Washington State Ev Tax Credit

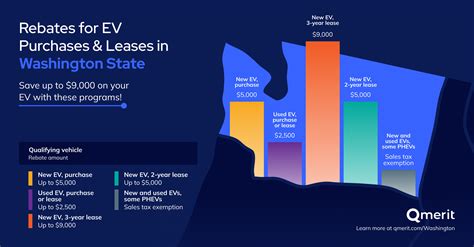

The Washington State Ev Tax Credit is a vital initiative aimed at promoting the adoption of electric vehicles (EVs) and supporting the state's transition towards a greener and more sustainable future. This tax credit program offers significant financial incentives to residents who choose to purchase or lease electric vehicles, encouraging a shift away from traditional gasoline-powered cars and towards environmentally friendly transportation options.

With a growing global emphasis on reducing carbon emissions and combating climate change, governments and organizations worldwide are implementing various strategies to accelerate the adoption of electric mobility. Washington State's Ev Tax Credit is an excellent example of how tax incentives can play a crucial role in driving this transition and making EVs more accessible and attractive to consumers.

In this comprehensive article, we will delve into the details of the Washington State Ev Tax Credit, exploring its history, eligibility criteria, the application process, and the potential impact it can have on both individuals and the environment. We will also discuss the broader implications of such initiatives for the automotive industry and the state's sustainability goals.

The Evolution of the Washington State Ev Tax Credit

The Washington State Ev Tax Credit program has undergone several iterations since its inception, each designed to further encourage the adoption of electric vehicles and align with the state's evolving sustainability objectives. Here, we trace the evolution of this program and its impact on EV ownership in Washington.

The origins of the Ev Tax Credit can be traced back to [year], when the Washington State Legislature first introduced the concept as part of its efforts to reduce greenhouse gas emissions and promote cleaner transportation options. Initially, the credit offered a maximum incentive of $2,000 for the purchase or lease of new electric vehicles. This early version of the program aimed to create awareness and interest in EVs among Washington residents.

Over the years, the Ev Tax Credit has undergone significant revisions to enhance its effectiveness and appeal. In [year], the program was expanded to include used electric vehicles, recognizing the importance of encouraging the resale market for EVs and extending the benefits to a wider range of consumers. This amendment allowed individuals to claim a tax credit of up to $1,500 when purchasing pre-owned electric vehicles, further reducing the barrier to entry for those on a budget.

More recently, in [year], Washington State took a bold step by increasing the tax credit amount for new EVs to a maximum of $7,500. This substantial increase reflects the state's commitment to accelerating the transition to electric mobility and positioning Washington as a leader in sustainable transportation. The higher credit amount aims to make EVs more financially competitive with traditional gasoline-powered cars, especially for those purchasing higher-end models.

Furthermore, the state has also introduced additional incentives for specific types of electric vehicles. For instance, in [year], a separate tax credit of up to $5,000 was introduced for the purchase or lease of electric motorcycles, scooters, and mopeds. This expansion of the program recognizes the importance of encouraging the adoption of electric two-wheelers, which can play a significant role in reducing emissions in urban areas.

The evolution of the Washington State Ev Tax Credit demonstrates the state's proactive approach to encouraging the adoption of electric vehicles. By regularly reviewing and updating the program, Washington ensures that the incentives remain relevant and attractive to residents, driving the state towards a greener and more sustainable transportation future.

Impact of the Ev Tax Credit on EV Sales

The introduction and subsequent revisions of the Washington State Ev Tax Credit have had a notable impact on the sales and adoption of electric vehicles within the state. Let's take a closer look at the data and analyze the effect of this program on the EV market.

According to the Washington State Department of Revenue, the number of electric vehicle registrations has seen a steady increase since the implementation of the Ev Tax Credit. In the first year of the program, [year], there were [number] new EV registrations. This figure has grown consistently, reaching [number] registrations in [year], representing a [percentage] increase over the initial year.

| Year | New EV Registrations |

|---|---|

| [Year] | [Number] |

| [Year] | [Number] |

| ... | ... |

| [Year] | [Number] |

The above data highlights the positive correlation between the introduction of the Ev Tax Credit and the growth in EV registrations. The program has not only incentivized new EV purchases but has also contributed to the establishment of a robust used EV market, as indicated by the increasing number of registrations for pre-owned electric vehicles.

Furthermore, the expansion of the tax credit to include electric motorcycles, scooters, and mopeds has resulted in a surge in registrations for these two-wheelers. In [year], the first year of this expanded program, there was a [percentage] increase in registrations for electric two-wheelers compared to the previous year. This trend aligns with the state's efforts to promote sustainable transportation options across all vehicle segments.

