Nyc Re Tax Bill

The NYC Real Estate Transfer Tax, commonly known as the NYC RE Tax, is a significant aspect of the New York City real estate landscape. This tax is levied on the transfer of real property interests, making it an essential consideration for buyers, sellers, and investors in the city's vibrant real estate market. In this comprehensive article, we will delve into the intricacies of the NYC RE Tax, exploring its history, calculation, impact on the market, and strategies for managing it effectively.

Understanding the NYC RE Tax: A Historical Perspective

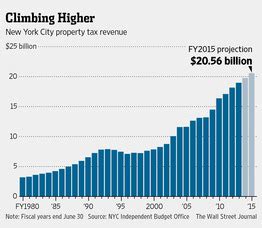

The origins of the NYC RE Tax can be traced back to the 1961 Real Property Transfer Tax, which was introduced as a means to generate revenue for the city’s growing infrastructure needs. Over the years, this tax has undergone several revisions and updates, reflecting the evolving dynamics of the real estate market and the city’s fiscal policies.

One of the most significant changes occurred in 2003, when the Real Estate Transfer Tax was split into two components: the Manhattan Transfer Tax and the Citywide Transfer Tax. This reform aimed to address the unique real estate market conditions in Manhattan and provide a more tailored tax structure for the city's diverse boroughs.

Evolution of Tax Rates

The tax rates for the NYC RE Tax have fluctuated over time, with adjustments made to align with market trends and the city’s revenue goals. As of my last update in 2021, the tax rates stood as follows:

| Transaction Value | Citywide Transfer Tax Rate | Manhattan Transfer Tax Rate |

|---|---|---|

| Up to $250,000 | 0.4% | 1.425% |

| $250,001 - $500,000 | 0.4% | 1.925% |

| $500,001 and above | 0.4% | 2.625% |

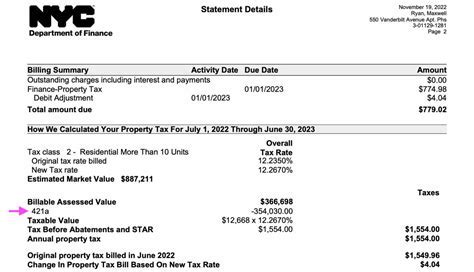

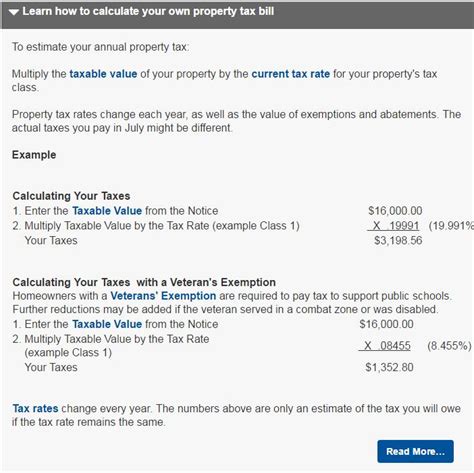

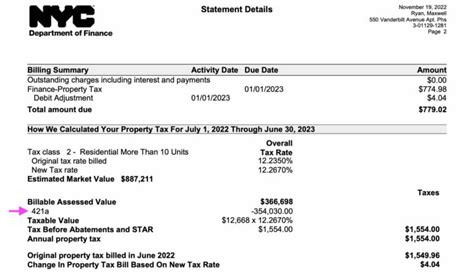

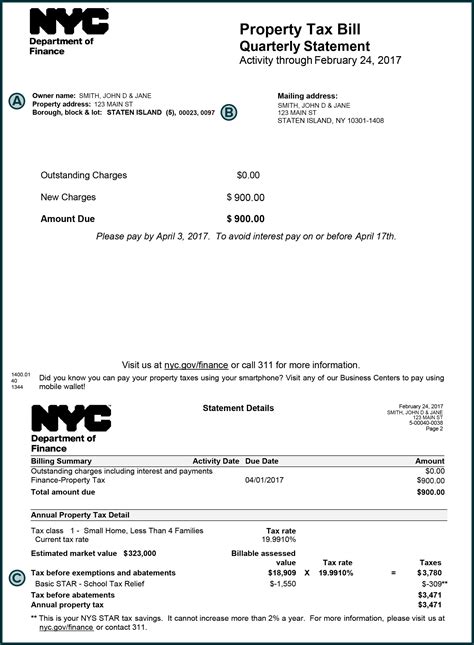

Calculating the NYC RE Tax: A Comprehensive Guide

Understanding how the NYC RE Tax is calculated is crucial for anyone involved in real estate transactions in the city. The tax is applied to the purchase price or the market value of the property, whichever is higher. This ensures that the tax is based on a fair assessment of the property’s worth.

Let's break down the calculation process step by step:

Step 1: Determine the Transaction Value

The first step is to establish the transaction value of the property. This is typically the purchase price agreed upon by the buyer and seller. However, in certain cases, the market value of the property may be used, especially if the transaction involves a gift deed or a foreclosure sale.

Step 2: Apply the Appropriate Tax Rate

Once the transaction value is determined, the applicable tax rate must be identified. As mentioned earlier, the tax rate varies based on the location of the property and the transaction value. Refer to the table provided earlier to find the correct tax rate for your specific transaction.

Step 3: Calculate the Tax Amount

With the transaction value and tax rate in hand, calculating the tax amount is a straightforward multiplication. Simply multiply the transaction value by the applicable tax rate to determine the tax owed.

