Medicare Tax Rates 2025

The Medicare tax is an essential component of the United States healthcare system, providing crucial funding for the Medicare program, which offers health insurance coverage to individuals aged 65 and older, as well as certain younger individuals with disabilities and end-stage renal disease. As we navigate the healthcare landscape, understanding the intricacies of Medicare tax rates is paramount, especially as we look ahead to the year 2025.

Understanding Medicare Tax Rates for 2025

The Medicare tax is a payroll tax levied on both employers and employees, with the revenue generated dedicated to financing Medicare Part A (hospital insurance) and Part B (medical insurance). The rates for this tax are subject to periodic adjustments, and it is crucial for individuals and businesses to stay informed about these changes to ensure compliance and accurate tax planning.

For the year 2025, the Medicare tax rates are expected to remain consistent with the current structure. However, it is essential to recognize that these rates can be influenced by various factors, including legislative changes and economic conditions. As such, while the following information provides a comprehensive outlook for 2025, it is always advisable to consult official sources and tax professionals for the most up-to-date and accurate information.

Employer and Employee Medicare Tax Rates

In the United States, the Medicare tax is divided into two components: one levied on employers and the other on employees. This bifurcated structure ensures that the burden of financing Medicare is shared equitably between employers and employees.

| Tax Type | Rate |

|---|---|

| Employer Medicare Tax | 2.9% |

| Employee Medicare Tax | 1.45% |

It's important to note that the employer Medicare tax is considered a business expense and is often factored into the overall cost of employing workers. Conversely, the employee Medicare tax is typically withheld from wages and reported on employee pay stubs. This dual structure ensures a balanced approach to funding Medicare, which is essential for the long-term sustainability of the program.

Additional Medicare Tax

In addition to the standard Medicare tax rates, there is an Additional Medicare Tax that applies to certain high-income individuals. This tax was introduced as part of the Affordable Care Act (ACA) to help finance the expansion of healthcare coverage under the act. The Additional Medicare Tax is calculated as a percentage of an individual’s wages, self-employment income, or other compensation.

| Income Threshold | Additional Medicare Tax Rate |

|---|---|

| Single/Head of Household: Income exceeding $200,000 | 0.9% |

| Married Filing Jointly/Qualifying Widow(er): Income exceeding $250,000 | 0.9% |

| Married Filing Separately: Income exceeding $125,000 | 0.9% |

The Additional Medicare Tax is applicable only to the portion of income that exceeds the threshold. For example, if a single individual earns $210,000, the Additional Medicare Tax would only apply to the amount over $200,000. This tax is designed to ensure that higher-income individuals contribute a larger share to the Medicare program, recognizing the increased demand for healthcare services associated with higher income levels.

Medicare Tax for Self-Employed Individuals

Self-employed individuals, including independent contractors, freelancers, and sole proprietors, have a unique tax situation when it comes to Medicare. They are responsible for both the employer and employee portions of the Medicare tax, effectively doubling the standard rate. This is known as the Self-Employment Tax, which also includes contributions to Social Security.

| Tax Type | Rate |

|---|---|

| Self-Employment Medicare Tax | 2.9% (combined employer and employee portion) |

| Additional Medicare Tax (for high-income self-employed) | 0.9% on income exceeding applicable thresholds |

Self-employed individuals can deduct half of their self-employment tax (including the Medicare tax portion) as a business expense when calculating their federal income tax liability. This deduction helps offset some of the increased tax burden associated with being self-employed.

Medicare Tax Exemptions and Limitations

While the Medicare tax is a universal requirement for most individuals and businesses, there are certain scenarios where exemptions or limitations may apply. These exceptions are typically granted to specific groups or in certain circumstances to ensure fairness and equitable treatment under the tax code.

- Student Employees: Students working for educational institutions may be exempt from the employer's portion of the Medicare tax if they meet certain conditions, such as being enrolled at least half-time in a degree-granting program.

- Government Employees: Certain federal, state, and local government employees may have different Medicare tax provisions based on their employment status and the specific laws governing their employment.

