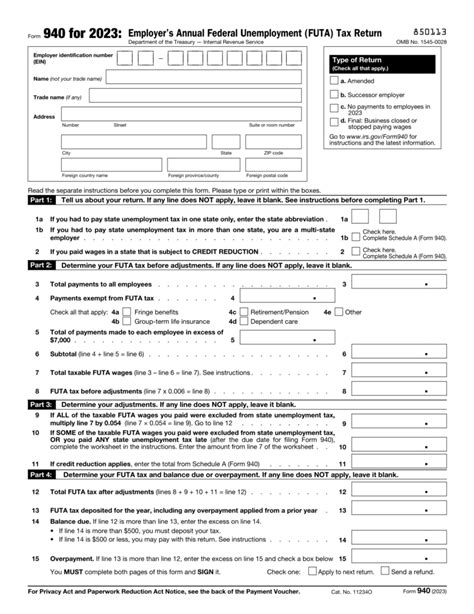

940 Tax Form

The 940 Tax Form is an essential component of the US tax system, playing a crucial role in reporting and paying employment taxes. This comprehensive guide will delve into the intricacies of the 940 Tax Form, offering an in-depth analysis of its purpose, requirements, and implications for businesses and employers. By understanding the ins and outs of this form, businesses can ensure compliance with tax regulations and avoid potential penalties.

Understanding the 940 Tax Form: A Comprehensive Overview

The 940 Tax Form, officially known as the Employer’s Annual Federal Unemployment (FUTA) Tax Return, is a critical document required by the Internal Revenue Service (IRS) for employers to report and pay Federal Unemployment Tax Act (FUTA) taxes. This form ensures that employers contribute to the unemployment compensation fund, which provides benefits to eligible workers who have lost their jobs.

The FUTA tax is an essential part of the social safety net, ensuring that unemployed workers receive some financial support during periods of joblessness. By understanding the requirements of the 940 Tax Form, businesses can fulfill their tax obligations and contribute to this vital system.

Purpose and Importance of the 940 Tax Form

The primary purpose of the 940 Tax Form is to enable employers to calculate and report their FUTA tax liability for the previous calendar year. This tax is used to fund unemployment benefits, providing a safety net for workers who become unemployed through no fault of their own. The FUTA tax is a federal tax, distinct from state unemployment taxes, and is an important component of the nation’s employment and social security systems.

By completing and filing the 940 Tax Form accurately, employers ensure that they meet their federal tax obligations and contribute to the overall economic stability of the country. The form is a critical tool for maintaining the integrity of the unemployment compensation system and ensuring that eligible workers receive the benefits they are entitled to.

Key Features and Requirements of the 940 Tax Form

The 940 Tax Form is a comprehensive document that requires detailed information about an employer’s operations and payroll. Here are some key features and requirements to note:

- Wage Base: The FUTA tax is applied to the first $7,000 of wages paid to each employee during the calendar year. This wage base is adjusted periodically to account for inflation.

- Tax Rate: The FUTA tax rate is typically 6.0% for the first $7,000 of wages paid to each employee. However, most employers can claim a credit of up to 5.4% for taxes paid to their state unemployment fund, reducing their effective FUTA tax rate to 0.6%.

- Filing Frequency: The 940 Tax Form is an annual return, typically due by January 31 of the year following the calendar year to which it applies. However, employers who have a FUTA tax liability of $500 or more must deposit their FUTA taxes on a semi-weekly or monthly schedule, depending on their payroll frequency and amount.

- Reporting Period: The reporting period for the 940 Tax Form is the calendar year. Employers must aggregate wages and taxes paid throughout the year to calculate their total FUTA tax liability.

Understanding these key features and requirements is essential for employers to accurately complete the 940 Tax Form and avoid potential penalties for underpayment or late filing.

Calculating FUTA Tax Liability

Calculating the FUTA tax liability is a critical step in completing the 940 Tax Form. Here’s a simplified breakdown of the calculation process:

- Identify Taxable Wages: Determine the total wages paid to each employee during the calendar year, up to the wage base limit of $7,000.

- Calculate Gross FUTA Tax: Multiply the taxable wages by the FUTA tax rate of 6.0% to determine the gross FUTA tax liability.

- Apply State Tax Credits: Reduce the gross FUTA tax liability by any credits earned for state unemployment taxes paid. The credit is typically 5.4% of the state unemployment taxes paid, but this can vary by state.

- Determine Net FUTA Tax Liability: The net FUTA tax liability is the final amount that employers must report on the 940 Tax Form and pay to the IRS. It is the result of subtracting the state tax credits from the gross FUTA tax.