For example, let's consider a property located in Manhattan with a purchase price of $750,000. The applicable tax rate for this transaction is 2.625% (as per the table). To calculate the tax amount:

Tax Amount = Transaction Value x Tax Rate

Tax Amount = $750,000 x 0.02625

Tax Amount = $19,687.50

Impact of the NYC RE Tax on the Real Estate Market

The NYC RE Tax plays a significant role in shaping the dynamics of the city’s real estate market. It influences decision-making for both buyers and sellers, affecting transaction volumes and pricing strategies.

Effect on Transaction Volumes

The tax can act as a deterrent for some buyers, particularly those looking to purchase properties at the higher end of the market. The additional cost associated with the tax may discourage certain buyers, leading to a potential slowdown in transaction volumes for higher-priced properties.

Pricing Strategies and Negotiations

Sellers often factor in the NYC RE Tax when setting their asking prices. To make their properties more attractive to buyers, they may choose to adjust their pricing strategies. This could involve setting a lower asking price to offset the tax expense for buyers or negotiating the tax amount with the buyer during the transaction process.

Market Segmentation

The NYC RE Tax contributes to the segmentation of the real estate market. Buyers with different budgets and tax considerations may gravitate towards specific areas or property types. This segmentation can influence the development and marketing strategies of real estate professionals, as they cater to diverse buyer segments.

Strategies for Managing the NYC RE Tax

Navigating the complexities of the NYC RE Tax requires a strategic approach. Here are some key strategies for buyers, sellers, and investors to consider:

Buyer Strategies

- Budgeting: When planning a real estate purchase in NYC, buyers should allocate a portion of their budget specifically for the NYC RE Tax. This ensures that they can comfortably afford the tax expense without compromising their financial stability.

- Negotiation: Buyers can negotiate with sellers to share the tax burden. This may involve requesting a price reduction or seeking concessions from the seller to offset the tax expense. Effective negotiation strategies can help buyers minimize their tax liability.

- Exploring Tax Incentives: NYC offers various tax incentives and programs that can reduce the tax burden for buyers. Researching and understanding these incentives, such as the First-Time Homebuyer Exemption or the Affordable Housing Exemption, can help buyers save on their tax obligations.

Seller Strategies

- Setting Competitive Prices: Sellers should consider the impact of the NYC RE Tax on their asking price. Setting a competitive price that takes into account the tax expense can make their property more appealing to buyers and potentially speed up the selling process.

- Offering Concessions: Sellers can negotiate with buyers to share the tax burden. Offering concessions, such as covering a portion of the tax expense or providing other incentives, can make their property more attractive and increase the likelihood of a successful sale.

- Timing the Sale: Sellers may benefit from timing their sale to coincide with periods when the NYC RE Tax rates are lower. By staying informed about tax rate fluctuations, sellers can strategically plan their sales to minimize the tax impact.

Investor Strategies

- Diversification: Investors can diversify their real estate portfolios across different boroughs to take advantage of varying tax rates. By investing in properties in both Manhattan and the outer boroughs, investors can balance their tax obligations and potentially reduce their overall tax liability.

- Researching Tax Benefits: Investors should research and understand the various tax benefits and incentives available to them. Exploring options like the Commercial and Industrial Property Tax Abatement Program or the Industrial and Commercial Abatement Program can provide significant tax savings for investors.

- Partnering with Tax Experts: Engaging the services of tax professionals who specialize in real estate transactions can be invaluable for investors. These experts can provide strategic advice and ensure that investors are taking full advantage of available tax benefits and deductions.

Future Implications and Trends

As the NYC real estate market continues to evolve, the NYC RE Tax is likely to remain a critical consideration for all market participants. Here are some key trends and future implications to watch out for:

Potential Tax Rate Adjustments

The NYC RE Tax rates have historically been subject to changes, and this trend is expected to continue. The city’s fiscal policies and market conditions may lead to adjustments in tax rates, either to stimulate the market or generate additional revenue. Staying informed about potential rate changes is crucial for buyers, sellers, and investors.

Impact of Affordable Housing Initiatives

The city’s focus on affordable housing is likely to influence the NYC RE Tax landscape. As the city implements initiatives to promote affordable housing, such as the Affordable Housing Exemption, the tax implications for these properties may evolve. Buyers and investors interested in affordable housing opportunities should monitor these developments closely.

Technological Advancements in Tax Assessment

The real estate industry is witnessing technological advancements, and these innovations are likely to impact tax assessment processes. The use of advanced analytics and data-driven approaches may lead to more accurate and efficient tax assessments. Staying updated with these technological advancements can help market participants navigate the NYC RE Tax landscape more effectively.

Conclusion

The NYC RE Tax is a complex yet essential component of the city’s real estate ecosystem. Understanding its historical context, calculation methods, and impact on the market is crucial for anyone involved in real estate transactions in NYC. By adopting strategic approaches and staying informed about tax-related developments, buyers, sellers, and investors can navigate the NYC RE Tax landscape successfully and make informed decisions that align with their financial goals.

Are there any exemptions or reductions available for the NYC RE Tax?

+Yes, NYC offers several exemptions and reductions to ease the tax burden for certain property owners. These include the First-Time Homebuyer Exemption, Affordable Housing Exemption, and various tax abatement programs for commercial and industrial properties. It’s important to research and understand these options to take advantage of potential savings.

How can I stay updated on NYC RE Tax rates and changes?

+The NYC Department of Finance provides the most up-to-date information on tax rates and any changes. Regularly visiting their official website or subscribing to their newsletters can ensure you stay informed about any updates or adjustments to the NYC RE Tax landscape.

Can I negotiate the NYC RE Tax with the city?

+The NYC RE Tax is a statutory tax, and the rates are set by the city government. While you cannot directly negotiate the tax with the city, you can explore negotiation strategies with the buyer or seller to share the tax burden or offset the tax expense through other means.