Sales Tax In Las Vegas

When planning a trip to Las Vegas, understanding the intricacies of sales tax is essential for managing your finances effectively. The city's vibrant entertainment scene and diverse shopping options make it a popular destination, but navigating the tax system can be crucial for both tourists and residents alike. In this comprehensive guide, we will delve into the specifics of sales tax in Las Vegas, providing you with the knowledge to make informed decisions and ensure a stress-free experience.

Understanding Sales Tax in Las Vegas

Las Vegas, the entertainment capital of the world, boasts a unique tax system that can vary based on the type of goods and services you purchase. The sales tax rate in the city is influenced by both state and local authorities, resulting in a multi-tiered structure. Let’s break down the key aspects to provide a clear understanding.

State Sales Tax

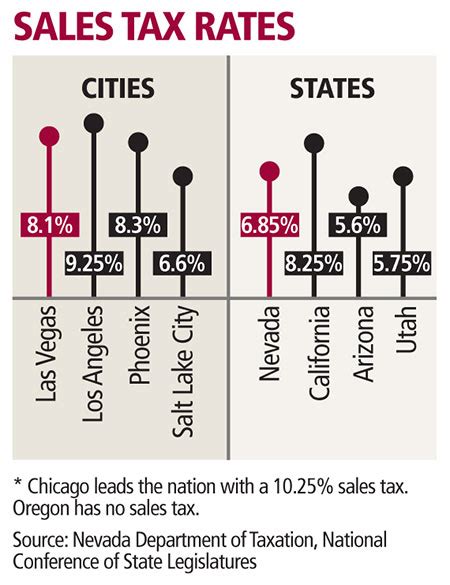

The state of Nevada imposes a uniform sales tax rate across the state, currently set at 6.85%. This applies to a wide range of goods and services, including retail items, restaurant meals, and even certain entertainment tickets. The state tax is a fundamental component of the overall sales tax you’ll encounter in Las Vegas.

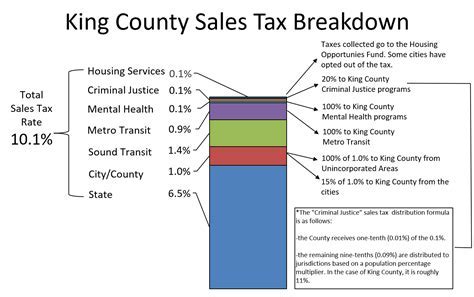

Local Sales Tax

In addition to the state tax, Las Vegas has a local sales tax of 2.65%, bringing the total sales tax rate to 9.50% for most purchases within the city limits. This local tax contributes to the city’s infrastructure, tourism development, and other essential services.

Special Tax Districts

Las Vegas is unique in that it encompasses several special tax districts, each with its own additional sales tax rates. These districts are designated areas within the city where extra taxes are levied to fund specific projects or initiatives. For instance, the Las Vegas Convention and Visitors Authority (LVCVA) imposes a 0.50% tax on goods and services, while the Southern Nevada Water Authority (SNWA) adds another 0.25% tax. These district-specific taxes can vary, so it’s essential to be aware of them when budgeting.

Taxable and Non-Taxable Items

Not all purchases in Las Vegas are subject to sales tax. Certain items are exempt, such as prescription medications, non-prepared food items, and some agricultural products. Additionally, some services, like legal and accounting services, are not taxed. Understanding these exemptions can help you budget effectively and avoid unexpected costs.

| Taxable Items | Tax Rate |

|---|---|

| Clothing and Accessories | 9.50% |

| Electronics | 9.50% |

| Restaurant Meals | 9.50% |

| Hotel Accommodations | 13.375% (includes state, local, and district taxes) |

| Vehicle Rentals | 9.50% |

Sales Tax for Tourists and Visitors

Las Vegas is a tourist hotspot, welcoming millions of visitors annually. If you’re planning a trip to Sin City, understanding how sales tax affects your purchases is crucial. Here’s a breakdown tailored specifically for tourists.

Shopping in Las Vegas

Whether you’re browsing the luxurious boutiques on the Strip or exploring the outlets in downtown Las Vegas, sales tax will apply to most of your purchases. Remember that the total tax rate can vary based on the specific tax district you’re in. Always check your receipts to ensure the correct tax rate has been applied.

Dining and Entertainment

When enjoying a meal at a fine dining restaurant or grabbing a quick bite at a food court, sales tax is typically included in the displayed price. However, it’s worth noting that some restaurants may add a service charge, which is not considered a taxable item. Keep this in mind when calculating your budget.

Gambling and Casino Taxes

While Las Vegas is renowned for its casinos, the good news is that there is no sales tax on gambling winnings. However, casinos do collect a resort fee, which can range from 10 to 40 per night, depending on the property. This fee covers various amenities and services, so it’s essential to factor it into your trip expenses.

Hotel Taxes

Hotel accommodations in Las Vegas are subject to a combination of taxes, including the state, local, and district taxes mentioned earlier. The total tax rate for hotel stays is 13.375%, which can significantly impact your overall travel budget. Always check the final cost breakdown when booking your hotel to avoid surprises.

