Check Your Progress: State of Michigan Income Tax Refund Status Now

Whenever tax season rolls around, I find myself glued to my computer screen, trying to keep track of my Michigan income tax refund status. I’ve noticed that checking my refund status quickly turns into a mini project—navigating different websites, logging into accounts, and trying to decipher confusing messages. That’s why I’m excited to share my experience and tips on how to "Check Your Progress: State of Michigan Income Tax Refund Status Now." If you’re like me, wanting a straightforward way to see if your refund is on its way, this guide is just what you need.

- Easy online tools: Check your refund status from the comfort of your home.

- Real-time updates: Get the latest information on your refund processing.

- Multiple methods: Use website, phone, or mobile app options for convenience.

- Preparation tips: Have your Social Security number and tax details ready for a quick check.

- Stay informed: Learn how to interpret common messages and troubleshoot delays.

Understanding How to Check Your Michigan Income Tax Refund

Personal Experience with the MI Refund Status Tool

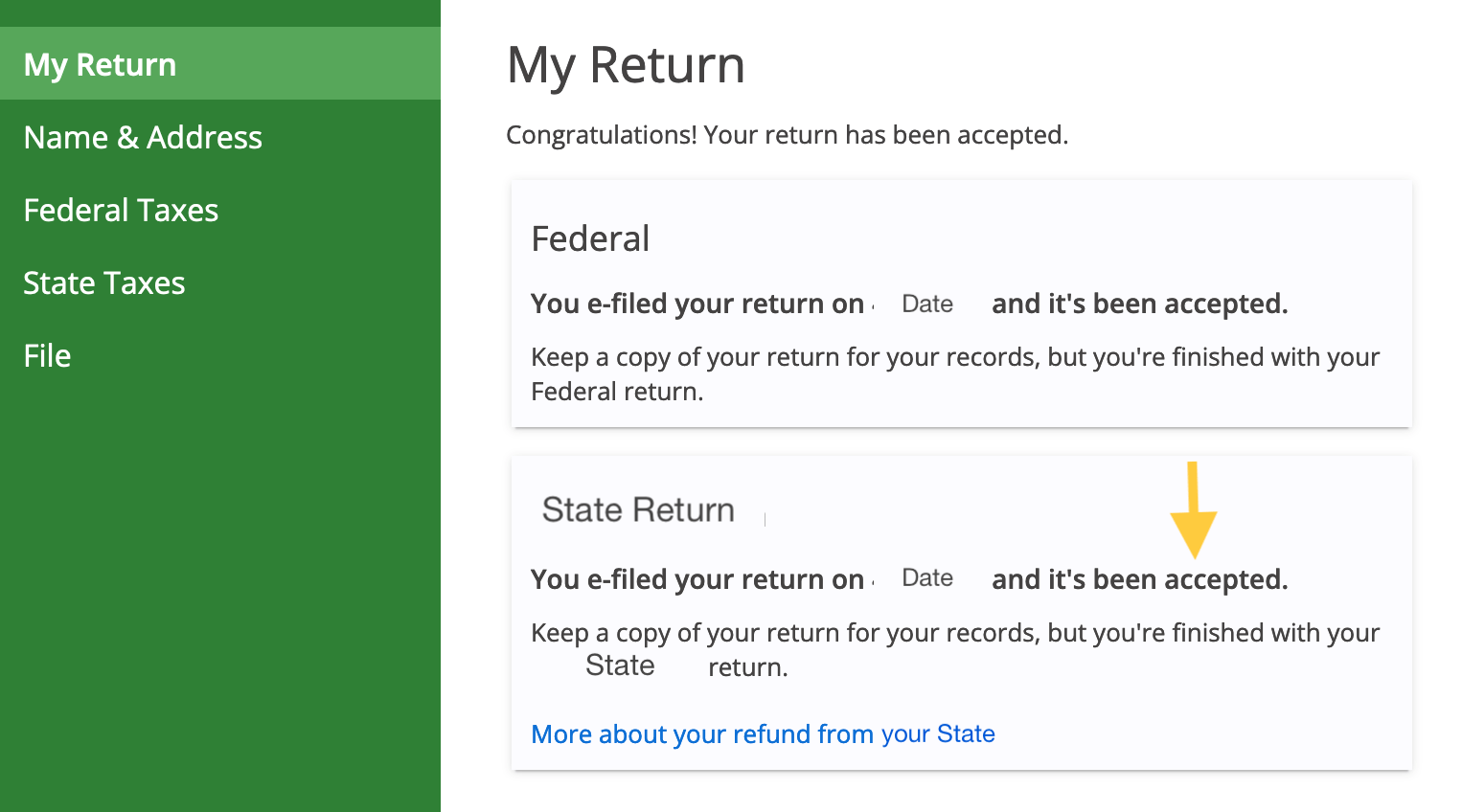

I’ve tried multiple times to verify my refund status, and trusting the Michigan Department of Treasury’s online system has been a game-changer. From what I’ve seen, checking the status is straightforward—once you know where to look. One thing I love about the official portal is its user-friendly interface and clear instructions. Usually, I just need my Social Security Number and the amount of my expected refund, and I’m in. I’ve noticed the process takes less than five minutes, which is a relief during busy tax season.