It's important to note that the calculation process can be more complex for employers with multiple states involved or for those who have employees working in multiple jurisdictions. In such cases, additional considerations and adjustments may be necessary to ensure accurate tax reporting.

| Example Calculation | Amount |

|---|---|

| Total Wages Paid to Employees | $150,000 |

| Taxable Wages (per employee) | $7,000 |

| Gross FUTA Tax (6.0%) | $6,300 |

| State Tax Credits (5.4%) | $5,670 |

| Net FUTA Tax Liability | $630 |

Filing and Payment Requirements

Once the FUTA tax liability is calculated, employers must ensure timely filing and payment of the taxes due. Here are the key filing and payment requirements for the 940 Tax Form:

- Filing Due Date: The 940 Tax Form is due by January 31 of the year following the calendar year to which it applies. For example, the form for the 2022 calendar year is due by January 31, 2023.

- Late Filing Penalties: Late filing of the 940 Tax Form can result in penalties. The penalty is 5% of the unpaid tax for each month or part of a month that the form is late, up to a maximum of 25% of the unpaid tax.

- Electronic Filing: The IRS encourages electronic filing of the 940 Tax Form. This can be done through the IRS website or through approved tax software providers. Electronic filing is faster, more secure, and reduces the risk of errors compared to paper filing.

- Payment Due Date: FUTA taxes are due on the same date as the filing deadline. In the example above, FUTA taxes for the 2022 calendar year would be due by January 31, 2023.

- Late Payment Penalties: Late payment of FUTA taxes can also result in penalties. The penalty is 0.5% of the unpaid tax for each month or part of a month that the payment is late, up to a maximum of 25% of the unpaid tax.

- Deposit Frequency: Employers with a FUTA tax liability of $500 or more must deposit their FUTA taxes on a semi-weekly or monthly schedule, depending on their payroll frequency and amount. This ensures that the IRS receives the taxes promptly and reduces the risk of late payment penalties.

Meeting these filing and payment requirements is essential to avoid penalties and maintain good standing with the IRS. It's important to note that the IRS provides guidance and resources to help employers understand and meet their tax obligations, including the 940 Tax Form requirements.

The Impact of the 940 Tax Form on Businesses and Employers

The 940 Tax Form has significant implications for businesses and employers, affecting their financial operations, tax strategies, and overall compliance with tax regulations. Understanding these impacts is crucial for business leaders to make informed decisions and ensure their organizations remain compliant and financially healthy.

Financial Considerations and Tax Strategies

The FUTA tax, reported on the 940 Tax Form, is an important financial consideration for businesses, impacting their cash flow and tax strategies. Here are some key financial considerations and tax strategies related to the 940 Tax Form:

- Cash Flow Management: FUTA taxes, like other payroll taxes, can significantly impact a business's cash flow. Employers must ensure they have sufficient funds to meet their FUTA tax obligations, which can be particularly challenging for small businesses with limited cash reserves. Effective cash flow management, including accurate forecasting and timely payments, is essential to avoid late payment penalties and maintain financial stability.

- Tax Planning and Strategies: The FUTA tax rate and wage base can provide opportunities for tax planning and strategies. For example, businesses can optimize their payroll structure to minimize the number of employees who reach the wage base limit, thereby reducing their FUTA tax liability. Additionally, understanding the state tax credits available can help businesses reduce their net FUTA tax liability and optimize their tax position.

- Employer Responsibility: Employers are responsible for paying the FUTA tax, even if their employees have not yet been paid. This means that businesses must set aside funds specifically for FUTA taxes to ensure they can meet their obligations, regardless of their employees' payment status.

By understanding these financial considerations and implementing effective tax strategies, businesses can manage their FUTA tax obligations while maintaining financial health and compliance with tax regulations.

Compliance and Legal Implications

Compliance with the 940 Tax Form requirements is not just a financial matter; it also carries significant legal implications. Non-compliance can result in penalties, audits, and legal action, which can be detrimental to a business’s reputation and financial stability. Here are some key compliance and legal considerations related to the 940 Tax Form:

- Penalties and Interest: Late filing or payment of the 940 Tax Form can result in significant penalties and interest charges. The IRS imposes penalties for late filing (5% of the unpaid tax per month) and late payment (0.5% of the unpaid tax per month), which can accumulate quickly. Additionally, the IRS may assess interest on unpaid taxes, compounding the financial burden of non-compliance.

- Audits and Investigations: The IRS has the authority to audit businesses to ensure compliance with tax laws, including the requirements of the 940 Tax Form. Audits can be triggered by various factors, including late filings, discrepancies in reported information, or random selection. During an audit, the IRS may review a business's records, payroll data, and tax returns to verify compliance. Non-compliance discovered during an audit can result in penalties, interest, and legal action.

- Legal Action: In cases of severe or repeated non-compliance, the IRS may take legal action against a business. This can include civil penalties, criminal charges, and even the revocation of the business's tax identification number. Legal action can have severe consequences, including fines, imprisonment, and the dissolution of the business.

Ensuring compliance with the 940 Tax Form requirements is therefore not just a matter of financial prudence but also a legal obligation. Businesses must take steps to understand and meet their tax obligations to avoid the potentially devastating consequences of non-compliance.

