Waukesha County Tax Bill

In the world of property ownership, understanding your tax obligations is crucial. For residents of Waukesha County, Wisconsin, the tax bill process can be a complex yet essential aspect of homeownership. This article aims to provide a comprehensive guide to Waukesha County's tax bill system, offering insights and practical information to help property owners navigate this important financial responsibility.

Unraveling the Waukesha County Tax Bill

The Waukesha County tax bill is an annual assessment sent to property owners, detailing the taxes owed for the current year. This bill is a critical document, providing transparency and clarity on the tax calculation process and the factors influencing the final amount.

The Breakdown: Understanding Your Tax Bill

Waukesha County’s tax bill is meticulously structured, encompassing various components that contribute to the overall tax amount. These include:

- Property Taxes: The primary component, determined by the assessed value of your property and the applicable tax rates.

- Special Assessments: Additional charges for specific improvements or services, such as road maintenance or sewer upgrades.

- Interest and Penalties: Late payments may incur interest, and penalties might apply for non-compliance.

- Discounts and Credits: Waukesha County offers incentives like the Homeowner's Tax Credit to eligible residents, reducing the overall tax burden.

Each of these elements is carefully calculated, taking into account various factors such as property characteristics, local ordinances, and state regulations. The resulting tax bill provides a detailed breakdown, allowing property owners to understand the distribution of their tax contributions.

| Tax Component | Description |

|---|---|

| Property Taxes | Based on property value and tax rates, typically the largest portion of the tax bill. |

| Special Assessments | Charges for specific services or improvements, often benefiting a defined area. |

| Interest and Penalties | Applied for late payments or non-compliance with tax regulations. |

| Discounts and Credits | Incentives like the Homeowner's Tax Credit reduce the tax burden for eligible residents. |

Tax Bill Timeline: When to Expect Your Assessment

The Waukesha County tax bill is typically issued annually, with a consistent timeline to ensure property owners have adequate time for review and payment. Here’s a breakdown of the key dates:

- July to September: Property assessments are conducted, determining the value of properties for tax purposes.

- October to November: Tax bills are mailed to property owners, detailing the taxes owed for the current year.

- December to January: Payment deadlines vary, with options for installment plans or full payment.

It's crucial for property owners to stay informed about these timelines to ensure timely payment and avoid penalties. Waukesha County provides online resources and notifications to keep residents updated on tax-related matters.

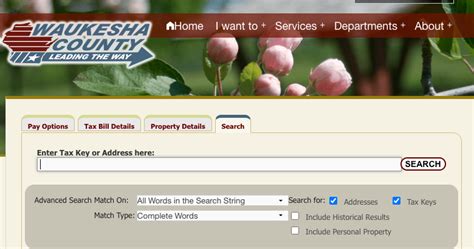

Payment Options: Flexibility for Property Owners

Waukesha County offers a range of payment options to accommodate the diverse financial situations of property owners. These options include:

- Online Payments: Secure online platform for quick and convenient tax bill payments.

- Mail-In Payments: Traditional method of sending checks or money orders to the Waukesha County Treasurer's Office.

- In-Person Payments: Property owners can visit the Treasurer's Office to make payments in person.

- Installment Plans: For those needing more flexibility, Waukesha County offers installment plans, allowing property owners to spread out their payments over several months.

By offering these diverse payment options, Waukesha County ensures that property owners can choose the method that best suits their financial circumstances, promoting timely payment and maintaining positive community relationships.

Challenging Your Tax Bill: The Appeal Process

Waukesha County recognizes that property assessments may not always reflect the current market value or may contain errors. To address this, the county provides a formal appeal process, allowing property owners to dispute their tax bill if they believe it is inaccurate or unfair.

The appeal process typically involves the following steps:

- Review and Research: Property owners should carefully review their tax bill and compare it with recent property sales in the area to assess the accuracy of the assessment.

- File an Appeal: If there is a discrepancy, property owners can file an appeal with the Waukesha County Board of Review. This board is responsible for hearing and deciding on tax assessment appeals.

- Present Evidence: During the appeal, property owners must provide evidence to support their claim, such as recent property sales data, appraisals, or other relevant information.

- Decision and Next Steps: The Board of Review will make a decision, which can be accepted or further appealed to the Wisconsin Department of Revenue or the courts.

The appeal process is a vital safeguard for property owners, ensuring that tax assessments are fair and accurate. By providing this mechanism, Waukesha County promotes transparency and accountability in its tax system.

The Future of Waukesha County’s Tax Bill

As Waukesha County continues to grow and evolve, its tax bill system is expected to adapt to meet the changing needs of its residents. Here are some potential future developments:

- Digital Transformation: Waukesha County may further enhance its online services, providing more efficient and accessible tax bill management, payment, and appeal processes.

- Community Engagement: The county could explore innovative ways to engage with residents, ensuring a better understanding of the tax system and fostering a sense of community involvement.

- Data-Driven Assessments: Advanced data analytics could be utilized to enhance the accuracy and fairness of property assessments, benefiting both the county and property owners.

By staying adaptable and responsive to technological advancements and community needs, Waukesha County can continue to provide a robust and transparent tax bill system, ensuring the long-term financial health and well-being of its residents.

What if I Disagree with My Tax Assessment?

+If you believe your tax assessment is inaccurate, you can file an appeal with the Waukesha County Board of Review. This process allows you to present evidence and argue your case for a potential reduction in your tax bill.

Are There Any Tax Relief Programs for Low-Income Residents?

+Yes, Waukesha County offers tax relief programs like the Homeowner’s Tax Credit and the Senior Citizen Property Tax Deferral Program to assist low-income and senior residents. These programs can significantly reduce the tax burden for eligible individuals.

How Can I Stay Updated on Tax-Related Changes or Deadlines?

+Waukesha County provides official websites and newsletters with important tax-related information. You can also subscribe to their email notifications or follow their social media accounts to stay informed about tax bill deadlines, payment options, and any relevant updates.