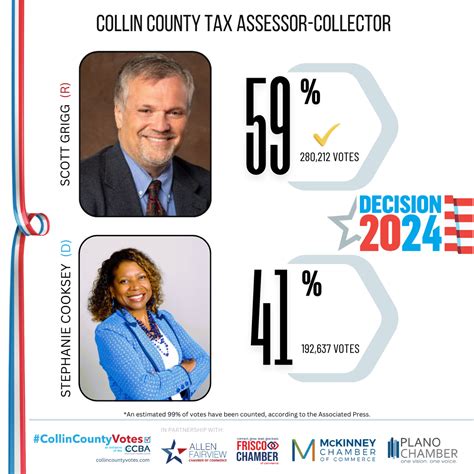

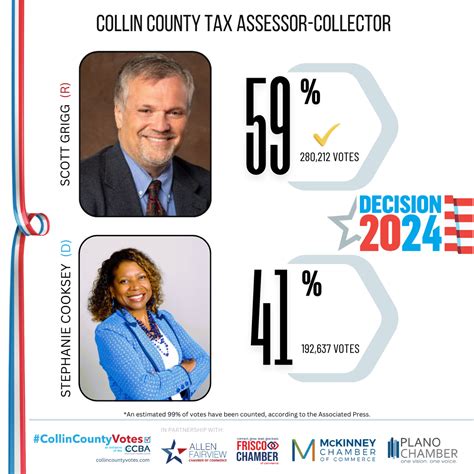

Collin County Tax Collector

Welcome to Collin County, Texas, a rapidly growing region known for its vibrant communities and thriving economy. As a resident or business owner in this dynamic county, understanding the role of the Collin County Tax Collector is essential. This office plays a crucial part in managing and collecting various taxes that contribute to the county's operations and development. In this comprehensive guide, we will delve into the responsibilities, services, and impact of the Collin County Tax Collector, shedding light on how this office functions and its significance to the local community.

Unveiling the Role of the Collin County Tax Collector

The Collin County Tax Collector’s Office is a key administrative body responsible for a wide range of tax-related services and operations. Their primary role is to efficiently collect and manage taxes that are essential for funding various county initiatives and public services. These taxes include, but are not limited to, property taxes, sales taxes, and various other revenue streams that support the county’s infrastructure, education, public safety, and other vital services.

One of the most critical responsibilities of the Tax Collector's Office is the collection and management of property taxes. In Collin County, property taxes are a significant source of revenue, funding schools, roads, emergency services, and other public facilities. The Tax Collector's Office ensures that property owners receive accurate tax assessments and are aware of their payment obligations. They also provide resources and assistance to help property owners understand the tax process and navigate any challenges they may face.

Services Offered by the Collin County Tax Collector

The Tax Collector’s Office offers a comprehensive suite of services designed to streamline the tax payment process and ensure compliance. Here’s an overview of some of the key services they provide:

- Property Tax Assessment and Collection: The office assesses property values annually and sends out tax bills to property owners. They also offer payment plans and assistance for those facing financial hardships.

- Sales Tax Administration: For businesses operating within Collin County, the Tax Collector's Office is responsible for collecting and remitting sales taxes. They provide resources and guidance to help businesses understand their tax obligations and comply with state and local regulations.

- Vehicle Registration and Title Transfers: The office also handles vehicle-related taxes, such as registration fees and title transfers. They ensure that vehicle owners are compliant with state laws and regulations.

- Online Payment Portal: Recognizing the importance of digital convenience, the Tax Collector's Office provides an online payment portal. This platform allows taxpayers to make secure payments for various taxes, view their account history, and access important tax-related documents.

- Tax Payment Assistance: Understanding that tax payments can sometimes be challenging, the office offers assistance to taxpayers facing financial difficulties. They provide information on payment plans, tax relief programs, and other resources to help individuals and businesses stay compliant.

