California Sales Tax Irvine

Sales tax in California, like in many other states, is a crucial aspect of the state's revenue generation and an important consideration for businesses and consumers alike. This article will delve into the specifics of sales tax in Irvine, California, offering a comprehensive guide for businesses, consumers, and anyone interested in understanding the tax landscape of this vibrant city.

Understanding California Sales Tax

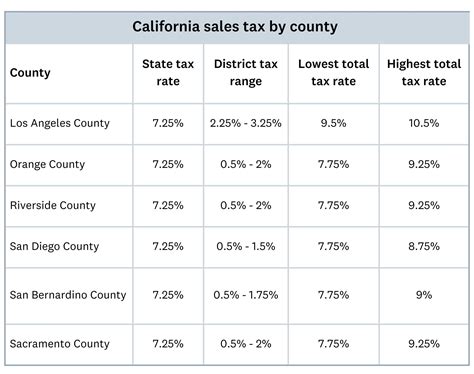

California has a state sales and use tax rate of 7.25%, which applies to most retail transactions involving tangible personal property and some services. However, the total sales tax rate varies by location, as cities and counties may impose additional taxes on top of the state rate. These additional taxes are often referred to as “district taxes” or “local taxes.”

The sales tax system in California is administered by the California Department of Tax and Fee Administration (CDTFA), which provides guidance and regulations to ensure compliance. The state's sales tax is a vital revenue stream, funding various public services and infrastructure projects.

Sales Tax Structure in California

California’s sales tax is structured with a base rate set at the state level and additional rates determined by local jurisdictions. This means that the total sales tax rate can vary significantly depending on the location of the transaction. For instance, the sales tax rate in San Francisco includes a city tax and a county tax, bringing the total rate to 8.75%, which is one of the highest in the state.

| Sales Tax Rate Component | Rate |

|---|---|

| State Sales Tax | 7.25% |

| Local Taxes (Variable) | Varies by Location |

The CDTFA maintains a comprehensive list of sales and use tax rates by location, which is a valuable resource for businesses operating in multiple areas of the state.

Sales Tax in Irvine, California

Irvine, located in Orange County, is known for its thriving business community and vibrant residential areas. The city’s sales tax rate is slightly higher than the state average, reflecting the needs and initiatives of the local community.

Irvine’s Sales Tax Breakdown

The total sales tax rate in Irvine is 8.75%, which includes the state sales tax rate of 7.25% and a 1.5% local tax. This local tax is composed of a 0.25% city tax and a 1.25% county tax, both of which are added to the state rate.

| Sales Tax Component | Rate |

|---|---|

| State Sales Tax | 7.25% |

| City Tax | 0.25% |

| County Tax | 1.25% |

| Total Sales Tax | 8.75% |

How Irvine’s Sales Tax is Applied

The sales tax in Irvine applies to the sale of tangible personal property and certain services. This includes items like clothing, electronics, furniture, and many other retail goods. Services that are subject to sales tax vary and can include things like hotel stays, car rentals, and certain professional services.

It's important to note that some items are exempt from sales tax in California. These include most groceries, prescription drugs, and certain medical devices. Additionally, California offers sales tax holidays during which certain items, such as clothing and school supplies, are exempt from sales tax for a limited time.

Compliance and Registration

For businesses operating in Irvine, compliance with sales tax regulations is essential. This involves registering with the CDTFA, collecting the appropriate tax rates, and remitting the collected taxes to the state. The CDTFA provides a comprehensive registration guide for businesses, which outlines the steps to obtain a seller’s permit and meet tax obligations.

Sales Tax Registration Process

To register for sales tax in California, businesses must complete the following steps:

- Obtain a Seller's Permit by registering with the CDTFA. This permit allows businesses to collect and remit sales tax.

- Determine the applicable tax rates for each location where the business operates. This includes the state rate and any local taxes.

- Collect the appropriate sales tax from customers at the point of sale. This is typically done by adding the tax to the total cost of the transaction.

- Remit the collected sales tax to the CDTFA on a regular basis. The frequency of remittance depends on the business's sales volume and can be monthly, quarterly, or annually.

- Keep accurate records of sales and tax payments. These records are essential for tax compliance and audits.

Penalties and Audits

Non-compliance with sales tax regulations can result in penalties and fines. The CDTFA has the authority to audit businesses to ensure they are properly collecting and remitting sales tax. Audits can be triggered by various factors, including random selection, customer complaints, or suspected non-compliance.

During an audit, the CDTFA will review a business's records, including sales receipts, invoices, and tax returns. If discrepancies are found, the business may be required to pay additional taxes, penalties, and interest. Therefore, maintaining accurate records and staying informed about sales tax regulations is crucial for businesses.

Sales Tax and E-Commerce

With the rise of e-commerce, sales tax has become more complex, especially for businesses selling goods online. California has specific regulations for online sellers, which are designed to ensure fair competition and tax compliance.

E-Commerce Sales Tax in Irvine

Online sellers with a physical presence in Irvine, such as a warehouse or distribution center, are generally required to collect sales tax on transactions delivered to Irvine addresses. This is known as nexus, and it triggers the obligation to collect and remit sales tax.

Additionally, under the Wayfair ruling, online sellers without a physical presence in California but with a certain level of economic activity in the state may also be required to collect and remit sales tax. This is often referred to as economic nexus.

Sales Tax for Consumers

Consumers in Irvine, like elsewhere in California, are responsible for paying sales tax on their purchases. This tax is typically included in the total price displayed at the point of sale, making it transparent for consumers.

Understanding Sales Tax on Receipts

On a sales receipt, the sales tax is often listed as a separate line item, clearly showing the amount of tax paid. For example, if an item costs 100 and the sales tax rate is 8.75%, the tax amount would be 8.75, and the total cost would be $108.75.

It's important for consumers to understand the sales tax rate in their area to make informed purchasing decisions. Higher sales tax rates can impact the overall cost of goods and services, especially for larger purchases.

Future Implications and Changes

Sales tax rates and regulations in California are subject to change. The state and local governments may adjust tax rates to meet budgetary needs or implement new regulations to improve tax compliance. It is essential for businesses and consumers to stay informed about any changes to sales tax laws.

Potential Sales Tax Changes

Some potential future changes to sales tax in California include:

- Increased Rates: In response to budgetary pressures, sales tax rates may be increased at the state or local level.

- Tax Exemptions: The state or local governments may introduce new tax exemptions for certain goods or services to promote specific industries or initiatives.

- Online Sales Tax Reforms: With the continued growth of e-commerce, there may be further reforms to ensure fair taxation of online sales.

- Simplification of Regulations: Efforts to simplify sales tax regulations could make compliance easier for businesses, especially those operating in multiple jurisdictions.

Keeping abreast of these potential changes is crucial for businesses to ensure they remain compliant and can adapt their pricing and business strategies accordingly.

How often must businesses remit sales tax in California?

+

The frequency of sales tax remittance in California depends on the business’s sales volume. Businesses with higher sales volumes may be required to remit sales tax monthly, while those with lower sales may remit quarterly or annually.

Are there any sales tax holidays in California?

+

Yes, California occasionally offers sales tax holidays during which certain items, like clothing and school supplies, are exempt from sales tax. These holidays are typically announced in advance and are a great opportunity for consumers to save money.

What happens if a business doesn’t register for sales tax in California?

+

Businesses operating in California without a valid seller’s permit may face penalties and fines. Additionally, they may be subject to audits and be required to pay back taxes, interest, and penalties. It’s important for businesses to register and comply with sales tax regulations to avoid these issues.