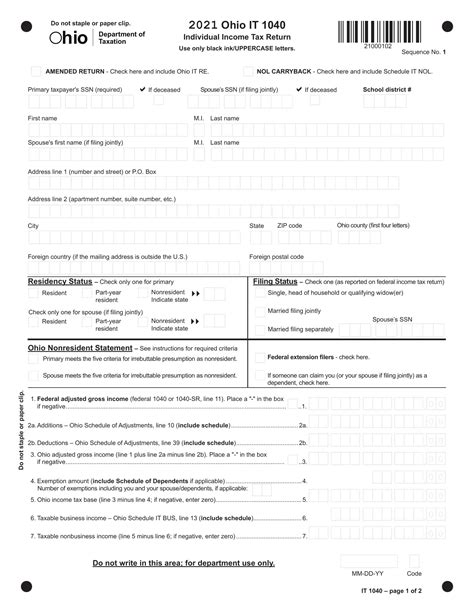

File Ohio Income Tax

Ohio, like many other states in the United States, has its own set of income tax regulations and filing requirements. Filing your Ohio income tax accurately and on time is crucial to avoid penalties and ensure compliance with state tax laws. In this comprehensive guide, we will delve into the process of filing Ohio income tax, providing you with detailed steps, insights, and practical advice to make the process as smooth as possible.

Understanding Ohio Income Tax

Ohio imposes an individual income tax on residents, nonresidents, and part-year residents based on their taxable income. The tax is calculated as a percentage of this taxable income, with rates varying depending on income brackets. As of the 2023 tax year, Ohio has a flat tax rate of 4.75% for all taxpayers.

The Ohio Department of Taxation oversees the collection and administration of state income taxes. It provides various resources and tools to assist taxpayers in understanding their obligations and filing their returns accurately.

Taxable Income and Deductions

Ohio’s taxable income includes wages, salaries, tips, commissions, bonuses, and other forms of compensation. Additionally, income from investments, businesses, and pensions is also subject to taxation. However, Ohio allows certain deductions and credits to reduce your taxable income, such as the Standard Deduction, Personal Exemption, and deductions for medical expenses, charitable contributions, and property taxes.

| Deduction Category | Deduction Amount |

|---|---|

| Standard Deduction (Single) | $10,950 |

| Standard Deduction (Married Filing Jointly) | $21,900 |

| Personal Exemption | $1,050 |

It's important to note that Ohio does not allow itemized deductions, and instead, it offers a larger standard deduction compared to the federal level. This simplifies the tax filing process for many taxpayers.

Filing Requirements and Deadlines

Ohio’s tax year runs from January 1st to December 31st, aligning with the federal tax year. The deadline for filing your Ohio income tax return is typically April 15th of the following year. However, if this date falls on a weekend or holiday, the deadline is extended to the next business day.

If you are unable to meet the April 15th deadline, you can request an extension by filing Form IT 40-EXT. This extension grants you an additional six months to file your return, pushing the deadline to October 15th. However, it's important to note that an extension of time to file does not extend the deadline to pay any taxes due.

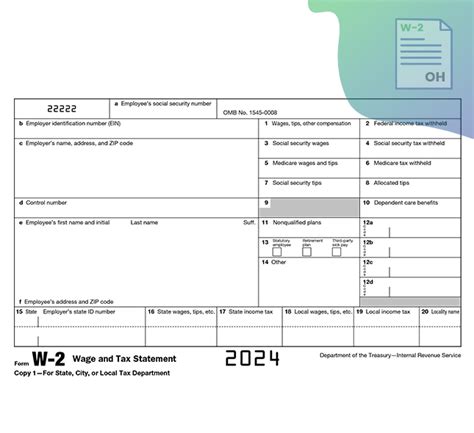

Gathering Necessary Information

Before you begin the filing process, it’s essential to gather all the necessary documents and information. Here’s a checklist of what you’ll typically need:

- Your Social Security Number (SSN) and that of your spouse (if applicable)

- Wage and income statements (W-2 forms, 1099-MISC, etc.)

- Interest and dividend statements (1099-INT, 1099-DIV)

- Records of deductions and credits, such as medical expenses, charitable contributions, and property taxes

- Information on any other income sources, such as business income or investment gains

- Previous year's Ohio tax return (for reference)

Organizing these documents beforehand will streamline the filing process and ensure you have all the necessary data to complete your return accurately.

Filing Methods: Online, Mail, or In-Person

Ohio offers multiple methods for filing your income tax return, allowing taxpayers to choose the option that best suits their preferences and circumstances.

Online Filing

The most popular and efficient way to file your Ohio income tax return is through the state’s official website, Ohio Department of Taxation. The website provides a user-friendly interface, allowing you to input your information and complete your return electronically. Online filing offers several advantages, including instant error checks, faster processing times, and the ability to track the status of your return.

To file online, you'll need to create an account on the Ohio Department of Taxation website. Once logged in, you can access the necessary forms and input your information. The website provides step-by-step guidance, making the process straightforward and convenient.

