Iowa Income Tax Refund

The Iowa income tax refund is a crucial aspect of the state's tax system, offering financial relief to residents and businesses alike. Understanding how this process works and the potential benefits it provides is essential for taxpayers in Iowa. This article aims to delve into the specifics of the Iowa income tax refund, providing an in-depth analysis of the process, eligibility criteria, timelines, and the impact it has on the state's economy.

The Iowa Income Tax Refund System: An Overview

Iowa, like many other states in the US, operates a progressive income tax system, which means that the tax rate increases as the taxpayer’s income rises. This system ensures that individuals and businesses with higher incomes contribute a larger share of their income to the state’s revenue. However, to mitigate the financial burden on taxpayers, Iowa provides a refund system, allowing eligible residents to reclaim a portion of the taxes they paid during the tax year.

The Iowa income tax refund is not a mere gesture of goodwill; it is a strategic tool that serves several purposes. Firstly, it provides a financial boost to taxpayers, especially those with lower or moderate incomes, helping them manage their financial obligations and maintain a healthy economic status. Secondly, the refund system encourages timely tax payments, as taxpayers are more likely to file their returns accurately and on time if they anticipate a refund. Lastly, it plays a vital role in stimulating the state's economy by putting money back into the hands of consumers, who can then use it to drive local businesses and industries.

Eligibility Criteria and Taxpayer Responsibilities

Not all Iowa taxpayers are eligible for a refund. The eligibility criteria are primarily based on income levels and tax obligations. Generally, individuals and businesses must have paid more in taxes than they owe, as determined by their tax bracket and the applicable tax rates. For instance, if a taxpayer’s total tax liability for the year is 5,000 but they paid 6,000 in taxes, they would be eligible for a refund of $1,000.

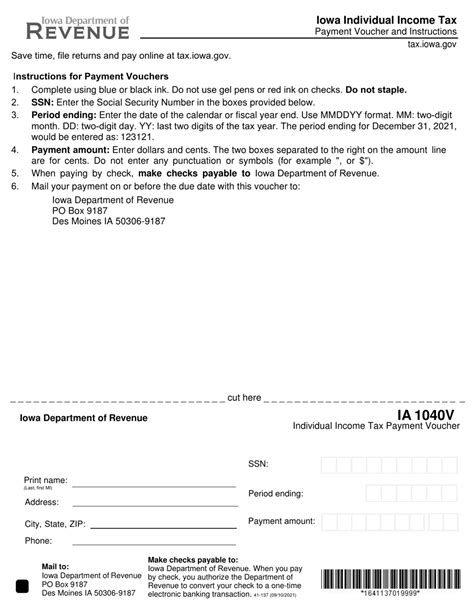

To claim a refund, taxpayers must file their income tax returns accurately and on time. The Iowa Department of Revenue provides various methods for filing returns, including online platforms, mail-in forms, and in-person assistance at designated centers. It is the responsibility of the taxpayer to ensure that their return is complete, accurate, and submitted by the deadline to avoid penalties or delays in processing their refund.

| Tax Year | Refund Eligibility Deadline |

|---|---|

| 2023 | April 30, 2024 |

| 2022 | April 30, 2023 |

| 2021 | April 30, 2022 |

The Iowa Income Tax Refund Process: Step by Step

The process of claiming an Iowa income tax refund is straightforward but requires attention to detail. Here’s a step-by-step guide to help taxpayers navigate this process efficiently.

Step 1: Determine Eligibility

Before initiating the refund process, taxpayers should assess their eligibility. This involves calculating their total tax liability for the year and comparing it to the taxes they paid. If the amount paid exceeds the liability, they may be eligible for a refund.

Step 2: Gather Necessary Documents

Taxpayers will need specific documents to complete their tax return and claim their refund. These typically include wage statements (W-2 forms), interest and dividend statements, business income records, and any other documents related to income, deductions, and credits. It’s crucial to organize these documents beforehand to streamline the filing process.

