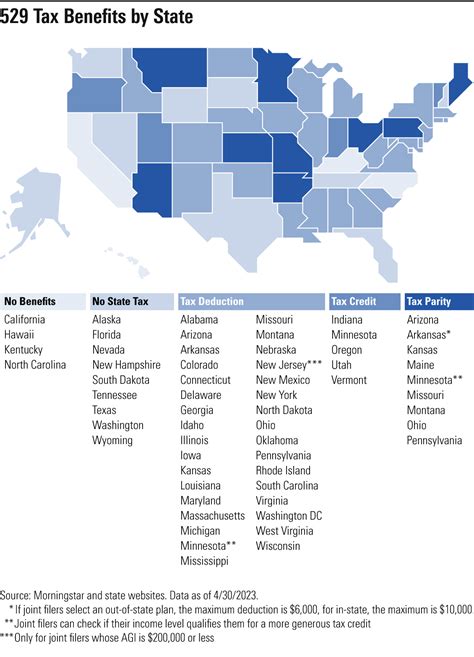

529 Tax Break California

In the pursuit of providing a comprehensive guide to California's 529 plans and the tax benefits they offer, this article delves into the specifics of these college savings plans. With a focus on the unique advantages available to California residents, we aim to equip readers with the knowledge needed to make informed decisions about their educational savings strategies.

Understanding 529 Plans: A California Perspective

529 plans, officially known as Qualified Tuition Programs, are tax-advantaged savings plans designed to help families set aside funds for future education expenses. These plans, authorized by Section 529 of the Internal Revenue Code, offer a range of benefits that make them an attractive option for college savings.

California, like many other states, has embraced the 529 plan model, offering residents the opportunity to save for their children's education while enjoying significant tax advantages. The Golden State's 529 plans are managed by the State Treasurer's office, ensuring a secure and well-regulated savings environment.

Key Features of California's 529 Plans

- Tax-Free Growth: One of the most significant advantages of California's 529 plans is the tax-free growth of investment earnings. Contributions grow tax-deferred, and withdrawals for qualified education expenses are tax-free at the federal and state levels.

- State Income Tax Deduction: California residents can deduct contributions to a 529 plan from their state taxable income, up to certain limits. This deduction can provide immediate tax savings, making it an appealing feature for many families.

- Flexible Investment Options: California's 529 plans offer a variety of investment options, allowing investors to choose a portfolio that aligns with their risk tolerance and time horizon. From conservative to aggressive investment strategies, there's an option for every saver.

- Accessibility: California residents and non-residents alike can open and contribute to a 529 plan. This accessibility is particularly beneficial for families with out-of-state relatives who wish to contribute to a child's education fund.

Maximizing Tax Benefits: Strategies for California Residents

California's 529 plans offer a unique opportunity for residents to maximize their tax benefits while saving for their children's education. Here's a deeper dive into some strategies to make the most of these plans:

Utilizing the State Income Tax Deduction

One of the primary advantages of California's 529 plans is the state income tax deduction. Residents can deduct contributions, up to $15,000 for single filers and $30,000 for married couples filing jointly, from their taxable income each year. This deduction can significantly reduce the tax burden for many families.

To maximize this benefit, consider contributing the full amount allowed by the deduction annually. By doing so, you can take advantage of the immediate tax savings and potentially accelerate your savings growth.

Investing Strategically

California's 529 plans offer a range of investment options, including age-based portfolios, static portfolios, and individual investment choices. Age-based portfolios automatically adjust their asset allocation as the beneficiary gets closer to college age, becoming more conservative over time. This feature can be particularly beneficial for those who prefer a hands-off approach.

For those who wish to have more control over their investments, static portfolios or individual investment choices provide the flexibility to select specific funds or asset classes. This allows for a more customized approach to savings, catering to individual risk preferences and investment goals.

Understanding Qualified Education Expenses

To ensure that your withdrawals are tax-free, it's crucial to understand what constitutes qualified education expenses. These include tuition, fees, books, supplies, and equipment required for enrollment or attendance at an eligible educational institution. Room and board are also included for students enrolled at least half-time.

It's important to note that qualified education expenses can be claimed for not just colleges and universities but also certain apprenticeship programs, vocational schools, and even some elementary and secondary schools. This broad definition provides flexibility for families with diverse educational goals.

Performance and Comparative Analysis

California's 529 plans have consistently performed well, offering competitive returns and low fees. The plans' investment options are managed by reputable fund managers, ensuring a well-diversified and professionally managed portfolio.

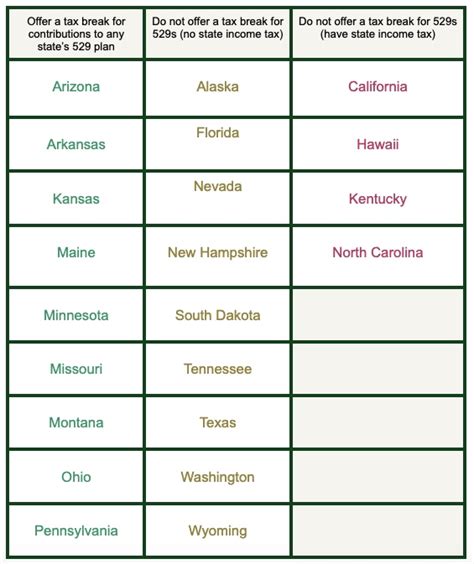

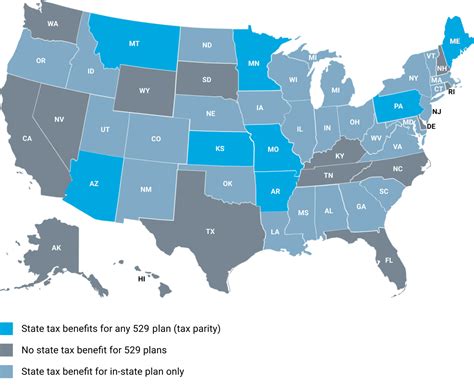

When comparing California's 529 plans to other states' offerings, it's evident that the Golden State provides a robust and competitive savings platform. The plans' tax advantages, coupled with their strong performance, make them an attractive choice for both California residents and non-residents.

| Plan Feature | California 529 Plan |

|---|---|

| Tax-Free Growth | Yes |

| State Income Tax Deduction | Up to $15,000 for single filers, $30,000 for joint filers |

| Investment Options | Age-based, Static, Individual Choices |

| Performance | Competitive, with low fees |

Frequently Asked Questions

Can non-California residents open a 529 plan in California?

+Yes, non-California residents can open and contribute to a 529 plan in the state. This provides an opportunity for out-of-state family members to contribute to a child’s education fund while enjoying the tax benefits offered by California’s plans.

What are the income limits for the state income tax deduction?

+There are no income limits for claiming the state income tax deduction. However, the deduction is subject to certain contribution limits. Single filers can deduct up to 15,000, while married couples filing jointly can deduct up to 30,000 annually.

Can I use my 529 plan for K-12 education expenses?

+Yes, you can use your 529 plan to pay for qualified K-12 education expenses, including tuition, fees, books, and supplies. This flexibility makes 529 plans an attractive option for families with children of all ages.

Are there any penalties for withdrawing funds for non-qualified expenses?

+Withdrawing funds for non-qualified expenses may result in a 10% penalty on the earnings portion of the distribution, in addition to federal and state income taxes. It’s important to ensure that withdrawals are used for qualified education expenses to avoid these penalties.