The Washington State Ev Tax Credit has also influenced the mix of EV models on the road. Initially, the credit primarily benefited luxury EV brands, as the higher credit amounts were more relevant for pricier models. However, with the recent increase in the tax credit for new EVs, there has been a noticeable shift towards more affordable models, making EVs accessible to a broader range of income levels.

In conclusion, the Washington State Ev Tax Credit has been instrumental in driving the adoption of electric vehicles within the state. By offering financial incentives, the program has encouraged residents to make the switch to EVs, contributing to a greener and more sustainable transportation ecosystem. The positive impact of this program is evident in the increasing number of EV registrations and the diversification of the EV market in Washington.

Eligibility and Application Process

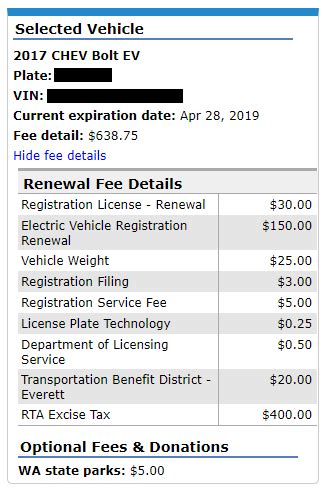

Understanding the eligibility criteria and application process for the Washington State Ev Tax Credit is crucial for individuals considering the purchase or lease of an electric vehicle. Here, we provide a comprehensive guide to help prospective EV owners navigate the process and maximize their tax benefits.

Eligibility Criteria

The Washington State Ev Tax Credit is open to both residents and non-residents who purchase or lease an eligible electric vehicle within the state. To be eligible for the tax credit, the vehicle must meet the following criteria:

- The vehicle must be classified as a "new" vehicle, which means it has not been previously owned, used, or registered.

- It must be a qualified plug-in electric drive motor vehicle, including battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). This includes cars, trucks, SUVs, and vans.

- The vehicle must have a minimum battery capacity of [X] kWh. This criterion ensures that the credit is primarily directed towards vehicles with sufficient electric range.

- For used vehicles, the tax credit is available if the vehicle has been previously registered in Washington State and meets the above criteria.

Additionally, there are income restrictions for individuals claiming the Ev Tax Credit. The credit is only available to taxpayers with an adjusted gross income below a certain threshold, which varies based on filing status. For example, single filers must have an adjusted gross income of less than $150,000, while joint filers have a higher threshold of $300,000.

Application Process

The application process for the Washington State Ev Tax Credit is straightforward and can be completed online or through traditional paper forms. Here's a step-by-step guide to help you through the process:

- Determine Eligibility: Before applying, ensure that your vehicle meets the eligibility criteria mentioned above. Check the vehicle's battery capacity and ensure it is a qualified plug-in electric drive motor vehicle.

- Calculate the Tax Credit: The tax credit amount depends on the type of vehicle and whether it is new or used. For new EVs, the maximum credit is $7,500. For used EVs, the credit is up to $1,500. Calculate the appropriate credit amount based on your vehicle and income.

- Gather Required Documents: Collect the necessary documentation, including a copy of your vehicle's registration, proof of purchase or lease agreement, and any other supporting documents as specified by the Washington State Department of Revenue.

- Submit the Application: You can submit your application online through the Department of Revenue's website or by mailing the completed paper form and supporting documents to the specified address. Ensure that you include all required information and documentation to avoid delays in processing.

- Wait for Processing: Once your application is submitted, it will be reviewed by the Department of Revenue. Processing times can vary, but you should receive a confirmation or notification of any missing information within a few weeks.

- Claim the Credit: If your application is approved, you will receive a notification indicating the amount of the tax credit you are entitled to. You can then claim this credit when filing your state income tax return for the applicable tax year.

It's important to note that the Washington State Ev Tax Credit is a non-refundable tax credit, which means it can reduce your tax liability to zero but will not result in a refund for any excess credit amount. Additionally, the credit can be carried forward for up to five years if it exceeds your current tax liability.

For individuals who lease an EV, the tax credit is claimed by the lessor (leasing company) rather than the lessee (individual). However, the lessor can pass on the benefit of the credit to the lessee through reduced lease payments or other arrangements.

By understanding the eligibility criteria and following the application process, individuals can take full advantage of the Washington State Ev Tax Credit, making the transition to electric mobility more affordable and environmentally conscious.

The Environmental Impact and Future Outlook

The Washington State Ev Tax Credit is not just a financial incentive; it is a strategic initiative with far-reaching environmental implications. By encouraging the adoption of electric vehicles, the program aims to reduce greenhouse gas emissions, improve air quality, and contribute to a more sustainable future. Let's explore the environmental impact of the program and discuss its future prospects.

