Pennsylvania Automobile Sales Tax

The Pennsylvania Automobile Sales Tax is a crucial aspect of the state's revenue generation and plays a significant role in the automotive industry within the state. This tax is levied on the sale or transfer of motor vehicles and is an essential component of the overall taxation system in Pennsylvania. In this comprehensive article, we will delve into the intricacies of the Pennsylvania Automobile Sales Tax, exploring its history, current regulations, and its impact on both consumers and the automotive market.

Understanding the Pennsylvania Automobile Sales Tax

The Pennsylvania Automobile Sales Tax, often referred to as the “Auto Sales Tax,” is a state-level tax imposed on the sale or lease of new and used motor vehicles. It is an essential revenue stream for the state government, contributing to various public services and infrastructure projects. The tax rate and collection process are governed by the Pennsylvania Department of Revenue, which ensures compliance and administers the tax efficiently.

The history of the Auto Sales Tax in Pennsylvania dates back to the mid-20th century when the state recognized the need for a stable revenue source to fund its growing infrastructure and public service demands. Over the years, the tax rate has been adjusted to align with economic conditions and the state's fiscal requirements.

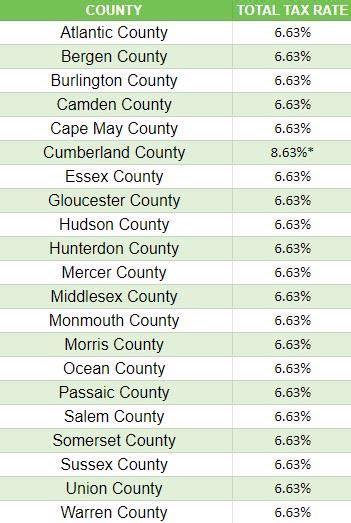

Tax Rate and Calculation

As of [current year], the Auto Sales Tax rate in Pennsylvania stands at 6% of the purchase price of the vehicle. This rate is uniform across the state and applies to both new and used vehicles. The tax is calculated based on the total purchase price, including any optional equipment, accessories, and dealer preparation costs.

For instance, if you purchase a new car priced at $30,000, the Auto Sales Tax amount would be calculated as follows:

| Vehicle Price | Tax Rate | Auto Sales Tax |

|---|---|---|

| $30,000 | 6% | $1,800 |

It's important to note that the tax is typically included in the final purchase price, so consumers often pay the tax amount along with the vehicle's cost.

Exemptions and Special Cases

While the Auto Sales Tax is generally applicable to all motor vehicle sales, there are certain exemptions and special cases to consider. Here are a few scenarios where the tax may be waived or reduced:

- Military Personnel: Active-duty military members stationed in Pennsylvania may be eligible for tax exemptions on vehicle purchases. This initiative aims to support and recognize the service of our armed forces.

- Vehicle Trade-Ins: In some cases, when trading in an old vehicle for a new one, the tax may be calculated based on the difference in value between the two vehicles, providing a partial exemption.

- Disability Accommodations: Vehicles modified for individuals with disabilities may be exempt from the Auto Sales Tax, ensuring equal access and mobility for all Pennsylvanians.

- First-Time Buyers: Pennsylvania offers incentives for first-time car buyers, providing reduced tax rates or exemptions under certain conditions to encourage vehicle ownership.

Impact on the Automotive Market

The Pennsylvania Automobile Sales Tax has a notable impact on the state’s automotive market and consumer behavior. Here’s a deeper look at how it influences various aspects:

Consumer Behavior and Purchase Decisions

The Auto Sales Tax is a significant factor in consumers’ vehicle purchase decisions. Potential buyers often consider the tax amount when evaluating the overall cost of ownership. Here’s how it affects consumer behavior:

- Budget Planning: Buyers must factor in the tax amount when creating their vehicle purchase budget. This influences the choice of vehicle and the level of discretionary spending.

- Timing of Purchases: Some consumers strategically time their vehicle purchases to take advantage of potential tax rate fluctuations or special exemptions, especially during promotional periods.