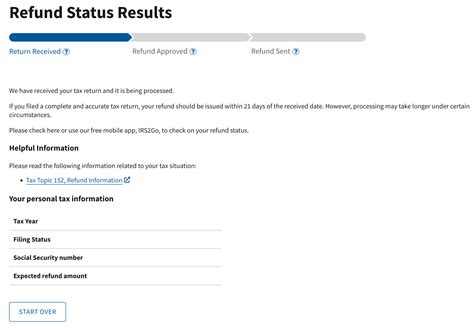

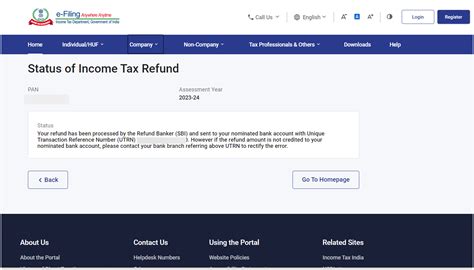

For those who want to avoid long holds phone lines, the online portal offers real-time updates, like “Your refund has been approved” or “Processing,” which saves a lot of guesswork. I’ve made it a habit to check my status a week after filing, especially if I’ve chosen direct deposit. Do you check your refund status regularly or wait until tax season ends? Either way, staying informed gives peace of mind and helps in planning finances.

How to Check Your Michigan Income Tax Refund Status

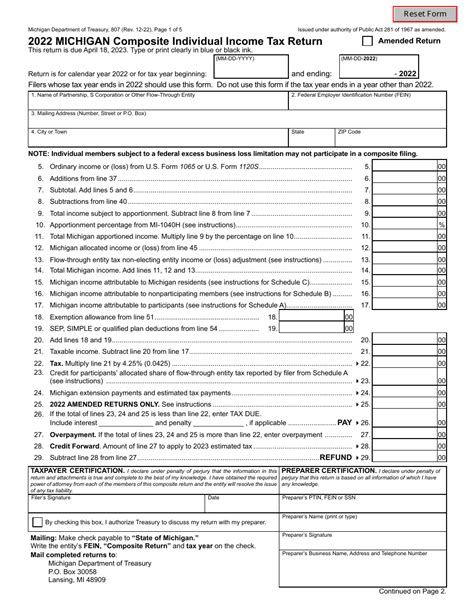

Using the Michigan Department of Treasury Website

If you want to verify your Michigan income tax refund status, the Michigan Department of Treasury’s website is your best bet. From what I’ve seen, it’s a simple, two-step process that anyone can follow. First, visit the official site at https://www.michigan.gov/taxes. Then, navigate to the “Check Refund Status” section.

- Enter your Social Security Number or ITIN.

- Input the exact refund amount or tax year.

- Click “Submit” and wait for the update.

I’ve found that making sure my information matches what I filed is crucial—typos will block your access. Once you submit, the system will tell you whether your refund is still processing, approved, or sent. If you see “Refund sent,” that usually means the money is on its way to your bank account or check in the mail, which adds to my little celebration every year.

Alternative Ways to Track Your Michigan Income Tax Refund

Using the Michigan Treasury Mobile App

Another thing I’ve tried that’s super convenient is the Michigan Treasury mobile app. It’s free, available on both iOS and Android, and offers instant updates right on my phone. Plus, I can even get notifications when my refund status changes—no need to keep manually checking.

From what I’ve experienced, the app simplifies the process: just log in with your personal info, and the app displays your refund status immediately. It also includes helpful tips on how to resolve common issues like tax filing errors or address mismatches.

- Download the app from your device’s app store.

- Register with your details.

- Check your refund status anytime, anywhere.

- Enable notifications for real-time updates.

Addressing Common Concerns and Delays

Why isn’t my refund showing yet?

Sometimes, I’ve seen delays, especially if I filed late or if there was an issue with my return. From what I’ve seen, processing times can vary between 2–4 weeks, depending on volume and accuracy. If my refund status remains “Processing” after that, I double-check for any messages or requests for additional info—like verifying my address or bank details. It’s always helpful to verify that your banking info matches what you filed.

What if I see an error message?

Error messages can be frustrating. I’ve learned to cross-check my personal info and ensure there are no typos. If everything appears correct, contacting Michigan’s tax support line is the best step. Usually, they resolve issues within a few days, and I appreciate their prompt feedback.

How long does it typically take to receive my Michigan tax refund?

+

Most refunds are processed within 2–4 weeks after filing, especially if you filed electronically and chose direct deposit. Paper checks may take a bit longer, around 4–6 weeks.

Can I check my refund status if I filed a paper return?

+

Yes, but it might take longer. The Michigan Department of Treasury provides manual processing, so your status might be updated less frequently—usually within 6–8 weeks.

What should I do if my refund hasn’t arrived after six weeks?

+I recommend contacting Michigan’s tax support or checking your refund status online. Sometimes, delays are due to mismatched info or processing backlog, and I’ve found that a quick call can often clarify the situation.