Ron Desantis Property Taxes

Property taxes are a significant concern for many homeowners, and Florida, with its diverse range of cities and counties, presents a unique landscape when it comes to these levies. Governor Ron DeSantis has played a pivotal role in shaping the property tax environment in the Sunshine State. This article delves into the impact of DeSantis' policies on property taxes, exploring how they have influenced the market and affected homeowners across Florida.

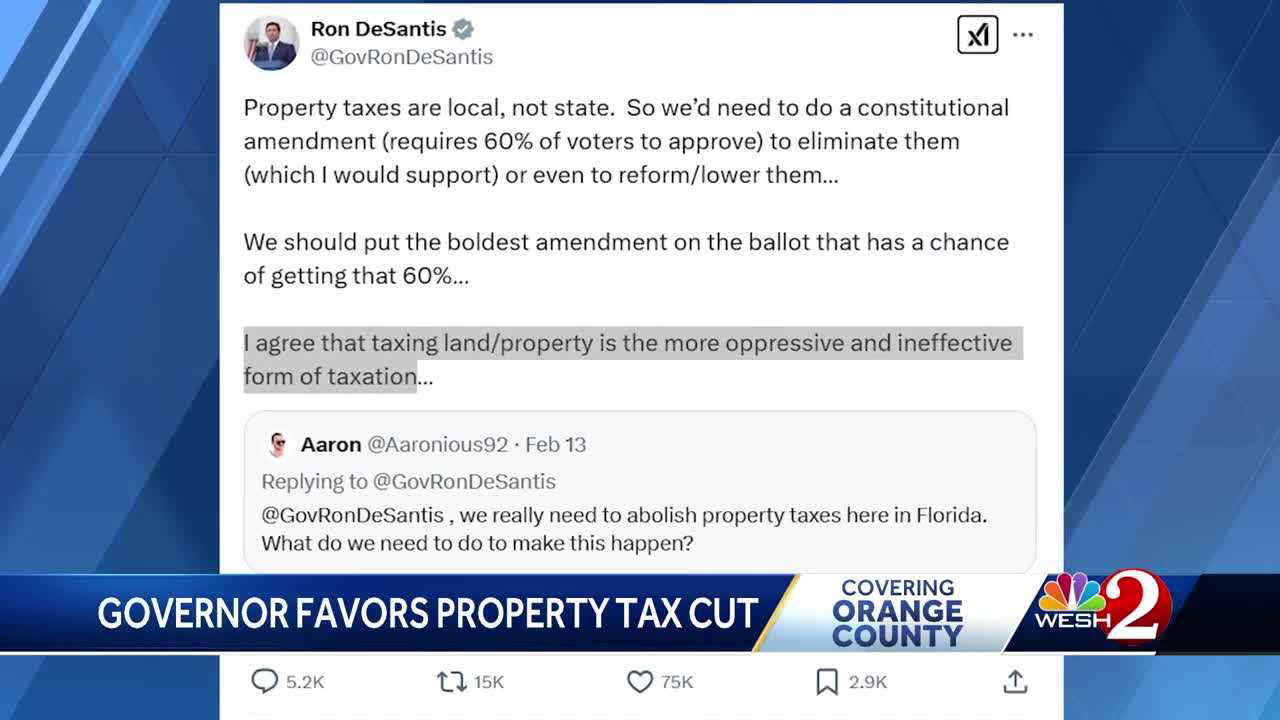

Governor DeSantis’ Property Tax Reform Agenda

Since assuming office, Governor Ron DeSantis has made property tax reform a key focus of his administration. His agenda aims to provide relief to homeowners and businesses, making Florida more affordable and attractive. The Governor’s initiatives have been welcomed by many, especially in the face of rising property values and increasing tax burdens.

One of the cornerstone policies of DeSantis' property tax reform is the constitutional amendment for a homestead exemption. This amendment, which was approved by Florida voters in 2020, significantly increased the amount of a property's assessed value that is exempt from taxation for homeowners with a permanent homestead designation.

Prior to this amendment, Florida offered a $25,000 homestead exemption. DeSantis' reform doubled this amount, providing a $50,000 exemption. For many homeowners, this means a substantial reduction in their annual property tax bill. This is especially beneficial for those in high-value property areas, where even a $50,000 exemption can make a significant difference.

