Do Teenagers Have To File Taxes

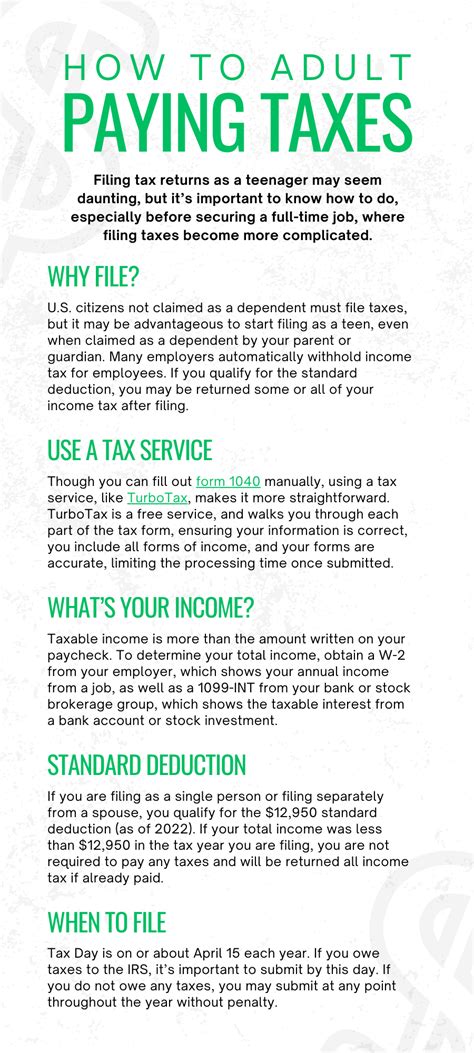

As a teenager, you may be wondering about your responsibilities when it comes to filing taxes. The process of tax filing can seem daunting, especially if you're new to the world of finances and the complexities of the tax system. In this comprehensive guide, we will explore the ins and outs of tax filing for teenagers, providing you with the knowledge and tools to navigate this important financial milestone.

Understanding your tax obligations as a teenager is crucial, as it not only ensures compliance with the law but also sets a strong foundation for your financial future. Let's delve into the specifics and answer the question: Do teenagers have to file taxes? Prepare to uncover the answers and gain valuable insights into the world of taxation.

The Legal Requirements and Exceptions for Teenagers

When it comes to tax filing, the legal requirements for teenagers can vary depending on several factors. It’s important to understand these requirements to determine whether you need to file taxes or not.

Income Thresholds and Exemptions

One key factor is your income level. In many jurisdictions, teenagers are exempt from filing taxes if their income falls below a certain threshold. This threshold varies from country to country and may also differ based on the type of income earned. For instance, earnings from a part-time job may have a different exemption limit compared to investment income.

Let's take an example. In the United States, as of [insert current year], teenagers are generally exempt from filing federal income taxes if their earned income (wages, salaries, tips) is below a certain amount, which is currently $12,950 for single individuals. However, if you have unearned income, such as interest or dividends, the exemption limit is lower, at $1,150. It's important to note that these thresholds are subject to change annually, so it's crucial to stay updated with the latest tax regulations.

| Income Type | Exemption Limit |

|---|---|

| Earned Income (Wages, Salaries) | $12,950 (as of [current year]) |

| Unearned Income (Interest, Dividends) | $1,150 (as of [current year]) |

Filing Requirements for Dependent Teenagers

Another crucial aspect to consider is your dependency status. If you are claimed as a dependent on your parent’s or guardian’s tax return, your tax filing obligations may differ. In many cases, dependent teenagers are not required to file taxes separately, as their income is included in their parents’ tax returns.

However, there are situations where dependent teenagers may still need to file taxes. For instance, if you have earned income above a certain threshold and your parents cannot claim you as a dependent, you may be required to file your own tax return. Additionally, if you have investment income or unearned income that exceeds the exemption limit, you may need to file a tax return even if you are a dependent.

Tax Benefits and Credits for Teenagers

While tax filing may seem like a burden, there are certain benefits and credits available specifically for teenagers. Understanding these incentives can make the process more appealing and provide financial advantages.

For example, in some countries, teenagers who work part-time may be eligible for tax credits or deductions. These incentives aim to encourage youth employment and provide financial support to those who are contributing to the workforce. Additionally, there may be specific education-related tax credits or grants available for teenagers pursuing higher education.

