New York Sale Tax

Welcome to our comprehensive guide on the intricate world of New York's Sales Tax. As one of the most populous states in the US, New York has a complex tax system that impacts both residents and businesses alike. In this expert-led exploration, we will delve into the specifics of New York's sales tax, covering everything from its history and structure to its impact on businesses and consumers. So, whether you're a business owner looking to navigate the tax landscape or an individual seeking a better understanding of your financial obligations, this guide has you covered.

The Evolution of New York’s Sales Tax

The history of sales tax in New York dates back to the early 20th century. The state’s first sales tax, implemented in 1965, started at a modest rate of 4% and was primarily applied to retail sales of tangible personal property. Over the years, the tax rate has fluctuated, with significant changes occurring in response to economic shifts and state budget requirements.

One of the most notable changes was the introduction of the Local Sales Tax in 1982. This addition aimed to provide a stable source of revenue for local governments, allowing counties and cities to impose their own sales taxes. The result was a complex system where the total sales tax rate varied across different regions of the state.

| Year | State Sales Tax Rate | Local Sales Tax Rate |

|---|---|---|

| 1965 | 4% | N/A |

| 1982 | 4% | Up to 3% |

| 2009 | 4% | Up to 4.5% |

| 2010 | 4% | Up to 4.5% |

| 2011 | 4% | Up to 4.5% |

| 2012 | 4% | Up to 4.5% |

| 2013 | 4% | Up to 4.5% |

| 2014 | 4% | Up to 4.5% |

| 2015 | 4% | Up to 4.5% |

| 2016 | 4% | Up to 4.5% |

| 2017 | 4% | Up to 4.5% |

The above table provides a glimpse into the historical sales tax rates in New York. While the state sales tax rate has remained relatively stable, the local sales tax rates have seen variations, with some regions imposing higher rates to meet their financial needs.

Understanding the Structure of New York’s Sales Tax

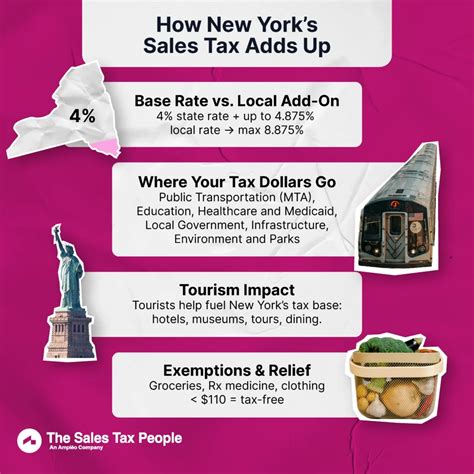

New York’s sales tax is a consumption tax, meaning it is levied on the sale or rental of goods and certain services. The tax is calculated as a percentage of the sale price, with the exact rate depending on the location of the sale and the nature of the product or service.

The state sales tax is imposed uniformly across New York, with a standard rate of 4%. However, as mentioned earlier, local governments can impose their own sales taxes, leading to a combined rate that can vary significantly from one city to another.

Sales Tax Exemptions and Special Considerations

While most tangible personal property is subject to sales tax in New York, there are certain exemptions and special considerations that businesses and consumers should be aware of.

- Food and Drugs: Sales of food products for home consumption and prescription drugs are generally exempt from sales tax. However, prepared foods and certain non-prescription drugs are taxable.

- Clothing and Footwear: Clothing and footwear items priced under $110 are exempt from sales tax. However, this exemption does not apply to accessories or items sold as a set with an exempt item.

- Grocery Stores: Sales made by grocery stores, including supermarkets and convenience stores, are subject to a lower sales tax rate of 1% for the first $500,000 of taxable sales annually.

- Internet Sales: New York has implemented a law requiring online retailers to collect sales tax on sales made to New York residents. This law aims to ensure fair competition between online and brick-and-mortar businesses.

The Impact on Businesses

For businesses operating in New York, understanding and managing sales tax is crucial for financial compliance and competitiveness. Here’s a deeper look at how sales tax affects businesses:

Registration and Compliance

Businesses engaged in taxable sales in New York must register with the New York State Department of Taxation and Finance and obtain a Certificate of Authority. This certificate authorizes the business to collect and remit sales tax to the state.

Compliance with sales tax regulations is essential. Businesses must keep accurate records of sales, calculate the correct tax rate for each transaction, and remit the collected tax to the state by the due date. Failure to comply can result in penalties and interest charges.

