Virginia Sales Tax On Food

In the state of Virginia, sales tax regulations can be complex, especially when it comes to food items. Understanding the tax implications on food purchases is crucial for both consumers and businesses. Let's delve into the specifics of Virginia's sales tax on food, exploring the categories, exemptions, and the impact on the state's economy.

Understanding Virginia's Sales Tax Structure

Virginia imposes a state sales and use tax on most tangible personal property and certain services. The state sales tax rate in Virginia is currently set at 4.3%, which is applied uniformly across the state. However, it's important to note that localities have the authority to impose additional taxes, leading to variations in effective tax rates across different jurisdictions.

The combined state and local sales tax rates can range from approximately 4.3% to 7.0%, depending on the location of the purchase. These local taxes are often used to fund specific projects or initiatives within the locality, such as infrastructure development or public services.

Taxation on Food Items in Virginia

When it comes to food, Virginia's sales tax regulations distinguish between prepared foods and grocery items. This distinction is crucial as it determines the applicable tax rate and potential exemptions.

Prepared Foods

Prepared foods, also known as "restaurant meals," are generally subject to the full sales tax rate, including both the state and local components. This means that when you dine out at a restaurant or purchase food that is intended to be consumed on the premises, you will typically pay the highest applicable tax rate.

For example, if the combined tax rate in a particular locality is 6.0%, then a meal purchased at a restaurant or a hot, ready-to-eat food item from a grocery store would be taxed at this rate. This includes items like sandwiches, salads, and other foods that are prepared and packaged for immediate consumption.

Grocery Items

Grocery items, on the other hand, often enjoy a reduced tax rate. In Virginia, certain food products, including staples like bread, milk, and eggs, are subject to a lower sales tax rate of 1.5%. This reduced rate is intended to ease the tax burden on essential food items, making them more affordable for consumers.

However, it's important to note that not all grocery items qualify for this reduced rate. Processed foods, such as soft drinks, snack foods, and certain pre-packaged meals, are typically taxed at the full rate. The distinction between taxable and reduced-rate grocery items can be nuanced, and it often depends on the specific characteristics and intended use of the product.

Taxable and Exempt Food Categories

To provide a clearer picture, here's a simplified table outlining some common food categories and their respective tax rates in Virginia:

| Food Category | Tax Rate |

|---|---|

| Restaurant Meals (Prepared Foods) | Full Rate (Combined State and Local) |

| Grocery Staples (e.g., bread, milk, eggs) | Reduced Rate (1.5%) |

| Processed Foods (e.g., snacks, soft drinks) | Full Rate (Combined State and Local) |

| Unprepared Ingredients (e.g., raw meat, vegetables) | Full Rate (Combined State and Local) |

| Dietary Supplements | Reduced Rate (1.5%) |

| Baby Food and Formula | Reduced Rate (1.5%) |

It's worth mentioning that Virginia, like many other states, offers certain exemptions and special considerations for specific food items. For instance, baby food and formula, as well as dietary supplements, are often subject to the reduced tax rate to support families and promote health.

The Impact on Consumers and Businesses

The varying sales tax rates on food items can have a significant impact on both consumers and businesses in Virginia. For consumers, understanding these tax distinctions can help with budgeting and financial planning. Knowing which items are taxed at the full rate and which qualify for reduced taxation can guide shopping decisions and potentially save money.

From a business perspective, navigating Virginia's sales tax regulations requires careful attention to detail. Restaurants and food retailers must accurately classify their products and apply the appropriate tax rates to avoid compliance issues. Proper tax management is essential to maintain a positive relationship with customers and avoid legal complications.

Sales Tax Compliance and Resources

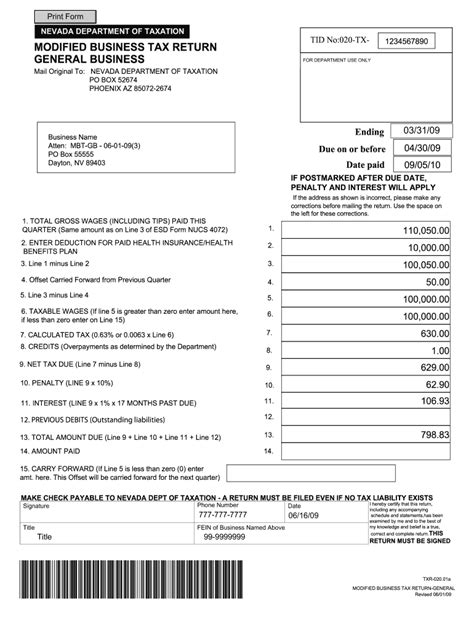

Ensuring compliance with Virginia's sales tax regulations is crucial for businesses operating within the state. The Virginia Department of Taxation provides extensive resources and guidelines to assist businesses in understanding their tax obligations. These resources cover various aspects, from registration and collection processes to specific industry guidelines.

Businesses can access these resources through the official Virginia Department of Taxation website. The site offers detailed explanations of sales tax laws, including specific rules related to food and beverage sales. It also provides tools and forms for registration, tax filing, and reporting, ensuring that businesses can navigate the tax landscape with confidence.

Additionally, the Virginia Department of Taxation offers support through its dedicated helpline and email services. Businesses can reach out to tax specialists for clarification on complex tax scenarios or to address specific concerns. This level of support helps businesses maintain compliance and stay informed about any changes in sales tax regulations.

Conclusion: Navigating Virginia's Food Sales Tax Landscape

Understanding Virginia's sales tax regulations on food is essential for both consumers and businesses. The state's approach to taxing food items is designed to balance the need for revenue with the affordability of essential groceries. By distinguishing between prepared foods and grocery items, and offering reduced tax rates for certain staples, Virginia aims to strike a delicate balance in its tax policies.

For consumers, being aware of these tax distinctions can lead to smarter shopping choices and potentially save money. Businesses, on the other hand, must stay informed about their tax obligations to ensure compliance and maintain positive relationships with customers. The resources provided by the Virginia Department of Taxation play a vital role in guiding businesses through the complexities of sales tax regulations.

As Virginia continues to evolve its tax policies, staying updated on these regulations is crucial. Whether you're a resident, a business owner, or simply interested in Virginia's economic landscape, understanding the sales tax on food provides valuable insights into the state's approach to taxation and its impact on daily life.

What is the current state sales tax rate in Virginia?

+The current state sales tax rate in Virginia is 4.3%.

Are there any localities in Virginia with a 0% local sales tax rate?

+Yes, some localities in Virginia have a 0% local sales tax rate. This means that only the state sales tax of 4.3% would be applicable in those areas.

Can you provide examples of food items that are taxed at the reduced rate of 1.5% in Virginia?

+Food items taxed at the reduced rate of 1.5% in Virginia include staples like bread, milk, eggs, baby food, and dietary supplements.

Are there any specific exemptions or special considerations for certain food items in Virginia’s sales tax regulations?

+Yes, Virginia offers special considerations for items like baby food and formula, as well as dietary supplements, which are taxed at the reduced rate of 1.5% to support families and promote health.