- Foreign Workers: Non-resident aliens working in the United States may have different tax obligations, including potential exemptions or reduced rates for Medicare tax. These exemptions often depend on the individual's country of origin and the tax treaties between the United States and that country.

It is crucial for individuals and businesses in these unique situations to consult with tax professionals and official government resources to understand their specific obligations and potential exemptions.

The Impact of Medicare Tax Rates on Healthcare and the Economy

The Medicare tax rates have far-reaching implications beyond their direct impact on individuals’ tax obligations. They play a pivotal role in shaping the healthcare landscape and the broader economy. Understanding these impacts is crucial for policymakers, healthcare providers, and the general public alike.

Financing Medicare Programs

The primary purpose of the Medicare tax is to finance the Medicare program, which provides healthcare coverage to millions of Americans. The funds generated through the Medicare tax directly support Part A (hospital insurance) and Part B (medical insurance) of Medicare, ensuring that eligible individuals have access to essential healthcare services.

The stability and sustainability of the Medicare program are directly tied to the tax rates. Higher tax rates can lead to increased funding, which can, in turn, improve the quality and availability of healthcare services for beneficiaries. Conversely, lower tax rates may result in funding constraints, potentially impacting the program's ability to meet the healthcare needs of its beneficiaries.

Economic Impact and Employment Considerations

The Medicare tax rates can also have significant economic implications, particularly for businesses and the employment landscape. For employers, the employer portion of the Medicare tax is a fixed cost that must be factored into their operating expenses. Higher tax rates can put additional pressure on businesses, potentially impacting their profitability and, in some cases, their ability to invest in growth and job creation.

On the other hand, for employees, the employee portion of the Medicare tax is typically viewed as a necessary cost of healthcare coverage. However, in certain economic scenarios, such as periods of high inflation or stagnant wage growth, higher Medicare tax rates can put a strain on household budgets, potentially impacting consumer spending and overall economic growth.

Impact on Healthcare Access and Quality

The Medicare tax rates directly influence the financial stability of the Medicare program, which, in turn, affects the program’s ability to provide high-quality healthcare services. Adequate funding ensures that Medicare beneficiaries have access to a wide range of medical services, medications, and treatments. It also supports the development and adoption of new technologies and innovative healthcare practices, ultimately improving patient outcomes.

Conversely, funding constraints resulting from lower tax rates or economic downturns can lead to reduced coverage options, longer wait times for services, and limited access to specialized care. This can have significant implications for the health and well-being of Medicare beneficiaries, particularly those with complex or chronic health conditions.

Looking Ahead: Potential Changes and Considerations for 2025

As we navigate the healthcare and economic landscape leading up to 2025, several factors may influence the future of Medicare tax rates. These considerations are essential for individuals, businesses, and policymakers to be aware of, as they can significantly impact tax obligations and healthcare financing.

Potential Changes to Medicare Tax Rates

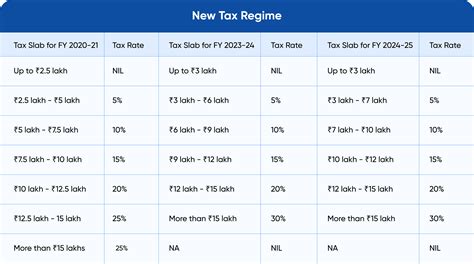

While the current Medicare tax rates are expected to remain consistent in 2025, it is important to recognize that these rates are subject to periodic review and adjustment. Changes in healthcare costs, demographic shifts, and legislative priorities can all influence future tax rates. For instance, if healthcare costs continue to rise, there may be calls for increased tax rates to ensure the financial stability of the Medicare program.

Additionally, there may be proposals to modify the tax structure itself. For example, some policymakers have suggested introducing a progressive Medicare tax, where higher-income individuals pay a larger percentage of their income in Medicare taxes. Such a change could help address concerns about the program's long-term sustainability while ensuring that those with greater financial means contribute proportionally more.