- Vehicle Selection: The tax rate may influence the type of vehicle consumers choose. Buyers may opt for more affordable options or consider fuel-efficient vehicles to offset the tax cost.

Automotive Industry Dynamics

The Auto Sales Tax also shapes the dynamics of the automotive industry within Pennsylvania. Dealers and manufacturers must navigate the tax implications to ensure competitive pricing and customer satisfaction. Here’s how it affects the industry:

- Dealer Strategies: Automotive dealers often incorporate the tax amount into their pricing strategies. They may offer incentives or discounts to offset the tax, making their vehicles more attractive to buyers.

- Market Competition: The tax rate can influence the competitive landscape among dealers. Those who effectively manage tax implications and provide value to customers may gain a competitive edge.

- Manufacturer Considerations: Vehicle manufacturers must consider the tax rate when setting suggested retail prices. They may adjust pricing strategies to maintain competitiveness and market share.

Administrative and Compliance Aspects

The Pennsylvania Department of Revenue plays a vital role in administering the Auto Sales Tax and ensuring compliance. Here’s an overview of the administrative processes and compliance requirements:

Registration and Reporting

Automotive dealers are responsible for registering with the Department of Revenue to collect and remit the Auto Sales Tax. They must adhere to specific reporting requirements, including submitting tax returns and providing accurate sales data.

Audit and Enforcement

The Department of Revenue conducts audits to verify compliance with tax regulations. Dealers and consumers must maintain proper documentation to demonstrate compliance. Failure to comply with tax obligations can result in penalties and legal consequences.

Online Sales and Out-of-State Purchases

With the rise of online vehicle sales and out-of-state purchases, the Department of Revenue has implemented measures to ensure tax compliance in these scenarios. Buyers and sellers must report and pay the applicable tax to avoid legal issues.

Future Outlook and Potential Changes

As Pennsylvania’s economy and automotive market evolve, the Auto Sales Tax may undergo changes to adapt to emerging trends and fiscal needs. Here are some potential future developments to consider:

Tax Rate Adjustments

The state government may consider adjusting the tax rate to align with economic conditions and revenue requirements. Changes in the tax rate can impact the affordability of vehicle purchases and influence consumer behavior.

Electric Vehicle Incentives

With the growing popularity of electric vehicles (EVs), Pennsylvania may introduce tax incentives or exemptions for EV purchases. Such initiatives could encourage the adoption of sustainable transportation and support the state’s environmental goals.

Online Sales and Technology Integration

As online vehicle sales continue to gain traction, the Department of Revenue may explore innovative ways to integrate technology into tax administration. This could include digital tax reporting systems and streamlined processes for online transactions.

Infrastructure and Public Services

The revenue generated from the Auto Sales Tax contributes to the funding of critical infrastructure projects and public services. The state may allocate tax proceeds to specific initiatives, such as road maintenance, public transportation, or environmental programs.

Conclusion

The Pennsylvania Automobile Sales Tax is a vital component of the state’s taxation system, influencing both consumer behavior and the automotive industry. Understanding the tax rate, exemptions, and administrative processes is essential for consumers and businesses alike. As the automotive market evolves, the tax landscape may adapt to meet the changing needs of Pennsylvania’s residents and businesses.

How often is the Auto Sales Tax rate reviewed and adjusted?

+The Auto Sales Tax rate is typically reviewed annually or bi-annually by the state government. Adjustments are made based on economic conditions and the state’s fiscal requirements. These reviews ensure that the tax remains competitive and generates sufficient revenue for public services.

Are there any online resources for calculating the Auto Sales Tax?

+Yes, the Pennsylvania Department of Revenue provides online tools and calculators to assist consumers and businesses in estimating the Auto Sales Tax. These resources simplify the tax calculation process and help in financial planning.

What happens if a dealer fails to remit the Auto Sales Tax to the state?

+Dealers are legally obligated to collect and remit the Auto Sales Tax to the state. Failure to do so can result in penalties, fines, and legal consequences. The Department of Revenue conducts audits to ensure compliance and may impose sanctions on non-compliant dealers.