Greenville Tax Collections

Welcome to an in-depth exploration of Greenville's tax collection system and its unique dynamics. In this comprehensive guide, we'll delve into the intricate process of tax collection in Greenville, uncovering the key players, strategies, and outcomes that shape the financial landscape of this vibrant city. From understanding the basics to exploring real-world challenges and innovative solutions, this article aims to provide a 360-degree view of Greenville's tax journey.

Understanding Greenville’s Tax Landscape

The city of Greenville boasts a dynamic economy, driven by a diverse range of industries and a thriving entrepreneurial spirit. This economic vitality translates into a robust tax collection ecosystem, where various entities contribute to the city’s fiscal health. Let’s break down the fundamentals of Greenville’s tax system.

Tax Types and Categories

Greenville’s tax structure is multifaceted, encompassing a variety of tax types to cater to its diverse population and businesses. Here’s a breakdown of the key tax categories:

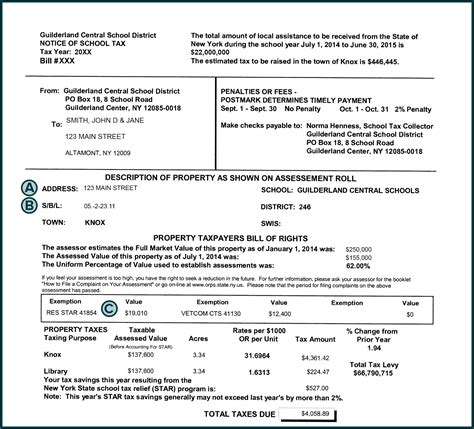

- Property Taxes: One of the primary sources of revenue, property taxes are levied on both residential and commercial properties. The tax rate is determined by the assessed value of the property and varies across different zones within Greenville.

- Income Taxes: Greenville imposes income taxes on individuals and businesses, with rates varying based on income brackets. These taxes contribute significantly to the city's overall revenue.

- Sales and Use Taxes: Sales taxes are applied to most goods and services sold within the city limits, while use taxes are levied on certain purchases made outside Greenville but used within the city. These taxes are a crucial source of revenue for essential city services.

- Excise Taxes: Specific excise taxes are applied to certain goods and activities, such as fuel, tobacco, and entertainment. These taxes often have a dedicated purpose, funding infrastructure development or public safety initiatives.

- Business Taxes: Greenville imposes various taxes on businesses, including business license fees, payroll taxes, and franchise taxes. These taxes support the city's business-friendly environment and contribute to economic growth.

The Role of the Greenville Tax Department

At the heart of Greenville’s tax collection system is the dedicated Greenville Tax Department. This department plays a pivotal role in ensuring efficient and fair tax collection, maintaining accurate records, and providing valuable services to taxpayers.

The Greenville Tax Department is responsible for:

- Assessing property values and determining tax liabilities for both real estate and personal property.

- Collecting and processing tax payments, including online and in-person transactions.

- Providing taxpayer assistance and resolving inquiries and disputes.

- Enforcing tax compliance and pursuing delinquent taxpayers through legal means if necessary.

- Developing and implementing tax policies and strategies to optimize revenue collection.

Taxpayer Demographics and Challenges

Greenville’s taxpayer base is diverse, ranging from individuals with varying income levels to small businesses and large corporations. This diversity presents unique challenges in tax collection and compliance.

Some common challenges include:

- Ensuring fair and accurate assessments for property taxes, especially in rapidly developing areas.

- Managing tax complexities for businesses operating across multiple tax jurisdictions.

- Educating taxpayers about their rights and responsibilities, especially for new residents and businesses.

- Addressing tax evasion and non-compliance, which can significantly impact the city's revenue.

- Adapting to changing economic conditions and ensuring tax policies remain sustainable.

The Process of Tax Collection in Greenville

The tax collection process in Greenville is a well-coordinated effort, involving various stages from assessment to payment and beyond. Let’s explore each step in detail.

