Tax Attorneys Near Me

When it comes to navigating the complex world of taxes, having a trusted advisor by your side can make all the difference. Tax attorneys, with their legal expertise and deep understanding of tax laws, are the go-to professionals for individuals and businesses seeking guidance and representation in matters related to taxation. In this comprehensive guide, we will explore the role of tax attorneys, their areas of expertise, and how to find the right one near you.

Understanding the Role of Tax Attorneys

Tax attorneys, often referred to as tax lawyers, are legal professionals who specialize in tax-related matters. They possess a unique combination of legal knowledge and tax expertise, making them invaluable assets for individuals and businesses facing a range of tax-related issues. Here’s an overview of their key roles and responsibilities:

Legal Counsel and Representation

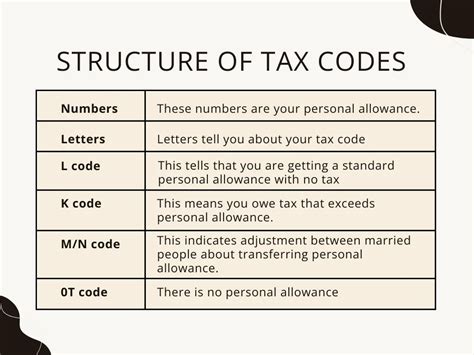

Tax attorneys provide legal advice and counsel to clients on a wide array of tax matters. They assist with tax planning, ensuring compliance with tax laws and regulations, and offering strategic guidance to minimize tax liabilities. In the event of disputes or legal issues, tax attorneys represent their clients, advocating for their rights and interests before tax authorities, courts, or other legal entities.

Tax Compliance and Filing

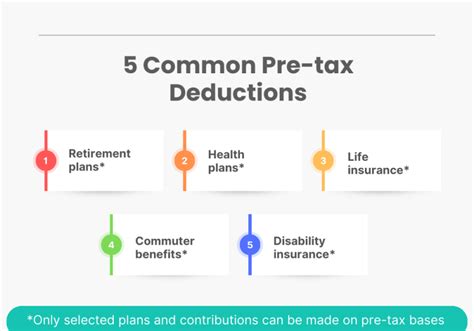

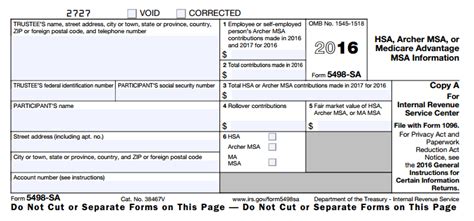

Navigating the intricacies of tax compliance can be daunting. Tax attorneys assist clients in understanding their tax obligations and ensuring timely and accurate filing of tax returns. They help identify deductions, credits, and other tax benefits that clients may be eligible for, maximizing their tax savings and minimizing the risk of errors or penalties.

Tax Controversy and Litigation

When disputes arise with tax authorities, tax attorneys step in to resolve the matter. They negotiate with the Internal Revenue Service (IRS) or state tax agencies, aiming for favorable resolutions. In cases where litigation is necessary, tax attorneys represent clients in tax court, handling complex tax controversies and ensuring a fair legal process.

Tax Planning and Strategy

Tax attorneys work closely with clients to develop comprehensive tax planning strategies. They analyze a client’s financial situation, business structure, and goals, providing insights and recommendations to optimize tax efficiency. Whether it’s structuring business transactions, creating tax-advantaged investment strategies, or planning for estate and gift taxes, tax attorneys offer tailored solutions to meet their clients’ unique needs.

Finding a Tax Attorney Near You

Locating a reputable and experienced tax attorney in your area is essential to ensure you receive the highest quality of legal representation and advice. Here are some steps to help you find the right tax attorney near you:

Online Directories and Referrals

Start your search by utilizing online directories and referral services. Websites like Martindale, Avvo, or FindLaw offer comprehensive listings of tax attorneys in your region. You can filter your search based on location, area of expertise, and client reviews to find attorneys who meet your specific needs. Additionally, ask for referrals from trusted sources such as accountants, financial advisors, or other professionals who frequently work with tax attorneys.

Check Qualifications and Experience

When considering a tax attorney, it’s crucial to verify their qualifications and experience. Ensure they are licensed to practice law in your state and have a solid background in tax law. Look for attorneys who have handled cases similar to yours and possess the necessary expertise to address your specific tax concerns. Consider their years of practice, education, and any specialized certifications or accolades they may have.