Steps to Determine Your Tax Obligations

Now that we’ve explored the legal requirements and exceptions, it’s time to guide you through the process of determining your own tax obligations as a teenager.

Calculate Your Total Income

The first step is to calculate your total income for the tax year. This includes all sources of income, such as wages from a part-time job, tips, allowances, scholarships (if applicable), and any other earnings. Make sure to consider both earned and unearned income to get an accurate picture of your total income.

Let's say you worked part-time during the summer and earned $2,500 in wages. Additionally, you received $500 in tips and had $300 in investment income from a small portfolio you've been building. Your total income for the tax year would be $3,300.

Check the Exemption Limits

Once you have your total income calculated, it’s time to compare it with the applicable exemption limits. As mentioned earlier, these limits may vary based on your jurisdiction and the type of income earned. Refer to the tax regulations or consult a tax professional to determine the specific exemption limits for your situation.

In our example, if we consider the U.S. tax system, the exemption limit for earned income is $12,950. Since your total income ($3,300) is well below this threshold, you would not be required to file taxes based on your earned income.

Consider Other Tax Obligations

While your earned income may fall below the exemption limit, it’s important to consider other types of income and tax obligations. As mentioned earlier, investment income or unearned income may have different exemption limits. Additionally, if you have income from a business or self-employment, there may be specific tax requirements to fulfill.

Let's assume you also have a small online business where you sell handmade crafts. If your business income exceeds a certain threshold, you may need to register for a business tax identification number and file business taxes separately. It's crucial to understand the specific tax obligations related to your business activities.

Filing Taxes as a Teenager: A Step-by-Step Guide

If, after assessing your income and obligations, you determine that you need to file taxes as a teenager, the process can seem intimidating. However, with the right guidance and resources, filing your taxes can be a straightforward and educational experience.

Gather Your Tax Documents

The first step in the tax filing process is to gather all the necessary documents. This includes any income statements, such as W-2 forms for wages, 1099 forms for self-employment income, or other tax documents provided by your employer or financial institutions. Additionally, you may need identification documents, such as your social security number or tax identification number.

For our example, you would need to obtain a W-2 form from your summer job, which will provide details about your earnings and taxes withheld. If you received any 1099 forms for your online business income, those should also be gathered.

Choose Your Filing Method

There are several methods available for filing taxes as a teenager. You can opt for traditional paper filing, where you complete and submit physical tax forms. However, with the advancement of technology, online tax filing has become increasingly popular and convenient. Many tax software programs offer user-friendly interfaces specifically designed for teenagers and first-time filers.

Consider your comfort level and preferences when choosing your filing method. Online tax filing can be more efficient and provide instant feedback on your tax obligations, but it's important to ensure you choose a reputable and secure platform.

Complete the Tax Forms

Whether you choose paper or online filing, you’ll need to complete the appropriate tax forms. These forms will guide you through the process of reporting your income, claiming deductions or credits (if applicable), and calculating your tax liability. It’s important to read the instructions carefully and provide accurate information.

For instance, in the United States, teenagers often use Form 1040-EZ, which is a simplified tax form for individuals with no dependents and no itemized deductions. This form is relatively straightforward and can be completed in a step-by-step manner.

Calculate Your Tax Liability

As you progress through the tax forms, you’ll reach the stage of calculating your tax liability. This is the amount of tax you owe based on your income and any applicable deductions or credits. Tax software or online calculators can be incredibly helpful in this step, as they provide accurate calculations and guide you through the process.

Let's say you have calculated your tax liability to be $150. This means you owe $150 in taxes for the tax year.

Pay Your Taxes or Claim a Refund

Once you have determined your tax liability, the next step is to either pay your taxes or claim a refund, depending on your situation. If you owe taxes, you’ll need to make the payment by the deadline specified by the tax authority. Payment methods may include direct debit, credit card, or electronic funds transfer.

However, if you are due a tax refund, you can expect to receive it within a certain timeframe. Tax refunds occur when you have overpaid your taxes throughout the year, and the tax authority returns the excess amount to you. It's always exciting to receive a tax refund, especially as a teenager starting your financial journey.

