Dc Real Estate Tax

When it comes to real estate and property ownership, taxes are an important consideration for both homeowners and investors. In the vibrant city of Washington, D.C., property taxes play a significant role in the local economy and are a key factor for residents and businesses alike. Understanding the DC real estate tax system is essential for anyone navigating the property market in the nation's capital.

Unraveling the DC Real Estate Tax System

The District of Columbia, often referred to as DC, employs a comprehensive property tax system that is designed to generate revenue for various public services and infrastructure projects. This tax system, though complex, is a crucial component of the city’s fiscal framework.

Property taxes in DC are calculated based on the assessed value of the property. The Office of Tax and Revenue (OTR) is responsible for assessing properties annually, ensuring that the tax burden is distributed fairly among property owners.

The assessed value takes into account several factors, including the property's location, size, condition, and any recent improvements or renovations. This valuation process ensures that properties are taxed based on their current market value, providing a more accurate representation of their worth.

Tax Rates and Assessments

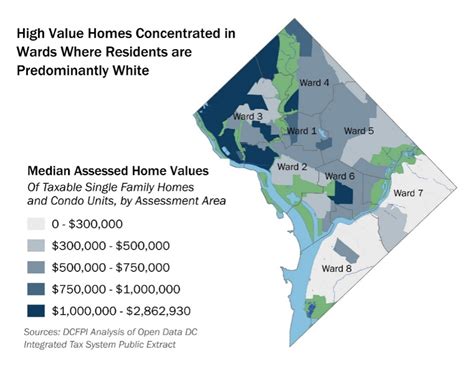

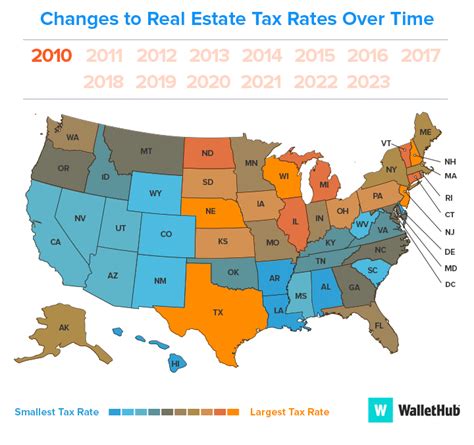

DC utilizes a progressive tax rate structure, which means that higher-valued properties are subject to higher tax rates. This approach aims to promote fairness and prevent the overburdening of homeowners with lower-valued properties.

| Property Value Range | Tax Rate |

|---|---|

| $0 - $300,000 | 0.85% |

| $300,001 - $400,000 | 0.90% |

| $400,001 - $500,000 | 0.95% |

| $500,001 and above | 1.00% |

For example, a property valued at $450,000 would be subject to a tax rate of 0.95%, resulting in an annual tax bill of $4,275. This progressive rate structure ensures that property owners with higher-valued properties contribute a larger share to the city's revenue.

Exemptions and Deductions

To provide relief to certain property owners, DC offers various exemptions and deductions. These measures aim to ease the tax burden for specific groups, such as senior citizens, veterans, and low-income homeowners.

- Homestead Deduction: Homeowners who occupy their property as their primary residence are eligible for a homestead deduction. This deduction reduces the taxable value of the property, providing a financial benefit to homeowners.

- Senior Citizen Exemption: Senior citizens who meet certain age and income requirements can apply for an exemption, reducing their property taxes. This exemption helps seniors retain their homes and maintain financial stability.

- Veteran Exemption: DC offers property tax exemptions to qualifying veterans, showing gratitude for their service and supporting their transition to civilian life.

These exemptions and deductions are a testament to DC's commitment to social equity and ensuring that property taxes are manageable for a diverse range of residents.

