Gross Before Or After Taxes

Understanding the concept of gross income is crucial for anyone navigating the world of personal finance and taxation. The term "gross" holds significant implications, impacting everything from payroll deductions to tax calculations. This article aims to demystify the relationship between gross income and taxes, offering a comprehensive guide to help individuals grasp this fundamental financial concept.

Gross Income: A Fundamental Concept

In the realm of personal finance, gross income represents the total amount earned before any deductions, taxes, or contributions are applied. It encompasses all forms of compensation an individual receives, including salaries, wages, bonuses, tips, and even certain benefits like housing or transportation allowances. Essentially, it is the income earned before any adjustments.

Gross income is a foundational metric in financial planning, serving as the starting point for various calculations. It influences an individual's tax liability, eligibility for certain benefits and deductions, and overall financial health. Accurate understanding and management of gross income are vital for effective financial decision-making.

The Role of Taxes

Taxes play a significant role in shaping an individual’s financial landscape. They are mandatory contributions levied by governments to fund public services and infrastructure. The amount of tax an individual owes is calculated based on their gross income, with rates varying depending on jurisdiction and income level.

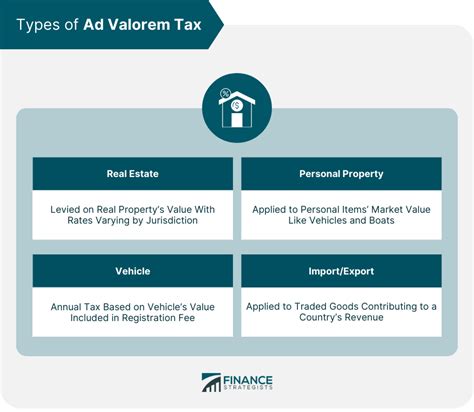

Taxes can be broadly categorized into two types: direct taxes and indirect taxes. Direct taxes, such as income tax, are levied directly on an individual's income or assets. Indirect taxes, on the other hand, are typically included in the price of goods and services and are paid indirectly by consumers. Understanding these distinctions is crucial for managing financial obligations effectively.

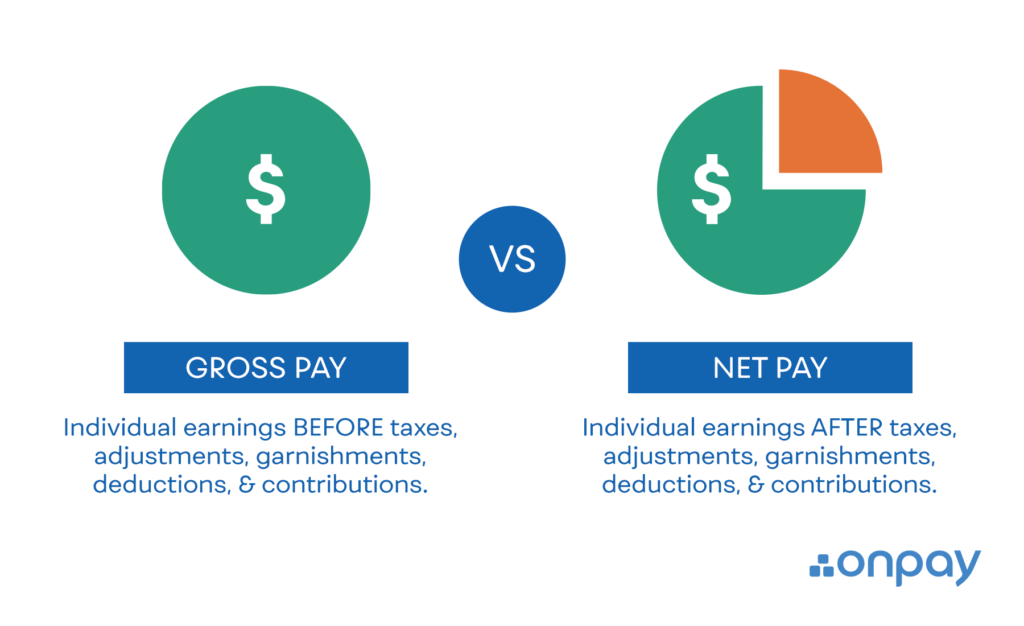

Gross Income vs. Net Income

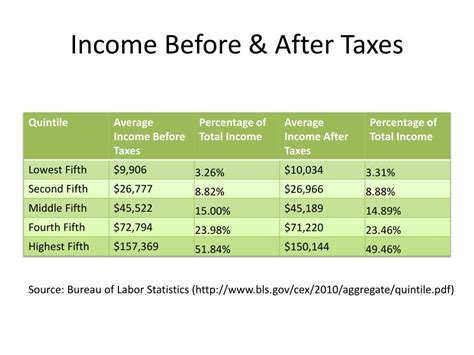

While gross income represents the total earnings before deductions, net income is the amount an individual is left with after all deductions and taxes are accounted for. Net income, often referred to as take-home pay, is the actual amount an individual receives and can use for personal expenses, savings, or investments.

The difference between gross income and net income is primarily attributed to various deductions, including taxes, retirement contributions, healthcare premiums, and other payroll deductions. These deductions can significantly impact an individual's financial planning, as they directly affect the amount available for discretionary spending.

