Octreasurer Property Tax Payment

Octreasurer, a leading online platform for property tax management, has revolutionized the way property owners and investors handle their tax obligations. With its innovative features and user-friendly interface, Octreasurer has become a go-to solution for efficient property tax payment and management. In this comprehensive article, we will delve into the world of Octreasurer, exploring its key functionalities, benefits, and impact on the real estate industry.

Revolutionizing Property Tax Management: An Introduction to Octreasurer

In the realm of real estate, property taxes are an inevitable and often complex aspect of ownership. Octreasurer, with its cutting-edge technology, aims to simplify this process, providing a seamless experience for property owners and investors alike. Let’s uncover how this platform has transformed the way we approach property tax payments.

Streamlined Tax Payment Process

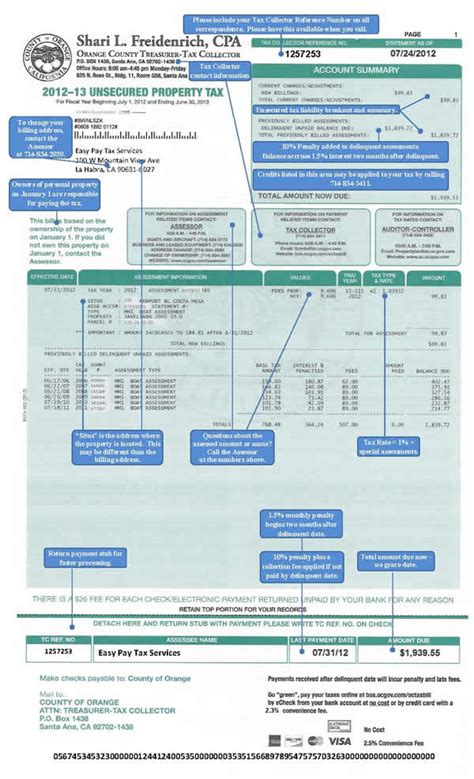

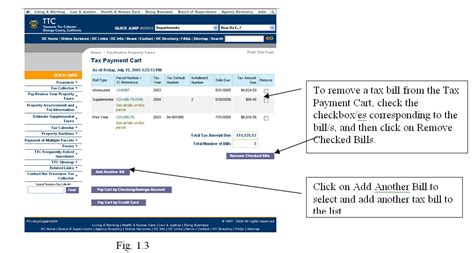

At the core of Octreasurer’s success is its streamlined tax payment system. Property owners can now say goodbye to tedious paperwork and long queues at government offices. The platform offers a secure online environment where users can access their property tax details, view due dates, and make payments with just a few clicks.

One notable feature is the automated payment reminder system. Octreasurer sends timely notifications to users, ensuring that tax payments are never missed. This not only helps property owners stay compliant but also avoids any potential penalties or late fees.

Additionally, the platform provides a transparent view of tax breakdowns, allowing users to understand how their taxes are allocated. This level of transparency fosters trust and empowers property owners to make informed decisions regarding their tax obligations.

Advanced Tax Calculation Tools

Octreasurer boasts an array of advanced tax calculation tools, making it a one-stop solution for property tax management. These tools consider various factors, such as property value, location, and applicable tax rates, to provide accurate tax estimates.

For instance, the platform’s AI-powered tax estimator analyzes historical data and market trends to offer precise tax predictions. This feature is particularly beneficial for investors looking to make informed decisions on potential acquisitions or for property owners seeking to understand the financial implications of owning a specific property.

