Tax On Alcohol

Taxation on alcohol, a complex and often controversial topic, plays a significant role in shaping the alcohol industry and consumer behavior worldwide. With varying tax rates and structures across countries, the impact of these levies extends beyond government revenue, influencing everything from production and distribution to consumer prices and public health. This article aims to provide an in-depth analysis of the global landscape of alcohol taxation, its historical context, current practices, and its far-reaching implications.

The Historical Perspective on Alcohol Taxation

Alcohol taxation is not a new phenomenon. Its roots can be traced back centuries, with early civilizations imposing duties on the production and sale of alcoholic beverages. In ancient Rome, for instance, taxes on wine, known as “vectigal vinarium,” were levied as early as the 2nd century BC. These taxes were often used to fund public projects and military campaigns, demonstrating the enduring role of alcohol taxation in shaping societal and economic development.

The evolution of alcohol taxation continued through the medieval period and the early modern era. In England, the Crown imposed various duties on beer and ale, with the Beer Act of 1643 being a notable example. These taxes, often referred to as "excise duties," were designed to raise revenue and regulate the alcohol market. Similarly, in France, the gabelle, a tax on salt, also applied to alcoholic beverages, highlighting the creative ways in which governments utilized taxation to control and monetize various industries.

The 18th century, particularly in the context of the American colonies, saw a significant shift in alcohol taxation. The infamous "Stamp Act" of 1765, which imposed a tax on all printed materials in the colonies, including licenses for the sale of alcohol, sparked widespread protest and played a pivotal role in the build-up to the American Revolution. This event underscores the deep-seated connection between alcohol taxation, public sentiment, and political movements.

Global Landscape of Alcohol Taxation

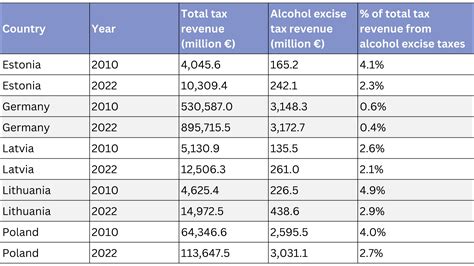

Today, alcohol taxation remains a critical component of government revenue strategies and public policy worldwide. The World Health Organization (WHO) estimates that alcohol taxes contribute significantly to national budgets, especially in low- and middle-income countries, where they can account for up to 10% of total tax revenues.

The global landscape of alcohol taxation is incredibly diverse, with countries employing various tax structures and rates. Broadly, these can be categorized into excise taxes, value-added taxes (VAT), and specific levies on alcohol production and distribution. Each of these tax types serves a unique purpose and has distinct impacts on the industry and consumers.

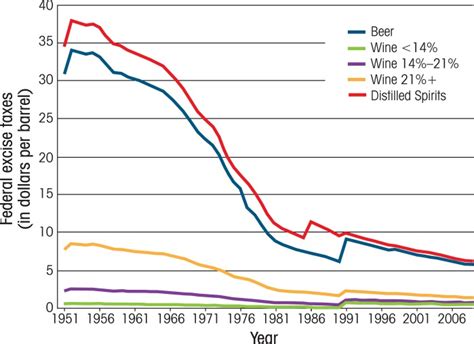

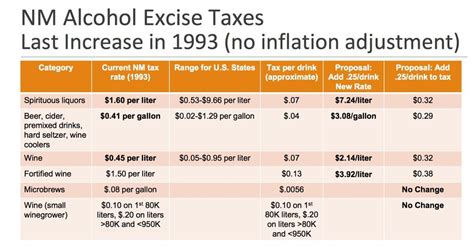

Excise Taxes

Excise taxes, also known as “sin taxes,” are levied on the production or sale of certain goods, including alcohol. These taxes are often based on the quantity of the product, such as a tax per liter of beer or per bottle of wine. Excise taxes are a common tool for governments to control the consumption of alcohol and raise revenue. For instance, in the United States, excise taxes on alcohol have been a key revenue source since the end of Prohibition, with the federal government imposing taxes on beer, wine, and spirits based on the alcohol content and quantity.

