Tax En Puerto Rico

In the vibrant Caribbean nation of Puerto Rico, understanding the intricacies of the tax system is essential for both residents and businesses. The island's unique political and economic status under the United States has resulted in a tax regime that is distinct from the mainland. This comprehensive guide will delve into the key aspects of Taxation in Puerto Rico, covering individual and corporate taxes, incentives, and the impact of recent legislation.

The Basics of Tax in Puerto Rico

Puerto Rico operates under a separate tax system from the United States, with its own Internal Revenue Service (known as the Departamento de Hacienda). The island's tax structure is designed to encourage economic growth and investment, offering a range of incentives and benefits to both local and foreign entities.

Individual Income Tax

For individuals, Puerto Rico has a progressive income tax system with six tax brackets. As of 2023, these brackets are as follows:

| Tax Bracket | Tax Rate |

|---|---|

| First $6,000 | 0% |

| $6,001 - $12,000 | 7% |

| $12,001 - $24,000 | 12% |

| $24,001 - $36,000 | 18% |

| $36,001 - $60,000 | 24% |

| Above $60,000 | 33% |

These tax rates are subject to change annually and are influenced by factors such as residency status and source of income. Puerto Rico residents are taxed on their worldwide income, while non-residents are taxed only on income sourced from the island.

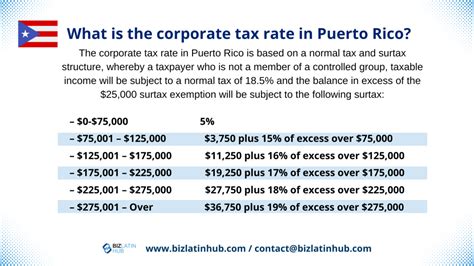

Corporate Income Tax

Corporations in Puerto Rico are subject to a corporate income tax, with a flat rate of 30% on net taxable income. This tax applies to both local and foreign corporations doing business on the island. However, Puerto Rico has implemented various tax incentives and zones to promote economic development, particularly in the manufacturing and services sectors.

Tax Incentives and Zones

One of the key features of Puerto Rico's tax system is the array of incentives designed to attract investment and foster economic growth. These incentives are particularly beneficial for businesses operating in specific industries and geographic areas.

Act 20 and Act 22

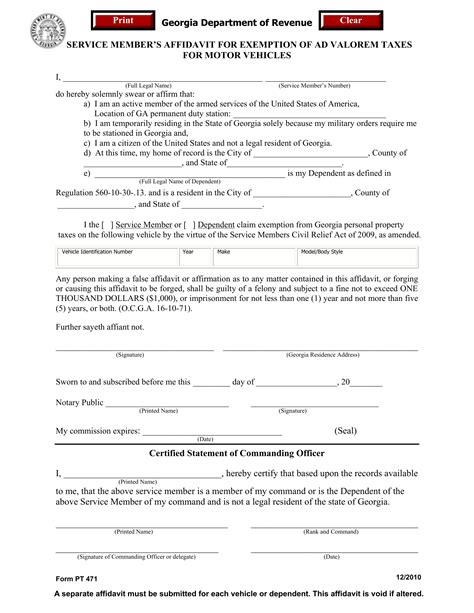

Act 20, also known as the Export Services Act, offers significant tax benefits for businesses exporting services from Puerto Rico. Qualified companies can enjoy a 4% tax rate on exported services, with no tax on dividends and interest. This act has been a major driver of growth in the financial services, software development, and intellectual property industries.

Similarly, Act 22, the Individual Investors Act, provides tax incentives for high-net-worth individuals who establish residency in Puerto Rico. Investors can benefit from a 0% tax rate on passive income, including dividends, interest, and capital gains, making Puerto Rico an attractive destination for international investors.

Other Incentive Programs

Beyond Acts 20 and 22, Puerto Rico offers several other incentive programs, such as Act 273, which provides tax credits for research and development, and Act 73, which offers incentives for companies establishing operations in designated zones. These programs aim to encourage investment in a wide range of industries, from manufacturing to tourism and renewable energy.

The Impact of Recent Legislation

Recent years have seen significant legislative changes that have further shaped Puerto Rico's tax landscape. One of the most notable developments is the passage of the Puerto Rico Fiscal Agency and Financial Advisory Authority Act (PROMESA) in 2016. This act established a financial oversight and management board to address the island's debt crisis, leading to various tax reforms and initiatives.

PROMESA and Tax Reform

PROMESA has led to a series of tax reforms aimed at stabilizing the island's economy and attracting investment. These reforms include the introduction of a value-added tax (VAT) and the modification of individual and corporate tax rates. The VAT, implemented in 2016, replaced the existing sales and use tax, and has been a key tool in generating revenue for the government.

The Future of Taxation in Puerto Rico

Looking ahead, Puerto Rico's tax system is likely to continue evolving in response to economic challenges and opportunities. The island's unique position as a U.S. territory with its own tax regime offers both advantages and complexities. As the government works to promote economic recovery and growth, tax incentives and reforms will play a crucial role in shaping the island's future.

Frequently Asked Questions

How does Puerto Rico’s tax system differ from that of the United States mainland?

+

Puerto Rico has its own tax system separate from the U.S. mainland, with its own tax rates, brackets, and incentives. While it operates under some U.S. tax laws, it has significant differences, particularly in the area of tax incentives and economic zones.

What are the main tax incentives offered by Puerto Rico for businesses?

+

Puerto Rico offers a range of tax incentives, including Act 20 for exported services, Act 22 for individual investors, and Act 73 for companies establishing operations in designated zones. These incentives provide reduced tax rates and tax credits for eligible businesses.

How has the PROMESA legislation affected Puerto Rico’s tax landscape?

+

PROMESA has led to tax reforms, including the introduction of a value-added tax (VAT) and modifications to individual and corporate tax rates. These changes aim to stabilize the island’s economy and make it more attractive for investment.

What are the key considerations for individuals looking to take advantage of Puerto Rico’s tax incentives?

+

Individuals should carefully consider their residency status, source of income, and eligibility for tax incentives like Act 22. Consulting with tax professionals is essential to ensure compliance and maximize the benefits of these incentives.

How can businesses navigate the complexities of Puerto Rico’s tax system?

+

Businesses should seek guidance from tax advisors and legal experts who specialize in Puerto Rico’s tax laws. Understanding the incentives, zones, and applicable tax rates is crucial for successful tax planning and compliance.