Step 3: Choose a Filing Method

Iowa taxpayers have several options for filing their tax returns. The most common methods include:

- Online Filing: The Iowa Department of Revenue offers an online platform for taxpayers to file their returns digitally. This method is convenient, secure, and often provides faster processing times for refunds.

- Paper Filing: Taxpayers can also choose to file their returns using paper forms, which can be downloaded from the Department’s website or picked up at designated centers. This method might be preferable for those who prefer a more traditional approach or have complex tax situations.

- In-Person Assistance: For taxpayers who need additional support, the Department provides in-person assistance at various locations across the state. This service is especially beneficial for those who may face language barriers or have limited access to technology.

Step 4: Complete the Tax Return

Whether filing online or using paper forms, taxpayers must ensure that their return is accurate and complete. This includes reporting all sources of income, claiming eligible deductions and credits, and providing any necessary supporting documentation.

Step 5: Claim Your Refund

Once the tax return is complete, taxpayers can indicate their intention to claim a refund. This is typically done by checking a box or selecting an option within the filing platform or form. It’s important to review the refund claim carefully to ensure all relevant information is included.

Step 6: Wait for Processing and Receipt

After submitting their tax return and claiming their refund, taxpayers must wait for the Department of Revenue to process their request. The processing time can vary depending on the method of filing and the complexity of the return. Generally, online filings tend to have faster processing times compared to paper filings.

Once the refund is processed, taxpayers will receive their refund amount, either through direct deposit (if they provided banking information) or by check. It's essential to keep track of the expected refund timeline and contact the Department if the refund is not received within the estimated timeframe.

Impact of Iowa Income Tax Refunds on the State’s Economy

The Iowa income tax refund system has a significant impact on the state’s economy, affecting both individuals and businesses. Here’s a closer look at these impacts.

Benefits for Individuals

For Iowa residents, particularly those with lower or moderate incomes, the income tax refund can provide a much-needed financial boost. This additional money can be used to pay off debts, cover essential expenses, or even be saved for future needs. By putting money back into the hands of consumers, the refund system helps improve the standard of living for many Iowans.

Moreover, the refund system encourages financial planning and awareness among taxpayers. As individuals anticipate their potential refund, they may become more conscious of their spending habits and tax obligations, leading to better financial management skills.

Advantages for Businesses

The Iowa income tax refund system also benefits businesses operating within the state. By providing a financial incentive for timely tax payments, the refund system encourages businesses to maintain good standing with the Department of Revenue. This, in turn, helps create a positive business environment, attracting and retaining businesses that contribute to the state’s economic growth.

Additionally, the refund system can indirectly support businesses by increasing consumer spending. As individuals receive their refunds, they are more likely to spend this money at local businesses, boosting sales and supporting job creation. This cycle of economic stimulation can have a positive ripple effect across various industries in Iowa.

State-Level Economic Impact

On a broader scale, the Iowa income tax refund system contributes to the state’s overall economic health. By putting money back into the hands of taxpayers, the system helps stimulate economic activity, which can lead to increased tax revenues for the state. This, in turn, can support essential public services, infrastructure development, and other initiatives that benefit all Iowans.

Conclusion

The Iowa income tax refund system is a vital component of the state’s tax structure, offering financial relief and incentives to taxpayers. By understanding the eligibility criteria, following the refund process, and recognizing the economic benefits, Iowa taxpayers can make the most of this system. For those eligible, the refund can provide a much-needed boost to their financial well-being, while for the state, it serves as a tool to stimulate economic growth and support its residents and businesses.

How often can I claim an Iowa income tax refund?

+

Iowa taxpayers can claim a refund annually, provided they meet the eligibility criteria for each tax year. It’s important to file your tax returns accurately and on time to ensure you receive your refund.

What happens if I don’t receive my refund within the expected timeframe?

+

If you don’t receive your refund within the estimated processing time, it’s recommended to contact the Iowa Department of Revenue. They can provide updates on your refund status and help resolve any potential issues.

Can I track the status of my Iowa income tax refund online?

+

Yes, Iowa taxpayers can track the status of their refund online through the Department of Revenue’s website. This service provides real-time updates on the progress of your refund claim, helping you stay informed.