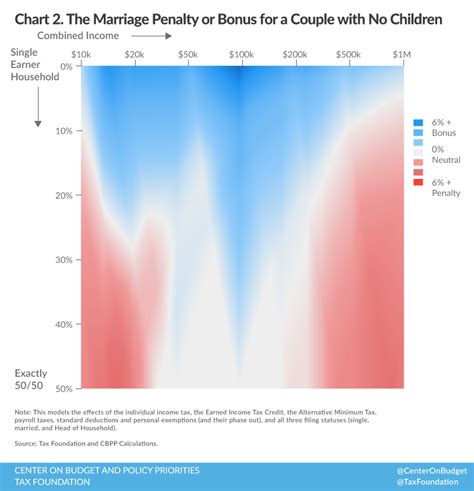

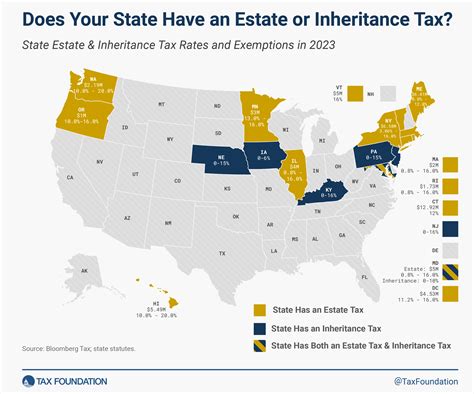

Furthermore, Octreasurer’s tax comparison tool allows users to compare tax rates across different jurisdictions. This enables property owners to make strategic decisions, such as relocating to areas with more favorable tax structures, thus optimizing their financial strategies.

Secure and Convenient Payment Options

Octreasurer understands the importance of secure and convenient payment methods. The platform integrates multiple payment gateways, ensuring a seamless experience for users. Property owners can choose from a range of options, including credit/debit card payments, e-wallets, and even cryptocurrency transactions.

The integration of blockchain technology adds an extra layer of security, making transactions tamper-proof and highly secure. This not only protects user data but also ensures the integrity of financial transactions, building trust within the platform’s ecosystem.

Additionally, Octreasurer’s partnership with leading financial institutions provides users with access to exclusive payment plans and discounts, further enhancing the convenience and cost-effectiveness of the platform.

The Impact of Octreasurer on the Real Estate Industry

The introduction of Octreasurer has had a profound impact on the real estate industry, shaping the way property tax management is approached. Let’s explore some key ways in which this platform has influenced the market.

Increased Efficiency and Cost Savings

Octreasurer’s automated processes and digital infrastructure have significantly reduced the time and resources required for property tax management. Property owners and investors can now dedicate more time to strategic decision-making rather than administrative tasks.

The platform’s efficient tax payment system has led to substantial cost savings for users. By eliminating the need for physical visits to government offices and reducing the risk of late fees, Octreasurer has streamlined the tax payment process, making it more cost-effective for property owners.

Moreover, the platform’s advanced tax calculation tools provide accurate estimates, helping users budget effectively and avoid any unexpected tax burdens.

Enhanced Transparency and Trust

Octreasurer’s commitment to transparency has fostered trust among its users. The platform’s open and clear communication of tax information ensures that property owners understand their obligations and rights. This level of transparency has been instrumental in building a reliable and trustworthy reputation for the platform.

Additionally, Octreasurer’s data-driven approach provides users with valuable insights into tax trends and market dynamics. This empowers property owners and investors to make informed decisions, further solidifying the platform’s position as a trusted partner in the real estate industry.

Improved Tax Compliance and Penalty Avoidance

With Octreasurer’s automated reminder system and precise tax calculation tools, property owners can easily stay compliant with tax regulations. The platform ensures that users are aware of their due dates, reducing the risk of missed payments and subsequent penalties.

By keeping users informed and providing a straightforward payment process, Octreasurer has contributed to improved tax compliance within the real estate sector. This not only benefits property owners but also strengthens the overall financial stability of the industry.

Case Studies: Octreasurer in Action

To further illustrate the impact and effectiveness of Octreasurer, let’s explore a few real-world case studies.

Case Study 1: Small Business Property Tax Management

Meet John, a small business owner who recently acquired a commercial property. With a busy schedule and limited resources, managing property taxes was a daunting task. However, John discovered Octreasurer and quickly realized its benefits.

Octreasurer’s user-friendly interface and automated payment system allowed John to efficiently manage his tax obligations. The platform’s tax calculator provided accurate estimates, helping John budget effectively and plan for future tax payments. Additionally, the timely reminders ensured that John never missed a due date, avoiding any potential penalties.

As a result, John’s business operations became more streamlined, and he could focus on growing his venture without the burden of tax-related headaches.

Case Study 2: Large-Scale Real Estate Investment Firm

Acme Investments, a leading real estate investment firm, manages a vast portfolio of properties across multiple jurisdictions. With a diverse range of tax obligations, the firm sought a centralized and efficient tax management solution.

Octreasurer’s advanced tax calculation tools and comprehensive payment system proved to be the perfect fit. The platform’s ability to handle complex tax scenarios and provide accurate estimates allowed Acme Investments to optimize their tax strategies. The firm could easily compare tax rates across different locations, making informed decisions on property acquisitions and management.