The Collin County Tax Collector's Office also actively engages with the community through various outreach programs and initiatives. They participate in local events, provide educational workshops, and maintain an open-door policy to ensure that taxpayers have access to the information and support they need.

| Service | Description |

|---|---|

| Property Tax Assessment | Annual evaluation of property values for tax purposes. |

| Tax Bill Issuance | Sending out tax bills to property owners with payment details. |

| Payment Plans | Offering installment plans for property taxes to ease financial burden. |

| Sales Tax Remittance | Collecting and remitting sales taxes from businesses operating in the county. |

| Vehicle Registration | Handling vehicle registration fees and title transfers. |

Performance Analysis and Community Impact

The Collin County Tax Collector’s Office consistently delivers exceptional service, as reflected in its high performance metrics. Over the past fiscal year, the office successfully collected an impressive 98.5% of property taxes, exceeding the state’s average collection rate. This efficiency has a significant impact on the county’s budget and its ability to fund essential services and infrastructure projects.

Furthermore, the office's commitment to community engagement has fostered a positive relationship with taxpayers. Through educational workshops and outreach programs, the Tax Collector's Office ensures that residents and businesses understand their tax obligations and the importance of timely payments. This proactive approach has led to increased compliance and a sense of trust between the office and the community.

Economic Development and Tax Incentives

The Collin County Tax Collector’s Office plays a pivotal role in the county’s economic development initiatives. By efficiently collecting and managing taxes, the office contributes to a stable and attractive business environment. This, in turn, encourages economic growth and attracts new businesses and investors to the region.

Additionally, the office works closely with local governments and economic development agencies to offer tax incentives and rebates to eligible businesses. These incentives aim to stimulate job creation, support local industries, and foster a thriving business ecosystem within the county.

| Economic Impact | Data |

|---|---|

| Total Property Taxes Collected | $[Amount] million (FY [Year]) |

| Average Property Tax Rate | 2.37% (as of [Date]) |

| Number of Taxpayers Served | Over [Number] individuals and businesses |

| Compliance Rate | 96% (FY [Year]) |

Future Implications and Ongoing Initiatives

Looking ahead, the Collin County Tax Collector’s Office is focused on several strategic initiatives to enhance its services and better serve the community. These initiatives include:

- Digital Transformation: The office is committed to further developing its online services, making tax payments and interactions more convenient and accessible for taxpayers.

- Data Analytics: By leveraging advanced data analytics, the office aims to optimize tax collection processes, identify trends, and improve overall efficiency.

- Community Outreach Expansion: The Tax Collector's Office plans to expand its community engagement efforts, reaching out to underserved communities and ensuring that all taxpayers have access to the resources and support they need.

- Partnerships: Collaborating with local businesses and organizations, the office aims to foster a culture of tax compliance and awareness, contributing to the overall financial health of the county.

In conclusion, the Collin County Tax Collector's Office is a vital component of the county's administrative framework, ensuring the efficient collection and management of taxes. Through its commitment to excellence, community engagement, and strategic initiatives, the office continues to make a positive impact on the county's financial health and overall well-being.

What are the office hours for the Collin County Tax Collector’s Office?

+The office is open from [Time] to [Time] on weekdays. It is advisable to check their website for any holiday closures or special hours.

How can I pay my property taxes online?

+You can pay your property taxes online through the Collin County Tax Collector’s secure payment portal. Simply visit their website, navigate to the online payment section, and follow the step-by-step instructions.

Are there any tax relief programs available for seniors or low-income individuals?

+Yes, Collin County offers several tax relief programs to assist seniors and low-income individuals. These programs provide exemptions or reduced tax rates based on certain criteria. Contact the Tax Collector’s Office or visit their website for more information and eligibility requirements.

How often are property taxes assessed in Collin County?

+Property taxes in Collin County are assessed annually. The Tax Assessor’s Office determines the value of each property, and the Tax Collector’s Office sends out tax bills based on these assessments.