Colorado Property Tax Rate

Property taxes in Colorado are an important aspect of the state's financial landscape and play a significant role in funding various public services and infrastructure. Understanding the property tax rate and its implications is crucial for homeowners, investors, and those considering moving to the Centennial State. This comprehensive guide will delve into the specifics of Colorado's property tax structure, offering insights into how it works, what it means for taxpayers, and how it compares to other states.

Understanding Colorado’s Property Tax System

Colorado’s property tax system is a vital source of revenue for local governments, including counties, cities, and special districts. These taxes are primarily used to support essential services such as public schools, fire and police departments, transportation infrastructure, and other vital community amenities.

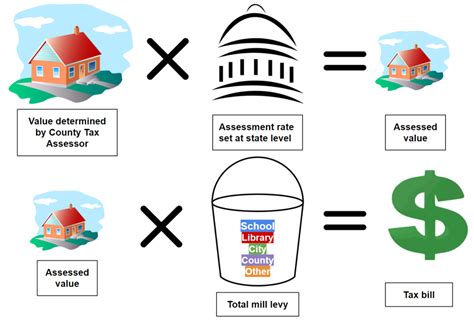

The state's property tax system operates under a mill levy structure, which is a rate expressed in mills. One mill represents $1 of tax for every $1,000 of a property's assessed value. This mill levy is determined by the combined rates of the local government entities that provide services to a particular property.

Here's a breakdown of the entities and their roles in Colorado's property tax system:

- School Districts: School districts typically have the highest mill levies, as property taxes are a significant funding source for public education.

- Counties: County mill levies support services like roads, law enforcement, and courts.

- Cities and Towns: Municipal mill levies are set by local governments to fund city operations and services.

- Special Districts: These include entities like water and sanitation districts, fire protection districts, and more. Each special district has a specific purpose and corresponding mill levy.

The combined mill levy from these entities determines the overall property tax rate for a given property. For instance, if a property has a total assessed value of $500,000 and a combined mill levy of 100 mills, the annual property tax bill would be $5,000.

Assessed Value and Property Tax Calculation

In Colorado, the assessed value of a property is determined by the county assessor. The assessor evaluates the property’s actual value and applies an assessment rate to calculate the assessed value. The assessment rate is set by the state and is currently 7.15% for residential properties and 29% for commercial properties.

To calculate the property tax, the assessed value is multiplied by the mill levy. Here's an example calculation:

| Property Type | Assessed Value | Mill Levy | Annual Property Tax |

|---|---|---|---|

| Residential | $500,000 | 100 mills | $3,575 |

| Commercial | $1,000,000 | 150 mills | $17,850 |

It's important to note that the assessed value is typically lower than the market value of the property, and the mill levy can vary significantly between different areas of the state, depending on the services provided and the needs of the local community.

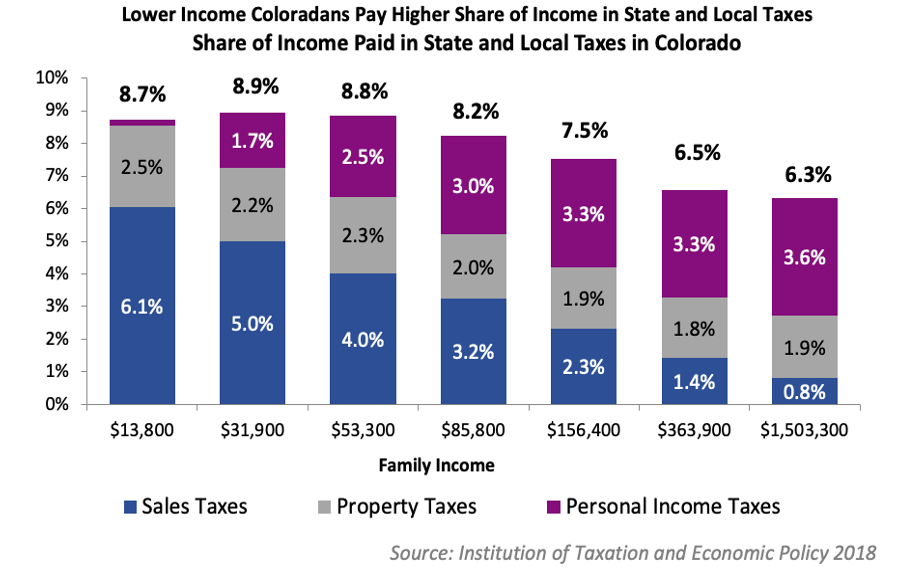

Property Tax Rates and Comparisons

Colorado’s property tax rates are generally considered moderate compared to other states. According to recent data, the statewide average effective property tax rate in Colorado is 0.57%, which is lower than the national average of 1.08%.

