What Is Sales Tax In New Jersey

Sales tax is an essential component of the revenue system in the state of New Jersey, impacting residents and businesses alike. With a sales tax rate that varies across the state, understanding the intricacies of this tax is crucial for both consumers and businesses operating in New Jersey. This article aims to provide an in-depth analysis of sales tax in New Jersey, covering its structure, variations, and impact on the state's economy.

Understanding Sales Tax in New Jersey

Sales tax in New Jersey is a type of consumption tax levied on the sale of tangible goods and certain services. It is a percentage of the sale price that is collected by the seller and remitted to the state’s tax authority, the New Jersey Division of Taxation. This tax is imposed on both retail and wholesale transactions, ensuring a steady stream of revenue for the state.

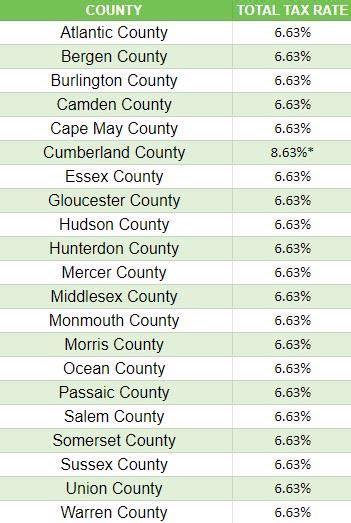

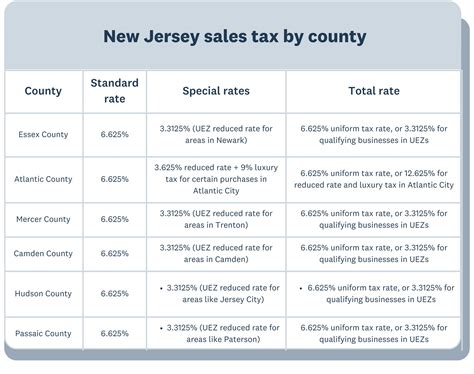

The sales tax rate in New Jersey is not uniform across the state. It is composed of a state-wide rate and an additional local rate, which can vary from county to county and even within counties. This local rate is often referred to as the Municipal Sales Tax or Local Purpose Tax. The current state sales tax rate is set at 6.625%, while the local rates can range from 0% to 3.5%.

Sales Tax Exemptions

While sales tax is applicable to a wide range of goods and services, New Jersey does provide exemptions for certain items. These exemptions are designed to encourage specific behaviors or support certain industries. For instance, New Jersey exempts sales tax on food items purchased for home consumption, as well as certain types of clothing and footwear. Additionally, sales tax is not applied to purchases made for resale or to purchases by certain tax-exempt organizations.

Collection and Remittance Process

Businesses operating in New Jersey are responsible for collecting sales tax from their customers and remitting it to the state. The process typically involves registering with the New Jersey Division of Taxation, obtaining a sales tax permit, and collecting the tax at the point of sale. The collected tax is then reported and remitted to the state on a regular basis, often monthly or quarterly.

For online businesses, the collection and remittance process can be more complex. New Jersey has specific regulations for out-of-state sellers, often referred to as Remote Sellers, who are required to collect and remit sales tax on transactions made with New Jersey residents. This process, known as Economic Nexus, has been a significant topic of discussion in recent years due to the rise of e-commerce.

| Statewide Sales Tax Rate | 6.625% |

|---|---|

| Local Sales Tax Rate Range | 0% - 3.5% |

Impact of Sales Tax on the Economy

Sales tax is a significant contributor to New Jersey’s revenue stream, accounting for a substantial portion of the state’s annual income. In the fiscal year 2021-2022, sales tax generated approximately $11.7 billion, making it the second largest source of revenue for the state, just behind income tax.

Effect on Consumer Behavior

The sales tax rate can significantly influence consumer behavior, often leading to what is known as border shopping or tax tourism. Residents may choose to make their purchases in neighboring states with lower sales tax rates, particularly for high-value items. This behavior can result in a loss of revenue for New Jersey, impacting the state’s budget and economic growth.

Economic Development and Revenue Allocation

The revenue generated from sales tax is allocated towards various state initiatives and programs. It plays a crucial role in funding public services, infrastructure development, and social programs. Additionally, the local sales tax rates provide municipalities with a source of revenue, which can be utilized for local projects and improvements.

Compliance and Challenges

While sales tax provides a stable source of revenue, it also presents challenges in terms of compliance and enforcement. Businesses must ensure accurate collection and remittance, which can be complex, especially for those operating in multiple jurisdictions. Furthermore, the state’s tax authority must ensure compliance and address any issues of tax evasion or avoidance.

Future Implications and Potential Changes

The landscape of sales tax in New Jersey is subject to change, influenced by various factors such as economic trends, political decisions, and technological advancements. Here are some potential future implications and changes to consider:

- Online Sales and Remote Sellers: With the continued growth of e-commerce, the state may further clarify and enforce regulations for remote sellers to ensure proper sales tax collection and remittance.

- Sales Tax Rate Adjustments: The state may consider adjusting the sales tax rate, either statewide or at the local level, to address budget shortfalls or economic goals.

- Exemption Expansions or Reductions: To promote certain industries or behaviors, the state could introduce new exemptions or reduce existing ones, impacting the tax burden on specific goods or services.

- Technological Innovations: The use of technology, such as point-of-sale systems and tax software, can streamline the sales tax collection and remittance process, improving compliance and efficiency.

Conclusion

Sales tax in New Jersey is a complex but crucial component of the state’s revenue system. It impacts consumers, businesses, and the overall economy, influencing spending habits, revenue generation, and allocation of resources. Understanding the intricacies of sales tax is essential for businesses to comply with regulations and for consumers to make informed purchasing decisions. As the state continues to evolve, so too will the landscape of sales tax, requiring ongoing attention and adaptation from all stakeholders.

What is the current sales tax rate in New Jersey for 2023?

+As of 2023, the statewide sales tax rate in New Jersey is 6.625%, while local sales tax rates can range from 0% to 3.5%.

Are there any items exempt from sales tax in New Jersey?

+Yes, New Jersey exempts sales tax on certain items such as food for home consumption, some types of clothing and footwear, and purchases made for resale.

How does New Jersey handle sales tax for online purchases?

+New Jersey has regulations for out-of-state sellers, known as remote sellers, requiring them to collect and remit sales tax on transactions made with New Jersey residents. This is often referred to as the Economic Nexus.

What happens if a business fails to collect and remit sales tax in New Jersey?

+Businesses that fail to collect and remit sales tax may face penalties, interest charges, and legal consequences. It is crucial for businesses to comply with sales tax regulations to avoid these issues.

Can sales tax rates change in New Jersey, and if so, how often?

+Sales tax rates can change in New Jersey, typically as a result of legislative decisions. While the statewide rate has remained stable in recent years, local rates can vary and are subject to change more frequently.