Alabama Tax Percentage

Understanding the tax landscape is crucial when navigating finances, especially in the context of state-specific regulations. This comprehensive guide delves into the intricacies of Alabama's tax structure, shedding light on the percentages, categories, and unique aspects that define its tax system. From income to sales tax, we explore the economic policies that shape the financial climate of the state.

Alabama’s Tax Structure: A Comprehensive Overview

Alabama, like many other states, employs a diverse tax system to fund its operations and services. This system is designed to balance the state’s budget and ensure the smooth functioning of various public sectors. Let’s unravel the key components of Alabama’s tax framework.

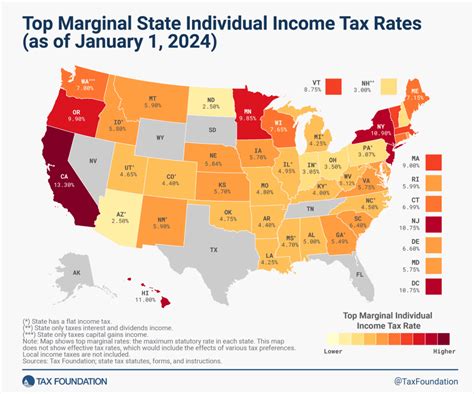

Income Tax: A Progressive Approach

Alabama’s income tax structure follows a progressive model, which means that higher incomes are taxed at a higher rate. This approach aims to distribute the tax burden fairly across different income levels. As of 2023, Alabama has five tax brackets, each with its own tax rate. Here’s a breakdown:

| Tax Bracket | Tax Rate | Income Range |

|---|---|---|

| 1 | 2% | Up to 5,000</td> </tr> <tr> <td>2</td> <td>4%</td> <td>5,001 - 10,000</td> </tr> <tr> <td>3</td> <td>5%</td> <td>10,001 - 25,000</td> </tr> <tr> <td>4</td> <td>5%</td> <td>25,001 - 35,000</td> </tr> <tr> <td>5</td> <td>5%</td> <td>Over 35,000 |

For instance, if an individual's annual income falls within the third tax bracket, they would be taxed at a rate of 5% on the portion of their income that exceeds $10,000 but is below or equal to $25,000. This progressive tax system ensures that higher-income earners contribute a larger proportion of their income to the state's revenue.

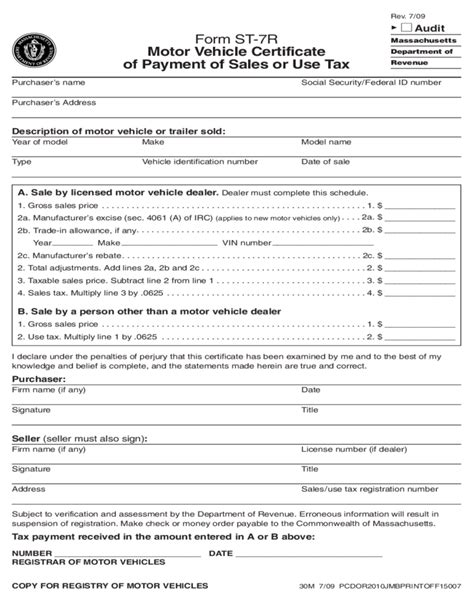

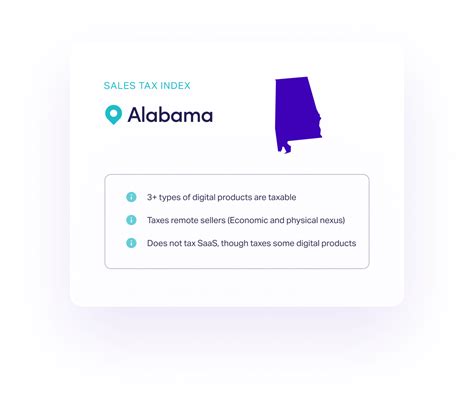

Sales and Use Tax: A Broad-Based Approach

Alabama imposes a state-wide sales and use tax on the sale of tangible personal property and certain services. As of 2023, the general sales tax rate in Alabama is 4%. However, this rate can vary based on local taxes, resulting in a combined sales tax rate that ranges from 8% to 11% across different jurisdictions within the state. This variability is due to the addition of county and municipal taxes, which are often levied on top of the state’s base rate.