Mail Filing

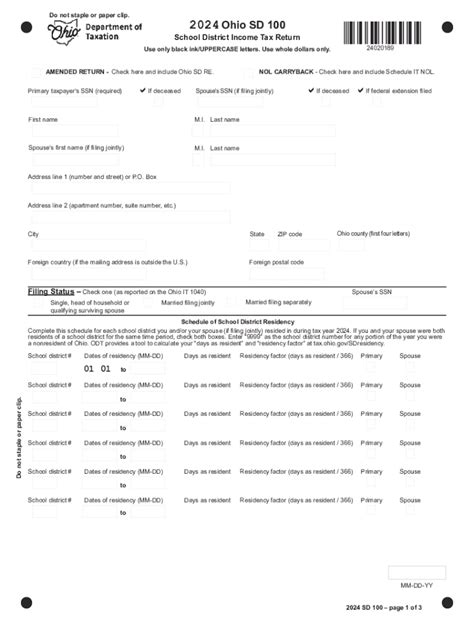

If you prefer a more traditional approach or do not have access to the internet, you can file your Ohio income tax return by mail. The Ohio Department of Taxation provides printable forms that you can complete and mail to the appropriate address. However, it’s important to note that mail filing may take longer and may not provide the same level of convenience and error checks as online filing.

To file by mail, download and print the appropriate forms from the Ohio Department of Taxation website. Carefully fill out the forms, ensuring accuracy and completeness. Include all required documentation and mail your return to the address specified on the forms.

In-Person Filing

For those who require additional assistance or have complex tax situations, in-person filing is an option. The Ohio Department of Taxation has local offices where taxpayers can receive help with their returns. These offices provide assistance with tax forms, deductions, and other tax-related matters. However, it’s important to note that in-person filing may require an appointment and is generally recommended for taxpayers with unique circumstances.

To file in person, locate the nearest Ohio Department of Taxation office using the website's office locator tool. Schedule an appointment if necessary, gather your required documents, and visit the office during their operating hours. Tax professionals at the office will assist you in completing your return accurately.

Common Errors and Tips for Accuracy

To ensure a smooth filing process and avoid potential errors, consider the following tips:

- Double-check your personal information, including your name, address, and SSN.

- Verify the accuracy of your income and deduction amounts. Cross-reference with your tax documents.

- Use the Ohio Department of Taxation's tax calculators and resources to estimate your tax liability.

- Consider using tax preparation software or engaging a tax professional for complex tax situations.

- If you have questions or uncertainties, utilize the Ohio Department of Taxation's helpline or online resources.

By following these tips and being diligent, you can minimize the risk of errors and ensure a smooth filing experience.

Paying Your Ohio Income Tax

Once you have completed your Ohio income tax return, you will need to determine your tax liability and make the necessary payments. Ohio offers various payment methods to accommodate different preferences and circumstances.

Payment Methods

- Electronic Payments: The Ohio Department of Taxation accepts electronic payments, including credit card, debit card, and electronic check payments. This method is secure, convenient, and allows for instant confirmation of payment.

- Check or Money Order: If you prefer a more traditional payment method, you can mail a check or money order along with your return. Ensure that you include your name, address, and SSN on the payment instrument.

- Payment Plans: If you are unable to pay your taxes in full, Ohio offers payment plans to help taxpayers manage their tax obligations. You can apply for a payment plan online or by contacting the Ohio Department of Taxation.

Tax Refunds

If you overpaid your taxes or are eligible for deductions and credits, you may be entitled to a tax refund. Ohio typically issues tax refunds within 45 days of receiving a complete and accurate return. You can check the status of your refund on the Ohio Department of Taxation website or by calling their helpline.

In the event that you do not receive your refund within the expected timeframe, it's important to contact the Ohio Department of Taxation to inquire about the status of your refund. They will assist you in resolving any issues and ensuring you receive your refund promptly.

Staying Informed and Prepared

Filing your Ohio income tax return is an annual obligation, and staying informed about tax laws, deadlines, and changes is crucial. The Ohio Department of Taxation regularly updates its website with important information and resources to assist taxpayers. It’s advisable to bookmark their website and periodically check for updates to ensure you are up-to-date with the latest tax requirements.

Additionally, consider subscribing to their email updates or following their social media channels to receive timely notifications about tax deadlines, changes in tax laws, and other important tax-related information.

Conclusion: A Smooth Filing Experience

Filing your Ohio income tax return may seem daunting, but with the right resources and preparation, it can be a straightforward and manageable process. By understanding the filing requirements, gathering necessary information, and utilizing the available resources, you can navigate the filing process with confidence.

Remember, accurate and timely filing is crucial to avoid penalties and maintain compliance with Ohio's tax laws. Whether you choose to file online, by mail, or in person, the Ohio Department of Taxation provides the tools and support to ensure a smooth filing experience.

As you embark on your tax filing journey, stay organized, utilize the resources available, and seek assistance when needed. With a well-prepared return, you can fulfill your tax obligations and focus on your financial goals for the year ahead.

What are the income tax rates in Ohio for the current tax year?

+

For the 2023 tax year, Ohio has a flat tax rate of 4.75% for all taxpayers.

When is the deadline to file my Ohio income tax return?

+

The deadline for filing your Ohio income tax return is typically April 15th of the following year. However, if this date falls on a weekend or holiday, the deadline is extended to the next business day.

Can I request an extension to file my Ohio income tax return?

+

Yes, you can request an extension by filing Form IT 40-EXT. This grants you an additional six months to file your return, pushing the deadline to October 15th.

What are the payment options for my Ohio income tax liability?

+

Ohio offers electronic payments, including credit card, debit card, and electronic check payments. You can also pay by check or money order, or opt for a payment plan if you’re unable to pay in full.

How can I check the status of my Ohio tax refund?

+

You can check the status of your Ohio tax refund on the Ohio Department of Taxation website or by calling their helpline. Typically, refunds are issued within 45 days of receiving a complete and accurate return.