that best suits your financial situation and preferences.

- Timely Payments: Ensure that you make your tax payments on time to avoid penalties and interest charges. Late payments can significantly increase the overall cost of your property taxes.

By implementing these strategies, homeowners can effectively manage their property tax obligations and maintain financial stability.

Conclusion: Empowering Homeowners and Investors with Knowledge

The process of conducting a DuPage County property tax lookup is a crucial step in understanding one's financial obligations and making informed decisions. By following the steps outlined in this guide and utilizing the available online tools, homeowners and investors can access accurate and up-to-date property tax information. Understanding property tax assessments, rates, and the appeals process empowers individuals to actively participate in the real estate market and protect their financial interests.

As DuPage County continues to thrive and evolve, staying informed about property taxes is essential for both residents and investors. This comprehensive guide serves as a valuable resource, offering a deep dive into the world of property tax lookups, assessments, and management strategies. With this knowledge, individuals can navigate the complexities of property taxes with confidence and make well-informed decisions regarding their real estate endeavors.

How often are property tax assessments conducted in DuPage County?

+Property tax assessments in DuPage County are conducted annually. The Assessor’s Office reviews and updates property values to ensure fair and accurate assessments.

Can I appeal my property tax assessment if I believe it is inaccurate?

+Yes, DuPage County provides a formal appeals process. Property owners can challenge their assessments by submitting a request to the Board of Review and presenting their case with supporting evidence.

What are the tax rates in DuPage County, and how are they determined?

+Tax rates in DuPage County are set by various taxing authorities, including school districts and municipalities. These rates are influenced by factors such as assessed property values, budgetary needs, and economic conditions.

Are there any tax exemptions available in DuPage County, and how can I apply for them?

+DuPage County offers several tax exemptions, including those for seniors, veterans, and individuals with disabilities. To apply, property owners can contact the Assessor’s Office or visit their website for detailed instructions and eligibility criteria.

Can I pay my property taxes online in DuPage County, and what are the available payment options?

+Yes, DuPage County provides online payment options through their official website. Property owners can pay their taxes using credit cards, e-checks, or by setting up automatic bank drafts. The website offers detailed instructions on how to make payments securely.