Understanding Deductions

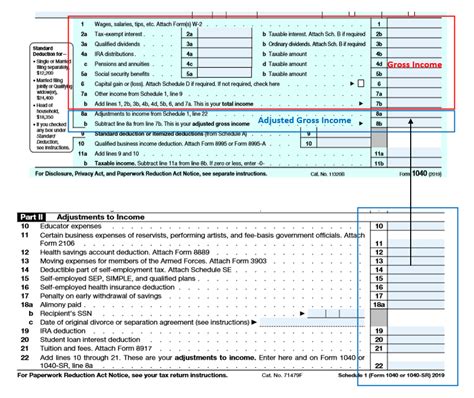

Deductions are an essential aspect of income management, allowing individuals to reduce their taxable income and, consequently, their tax liability. There are two main types of deductions: above-the-line and below-the-line deductions.

Above-the-line deductions, also known as adjustments to income, reduce an individual's gross income before calculating their taxable income. Examples include contributions to certain retirement accounts, student loan interest payments, and certain business expenses. These deductions are often beneficial for individuals seeking to lower their taxable income and maximize their tax savings.

Below-the-line deductions, on the other hand, are applied after calculating taxable income. These deductions include personal exemptions, standard deductions, and itemized deductions. Itemized deductions cover a range of expenses, such as medical costs, state and local taxes, mortgage interest, and charitable contributions. By strategically utilizing deductions, individuals can further reduce their tax liability and optimize their financial outcomes.

Tax Calculation and Withholding

The process of calculating taxes involves applying tax rates to an individual’s taxable income. Tax rates can be progressive, meaning higher income levels are taxed at higher rates, or regressive, where lower income levels are taxed at higher rates. Understanding the applicable tax rates is crucial for estimating tax liabilities accurately.

To ensure compliance and facilitate tax payments, many employers utilize a system known as pay-as-you-earn (PAYE) or payroll withholding. This process involves employers deducting estimated tax amounts from employees' paychecks and remitting them to the relevant tax authorities. The withheld amounts are then applied towards an individual's tax liability when they file their tax returns.

Tax Rates and Brackets

Tax rates are typically divided into tax brackets, which represent different income ranges and corresponding tax rates. Each bracket is associated with a specific tax rate, with income above a certain threshold subject to a higher rate. For example, an individual’s income might be taxed at 10% up to a certain amount, and then at 20% for income above that threshold.

It's important to note that tax brackets and rates can vary significantly based on jurisdiction, income type, and individual circumstances. Staying informed about the applicable tax rates and brackets is essential for accurate tax planning and financial forecasting.

Maximizing Tax Benefits

Tax planning is a critical component of financial management, offering individuals opportunities to optimize their tax liabilities and enhance their financial outcomes. There are various strategies and deductions that can be employed to maximize tax benefits, including the following:

- Retirement Contributions: Contributions to retirement accounts, such as 401(k)s or IRAs, offer tax advantages. These contributions are often tax-deductible, reducing taxable income and potentially lowering tax liability.

- Education Expenses: Certain education-related expenses, such as tuition fees and student loan interest, can be deductible, providing tax relief for individuals investing in their education.

- Medical and Dental Expenses: Medical and dental expenses that exceed a certain percentage of an individual's income can be deductible, helping to offset the cost of healthcare.

- Charitable Contributions: Donations to qualified charitable organizations are often tax-deductible, allowing individuals to support causes they care about while also reducing their taxable income.

- Homeownership Benefits: Owning a home can provide tax advantages, including deductions for mortgage interest and property taxes. These deductions can significantly reduce taxable income for homeowners.

Seeking Professional Advice

Navigating the complex world of taxes and financial planning can be challenging. Seeking guidance from tax professionals or financial advisors can be invaluable. These experts can provide personalized advice, ensuring individuals maximize their tax benefits while remaining compliant with tax regulations.

Financial advisors can also assist in developing comprehensive financial plans, taking into account an individual's unique circumstances and goals. By working with professionals, individuals can make informed decisions, optimize their financial strategies, and achieve their long-term financial objectives.

Conclusion

Understanding the relationship between gross income and taxes is a cornerstone of effective financial management. By grasping the concepts of gross income, net income, deductions, and tax rates, individuals can make informed decisions to optimize their financial outcomes. Additionally, seeking professional advice can provide valuable insights and guidance, ensuring individuals navigate the complex world of taxes with confidence and success.

What is the difference between gross income and net income?

+Gross income is the total amount earned before any deductions, while net income is the amount left after all deductions and taxes are applied. Net income, also known as take-home pay, is the actual amount an individual receives and can use for personal expenses.

How are tax rates determined?

+Tax rates are typically set by governments and can vary based on jurisdiction, income type, and individual circumstances. They are often divided into tax brackets, with different income ranges subject to specific tax rates.

What are some common tax deductions I can take advantage of?

+Common tax deductions include retirement contributions, education expenses, medical and dental costs, charitable donations, and homeownership benefits such as mortgage interest and property taxes.

Should I consult a tax professional for my financial planning?

+Yes, consulting a tax professional or financial advisor is highly recommended. They can provide personalized advice, help you navigate complex tax laws, and ensure you maximize your tax benefits while remaining compliant with regulations.