Sales Tax Collection and Remittance

Businesses act as agents for the state by collecting sales tax from customers at the point of sale. The collected tax is then remitted to the state on a regular basis, typically monthly or quarterly, depending on the business’s sales volume.

The remittance process involves filing a sales tax return, which includes details of taxable sales, exemptions, and the amount of tax due. The return must be filed by the due date to avoid penalties.

Sales Tax Filing and Payment Options

New York offers businesses several options for filing and paying sales tax. These include:

- Online Filing: The Department of Taxation and Finance provides an online portal for businesses to file their sales tax returns and make payments.

- Paper Returns: Businesses can choose to file paper returns if they prefer. However, this method is less efficient and may result in delays.

- Electronic Funds Transfer (EFT): Businesses can set up EFT payments to automate the sales tax remittance process. This option ensures timely payments and reduces the risk of late fees.

The Impact on Consumers

Consumers in New York play a crucial role in the sales tax system as they ultimately bear the cost of the tax. Here’s how sales tax affects consumers:

Understanding the Tax at Checkout

When making a purchase in New York, consumers will see the sales tax added to their total. The tax amount is calculated based on the applicable rate for the location of the sale. Consumers should be aware of the tax rate in their area to understand the final cost of their purchases.

Sales Tax and Online Shopping

With the rise of e-commerce, consumers now have the option to shop online, often from retailers located outside their state. New York’s law requiring online retailers to collect sales tax ensures that consumers pay the appropriate tax, even on online purchases. This helps level the playing field for local businesses and prevents tax evasion.

Sales Tax and Refunds

Consumers who believe they have been overcharged on sales tax can request a refund from the retailer. However, the refund process can be complex, and it’s important for consumers to understand their rights and the retailer’s policies regarding sales tax.

Future Implications and Potential Changes

New York’s sales tax system is subject to ongoing changes and developments. Here are some potential future implications and changes to watch for:

Online Sales Tax Collection

With the increasing importance of e-commerce, the state may further refine its laws and regulations to ensure effective sales tax collection from online retailers. This could involve updating laws to keep pace with evolving online shopping trends.

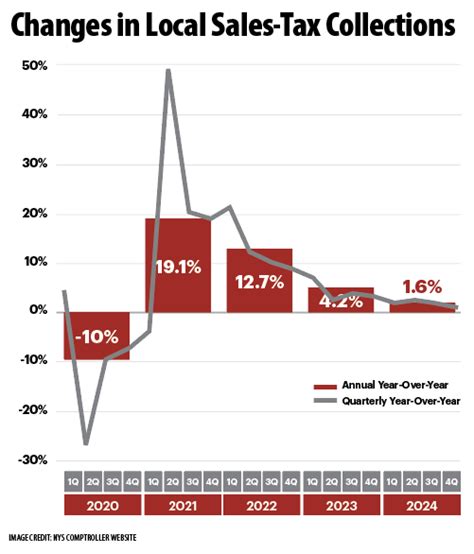

Sales Tax Rate Adjustments

The state sales tax rate has remained relatively stable over the years, but economic conditions and budget requirements can lead to rate adjustments. Businesses and consumers should stay informed about any potential changes to the sales tax rate.

Expanding Sales Tax Exemptions

As the state’s economy evolves, there may be calls to expand sales tax exemptions to certain products or services. This could impact the overall tax burden on consumers and businesses.

Sales Tax Simplification

The complex nature of New York’s sales tax, with its varying local rates, can be a challenge for businesses and consumers. There may be future efforts to simplify the tax system, potentially by standardizing rates across the state or implementing a uniform tax rate.

Frequently Asked Questions

What is the current state sales tax rate in New York?

+The current state sales tax rate in New York is 4%.

Are there any sales tax holidays in New York?

+No, New York does not currently have any sales tax holidays.

How often do I need to file my sales tax returns as a business owner in New York?

+The frequency of filing sales tax returns depends on your business’s sales volume. If your annual sales are 1 million or more, you must file monthly. If your annual sales are less than 1 million, you must file quarterly. However, you can opt to file monthly regardless of your sales volume.

Can I claim a sales tax deduction on my personal income tax return in New York?

+No, New York does not allow for a sales tax deduction on personal income tax returns.

Are there any special sales tax rates for specific industries in New York?

+Yes, certain industries, such as grocery stores and restaurants, may be subject to special sales tax rates or exemptions. It’s important to consult the relevant tax guidelines for your specific industry.