However, it's essential to recognize that property tax rates can vary significantly within the state. Factors such as the cost of living, local amenities, and the quality of public services can influence the mill levies set by local governments. For instance, popular areas with high-quality schools and extensive infrastructure may have higher mill levies and, consequently, higher property taxes.

To illustrate the variability, let's compare the effective property tax rates of a few Colorado counties:

| County | Effective Property Tax Rate |

|---|---|

| Denver County | 0.59% |

| Boulder County | 0.61% |

| El Paso County | 0.54% |

| Larimer County | 0.68% |

These variations highlight the importance of considering local factors when evaluating property tax rates in Colorado. While the statewide average provides a general perspective, the specific rate for a property depends on its location and the services it receives.

The Impact of Property Taxes on Homeownership

Property taxes are an essential consideration for anyone looking to purchase a home in Colorado. They represent a significant ongoing cost associated with homeownership and can influence a buyer’s decision-making process.

Property Tax as a Factor in Home Buying Decisions

When considering a home purchase, prospective buyers often evaluate multiple factors, including location, property features, and overall affordability. Property taxes are an integral part of the affordability equation, as they represent a recurring expense that can vary significantly depending on the property’s location and value.

Buyers often use online tools and resources to estimate property taxes for specific properties. These estimates, combined with other financial considerations, help buyers determine whether a particular property aligns with their budget and long-term financial goals.

Strategies for Managing Property Tax Costs

For homeowners in Colorado, managing property tax costs is an essential aspect of financial planning. Here are some strategies to consider:

- Review Assessment Notices: Property owners should carefully review their annual assessment notices to ensure the assessed value is accurate. If there are concerns about the valuation, it's advisable to contact the county assessor's office.

- Understand Exemptions and Deferrals: Colorado offers various property tax exemptions and deferral programs. These can provide significant savings for eligible homeowners, particularly seniors and those with disabilities. It's important to research and understand the criteria for these programs.

- Consider Refinancing: Refinancing a mortgage can sometimes lead to a lower property tax bill. This is because the assessed value may be tied to the property's market value, and refinancing can impact this value. However, it's crucial to weigh the potential savings against any associated costs and the long-term financial implications.

- Appeal Property Tax Assessments: If a homeowner believes their property tax assessment is inaccurate or too high, they have the right to appeal. This process typically involves providing evidence and justifying why the assessment should be adjusted. It's a detailed process, but it can result in significant savings if successful.

Future Trends and Considerations

Colorado’s property tax landscape is subject to various factors that can influence rates and assessments in the future. Here are some key considerations:

Economic Growth and Development

Colorado’s strong economic growth and development have positive implications for property values and tax revenue. As the state continues to attract businesses and residents, property values may increase, leading to higher tax assessments. This can provide additional funding for local governments and public services.

Infrastructure Needs and Investments

The state’s infrastructure, including transportation networks, schools, and public facilities, requires ongoing investment and maintenance. Local governments may need to adjust mill levies to fund these necessary improvements. Property owners should stay informed about proposed infrastructure projects and their potential impact on property taxes.

Population Growth and Demographic Shifts

Colorado’s population is expected to continue growing, particularly in urban areas. This growth can put pressure on existing infrastructure and public services, potentially leading to increased mill levies to meet the rising demand. Additionally, demographic shifts, such as an aging population, can influence the types of services required and, consequently, the property tax rates.

Policy Changes and Initiatives

Changes in state and local policies can impact property tax rates. For instance, initiatives to enhance education funding or support specific community projects may lead to higher mill levies. Staying informed about proposed policy changes and their potential effects is crucial for property owners.

How are property taxes calculated in Colorado?

+Property taxes in Colorado are calculated by multiplying the assessed value of a property by the mill levy. The assessed value is determined by the county assessor and is based on the property’s actual value. The mill levy is the combined rate set by local government entities, including school districts, counties, cities, and special districts.

What is the average property tax rate in Colorado?

+The average effective property tax rate in Colorado is approximately 0.57%, which is lower than the national average. However, it’s important to note that rates can vary significantly within the state, depending on factors like location, property value, and the services provided by local governments.

Are there any property tax exemptions or deferrals in Colorado?

+Yes, Colorado offers several property tax exemptions and deferral programs. These include exemptions for seniors, veterans, and individuals with disabilities. Deferral programs allow eligible homeowners to defer their property taxes until a later date, often providing significant savings.

How can I reduce my property tax burden in Colorado?

+To reduce your property tax burden, you can review your assessment notices for accuracy, understand and apply for eligible exemptions or deferrals, consider refinancing your mortgage, and, if necessary, appeal your property tax assessment if you believe it’s inaccurate or too high.