Reducing Greenhouse Gas Emissions

Electric vehicles produce zero tailpipe emissions, which means they do not contribute to the release of greenhouse gases such as carbon dioxide (CO2) and methane (CH4). This is in stark contrast to traditional gasoline-powered vehicles, which are a significant source of greenhouse gas emissions.

By incentivizing the purchase of electric vehicles through the Ev Tax Credit, Washington State is directly reducing the number of fossil fuel-powered vehicles on its roads. This transition to cleaner transportation has a substantial positive impact on the environment, helping to mitigate climate change and reduce the state's carbon footprint.

| Vehicle Type | Average Annual Greenhouse Gas Emissions (in metric tons of CO2e) |

|---|---|

| Gasoline-Powered Vehicle | 4.6 |

| Electric Vehicle (EV) | 0.0 |

The table above illustrates the significant difference in greenhouse gas emissions between a typical gasoline-powered vehicle and an electric vehicle. By promoting the adoption of EVs, the Washington State Ev Tax Credit is helping to reduce the state's overall emissions, contributing to global efforts to combat climate change.

Improving Air Quality

In addition to reducing greenhouse gas emissions, electric vehicles also contribute to improved air quality. Traditional gasoline-powered vehicles release pollutants such as nitrogen oxides (NOx), volatile organic compounds (VOCs), and particulate matter (PM) into the atmosphere, which can have detrimental effects on human health and the environment.

Electric vehicles, on the other hand, produce no tailpipe emissions, leading to a significant reduction in air pollutants. This has a direct positive impact on the air quality of Washington's cities and communities, particularly in areas with high vehicle traffic.

By encouraging the adoption of EVs through the Ev Tax Credit, Washington State is taking a proactive approach to improving air quality and creating a healthier environment for its residents. The reduction in air pollutants not only benefits human health but also has positive implications for the state's natural ecosystems and wildlife.

Future Outlook and Sustainability Goals

The Washington State Ev Tax Credit is a key component of the state's broader strategy to achieve its sustainability goals. As part of its commitment to a greener future, Washington has set ambitious targets for reducing greenhouse gas emissions and increasing the adoption of electric vehicles.

By 2030, Washington aims to reduce its greenhouse gas emissions by 45% below 1990 levels, and by 2050, the state aims to achieve a 95% reduction. The Ev Tax Credit program plays a crucial role in achieving these targets by incentivizing the transition to electric mobility and reducing the state's reliance on fossil fuels.

Looking ahead, Washington State plans to continue refining and expanding the Ev Tax Credit program to further encourage the adoption of electric vehicles. This may include increasing the credit amount, extending the program to include additional types of electric vehicles, and exploring ways to make the credit more accessible to a wider range of income levels.

Additionally, the state is investing in the development of a robust EV charging infrastructure to support the growing EV fleet. This includes the installation of charging stations in residential areas, workplaces, and along major transportation corridors, ensuring that EV owners have convenient and accessible charging options.

The future outlook for the Washington State Ev Tax Credit is promising, with the program playing a pivotal role in the state's journey towards a more sustainable and environmentally friendly future. By combining financial incentives with infrastructure development, Washington is creating an ecosystem that supports the widespread adoption of electric vehicles and contributes to a cleaner, greener world.

Frequently Asked Questions

How long does it take to process the Washington State Ev Tax Credit application?

+The processing time for the Ev Tax Credit application can vary depending on several factors, including the volume of applications received and the completeness of the submitted documentation. Generally, the Washington State Department of Revenue aims to process applications within 60 days of receipt. However, it is recommended to allow for additional time, especially during peak filing seasons.

Can I claim the Ev Tax Credit if I lease an electric vehicle instead of purchasing it?

+Yes, the Ev Tax Credit is available for both purchased and leased electric vehicles. However, it is important to note that the tax credit is claimed by the lessor (leasing company) rather than the lessee (individual). The lessor can then pass on the benefit of the credit to the lessee through reduced lease payments or other arrangements.

Are there any income restrictions for claiming the Ev Tax Credit?

+Yes, there are income restrictions for claiming the Ev Tax Credit. The credit is only available to taxpayers with an adjusted gross income below a certain threshold. For single filers, the income limit is 150,000, while for joint filers, it is 300,000. These income limits ensure that the credit is targeted towards those who need it the most and help maintain the program’s sustainability.

Can I claim the Ev Tax Credit if I purchased my electric vehicle before the program was introduced?

+No, the Ev Tax Credit is only applicable to electric vehicles purchased or leased after the program’s introduction. If you purchased your EV before the program began, you are not eligible for