Healthcare Reform and Policy Considerations

The ongoing debate surrounding healthcare reform and policy changes can also impact Medicare tax rates. If significant healthcare reforms are implemented, such as expanding Medicare coverage to a broader age range or adding new benefits, the tax rates may need to be adjusted to accommodate the increased costs associated with these changes. On the other hand, if there are efforts to streamline healthcare delivery or reduce costs, tax rates could potentially remain stable or even decrease.

Furthermore, policy changes related to the Affordable Care Act (ACA) or other healthcare legislation can have ripple effects on Medicare tax rates. For instance, if the ACA were to be repealed or significantly modified, it could impact the Additional Medicare Tax, which was introduced as part of the ACA. Such changes would have significant implications for both individuals and businesses, particularly those with high incomes.

Economic Conditions and Tax Policy

The state of the economy is another critical factor that can influence Medicare tax rates. During periods of economic growth and prosperity, there may be a greater capacity for individuals and businesses to contribute to Medicare through higher tax rates. Conversely, during economic downturns or recessions, policymakers may need to consider the impact of higher tax rates on businesses and individuals, potentially leading to rate adjustments or temporary tax relief measures.

Additionally, changes in tax policy at the federal, state, or local level can have indirect effects on Medicare tax rates. For example, if there are proposals to reduce overall tax burdens on individuals or businesses, this could impact the revenue generated through Medicare taxes, potentially necessitating rate adjustments to maintain the program's financial stability.

Conclusion: A Comprehensive Understanding for Effective Planning

As we look ahead to 2025, it is evident that Medicare tax rates are a dynamic and crucial component of the healthcare and economic landscape. Understanding these rates and their potential implications is essential for individuals, businesses, and policymakers to make informed decisions and effectively plan for the future.

The Medicare tax rates for 2025, while expected to remain consistent with current rates, are subject to various influences, including legislative changes, economic conditions, and healthcare reform efforts. By staying informed about these factors and consulting official sources and tax professionals, individuals and businesses can ensure they are prepared for any potential changes and can effectively navigate the complex world of Medicare tax obligations.

In conclusion, the Medicare tax is not just a tax obligation but a critical component of the healthcare system, ensuring that millions of Americans have access to essential healthcare services. As we continue to navigate the evolving healthcare landscape, a comprehensive understanding of Medicare tax rates and their implications is a key step toward ensuring the long-term sustainability and effectiveness of the Medicare program.

What is the Medicare tax, and why is it important?

+

The Medicare tax is a payroll tax levied on employers and employees to fund the Medicare program, which provides health insurance coverage to individuals aged 65 and older, as well as certain younger individuals with disabilities. It is crucial for financing essential healthcare services and ensuring the long-term sustainability of the Medicare program.

How are Medicare tax rates determined, and can they change over time?

+

Medicare tax rates are set by the federal government and are subject to periodic adjustments. They can be influenced by factors such as legislative changes, healthcare costs, and demographic shifts. While the rates for 2025 are expected to remain consistent, they can change in the future to accommodate changing economic and healthcare conditions.

Who is responsible for paying the Medicare tax, and how is it calculated?

+

Both employers and employees are responsible for paying the Medicare tax. The employer pays a portion of the tax as a business expense, while the employee’s portion is typically withheld from their wages. The tax is calculated as a percentage of wages, self-employment income, or other compensation.

Are there any exemptions or special considerations for certain individuals or businesses regarding the Medicare tax?

+

Yes, there are certain exemptions and special considerations for specific groups. For example, student employees working for educational institutions may be exempt from the employer’s portion of the Medicare tax under certain conditions. Additionally, government employees and foreign workers may have different tax obligations based on their employment status and country of origin.

How do Medicare tax rates impact the healthcare and economic landscape, and what are the potential implications for 2025 and beyond?

+

Medicare tax rates have far-reaching implications for healthcare access, quality, and the broader economy. Higher tax rates can improve the financial stability of the Medicare program, leading to better healthcare services. However, they can also impact businesses and individuals, particularly during economic downturns. As we approach 2025, potential changes in tax rates, healthcare reform, and economic conditions will shape the future of Medicare tax obligations.