County Real Estate Taxes

Understanding county real estate taxes is crucial for homeowners and prospective buyers alike. These taxes, often referred to as property taxes, are a significant source of revenue for local governments and can have a substantial impact on a property owner's financial obligations. In this comprehensive guide, we will delve into the intricacies of county real estate taxes, exploring how they are calculated, their purpose, and the factors that influence their rates.

The Purpose and Impact of County Real Estate Taxes

County real estate taxes, or property taxes, are a vital component of local government funding. They are used to support a wide range of public services and infrastructure, including schools, police and fire departments, road maintenance, parks, libraries, and other community amenities. In essence, these taxes contribute directly to the quality of life in a given county.

For property owners, real estate taxes represent a substantial financial commitment. The amount owed is typically calculated annually and is based on the assessed value of the property. This value is determined by local tax assessors, who take into account various factors such as the property's location, size, improvements, and market conditions. As a result, real estate taxes can vary significantly from one county to another, and even within the same county, due to differences in property values and tax rates.

How County Real Estate Taxes Are Calculated

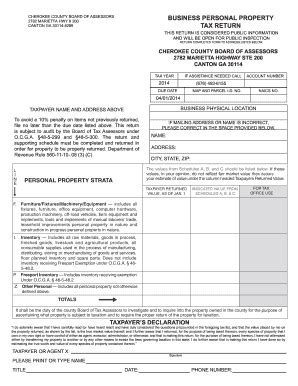

The calculation of county real estate taxes involves a multi-step process. Firstly, the local tax assessor’s office conducts a property assessment, determining the fair market value of each property within the county. This value is then multiplied by an assessment ratio, which converts the market value to an assessed value. The assessment ratio is typically a percentage, and it can vary based on the type of property and the jurisdiction.

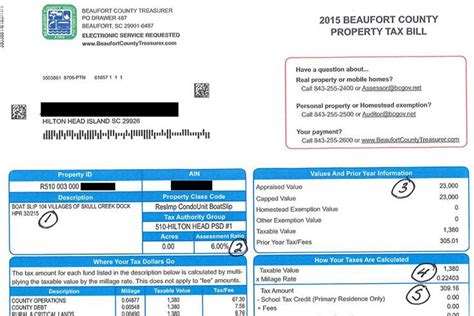

Once the assessed value is determined, it is subjected to a tax rate, often referred to as the mill rate. A mill rate is expressed in mills, with one mill equating to one-tenth of a cent. For example, a tax rate of 20 mills would be 0.02 dollars per dollar of assessed value. This rate is set by the local government and is used to calculate the actual tax amount owed by property owners.

To illustrate, consider a property with an assessed value of $200,000 and a tax rate of 20 mills. The tax amount would be calculated as follows: $200,000 x 0.02 = $4,000. Thus, the property owner would owe $4,000 in county real estate taxes for that year.

Factors Influencing County Real Estate Tax Rates

The tax rate for county real estate taxes can vary significantly, and several factors contribute to these variations. One key factor is the budget needs of the local government. If a county requires more funding for public services, it may need to increase the tax rate to meet these demands. This can occur, for instance, when a county experiences population growth, leading to increased demand for services and infrastructure.

Another influential factor is the overall economic climate. During periods of economic downturn, property values may decline, leading to reduced tax revenues. To compensate, local governments may need to raise tax rates to maintain their revenue streams. Conversely, during economic booms, property values may increase, resulting in higher tax revenues without the need for rate adjustments.

Assessed Value Considerations

The assessed value of a property is not static and can change over time. Local governments typically conduct periodic reassessments to ensure that property values remain up-to-date. These reassessments can impact the tax bill, especially if the assessed value increases. However, some jurisdictions have implemented measures to limit the impact of reassessments, such as cap rates or assessment freezes, to provide stability for property owners.

Comparison of Tax Rates Across Counties

It is worth noting that tax rates can vary not only within a state but also across different states. This variation is due to a combination of factors, including the cost of living, the level of services provided, and the overall fiscal health of the local government. For instance, counties with higher costs of living or extensive public service networks may have higher tax rates to support these expenses.

| County | Tax Rate (Mills) |

|---|---|

| Fairfield County, CT | 16.85 |

| Cook County, IL | 9.68 |

| Orange County, CA | 7.22 |

The above table provides a glimpse of the varying tax rates across different counties. It's important to remember that these rates can change annually, and they are just one piece of the complex puzzle that is county real estate taxation.

