Death And Taxes Raleigh Nc

In the heart of North Carolina, the city of Raleigh is known for its vibrant culture, thriving businesses, and, like any other place, its inevitable encounters with two universal constants: death and taxes. While these topics may not be the most pleasant to discuss, understanding them is crucial for individuals and businesses alike. This comprehensive guide will delve into the world of death and taxes in Raleigh, North Carolina, providing valuable insights and information for those navigating these complex and often daunting subjects.

The Inevitable Encounter: Death and Its Legal Implications

Death is an inevitable part of life, and its legal and financial aspects can be intricate and emotionally challenging. In Raleigh, as in any city, it is essential to be aware of the legal processes and requirements that come into play when dealing with the loss of a loved one.

Estate Planning and Probate

Estate planning is a critical step for anyone wishing to ensure their assets are distributed according to their wishes after their death. In Raleigh, this process often involves creating a will or trust, which can be done with the guidance of an experienced estate planning attorney. These legal documents provide clarity and direction for the distribution of property, financial assets, and personal belongings.

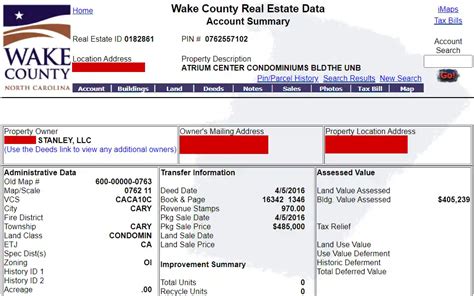

The probate process in Raleigh is overseen by the Wake County Clerk of Superior Court. Probate is the legal procedure that validates a will and oversees the distribution of assets. It is essential to understand the probate process, as it can be lengthy and complex, especially if the estate is large or contested. Engaging a probate lawyer can help navigate this process smoothly.

Funeral Arrangements and Costs

When a loved one passes away, one of the first considerations is funeral arrangements. Raleigh offers a range of funeral homes and services to cater to different cultural and religious needs. The costs of funerals can vary significantly, and it is crucial to research and plan ahead to ensure the wishes of the deceased are respected and the financial burden is manageable.

Raleigh also has resources for those seeking affordable funeral options, such as low-cost funeral homes and pre-need planning services. These services can help reduce the financial strain during an already emotionally challenging time.

Legal Assistance and Support

Navigating the legal aspects of death can be overwhelming. Raleigh has a network of legal professionals, including estate planning attorneys, probate lawyers, and elder law specialists, who can provide guidance and support. These experts can help with everything from drafting wills and trusts to managing the probate process and ensuring the deceased’s wishes are honored.

| Estate Planning Resources | Contact Information |

|---|---|

| The Elder Law Center of North Carolina | Website: elderlawcenter.com Phone: (919) 844-8448 |

| The Law Offices of David G. White | Website: davidgwhitelaw.com Phone: (919) 810-0500 |

| Hulse Law Firm, P.A. | Website: hulselaw.com Phone: (919) 834-5151 |

Taxes: Navigating the Financial Landscape

While death is a deeply personal matter, taxes are a universal reality that affects every individual and business. Understanding the tax landscape in Raleigh is crucial for financial planning and compliance.

Income Taxes

Raleigh residents and businesses are subject to both state and federal income taxes. The North Carolina Department of Revenue oversees the collection of state income taxes, which are based on a progressive tax structure. This means that as your income increases, so does the tax rate.

For individuals, the state income tax rates range from 5.25% to 5.75%, depending on income level. Businesses, on the other hand, face a flat corporate income tax rate of 2.5%. Understanding these rates and ensuring accurate reporting is essential for compliance and financial health.

Sales and Use Taxes

Sales and use taxes are another significant aspect of the tax landscape in Raleigh. The city, like the rest of North Carolina, imposes a state sales tax of 4.75% on most tangible personal property and certain services. In addition, Wake County, where Raleigh is located, levies a local sales tax of 2%, bringing the total sales tax rate to 6.75%.

Businesses in Raleigh must also be aware of their responsibilities regarding use taxes. Use taxes are applicable when goods are purchased from out-of-state vendors and brought into North Carolina. These taxes ensure fairness in the sales tax system and are often a consideration for online retailers and e-commerce businesses.

Property Taxes

Property taxes are a vital source of revenue for local governments, including the city of Raleigh. These taxes are assessed on real estate properties, including land and buildings, and are used to fund public services such as schools, roads, and emergency services.

The property tax rate in Raleigh is set annually by the Wake County Board of Commissioners. As of the most recent assessment, the tax rate is 0.7468 per $100 of assessed value. This rate can vary slightly from year to year, so it is important for property owners to stay informed about any changes.

Tax Preparation and Planning

Navigating the complex world of taxes can be daunting, but there are resources available to help. Raleigh is home to numerous accounting firms and tax professionals who can assist with tax preparation, planning, and compliance.

These professionals can help individuals and businesses understand their tax obligations, identify deductions and credits, and ensure accurate filing. Whether it’s a simple tax return or a complex business tax situation, having expert guidance can save time, money, and potential legal headaches.

| Tax Preparation and Accounting Services | Contact Information |

|---|---|

| The Accounting Group | Website: theaccountinggroup.net Phone: (919) 872-1060 |

| Wake Accounting & Tax Services | Website: wakeaccounting.com Phone: (919) 790-7977 |

| Carolina Tax Solutions | Website: carolinataxsolutions.com Phone: (919) 272-9402 |

Conclusion: Embracing Preparedness

Death and taxes are two of life’s certainties, and while they may be daunting topics, being informed and prepared can make a significant difference. Raleigh, with its vibrant community and thriving businesses, offers a wealth of resources to help individuals and businesses navigate these complex subjects.

From estate planning and probate to tax preparation and compliance, the city provides a network of legal and financial professionals ready to assist. By understanding the legal and financial implications of death and taxes, Raleigh residents can ensure they are taking the necessary steps to protect their assets, honor their loved ones’ wishes, and maintain financial stability.

Remember, while these topics may be uncomfortable to discuss, addressing them proactively can provide peace of mind and ensure a smoother journey through life’s inevitable challenges.

What are the average funeral costs in Raleigh, NC?

+The average cost of a funeral in Raleigh can vary widely, ranging from 5,000 to 15,000 or more, depending on the type of service, burial or cremation, and any additional expenses. It is advisable to research and plan ahead to ensure the funeral aligns with your preferences and budget.

Are there any tax benefits for seniors or veterans in Raleigh?

+Yes, Raleigh offers several tax benefits for seniors and veterans. These include property tax exclusions and deferred payment options for qualifying individuals. It is recommended to consult with a tax professional or visit the Wake County Tax Office website for detailed information on these benefits.

How can I find a reputable estate planning attorney in Raleigh?

+Finding a reputable estate planning attorney in Raleigh can be done through recommendations from trusted sources, such as family, friends, or financial advisors. You can also search online directories or the North Carolina State Bar website for licensed attorneys specializing in estate planning. It is advisable to schedule consultations with multiple attorneys to find the best fit for your needs.

What is the process for filing tax returns in Raleigh?

+The process for filing tax returns in Raleigh involves gathering all necessary tax documents, such as W-2s, 1099s, and any applicable deductions or credits. You can then use tax preparation software or hire a professional tax preparer to assist with filing. The deadline for filing state and federal tax returns is typically April 15th, but it is advisable to file as early as possible to avoid potential penalties.