Sales Tax for Residents

For those who call Las Vegas home, understanding the sales tax system is an integral part of daily life. Let’s explore how sales tax affects residents and some strategies to navigate it effectively.

Everyday Purchases

From groceries to household items, residents of Las Vegas encounter sales tax on most of their day-to-day purchases. While the tax rate may seem insignificant on small items, it can add up over time. Budgeting wisely and comparing prices across different stores can help mitigate the impact of sales tax.

Online Shopping

With the convenience of online shopping, many residents opt to purchase goods from the comfort of their homes. It’s important to note that sales tax still applies to online purchases, and the rate is based on the delivery address. Some online retailers provide tools to estimate sales tax accurately, ensuring you’re not caught off guard at checkout.

Property Taxes

In addition to sales tax, residents of Las Vegas also pay property taxes, which contribute to the city’s infrastructure and public services. Property taxes are based on the assessed value of your home and can vary depending on the location and size of your property. Understanding your property tax obligations is crucial for long-term financial planning.

Sales Tax and Business Operations

For businesses operating in Las Vegas, sales tax is a critical component of their financial strategy. Let’s explore how businesses navigate the sales tax landscape and the implications for consumers.

Sales Tax Collection and Remittance

Businesses in Las Vegas are responsible for collecting and remitting sales tax on behalf of the state and local authorities. This process involves accurately calculating the tax on each transaction and submitting it to the appropriate tax authorities. Failure to comply with sales tax regulations can result in penalties and legal consequences.

Sales Tax Exemptions for Businesses

Certain businesses in Las Vegas may be eligible for sales tax exemptions, especially those operating in specific industries or providing essential services. These exemptions can significantly impact a business’s financial health and pricing strategies. It’s crucial for businesses to stay informed about their eligibility and navigate the exemption process effectively.

Impact on Pricing Strategies

The sales tax structure in Las Vegas can influence businesses’ pricing strategies. Some businesses may choose to absorb the tax into their pricing, while others may opt to display prices excluding tax. Understanding the impact of sales tax on pricing can help consumers make informed choices and compare prices accurately.

Future Implications and Potential Changes

The sales tax landscape in Las Vegas is subject to change, influenced by economic trends, legislative decisions, and community needs. Here’s a glimpse into potential future developments.

Economic Growth and Tax Rates

As Las Vegas continues to grow and attract more businesses and tourists, the demand for public services and infrastructure development increases. This could potentially lead to changes in sales tax rates or the introduction of new tax initiatives to fund specific projects. Staying informed about local economic developments is essential for understanding future tax implications.

Legislative Updates

The Nevada Legislature periodically reviews and updates tax laws, including sales tax regulations. These updates can bring about changes in tax rates, exemptions, or the introduction of new tax categories. Staying abreast of legislative changes ensures businesses and individuals can adapt their financial strategies accordingly.

Community Initiatives and Referendums

Las Vegas residents often have a say in tax-related matters through community initiatives and referendums. These initiatives can propose changes to sales tax rates or allocate funds for specific community projects. Engaging in local governance and staying informed about upcoming referendums allows residents to have a direct impact on the city’s tax landscape.

What is the current sales tax rate in Las Vegas?

+The current sales tax rate in Las Vegas is 9.50%, which includes the state tax of 6.85% and the local tax of 2.65%. Additionally, there are special tax districts with their own rates, such as the Las Vegas Convention and Visitors Authority (LVCVA) tax of 0.50% and the Southern Nevada Water Authority (SNWA) tax of 0.25%.

Are there any tax-free shopping days in Las Vegas?

+Yes, Las Vegas occasionally hosts tax-free shopping events, especially during holiday seasons. These promotions can offer significant savings on various goods. It's advisable to check local calendars and promotional campaigns for specific dates and participating retailers.

How do I calculate the sales tax on a purchase in Las Vegas?

+To calculate the sales tax on a purchase, you can multiply the total cost of the item by the applicable tax rate. For example, if an item costs $100 and the tax rate is 9.50%, the sales tax would be $9.50, making the final cost $109.50.

Are there any sales tax exemptions for specific items in Las Vegas?

+Yes, certain items are exempt from sales tax in Las Vegas. These include prescription medications, non-prepared food items, and some agricultural products. Additionally, services like legal and accounting services are generally not subject to sales tax.

How do businesses handle sales tax in Las Vegas?

+Businesses in Las Vegas are responsible for collecting and remitting sales tax on behalf of the state and local authorities. They must accurately calculate the tax on each transaction and submit it to the appropriate tax authorities. Failure to comply can result in penalties and legal consequences.

In conclusion, understanding the sales tax system in Las Vegas is essential for both residents and visitors alike. From shopping and dining to accommodations and business operations, sales tax impacts various aspects of life in Sin City. By staying informed about the tax rates, exemptions, and potential changes, you can navigate the city’s financial landscape with confidence and make the most of your Las Vegas experience.