Missouri Tax Calculator

Welcome to the comprehensive guide on understanding and navigating the tax landscape of the Show-Me State, Missouri. In this expert-driven analysis, we'll delve into the intricacies of Missouri's tax system, providing you with the tools and insights needed to calculate your tax obligations accurately and efficiently.

Exploring Missouri’s Tax Structure: A Comprehensive Overview

Missouri, known for its vibrant cities, diverse landscapes, and a strong sense of community, also boasts a unique tax system. Understanding this system is crucial for individuals and businesses alike, as it forms the foundation for financial planning and compliance.

Missouri's tax structure is characterized by a combination of income taxes, sales taxes, and various other levies. While it may seem complex at first glance, breaking it down into manageable components can simplify the process significantly.

Income Taxes: A Personalized Approach

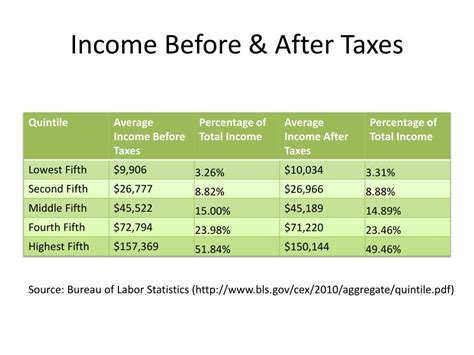

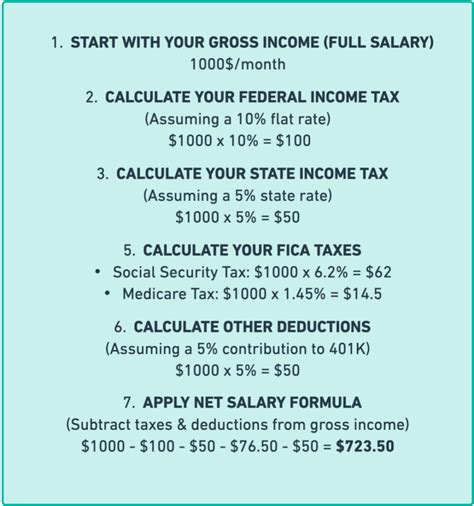

For Missouri residents, income taxes are a key component of the state’s revenue stream. The Missouri Department of Revenue administers a progressive tax system, which means the tax rate increases as your income rises. This ensures that higher-income earners contribute a larger proportion of their income towards state revenues.

The income tax rates in Missouri range from 1.5% to 6%, with six tax brackets in total. Here's a breakdown of the current tax rates for the 2023 tax year:

| Tax Rate | Income Bracket |

|---|---|

| 1.5% | Up to $1,000 |

| 2.0% | $1,001 to $2,000 |

| 2.5% | $2,001 to $3,000 |

| 3.0% | $3,001 to $4,000 |

| 4.0% | $4,001 to $8,000 |

| 6.0% | Above $8,000 |

It's important to note that Missouri also offers various tax credits and deductions that can reduce your taxable income, thereby lowering your overall tax liability. These include credits for education expenses, property taxes, and certain types of investments.

Sales and Use Taxes: A Consumer Perspective

In Missouri, sales taxes are levied on the sale or lease of tangible personal property and certain services. The state’s base sales tax rate is 4.225%, but local municipalities can add additional taxes, resulting in varying rates across different regions.

For instance, in the bustling city of St. Louis, the total sales tax rate is 9.225%, consisting of the state base rate and a 5% local tax. On the other hand, in the charming town of Ozark, the total sales tax rate is 7.025%, reflecting a more modest local tax rate.

Missouri also enforces a use tax, which applies to purchases made outside the state but used or stored in Missouri. This ensures that consumers pay taxes on items purchased online or from out-of-state vendors, promoting fairness and contributing to the state's revenue stream.

Property Taxes: A Localized Approach

Property taxes in Missouri are primarily managed at the local level, with rates varying significantly across counties and municipalities. These taxes are a major source of revenue for local governments, funding essential services like schools, fire departments, and infrastructure maintenance.

The property tax rate in Missouri typically ranges from 1% to 3.5%, with an average effective rate of around 1.06%. However, it's important to note that these rates can vary greatly depending on the location and the assessed value of the property.

For instance, in the vibrant city of Kansas City, the property tax rate can be as high as 2.8%, while in the rural community of Hermann, it might be closer to 1.2%. This localized approach ensures that communities have the resources to meet their specific needs and priorities.

Maximizing Tax Efficiency: Strategies and Insights

Understanding Missouri’s tax structure is just the first step. To truly optimize your financial position, it’s essential to explore strategies that can help you minimize your tax liability while remaining compliant with state regulations.

Leveraging Tax Credits and Deductions

Missouri offers a range of tax credits and deductions that can significantly reduce your taxable income. These incentives are designed to encourage specific behaviors or support particular sectors of the economy.

For example, the Missouri Property Tax Credit provides a credit for a portion of the property taxes paid by low-income individuals. Similarly, the Missouri Earned Income Tax Credit mirrors the federal credit, offering a boost to working individuals and families with low to moderate incomes.