Assessment and Valuation

The first step in tax collection is assessing the value of taxable entities, primarily properties and businesses. The Greenville Tax Department employs a team of trained assessors who conduct thorough evaluations to determine the fair market value of each taxable asset.

For property taxes, assessors consider factors such as location, size, improvements, and recent sales data. This process ensures that property owners pay taxes commensurate with their property's value. Similarly, for business taxes, assessors analyze financial statements and other relevant data to determine the appropriate tax liability.

Notifying Taxpayers

Once assessments are complete, the Greenville Tax Department issues tax notices to all taxpayers. These notices provide detailed information about the assessed value, applicable tax rates, and the amount due. Taxpayers are given a specific timeframe to review and respond to these notices.

Payment Options and Deadlines

Greenville offers a range of convenient payment options to accommodate different taxpayer preferences and needs. These options include:

- Online Payments: Taxpayers can make secure online payments through the Greenville Tax Department's website. This method is popular for its convenience and speed.

- In-Person Payments: The Tax Department maintains physical offices where taxpayers can pay their taxes in person. This option is ideal for those who prefer face-to-face interactions.

- Mail-In Payments: Taxpayers can also remit their payments via mail, ensuring privacy and security.

- Automatic Payment Plans: For taxpayers who prefer a set-and-forget approach, Greenville offers automatic payment plans. These plans allow for automatic deductions from bank accounts on specified dates.

Taxpayers are encouraged to pay their taxes by the specified deadlines to avoid penalties and interest. Late payments can incur additional fees, impacting the taxpayer's overall financial burden.

Tax Payment Processing and Verification

Once taxpayers make their payments, the Greenville Tax Department employs robust systems to process and verify these transactions. This ensures that payments are accurately recorded and applied to the correct tax accounts.

The Tax Department's advanced software integrates with various payment methods, allowing for real-time tracking of payments. This transparency provides taxpayers with peace of mind and helps the department identify and resolve any payment-related issues promptly.

Delinquent Tax Collection Strategies

In cases where taxpayers fail to meet their tax obligations, the Greenville Tax Department employs a range of strategies to recover delinquent taxes. These strategies are designed to be fair yet firm, ensuring that the city’s revenue stream remains stable.

The department may:

- Send reminder notices and work with taxpayers to establish payment plans.

- Initiate legal actions, including liens and seizures, for persistent non-payment.

- Partner with collection agencies to pursue delinquent taxpayers.

- Implement tax amnesty programs to encourage voluntary compliance and reduce penalties.

Innovations and Best Practices in Greenville’s Tax Collection

Greenville’s tax collection system is not static; it evolves with technological advancements and changing taxpayer needs. The city embraces innovation to enhance efficiency, transparency, and taxpayer satisfaction.

Digital Transformation

Greenville has invested significantly in digital technologies to streamline tax collection processes. The online tax portal, for instance, offers a user-friendly interface for taxpayers to access their accounts, view tax information, and make payments. This digital transformation has led to increased efficiency and reduced wait times.

Data Analytics and AI Integration

By leveraging data analytics and artificial intelligence, Greenville’s Tax Department can identify patterns and trends in tax behavior. This allows for more accurate predictions of tax revenue and helps identify potential issues before they become major problems. AI-powered systems can also automate routine tasks, freeing up resources for more complex tasks.

Taxpayer Education and Outreach

Recognizing the importance of taxpayer education, Greenville organizes regular workshops and seminars to inform residents and businesses about their tax obligations. These educational initiatives help reduce confusion and increase voluntary compliance.

The Tax Department also maintains an extensive online knowledge base, providing taxpayers with easy access to information and resources. This self-service approach empowers taxpayers to resolve their queries independently.

Collaborative Partnerships

Greenville actively collaborates with other government agencies and private sector partners to enhance its tax collection efforts. For instance, the city works closely with real estate agents and property managers to ensure accurate property assessments. These partnerships strengthen the overall tax ecosystem.