The impact of this reform is best illustrated with an example. Let's consider a homeowner in Miami-Dade County with a property valued at $500,000. Prior to DeSantis' reform, this homeowner would have received an exemption on the first $25,000 of their property's value, meaning they would pay taxes on $475,000. With the new $50,000 exemption, they now only pay taxes on $450,000. This results in a considerable savings for the homeowner, and such savings can be the difference between affordability and financial strain for many.

Impact on Different Regions of Florida

Florida’s diverse landscape means that property tax rates and values vary significantly across the state. Governor DeSantis’ reforms have had a varying impact on different regions, depending on a multitude of factors including property values, local economies, and historical tax rates.

Miami-Dade County

Miami-Dade County, with its vibrant metropolis and high-value real estate, has seen a significant impact from DeSantis’ property tax reforms. The increased homestead exemption has provided much-needed relief to homeowners in this expensive market. Additionally, DeSantis’ push for property tax portability has further benefited those moving within the state.

Property tax portability allows homeowners who sell their primary residence and buy another within Florida to transfer their Save Our Homes benefit, which limits the annual increase in the assessed value of their homestead property. This policy, signed into law by DeSantis, has made it more affordable for Miami residents to move within the county or state without facing a large increase in their property taxes.

Central Florida: The Orlando Area

Central Florida, home to the bustling city of Orlando and its thriving tourism industry, has also felt the impact of DeSantis’ reforms. The region has seen a boom in property values due to its popularity as a tourist destination and its growing tech and entertainment industries. DeSantis’ increased homestead exemption has been a welcome relief for homeowners in this market.

In addition, DeSantis' support for legislation to prevent local governments from assessing new fees on homeowners has been significant. This legislation, which limits the ability of local governments to increase the tax burden on homeowners through various fees, has helped maintain affordability in a region where property values are on the rise.

The Panhandle and Rural Florida

The impact of DeSantis’ reforms has been just as significant in the Panhandle and rural areas of Florida. These regions often have lower property values compared to the state’s urban centers, but they face unique challenges, such as recovering from natural disasters like hurricanes.

DeSantis' commitment to providing property tax relief for hurricane survivors has been crucial in these areas. His administration has implemented measures to reduce property taxes for homeowners who have suffered damage due to natural disasters. This relief has been instrumental in helping communities recover and rebuild.

The Future of Property Taxes in Florida

Governor DeSantis’ property tax reforms have had a significant impact on Florida’s real estate landscape. His initiatives have provided much-needed relief to homeowners across the state, making Florida more affordable and attractive. However, the story of property taxes in Florida is far from over.

As Florida continues to grow and develop, with its population increasing and real estate values rising, the challenge of maintaining affordable property taxes will remain a key issue. Governor DeSantis and future administrations will need to continue to innovate and find solutions to ensure that Florida remains a desirable place to live and do business.

One potential area of focus could be further reforms to make the property tax system more equitable. This could involve exploring ways to ensure that the tax burden is distributed fairly across different income groups and property types. Additionally, as Florida's population ages, policies that support seniors and long-term homeowners may become increasingly important.

The future of property taxes in Florida is tied to the state's economic growth, environmental challenges, and demographic shifts. As these factors evolve, so too will the strategies and policies required to manage property taxes effectively. Governor DeSantis has set a strong foundation for future reforms, and it will be fascinating to see how these policies develop and adapt over time.

What is the Save Our Homes benefit in Florida, and how does it work with property tax portability?

+The Save Our Homes benefit is a constitutional amendment in Florida that limits the annual increase in the assessed value of a homestead property to 3% or the Consumer Price Index, whichever is less. Property tax portability allows homeowners to transfer this benefit when they sell their current homestead and purchase a new one within Florida. This means they can continue to enjoy the same property tax savings on their new home.

How do property taxes vary across different counties in Florida, and what factors influence these variations?

+Property taxes in Florida vary significantly across counties due to several factors. These include the millage rate set by local governments, the assessed value of properties, and any additional fees or taxes imposed by local authorities. Additionally, the value of properties, which is influenced by factors such as location, size, and market demand, plays a crucial role in determining the tax burden.

What are some potential future reforms to Florida’s property tax system that could be considered to ensure fairness and affordability?

+Future reforms could include measures to ensure that the property tax burden is distributed more equitably across different income groups. This might involve implementing a progressive tax system or providing additional exemptions and credits for low-income homeowners. Additionally, exploring ways to simplify the tax assessment process and improve transparency could also be beneficial.