Impact of County Real Estate Taxes on Property Owners

For property owners, county real estate taxes can represent a significant financial commitment. These taxes are often the largest annual expense associated with homeownership, aside from the mortgage payment. As such, it is essential for homeowners to understand how these taxes are calculated and to budget accordingly.

The impact of real estate taxes can be particularly notable for those on a fixed income or those with limited financial resources. Higher tax rates or sudden increases in assessed values can place a significant burden on these individuals. Fortunately, many jurisdictions offer programs to assist low-income property owners, such as tax deferrals or exemptions.

Strategies for Managing Real Estate Taxes

There are several strategies that property owners can employ to manage their real estate tax obligations effectively. One common approach is to take advantage of tax deductions and credits, which can reduce the overall tax liability. For instance, homeowners may be eligible for deductions based on their mortgage interest or property taxes paid. Additionally, certain improvements to the property, such as energy-efficient upgrades, may qualify for tax credits.

Another strategy is to carefully review the annual tax assessment. Property owners have the right to appeal their assessed value if they believe it is inaccurate or if they feel it does not reflect the current market conditions. This process, known as a tax appeal, can lead to a reduction in the assessed value and, consequently, the tax bill.

The Future of County Real Estate Taxes

As we look to the future, several trends and factors are likely to influence the landscape of county real estate taxes. One key trend is the increasing focus on equity and fairness in taxation. Many jurisdictions are reevaluating their assessment and taxation systems to ensure that the burden is distributed more equitably among property owners.

Technological advancements are also playing a role in the evolution of real estate taxation. Advanced data analytics and machine learning are being utilized to improve the accuracy and efficiency of property assessments. These tools can help identify properties that may have been undervalued or overvalued, leading to a more fair and accurate tax system.

Additionally, the ongoing debate around property tax reform is likely to shape the future of county real estate taxes. Proposals for reform often aim to simplify the tax system, reduce the burden on homeowners, and promote economic growth. These reforms can take various forms, such as adjusting assessment ratios, implementing tax caps, or shifting the tax burden to other sources of revenue.

The Role of Public Engagement

Public engagement and education are crucial aspects of the future of real estate taxation. By understanding the intricacies of the tax system and the factors that influence rates, property owners can advocate for policies that align with their interests and the overall well-being of their communities. Active participation in local government processes, such as town hall meetings or public hearings, can provide an opportunity for homeowners to voice their concerns and influence decision-making.

Conclusion

County real estate taxes are a complex yet essential aspect of homeownership and local government funding. By understanding the calculation process, the factors that influence tax rates, and the strategies for managing these obligations, property owners can navigate the world of real estate taxation with confidence. As the landscape continues to evolve, staying informed and engaged will be key to ensuring a fair and sustainable tax system for all.

How often are real estate taxes assessed and collected?

+Real estate taxes are typically assessed annually, with the assessed value being used to calculate the tax amount for that year. The collection of these taxes may vary, with some jurisdictions collecting taxes twice a year (semi-annually) and others collecting them in a single payment.

Can I appeal my property’s assessed value?

+Yes, property owners have the right to appeal their assessed value if they believe it is incorrect or unfair. The process for appealing varies by jurisdiction, but it typically involves providing evidence and arguments to support your case. It’s important to review the appeal guidelines and timelines for your specific county.

Are there any tax deductions or credits available for real estate taxes?

+Yes, many jurisdictions offer tax deductions and credits to reduce the overall tax liability. Common deductions include mortgage interest, property taxes paid, and certain improvements to the property, such as energy-efficient upgrades. It’s advisable to consult a tax professional or review the guidelines provided by your local government for specific deductions and credits.

How do real estate taxes impact property values and the housing market?

+Real estate taxes can have a significant impact on property values and the housing market. High tax rates can make properties less attractive to buyers, potentially leading to lower property values. Conversely, lower tax rates can stimulate the housing market, making properties more affordable and attractive to potential buyers.