| Country | Excise Tax on Beer (per liter) | Excise Tax on Wine (per liter) | Excise Tax on Spirits (per liter) |

|---|---|---|---|

| United States | $0.54 | $0.33 | $13.50 |

| United Kingdom | £0.47 | £0.40 | £28.74 |

| Australia | A$0.12 | A$0.38 | A$16.20 |

However, the impact of excise taxes extends beyond revenue generation. These taxes can influence consumer behavior, potentially reducing alcohol consumption and its associated health and social harms. Studies suggest that higher excise taxes lead to reduced alcohol-related harm, particularly among heavy drinkers. For instance, a 10% increase in alcohol prices due to excise taxes could result in a 5-9% reduction in alcohol consumption and related injuries.

Value-Added Taxes (VAT)

Value-Added Taxes (VAT), a form of consumption tax, are applied to the value added at each stage of the production and distribution chain. Unlike excise taxes, VAT is not specific to alcohol but applies to a wide range of goods and services. However, many countries include alcohol within their VAT regime, either at the standard rate or a higher rate for certain types of alcohol.

For example, the European Union (EU) requires all member states to impose a minimum VAT rate of 15% on most goods and services, including alcohol. However, countries can set their own higher rates, with some choosing to levy additional taxes on specific alcohol products. In the United Kingdom, the standard VAT rate is 20%, but beer and cider are taxed at a reduced rate of 12.5%, and spirits, wine, and most mixed alcoholic drinks are taxed at the full rate.

Specific Levies on Alcohol Production and Distribution

In addition to excise taxes and VAT, some countries impose specific levies on various stages of alcohol production and distribution. These levies can include license fees for producers and distributors, duties on imported alcohol, and even taxes on advertising and promotion.

For instance, many countries require alcohol producers to obtain licenses and pay annual fees. These fees can vary based on the type and scale of production, with larger producers often paying higher fees. Similarly, duties on imported alcohol can be significant, with rates varying based on the origin of the product and its alcohol content.

Impact of Alcohol Taxation

The impact of alcohol taxation is multifaceted, influencing various aspects of the alcohol industry, consumer behavior, and public health.

Industry Impact

Alcohol taxation can significantly impact the profitability and competitiveness of the alcohol industry. Higher taxes can increase the cost of production and distribution, potentially leading to higher consumer prices. This can result in reduced demand, especially for premium or luxury alcohol products, as consumers may opt for cheaper alternatives or reduce their consumption.

Moreover, alcohol taxation can encourage innovation and diversification within the industry. Producers may respond to higher taxes by developing new, lower-alcohol products or entering new market segments. For instance, the rise of craft breweries and distilleries, which often produce unique, small-batch products, can be partly attributed to the flexibility they offer in navigating tax structures and consumer preferences.

Consumer Behavior and Public Health

Alcohol taxation has a direct impact on consumer behavior and, subsequently, public health. Higher taxes on alcohol can lead to reduced consumption, particularly among heavy drinkers and young adults, who are often price-sensitive. This reduction in consumption can lead to lower rates of alcohol-related harm, including injuries, diseases, and social problems.

For instance, studies have shown that increases in alcohol taxes have been associated with reduced rates of alcohol-related traffic accidents, particularly among young drivers. Additionally, higher taxes can lead to a shift in consumer preferences towards lower-alcohol or non-alcoholic beverages, promoting healthier drinking habits.

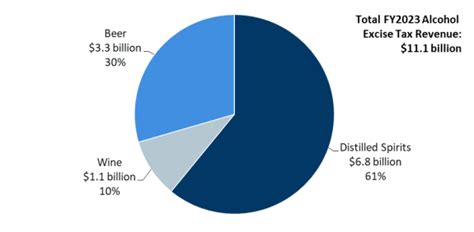

Revenue Generation and Government Policy

Alcohol taxation is a significant source of revenue for many governments, especially in low- and middle-income countries. These revenues can be used to fund a range of public services, including healthcare, education, and infrastructure development. In some cases, alcohol taxes are specifically earmarked for health or social programs, ensuring a direct link between alcohol consumption and the resources available to address its negative impacts.