Online Payment and Resources

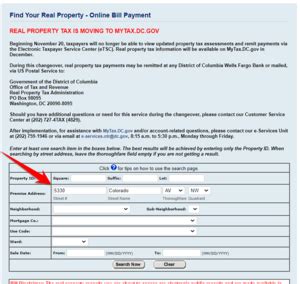

The Office of Tax and Revenue (OTR) provides an online platform for property owners to manage their tax obligations conveniently. Property owners can access their accounts, view assessment details, and make payments securely through the OTR website.

Additionally, the OTR offers a wealth of resources and information to assist property owners in understanding their tax responsibilities. From tax rate calculators to assessment appeals processes, the OTR ensures transparency and accessibility in the property tax system.

Impact on Real Estate Market

DC’s real estate tax system has a significant influence on the local real estate market. Property taxes directly impact the affordability and attractiveness of properties, influencing buyers’ decisions and investment strategies.

For investors, understanding the tax implications is crucial when considering real estate acquisitions. The progressive tax rate structure encourages investment in lower-valued properties, as they are subject to lower tax rates. This dynamic can drive investment towards revitalizing neighborhoods and promoting affordable housing options.

On the other hand, homeowners may face challenges when property values appreciate rapidly. While higher property values can be a sign of a thriving market, they also result in increased tax liabilities. This can lead to a delicate balance between benefiting from a thriving real estate market and managing the associated tax obligations.

Case Study: Neighborhood Revitalization

Let’s explore a real-world example of how DC’s real estate tax system can drive positive change in a neighborhood. In the historic Shaw neighborhood, a wave of investment and redevelopment has transformed the area into a vibrant hub for culture and commerce.

As property values in Shaw rose, the progressive tax rate structure ensured that the increased tax revenue was reinvested into the community. This led to improved infrastructure, enhanced public spaces, and increased access to essential services. The neighborhood's transformation not only benefited residents but also attracted new businesses and contributed to the city's overall economic growth.

Future Considerations and Trends

As DC continues to evolve and adapt to changing economic conditions, the real estate tax system may undergo adjustments to remain fair and sustainable. Here are some key considerations for the future:

- Tax Reform: Ongoing discussions around tax reform aim to ensure that the tax system remains equitable and supportive of the city's economic goals. This may involve reviewing tax rates, exemptions, and assessment processes to adapt to changing property values and market dynamics.

- Digital Transformation: The OTR's digital transformation efforts are crucial for improving the efficiency and accessibility of the tax system. Online platforms and digital tools will continue to enhance the taxpayer experience, making it easier for property owners to manage their tax obligations.

- Community Engagement: Engaging with the community is essential for gaining valuable insights and feedback on the tax system. Community forums, town hall meetings, and public consultations can provide valuable input to shape future tax policies and ensure they align with the needs and aspirations of DC residents.

Frequently Asked Questions

What is the average property tax rate in DC?

+

The average property tax rate in DC varies based on the property’s value. For properties valued at 450,000, the tax rate is 0.95%, resulting in an average annual tax bill of approximately 4,275.

Are there any tax exemptions for first-time homebuyers in DC?

+

Yes, DC offers a First-Time Homebuyer Tax Credit, which provides a credit of up to $5,000 for eligible first-time homebuyers. This credit helps offset the costs associated with purchasing a home and can be a significant financial benefit.

How often are properties assessed for tax purposes in DC?

+

Properties in DC are assessed annually by the Office of Tax and Revenue. This annual assessment ensures that property values remain up-to-date and that tax obligations are calculated accurately.

Can I appeal my property assessment if I disagree with the valuation?

+

Yes, property owners have the right to appeal their assessments if they believe the valuation is inaccurate. The Office of Tax and Revenue provides a detailed appeals process, allowing property owners to present evidence and argue their case for a potential reassessment.

Are there any tax incentives for green or energy-efficient properties in DC?

+

Yes, DC offers a Green Building Tax Abatement Program, which provides a tax abatement for properties that meet certain green building standards. This program encourages sustainable practices and supports the city’s environmental goals.