Best Practices for Compliance

To ensure compliance with the 940 Tax Form requirements and avoid potential penalties and legal issues, businesses should adopt the following best practices:

- Stay Informed: Keep up-to-date with the latest tax laws, regulations, and IRS guidelines related to the 940 Tax Form. The IRS website provides valuable resources, including forms, instructions, and publications, to help businesses understand their tax obligations.

- Accurate Record-Keeping: Maintain detailed and accurate records of payroll data, including wages paid to each employee, to facilitate the calculation of FUTA tax liability. Accurate record-keeping is essential for compliance and can simplify the process of completing the 940 Tax Form.

- Timely Filing and Payment: Ensure that the 940 Tax Form is filed and FUTA taxes are paid on time. Use the IRS' electronic filing and payment options to simplify the process and reduce the risk of errors. Consider setting up reminders or using tax software that can automate the filing and payment process.

- Consultation with Tax Professionals: For businesses with complex payroll structures, multiple states involved, or other complexities, consultation with tax professionals can be invaluable. Tax professionals can provide expert guidance on tax laws, help with tax planning and strategy, and ensure compliance with tax regulations.

By adopting these best practices, businesses can navigate the complexities of the 940 Tax Form requirements, ensure compliance, and maintain good standing with the IRS.

Future Trends and Developments

The landscape of tax regulations, including those related to the 940 Tax Form, is subject to ongoing changes and developments. Understanding these future trends and developments is essential for businesses to adapt their tax strategies and compliance practices accordingly.

Potential Changes in Tax Rates and Wage Bases

The FUTA tax rate and wage base are subject to periodic adjustments by the IRS. These adjustments are typically made to account for inflation and ensure that the tax system remains fair and sustainable. Here are some potential changes to watch for:

- Tax Rate Adjustments: The FUTA tax rate of 6.0% is not set in stone and can be adjusted by the IRS. While this rate has remained stable for several years, future economic conditions or legislative changes could lead to adjustments. Businesses should monitor any announcements or proposed legislation that could impact the FUTA tax rate.

- Wage Base Increases: The wage base, currently set at $7,000, is also subject to periodic adjustments. As the cost of living and wages increase, the IRS may raise the wage base to ensure that FUTA taxes remain applicable to a significant portion of employees' wages. Businesses should stay informed about any proposed or enacted changes to the wage base to accurately calculate their FUTA tax liability.

Monitoring these potential changes is crucial for businesses to adapt their tax strategies and ensure compliance with any new regulations.

The Impact of Technological Advances

Technological advances are transforming the tax landscape, including the process of filing and paying taxes like the FUTA tax reported on the 940 Tax Form. Here are some ways in which technology is impacting tax processes:

- Electronic Filing and Payment: The IRS has increasingly encouraged electronic filing and payment of taxes, including the 940 Tax Form. Electronic filing offers several advantages, including faster processing, reduced errors, and improved security. As technology continues to advance, the IRS may further incentivize or even require electronic filing, making it essential for businesses to adopt these digital processes.

- Data Analytics and Tax Compliance: Advanced data analytics tools can help businesses manage their tax obligations more effectively. These tools can streamline the process of collecting and analyzing payroll data, automating the calculation of tax liabilities, and ensuring compliance with tax regulations. By leveraging technology, businesses can improve the accuracy and efficiency of their tax processes.

- Blockchain and Tax Transparency: The use of blockchain technology is gaining traction in the tax world, offering increased transparency and security in tax transactions. Blockchain can enhance the traceability of tax payments, reduce the risk of fraud, and improve overall tax compliance. While still in its early stages, blockchain technology has the potential to revolutionize tax processes, including the filing and payment of FUTA taxes.

As technology continues to evolve, businesses should stay informed about these advancements and consider adopting them to improve their tax processes and compliance practices.

Policy Changes and Their Impact

Policy changes at the federal and state levels can have a significant impact on the FUTA tax system and the requirements of the 940 Tax Form. Here are some policy changes to watch for:

- Changes in State Unemployment Tax Laws: State unemployment tax laws, which impact the FUTA tax credits available to employers, can change periodically. These changes can impact the amount of FUTA tax credits employers can claim, affecting their net FUTA tax liability. Businesses with operations in multiple states should stay informed about changes to state unemployment tax laws to ensure they accurately calculate their FUTA tax liability.

- Federal Policy Changes: Federal policies, such as those related to unemployment benefits or tax reforms, can also impact the FUTA tax system. For example, changes in unemployment benefit levels or eligibility criteria can affect the funding needs of the unemployment compensation fund, potentially leading to adjustments in the FUTA tax rate or wage base. Businesses should monitor federal policy changes to understand their potential impact on FUTA tax obligations.

By staying informed about policy changes, businesses can adapt their tax