Tips and Best Practices for Teenagers Filing Taxes

Now that you have a solid understanding of the tax filing process as a teenager, let’s explore some valuable tips and best practices to ensure a smooth and successful experience.

Stay Informed and Educate Yourself

Tax laws and regulations can be complex and subject to change. It’s crucial to stay informed and educate yourself about the latest tax updates. Follow reputable tax websites, subscribe to tax newsletters, or attend tax workshops or webinars specifically designed for teenagers. The more you know, the better equipped you’ll be to navigate the tax system.

Keep Accurate Records

Maintaining accurate records is essential for tax filing. Keep track of all your income sources, expenses, and any tax-related documents. Create a filing system, either physical or digital, to organize your records. This will not only make the tax filing process smoother but also provide valuable data for future financial planning.

Seek Professional Guidance

If you have complex tax situations or are unsure about certain aspects of the process, it’s always a good idea to seek professional guidance. Tax professionals, such as accountants or tax attorneys, can provide expert advice tailored to your specific circumstances. They can help you navigate complex tax laws, claim all eligible deductions, and ensure compliance with tax regulations.

Start Early and Plan Ahead

Tax filing doesn’t have to be a last-minute scramble. Start preparing for tax season early by gathering your documents, understanding your income, and setting aside time to complete the necessary forms. By starting early, you can avoid the stress of rushing through the process and increase the likelihood of accurate filing.

Explore Tax-Saving Strategies

While tax filing may be a requirement, there are strategies you can implement to minimize your tax liability and maximize your financial benefits. Explore tax-saving options such as claiming deductions for education expenses, contributing to retirement accounts (if eligible), or taking advantage of tax credits specifically designed for teenagers.

Understand Tax Deadlines and Penalties

Tax deadlines are crucial to comply with. Missing a tax deadline can result in penalties and interest charges. Familiarize yourself with the specific deadlines for filing taxes and paying any taxes owed. Mark these dates on your calendar or set reminders to ensure you meet the deadlines and avoid unnecessary financial burdens.

Conclusion: Empowering Teenagers with Financial Knowledge

Navigating the world of taxes as a teenager can be a challenging but empowering experience. By understanding your tax obligations, gathering the necessary information, and following the step-by-step guide provided, you can successfully file your taxes and take control of your financial future.

Remember, tax filing is not just about compliance; it's an opportunity to learn about personal finance, develop important skills, and make informed decisions. As you embark on this journey, stay curious, seek knowledge, and embrace the financial literacy that will serve you well throughout your life.

At what age do teenagers typically start filing taxes?

+The age at which teenagers start filing taxes depends on various factors, including their income level and dependency status. In general, teenagers who have earned income above a certain threshold or have unearned income exceeding exemption limits may need to file taxes. It’s essential to consult tax regulations and guidelines specific to your country to determine the exact age requirements.

Are there any penalties for not filing taxes as a teenager if I’m not required to?

+If you are not required to file taxes as a teenager due to your income falling below the exemption limits, there are typically no penalties for not filing. However, it’s important to note that certain situations may require you to file even if your income is below the threshold. These situations include claiming tax credits, receiving certain types of income, or having a business. It’s always best to consult a tax professional to ensure you understand your specific obligations.

Can I claim deductions or credits as a teenager when filing taxes?

+Absolutely! Teenagers can take advantage of various deductions and credits when filing taxes. These may include education-related expenses, student loan interest deductions, or specific tax credits designed for youth employment or education. It’s important to explore these options and understand the eligibility criteria to maximize your tax benefits.

What happens if I make a mistake when filing my taxes as a teenager?

+Mistakes can happen, and it’s important to remember that you are not alone in this journey. If you make a mistake when filing your taxes, the first step is to identify and correct the error as soon as possible. This may involve amending your tax return or contacting the tax authority for guidance. It’s crucial to act promptly and take responsibility for any mistakes to ensure compliance and avoid potential penalties.

How can I stay updated with tax regulations and changes as a teenager?

+Staying updated with tax regulations is essential to ensure you remain compliant and take advantage of any changes that may benefit you. Follow reputable tax websites, subscribe to tax newsletters, and consider attending tax workshops or webinars specifically designed for teenagers. Additionally, consult with tax professionals or seek advice from financial advisors who can provide guidance tailored to your circumstances.