Whats Ad Valorem Tax

Ad valorem tax, a fundamental concept in the world of taxation, plays a significant role in various economies worldwide. This type of tax is unique in its approach, and its implications are far-reaching. In this comprehensive article, we will delve into the intricacies of ad valorem tax, exploring its definition, historical context, practical applications, and its impact on individuals and businesses. By the end, you'll have a deeper understanding of this essential tax mechanism and its place in modern fiscal systems.

Understanding Ad Valorem Tax: Definition and Origin

Ad valorem tax is a Latin term meaning “according to value”. It is a type of tax levied on the value of a product, good, or service, as opposed to a fixed tax rate. This tax system is designed to assess the worth of an item and impose a tax proportionate to that value. The concept of ad valorem tax is ancient, with roots tracing back to Roman times where it was used to tax property and goods.

The key characteristic of ad valorem tax is its progressive nature. Unlike a flat tax, which applies the same rate regardless of value, ad valorem taxes increase as the value of the item increases. This makes it a popular choice for governments looking to tax high-value items or services more heavily, thus generating significant revenue.

How Ad Valorem Tax Works in Practice

In practice, ad valorem tax is implemented in various ways, depending on the jurisdiction and the specific item being taxed. Here are some common applications:

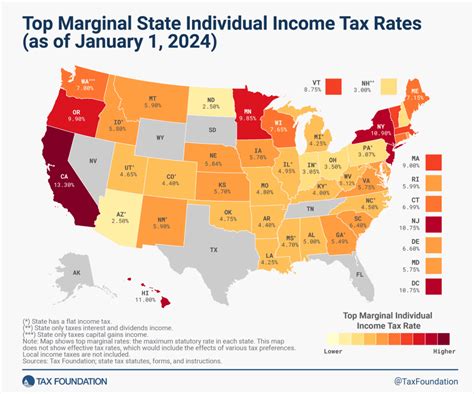

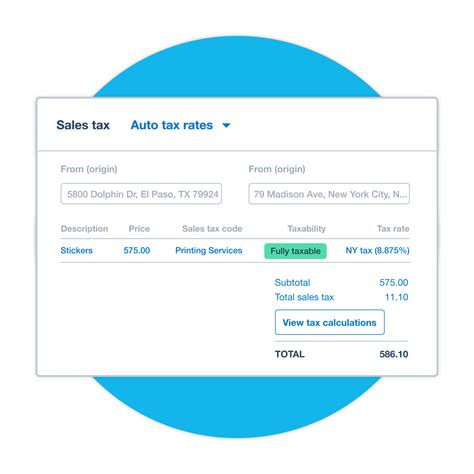

- Sales Tax: Many countries and states impose a sales tax on goods and services, with the tax amount varying based on the purchase price. This is a straightforward application of ad valorem tax, where the tax burden increases with the value of the item.

- Property Tax: Property taxes are often assessed based on the value of the property, with higher-value properties attracting higher taxes. This ensures that those with more valuable assets contribute more to the tax base.

- Import Duties: Ad valorem taxes are frequently used on imported goods, with the tax rate applied to the customs value of the item. This can help protect domestic industries and generate revenue from international trade.

- Excise Taxes: Certain goods, like alcohol and tobacco, often carry excise taxes, which are a form of ad valorem tax. The tax is calculated based on the value of the product, making it an effective tool for influencing consumer behavior and raising revenue.

The flexibility of ad valorem tax allows governments to tailor the tax rate to specific goals. For instance, a government might impose a higher ad valorem tax on luxury goods to discourage consumption and promote social equality, while keeping taxes low on essential goods to reduce the burden on lower-income individuals.

Advantages and Disadvantages of Ad Valorem Tax

Like any tax system, ad valorem tax has its advantages and disadvantages. Understanding these can help us appreciate its role and potential impact.

Pros of Ad Valorem Tax

Ad valorem tax offers several benefits, including:

- Progressive Taxation: By taxing higher-value items and services more heavily, ad valorem tax promotes a more equitable distribution of the tax burden. This can help reduce income inequality and ensure a fairer society.

- Revenue Generation: The ability to impose higher taxes on higher-value items makes ad valorem tax an efficient revenue generator for governments. This revenue can be used to fund public services and infrastructure.

- Flexibility: Governments can adjust tax rates based on the value of goods, allowing for a more nuanced approach to taxation. This flexibility can be used to achieve specific policy goals, such as discouraging certain behaviors or protecting domestic industries.

