Oakland Sales Tax Measure 2022

In November 2022, the city of Oakland, California, witnessed a crucial ballot measure that aimed to address its financial challenges and improve vital public services. Known as Oakland Sales Tax Measure 2022 or Measure Z, this initiative proposed an increase in the city's sales tax rate to generate additional revenue for specific purposes. The measure sparked intense debates and discussions among Oakland residents, as it carried significant implications for the city's future and the well-being of its communities.

Understanding Oakland Sales Tax Measure 2022

Oakland Sales Tax Measure 2022, officially titled the Measure Z - City of Oakland Sales Tax Increase for General Fund Purposes, was a proposed ordinance aimed at enhancing the city’s financial stability and allocating resources to essential public services. The measure proposed a 0.5% increase in the sales tax rate, bringing it to 9.25%, one of the highest in the Bay Area.

The primary objective of Measure Z was to address the city's budgetary shortfall, which had been exacerbated by the COVID-19 pandemic and economic downturns. It aimed to prevent further cuts to critical city services and support the ongoing recovery of Oakland's economy.

If passed, the measure would have generated an estimated $40 million annually for the city's General Fund, providing much-needed financial support for various services and initiatives. The revenue was intended to be allocated across several key areas, including:

- Public Safety: Funding for police, fire, and emergency services to enhance response times and community safety.

- Homelessness and Housing: Support for homelessness prevention programs, affordable housing initiatives, and services for vulnerable populations.

- Parks and Recreation: Maintenance and improvements to parks, playgrounds, and recreational facilities, ensuring safe and accessible public spaces.

- Community Programs: Funding for youth programs, senior services, and cultural and community events, promoting social cohesion and well-being.

- Economic Development: Investments in small business support, job training programs, and initiatives to attract and retain businesses in Oakland.

The measure also included provisions for annual audits and public reporting to ensure transparency and accountability in the use of funds.

Key Arguments and Concerns

Measure Z sparked a range of opinions and concerns among Oakland residents and stakeholders. Here are some of the key arguments and considerations surrounding the measure:

Supporters’ Viewpoints

Proponents of Measure Z argued that the sales tax increase was necessary to preserve vital city services and prevent further budget cuts. They highlighted the importance of investing in public safety, homelessness prevention, and community programs, especially in the wake of the pandemic. Supporters believed that the measure would provide a stable funding source for these critical areas, ensuring the city’s long-term viability and resilience.

Additionally, they emphasized that the revenue generated would be allocated through a transparent and accountable process, with regular audits and public reporting. This, they argued, would ensure that the funds were directed towards the intended purposes and would not be misused.

Opponents’ Concerns

Opponents of Measure Z expressed concerns about the potential impact on low-income residents and businesses. They argued that a higher sales tax rate could disproportionately affect those already struggling financially, making essential goods and services more expensive. Critics also questioned the measure’s effectiveness, suggesting that it might not address the root causes of the city’s financial challenges and could lead to further reliance on regressive taxes.

Furthermore, some opponents believed that the measure lacked sufficient accountability measures and feared that the additional revenue could be misused or misallocated, undermining the trust between the city and its residents.

Community Engagement and Education

Leading up to the election, various community organizations, advocacy groups, and local leaders played a crucial role in engaging residents and educating them about the measure’s implications. Town hall meetings, public forums, and information campaigns were organized to provide a platform for discussions and address concerns.

These efforts aimed to ensure that Oakland residents were well-informed about the potential benefits and drawbacks of Measure Z, allowing them to make an educated decision at the polls.

The Outcome and Future Implications

The Oakland Sales Tax Measure 2022 was ultimately approved by voters, with a majority supporting the increase in the sales tax rate. This outcome signifies a mandate from the community to address the city’s financial challenges and invest in essential public services.

With the measure's passage, the city of Oakland can now move forward with implementing the proposed initiatives and allocating the additional revenue to the designated areas. This includes enhancing public safety, addressing homelessness, improving parks and recreational facilities, and supporting community programs and economic development.

However, the success of Measure Z will depend on the city's ability to effectively manage and allocate the funds, ensuring that they are directed towards the intended purposes and delivering tangible benefits to the community. Regular reporting and engagement with residents will be crucial in maintaining transparency and accountability.

Furthermore, the measure's passage may set a precedent for future tax initiatives in Oakland, highlighting the community's willingness to support increased taxation for specific purposes. This could influence future policy decisions and budget allocations, shaping the city's financial landscape and its approach to addressing social and economic challenges.

The Role of Sales Tax in Oakland’s Future

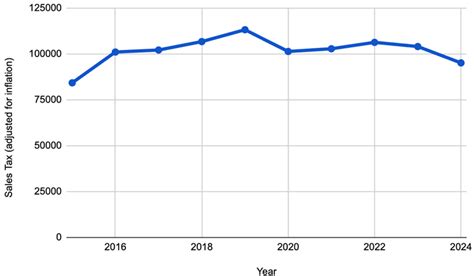

Oakland’s decision to increase its sales tax rate through Measure Z reflects a broader trend among cities and municipalities across the United States. Sales tax has become an increasingly popular revenue source, particularly in the aftermath of economic downturns and budget shortfalls.

While sales tax can provide a stable and predictable revenue stream, it also carries certain limitations and challenges. Critics argue that it can be regressive, disproportionately impacting lower-income individuals and households. Additionally, the reliance on sales tax revenue may lead to a shift in priorities, with cities focusing more on attracting retail businesses and consumers rather than diversifying their tax base.

Despite these challenges, sales tax remains a crucial component of many cities' financial strategies. In Oakland's case, the additional revenue generated by Measure Z will play a vital role in supporting critical public services and infrastructure, contributing to the city's overall well-being and resilience.

As Oakland moves forward with implementing the initiatives outlined in Measure Z, it will be essential to monitor the impact of the sales tax increase on different segments of the community and ensure that the benefits are equitably distributed. This will require ongoing engagement, collaboration, and adaptive governance to address any emerging challenges and ensure the long-term sustainability of the city's finances.

What was the final vote count for Oakland Sales Tax Measure 2022?

+The final vote count was in favor of the measure, with a majority of voters supporting the sales tax increase.

How will the additional revenue be spent?

+The revenue generated by the measure will be allocated to various areas, including public safety, homelessness prevention, parks and recreation, community programs, and economic development initiatives.

Are there any safeguards to ensure the funds are used as intended?

+Yes, the measure includes provisions for annual audits and public reporting to ensure transparency and accountability in the use of funds.

What impact might the sales tax increase have on low-income residents and businesses?

+Opponents raised concerns about the potential regressive effects of the sales tax increase, arguing that it could disproportionately affect those with lower incomes. However, supporters believe that the benefits of improved public services outweigh these concerns.