Additionally, Missouri residents can benefit from tax deductions for various expenses, including student loan interest, tuition, and certain medical costs. These deductions can further reduce your taxable income, lowering your overall tax burden.

Optimizing Business Taxes

For businesses operating in Missouri, understanding the state’s tax environment is crucial for financial planning and strategic decision-making. Missouri imposes a corporate income tax, with rates ranging from 4% to 6.25%, depending on the business’s taxable income.

However, businesses can also take advantage of various tax incentives and credits. For instance, the Missouri Enterprise Zone Tax Credit offers tax benefits to businesses that invest in economically distressed areas of the state. Similarly, the Missouri Quality Jobs Tax Credit provides incentives for businesses that create and retain jobs in targeted industries.

Additionally, Missouri's sales tax structure provides opportunities for businesses to optimize their tax liability. By understanding the state's sales tax laws and regulations, businesses can ensure they are compliant while also exploring strategies to minimize their tax burden.

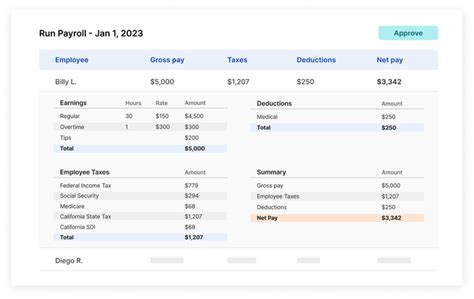

Efficient Filing and Payment Processes

To ensure a smooth tax experience, it’s crucial to familiarize yourself with Missouri’s filing and payment processes. The state offers both online and offline options for tax filing, with the Missouri Taxpayer Access Point (TAP) being a user-friendly online portal for individuals and businesses.

Through TAP, taxpayers can register for an account, file their tax returns, make payments, and manage their tax obligations. This platform also provides access to various tax forms, publications, and resources, making it a one-stop shop for all your Missouri tax needs.

For businesses, Missouri also offers a Business Tax Registration System, which simplifies the process of registering for various state taxes, including income tax, sales tax, and unemployment insurance tax.

Future Outlook: Missouri’s Tax Landscape

As we look ahead, Missouri’s tax landscape is poised for some interesting developments. While the state’s tax system has remained relatively stable in recent years, there are ongoing discussions and initiatives that could shape its future direction.

Potential Tax Reform and Simplification

Missouri has been exploring ways to simplify its tax code, making it more efficient and easier to navigate for taxpayers. This includes proposals to consolidate and streamline various taxes, as well as efforts to enhance tax compliance and enforcement.

One notable initiative is the Missouri Tax Reform and Fairness Act, which aims to reduce tax burdens on individuals and businesses while also improving the state's overall fiscal health. This act proposes a reduction in the state's income tax rates and an expansion of the sales tax base, among other reforms.

Emerging Technologies and Tax Administration

The state is also embracing technological advancements to enhance its tax administration processes. The use of digital tools and platforms, such as the TAP portal, is expected to continue expanding, providing taxpayers with greater convenience and efficiency.

Additionally, Missouri is exploring the potential of blockchain technology for tax administration. This could revolutionize the way taxes are collected and managed, increasing transparency and reducing the risk of fraud.

Economic Development and Tax Incentives

Missouri’s focus on economic development is expected to continue, with tax incentives playing a pivotal role. The state’s ongoing efforts to attract and retain businesses, particularly in targeted industries, will likely drive the creation and expansion of tax incentive programs.

These initiatives aim to stimulate economic growth, create jobs, and enhance the state's competitiveness in the national and global markets. By offering tax incentives, Missouri can provide businesses with the necessary incentives to invest, innovate, and thrive within its borders.

Conclusion: Empowering Missourians with Tax Knowledge

In conclusion, understanding Missouri’s tax system is a crucial step towards financial empowerment and compliance. By exploring the state’s tax structure, from income and sales taxes to property taxes and local variations, individuals and businesses can make informed decisions and optimize their tax strategies.

As Missouri continues to evolve and adapt its tax policies, staying informed and engaged is key. By leveraging tax credits, deductions, and incentives, taxpayers can reduce their tax burden while contributing to the state's economic growth and development.

Whether you're a resident, business owner, or simply curious about Missouri's tax landscape, this guide aims to provide the tools and insights needed to navigate this complex yet crucial aspect of life in the Show-Me State.

How often are Missouri’s tax rates updated?

+Missouri’s tax rates are typically updated annually to reflect changes in the state’s budget and economic conditions. The state legislature sets the tax rates, and these changes usually take effect for the upcoming tax year.

Are there any special tax considerations for remote workers in Missouri?

+Remote workers in Missouri are generally subject to the same tax laws as other residents. However, if you work remotely for an out-of-state company, there may be additional considerations regarding income tax liability. It’s advisable to consult a tax professional for specific guidance.

What is the process for claiming tax credits in Missouri?

+The process for claiming tax credits in Missouri varies depending on the specific credit. Generally, you’ll need to complete the appropriate tax forms and provide supporting documentation. It’s essential to review the requirements for each credit and ensure you meet the eligibility criteria.