Furthermore, Octreasurer’s secure payment options and blockchain integration ensured the safety of financial transactions, providing peace of mind to the firm’s stakeholders.

Case Study 3: Individual Property Owner

Sarah, a homeowner, was overwhelmed by the complexity of property tax management. With multiple properties in different states, keeping track of tax obligations was a challenge. That’s when she stumbled upon Octreasurer.

The platform’s centralized dashboard and automated tax payment system simplified Sarah’s life. She could easily access all her property tax details in one place and make payments securely with just a few clicks. Octreasurer’s tax comparison tool also helped Sarah identify areas with more favorable tax structures, allowing her to make strategic decisions on property ownership.

Thanks to Octreasurer, Sarah could focus on enjoying her properties rather than worrying about tax-related stress.

The Future of Property Tax Management: Octreasurer’s Vision

As Octreasurer continues to make its mark in the real estate industry, the platform’s vision for the future is both ambitious and promising. Let’s explore some potential developments and innovations that could shape the landscape of property tax management.

Integration with Smart Contracts

Octreasurer’s integration with smart contract technology could revolutionize the way property taxes are managed. Smart contracts, self-executing contracts with predefined rules, could automate various tax-related processes, making them even more efficient and secure.

For instance, smart contracts could be utilized to automatically trigger tax payments upon meeting certain conditions, such as the sale of a property or the achievement of specific milestones. This would further reduce the risk of missed payments and streamline the entire tax management process.

Real-Time Tax Data Analytics

The platform’s data-driven approach could be enhanced by incorporating real-time tax data analytics. By analyzing tax trends and market dynamics in real-time, Octreasurer could provide even more accurate tax predictions and insights.

This would enable property owners and investors to make timely and well-informed decisions, adapting their tax strategies to changing market conditions. Real-time data analytics would also empower users to identify potential tax benefits and opportunities, further optimizing their financial positions.

Expanding Global Reach

Octreasurer’s success in the real estate industry has the potential to extend beyond national borders. The platform could explore partnerships and collaborations with international property tax authorities, expanding its reach and catering to a global audience.

By offering a unified platform for property tax management across different countries, Octreasurer could become a trusted partner for international property owners and investors. This expansion would not only enhance the platform’s reputation but also contribute to a more interconnected and efficient global real estate market.

Conclusion: Embracing the Future of Property Tax Management

Octreasurer has emerged as a game-changer in the realm of property tax management, offering a seamless and efficient solution for property owners and investors. With its innovative features, advanced tools, and commitment to transparency, the platform has transformed the way we approach tax obligations.

As the real estate industry continues to evolve, Octreasurer’s vision for the future promises even greater advancements. From integrating smart contracts to expanding its global reach, the platform is poised to shape the landscape of property tax management, making it more accessible, secure, and efficient.

By embracing Octreasurer’s cutting-edge technology and comprehensive approach, property owners and investors can navigate the complex world of property taxes with confidence and ease. The future of property tax management is here, and it’s time to embrace the possibilities.

How does Octreasurer ensure the security of user data and financial transactions?

+Octreasurer employs robust security measures, including encryption protocols and blockchain technology, to safeguard user data and financial transactions. The platform adheres to industry best practices and regularly updates its security infrastructure to mitigate potential risks.

Can Octreasurer assist with tax planning and strategy development?

+Absolutely! Octreasurer provides valuable insights and tools to assist property owners and investors in tax planning. The platform’s advanced tax calculation tools and tax comparison features enable users to make informed decisions and develop effective tax strategies.

What payment methods does Octreasurer support for property tax payments?

+Octreasurer offers a wide range of payment options, including credit/debit card payments, e-wallets, and even cryptocurrency transactions. The platform strives to provide convenient and secure payment methods to cater to the diverse needs of its users.

How does Octreasurer handle international property tax obligations?

+Octreasurer is committed to expanding its global reach and currently supports property tax management in multiple countries. The platform provides localized tax information and payment options, ensuring a seamless experience for international property owners and investors.

Is Octreasurer suitable for small businesses and individual property owners?

+Absolutely! Octreasurer is designed to cater to a wide range of users, including small businesses and individual property owners. The platform’s user-friendly interface and efficient payment system make it an ideal solution for managing tax obligations, regardless of the scale of ownership.