Furthermore, alcohol taxation can be a tool for governments to influence public policy and social norms. By imposing higher taxes on alcohol, governments can send a signal about the acceptability and desirability of certain consumption behaviors. This can contribute to a broader public health strategy, encouraging responsible drinking and reducing alcohol-related harm.

Challenges and Future Considerations

Despite its potential benefits, alcohol taxation faces several challenges and considerations, particularly in the context of global health and economic development.

Public Health vs. Revenue Generation

One of the key challenges in alcohol taxation is balancing the public health benefits of reduced consumption with the revenue generation goals of governments. While higher taxes can lead to reduced consumption and associated health benefits, they can also result in lost revenue, especially in contexts where alcohol consumption is already low or where there is significant informal alcohol production and distribution.

This trade-off is particularly relevant in low- and middle-income countries, where alcohol taxes can be a significant source of revenue for essential public services. Striking the right balance requires careful policy design and consideration of the specific context and priorities of each country.

Informal Alcohol Markets

The existence of informal alcohol markets, particularly in low- and middle-income countries, presents a significant challenge to effective alcohol taxation. Informal alcohol, often produced and sold outside the regulated market, can be cheaper and more accessible than taxed alcohol, undermining the potential health benefits of higher taxes. Furthermore, the presence of informal markets can lead to lost tax revenue, impacting government budgets and public services.

Addressing informal alcohol markets requires a comprehensive strategy that includes not only taxation but also regulation, enforcement, and community engagement. This may involve initiatives such as community-based alcohol control programs, education and awareness campaigns, and targeted interventions to reduce the demand for informal alcohol.

International Trade and Competition

In an increasingly globalized world, alcohol taxation must also consider the implications of international trade and competition. Variations in tax rates across countries can create incentives for consumers to purchase alcohol from lower-tax jurisdictions, either through cross-border shopping or online purchases. This can lead to lost revenue for governments and potentially impact the competitiveness of domestic alcohol producers.

To address these challenges, countries may need to coordinate their alcohol taxation policies and harmonize tax rates to some extent. This could involve regional agreements or international initiatives to ensure fair competition and maintain the integrity of alcohol taxation as a tool for public health and revenue generation.

Conclusion

Alcohol taxation is a complex and multifaceted issue, with implications for public health, economic development, and government policy. While it presents challenges, particularly in balancing public health goals with revenue generation, alcohol taxation remains a critical tool for governments to influence consumer behavior, reduce alcohol-related harm, and generate revenue for essential public services.

As we move forward, a nuanced understanding of the impacts and challenges of alcohol taxation is essential. This includes recognizing the diversity of global contexts and tailoring policies to the specific needs and priorities of each country. By doing so, we can maximize the benefits of alcohol taxation while minimizing its potential negative impacts, ultimately contributing to healthier, more prosperous societies.

What are the main types of alcohol taxes?

+The main types of alcohol taxes include excise taxes, value-added taxes (VAT), and specific levies on alcohol production and distribution. Excise taxes are often based on the quantity of the product, while VAT is applied to the value added at each stage of the production and distribution chain. Specific levies can include license fees for producers and distributors, duties on imported alcohol, and taxes on advertising and promotion.

How do alcohol taxes impact public health?

+Alcohol taxes can have a significant impact on public health by influencing consumer behavior and reducing alcohol consumption. Higher taxes can lead to reduced consumption, particularly among heavy drinkers and young adults, resulting in lower rates of alcohol-related harm, including injuries, diseases, and social problems.

What are the challenges associated with alcohol taxation?

+Some of the key challenges associated with alcohol taxation include balancing public health benefits with revenue generation goals, addressing informal alcohol markets, and managing the implications of international trade and competition. These challenges require careful policy design and coordination to ensure the effectiveness and fairness of alcohol taxation.