- Ease of Administration: Ad valorem tax is relatively straightforward to administer, as the tax amount is based on the value of the item, which is often readily available information.

Cons of Ad Valorem Tax

However, ad valorem tax also has some drawbacks, such as:

- Potential for Price Distortion: High ad valorem tax rates can lead to price distortions, as businesses may pass on the tax burden to consumers, resulting in higher prices.

- Complexity in International Trade: Ad valorem taxes on imports can complicate international trade, especially when different countries have varying tax rates. This can lead to trade disputes and complexities in calculating the final cost of goods.

- Administrative Costs: While ad valorem tax is generally easy to administer, the process can become complex for high-value items or specialized goods, requiring specialized knowledge and resources.

Despite these challenges, ad valorem tax remains a popular and effective tool in modern tax systems, providing governments with the flexibility to achieve their fiscal and social goals.

Ad Valorem Tax in the Modern Economy

In today’s globalized economy, ad valorem tax plays a crucial role in shaping international trade and domestic markets. Governments use ad valorem taxes to influence trade patterns, protect domestic industries, and raise revenue to fund public services.

Ad Valorem Tax and International Trade

Ad valorem taxes on imports are a common tool used by countries to protect their domestic industries and generate revenue. These taxes can be strategically applied to specific industries or products, helping to level the playing field for domestic producers who may face competition from lower-cost foreign producers. For example, the European Union imposes ad valorem taxes on a range of imports, including textiles, electronics, and agricultural products, to protect its own industries and maintain fair competition.

However, the use of ad valorem taxes in international trade can also lead to tensions and disputes. Countries may view certain tax rates as unfair or protectionist, leading to trade wars and negotiations. The World Trade Organization (WTO) plays a vital role in mediating these disputes and setting guidelines for fair trade practices, including the use of ad valorem taxes.

Ad Valorem Tax and Domestic Markets

Within domestic markets, ad valorem taxes are used to shape consumer behavior and generate revenue. For instance, many countries impose higher ad valorem taxes on tobacco and alcohol, not only to raise revenue but also to discourage consumption of these potentially harmful products. Similarly, some countries apply lower ad valorem taxes on essential goods, like food and medicine, to ensure these items remain affordable for all citizens.

Ad valorem taxes can also be used to promote specific industries or technologies. For example, some countries offer tax incentives or reduced ad valorem taxes for renewable energy technologies, encouraging the adoption of cleaner energy sources. This approach not only generates revenue but also supports the country's transition to a more sustainable economy.

Future of Ad Valorem Tax

As the world economy continues to evolve, so too will the role of ad valorem tax. With the rise of e-commerce and global supply chains, the application and administration of ad valorem taxes are likely to become more complex. Governments will need to adapt their tax systems to keep pace with these changes, ensuring fair taxation and efficient revenue collection.

Furthermore, the growing focus on sustainability and social equality may lead to increased use of ad valorem taxes to influence consumer behavior and promote more equitable societies. For example, higher taxes on carbon-intensive goods could encourage a shift towards more sustainable alternatives, while progressive ad valorem taxes on high-value assets could help reduce wealth inequality.

In conclusion, ad valorem tax is a versatile and powerful tool in the hands of governments, offering the flexibility to achieve a wide range of fiscal and social goals. While it has its challenges, its advantages make it an essential component of modern tax systems. As we navigate the complexities of the global economy, the role of ad valorem tax will only become more significant, shaping the way we trade, consume, and distribute wealth.

What is the difference between ad valorem tax and a flat tax rate?

+Ad valorem tax is a progressive tax, meaning the tax rate increases with the value of the item. In contrast, a flat tax rate applies the same tax percentage regardless of the value of the item. Ad valorem tax is thus more flexible and can be used to achieve specific policy goals, while a flat tax rate provides simplicity and predictability.

How do ad valorem taxes impact international trade relations?

+Ad valorem taxes on imports can complicate international trade relations. Countries may view certain tax rates as unfair or protectionist, leading to trade disputes and negotiations. However, these taxes can also be used strategically to protect domestic industries and promote fair competition.

Can ad valorem taxes be used to promote social equality?

+Yes, ad valorem taxes can be structured to promote social equality. By taxing higher-value items and services more heavily, ad valorem tax can help reduce income inequality and ensure a fairer distribution of the tax burden. This progressive approach can contribute to a more equitable society.