Review Client Testimonials and Ratings

Client testimonials and ratings can provide valuable insights into an attorney’s reputation and level of service. Read reviews on online directories or social media platforms to get a sense of their professionalism, communication skills, and overall client satisfaction. Positive feedback from past clients can be a strong indicator of an attorney’s competency and commitment to delivering exceptional legal services.

Schedule a Consultation

Once you’ve identified a few potential tax attorneys, schedule consultations to discuss your specific tax matters. Many attorneys offer free initial consultations, allowing you to assess their expertise, communication style, and compatibility. Use this opportunity to ask questions about their approach, strategies, and potential outcomes for your case. A consultation is a great way to gauge whether the attorney understands your needs and can provide the guidance and representation you require.

Key Considerations for Choosing a Tax Attorney

Selecting the right tax attorney is a crucial decision that can significantly impact the outcome of your tax-related matters. Here are some key considerations to keep in mind when making your choice:

Specialization and Expertise

Tax law encompasses a wide range of specialties, including individual taxation, business taxation, estate planning, international tax, and more. Ensure the tax attorney you choose has experience and expertise in the specific area of tax law that pertains to your case. A specialized tax attorney will have a deeper understanding of the nuances and complexities involved, providing more effective guidance and representation.

Communication and Accessibility

Effective communication is vital in any attorney-client relationship. Choose a tax attorney who is responsive, accessible, and willing to communicate regularly. You should feel comfortable discussing your tax matters with them and receive timely updates and explanations throughout the process. Clear and open communication ensures you are well-informed and actively involved in decision-making regarding your tax case.

Fee Structure and Transparency

Understanding the fee structure of a tax attorney is essential to manage your expectations and budget. Discuss the attorney’s billing practices, including hourly rates, flat fees, or contingency arrangements. Ensure there is transparency regarding potential costs and any additional expenses that may arise. A reputable tax attorney will provide a detailed fee agreement outlining the scope of services, fees, and any potential disbursements or expenses.

Track Record and Success Stories

Reviewing a tax attorney’s track record and success stories can provide valuable insights into their abilities and the outcomes they have achieved for past clients. Ask for case examples or success stories that demonstrate their expertise and problem-solving skills. A strong track record of successful resolutions can give you confidence in their ability to handle your tax matters effectively.

Proximity and Convenience

Consider the proximity of the tax attorney’s office to your location. While many tax matters can be handled remotely, having an attorney nearby can be advantageous for in-person meetings, document reviews, and other face-to-face interactions. Convenience and accessibility can enhance the overall client experience and make it easier to maintain open lines of communication.

Conclusion: Empowering Your Tax Journey

Navigating the complex world of taxes can be daunting, but with the right tax attorney by your side, you can approach your tax matters with confidence and peace of mind. By understanding the role of tax attorneys and following the steps outlined in this guide, you can find a reputable and experienced tax attorney near you. Remember, choosing the right tax attorney is a crucial decision that can impact the outcome of your tax-related matters, so take the time to evaluate their qualifications, expertise, and compatibility.

With their legal expertise and strategic guidance, tax attorneys can help you optimize your tax efficiency, resolve disputes, and ensure compliance with tax laws. Empower your tax journey by finding a trusted advisor who understands your unique needs and provides exceptional legal representation. Take control of your tax obligations and achieve the best possible outcomes with the support of a skilled tax attorney.

How much does a tax attorney typically charge for their services?

+The cost of hiring a tax attorney can vary depending on several factors, including the complexity of your case, the attorney’s experience, and the location. Tax attorneys may charge hourly rates, flat fees, or contingency fees. It’s important to discuss the fee structure and potential costs with the attorney during your initial consultation to ensure you understand the financial commitment.

What should I bring to my initial consultation with a tax attorney?

+When attending your initial consultation, it’s beneficial to bring relevant documentation related to your tax matter. This may include tax returns, financial statements, correspondence with tax authorities, and any other supporting documents. Providing the attorney with comprehensive information will help them understand your situation and offer more accurate advice.

Can a tax attorney help with international tax matters?

+Absolutely! Tax attorneys with expertise in international tax law can provide guidance and representation for individuals and businesses with cross-border tax obligations. They can assist with compliance, planning, and resolving issues related to international taxation, ensuring you meet your tax obligations while taking advantage of any available tax benefits.