Performance Analysis and Future Outlook

Analyzing Greenville’s tax collection performance provides valuable insights into the city’s financial health and the effectiveness of its tax policies.

Key Performance Indicators (KPIs)

Greenville monitors several KPIs to assess the success of its tax collection efforts. These include:

- Collection Rate: The percentage of taxes collected compared to the total taxes due. A high collection rate indicates effective tax collection.

- Delinquency Rate: The percentage of taxpayers who fail to pay their taxes by the deadline. A low delinquency rate is a positive indicator.

- Tax Revenue Growth: The annual growth rate of tax revenue, which reflects the city's economic health and the effectiveness of tax policies.

- Taxpayer Satisfaction: Regular surveys and feedback mechanisms help gauge taxpayer satisfaction with the tax collection process and services.

Future Implications and Strategies

Looking ahead, Greenville’s tax collection landscape is poised for continued growth and innovation. Here are some key strategies and considerations for the future:

- Embracing Blockchain Technology: Greenville could explore blockchain-based solutions for secure and transparent tax record-keeping and transactions.

- Expanding Online Services: Further enhancing the online tax portal to offer more advanced features and services, such as real-time tax estimation tools.

- Tax Policy Review: Regularly reviewing and updating tax policies to ensure they remain fair, equitable, and aligned with the city's economic goals.

- International Tax Considerations: As Greenville's economy becomes more interconnected globally, the city may need to address international tax complexities, especially for cross-border businesses.

Conclusion

Greenville’s tax collection system is a dynamic and evolving entity, reflecting the city’s vibrant economy and diverse population. By understanding the intricacies of this system, we gain insights into the financial backbone of this thriving community. From efficient assessment processes to innovative digital solutions, Greenville’s tax collection journey showcases a commitment to fairness, transparency, and taxpayer satisfaction.

How can I pay my taxes in Greenville if I prefer a paper-based system?

+While Greenville encourages digital payments for their convenience, you can still pay your taxes using traditional methods. Simply mail your payment to the Greenville Tax Department, ensuring you include the appropriate payment coupon and your account information. Remember to allow sufficient time for processing, and consider using a trackable mailing service for added security.

What happens if I disagree with my property tax assessment in Greenville?

+If you believe your property tax assessment is inaccurate, you have the right to appeal. The Greenville Tax Department provides a clear appeals process, allowing you to present your case and supporting evidence. The department will review your appeal and make a decision, which you can further challenge if necessary. It’s important to note that timely action is crucial when appealing tax assessments.

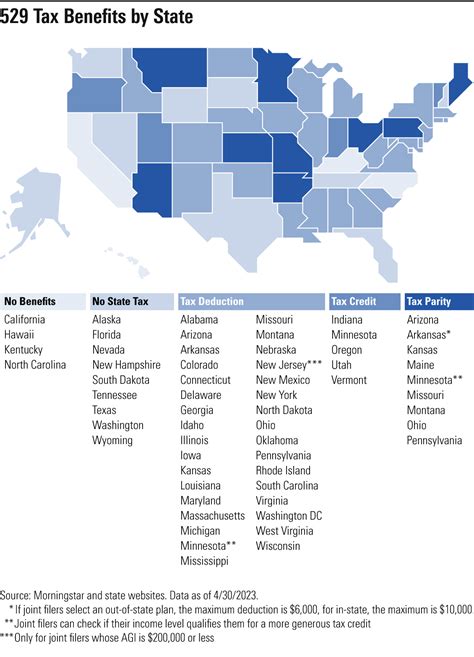

Are there any tax incentives or credits available for businesses in Greenville?

+Yes, Greenville offers a range of tax incentives and credits to encourage business growth and investment. These incentives can include tax credits for job creation, research and development, and energy-efficient initiatives. The city regularly updates its tax incentive programs to align with its economic development goals. Contact the Greenville Economic Development Office for more information on available incentives.