For instance, the city of Birmingham has a local sales tax rate of 5%, resulting in a combined sales tax rate of 9% for purchases made within the city limits. On the other hand, rural areas with fewer local taxes may have a lower combined rate, closer to the state's base rate.

Property Tax: A Localized Perspective

Property taxes in Alabama are primarily assessed and collected at the county level. The state’s property tax system is characterized by a relatively low millage rate compared to some other states. A millage rate represents the tax rate per $1,000 of assessed property value. As of 2023, Alabama’s average millage rate is 23 mills, which is relatively low when compared to the national average.

For instance, Jefferson County, which includes Birmingham, has a millage rate of 35 mills, resulting in a higher property tax burden for homeowners in that county. On the other hand, less densely populated counties like Hale County have a millage rate of 20 mills, offering a more favorable property tax environment.

Excise Taxes: Targeted Levies

Alabama, like many states, imposes excise taxes on specific goods and services. These taxes are designed to target certain behaviors or industries and often carry a higher rate compared to general sales tax. Some common excise taxes in Alabama include:

- Alcoholic Beverage Tax: Taxes on the sale of alcohol vary based on the type of beverage and the location of sale. For instance, the tax on beer is 20 cents per gallon, while the tax on wine ranges from 1.10 to 3.50 per gallon, depending on the alcohol content.

- Tobacco Tax: A $1.11 tax is levied on each pack of cigarettes sold in Alabama. This tax is one of the highest in the Southeast region.

- Motor Fuel Tax: Alabama imposes a tax of 18 cents per gallon on gasoline and 22 cents per gallon on diesel fuel. This tax is used to fund road and infrastructure projects across the state.

Corporate Taxes: A Competitive Environment

Alabama aims to attract businesses and investments by offering a competitive corporate tax environment. The state’s corporate income tax rate is 6.5%, which is lower than the national average. Additionally, Alabama provides various tax incentives and credits to encourage business growth and job creation.

For instance, the Alabama Jobs Act offers a 25% refundable tax credit for new job creation in targeted industries. This incentive aims to stimulate economic growth and make Alabama an attractive destination for businesses.

Economic Impact and Considerations

Alabama’s tax structure has a significant impact on the state’s economy and its residents. The progressive income tax system ensures that higher-income earners contribute proportionally more, while the sales tax provides a broad-based revenue stream. The localized property tax system allows counties to fund their own operations and services, contributing to the state’s overall financial stability.

However, it's essential to consider the potential burdens that these taxes can impose on residents and businesses. Higher sales tax rates, for instance, can impact the purchasing power of consumers and affect the competitiveness of local businesses. On the other hand, lower corporate tax rates can attract investments and foster economic growth.

Conclusion: Navigating Alabama’s Tax Landscape

Understanding Alabama’s tax percentages is crucial for residents, businesses, and investors alike. This guide has provided an in-depth look at the state’s tax system, covering income, sales, property, and corporate taxes. By unraveling these components, individuals can make informed decisions about their financial strategies, while businesses can assess the economic climate and potential opportunities in Alabama.

Stay tuned for further insights and updates on Alabama's tax landscape as the state continues to evolve its economic policies.

What is the overall tax burden in Alabama compared to other states?

+Alabama’s overall tax burden is relatively moderate compared to many other states. Its income tax rates are competitive, and its property tax rates are lower than the national average. However, sales tax rates can vary significantly across the state due to local taxes, resulting in a complex tax landscape.

How do Alabama’s tax rates impact business operations?

+Alabama’s competitive corporate tax rate and various tax incentives make it an attractive destination for businesses. However, the variability in sales tax rates across the state can impact pricing strategies and consumer behavior, requiring businesses to adapt their approaches accordingly.

Are there any tax incentives for renewable energy projects in Alabama?

+Yes, Alabama offers tax incentives for renewable energy projects. The state provides a 10% investment tax credit for solar energy systems and a 5% investment tax credit for wind energy systems. These incentives aim to promote the adoption of renewable energy technologies.