Sales Tax King County Wa

Sales tax is an essential component of any jurisdiction's revenue system, and understanding its intricacies is crucial for both businesses and consumers. King County, Washington, is a vibrant region known for its diverse economy and thriving businesses. The sales tax structure in this area plays a significant role in funding various public services and infrastructure projects. This comprehensive guide aims to delve into the specifics of Sales Tax in King County, WA, exploring its rates, applications, exemptions, and the impact it has on the local economy.

Unraveling the Sales Tax Structure in King County, WA

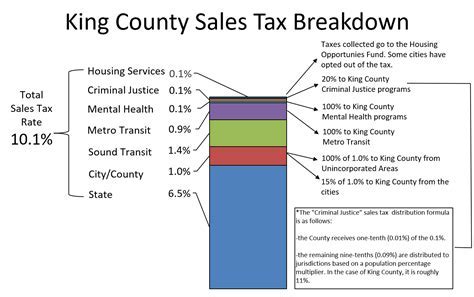

Sales tax in King County is a cumulative tax, meaning that it is applied at each level of sale or use. The tax is collected by the Washington State Department of Revenue and is then distributed to various local and state governments. The sales tax rate in King County is composed of three main components: the state tax rate, the county tax rate, and the optional local tax rate.

The state tax rate in Washington is currently set at 6.5%, which is applied uniformly across the state. However, when it comes to King County, the county tax rate adds an additional 0.4% to the overall sales tax burden. This county-level tax is used to fund specific initiatives and services within King County.

Furthermore, King County, like many other counties in Washington, has the authority to impose an optional local tax. This local tax rate can vary depending on the municipality or district within the county. For instance, the city of Seattle, which is located within King County, has an optional local tax rate of 2.4%. This additional tax is often used to support local projects, infrastructure development, or specific community initiatives.

To illustrate the cumulative nature of sales tax in King County, consider the example of purchasing a new laptop. If you were to buy a laptop in Seattle, the total sales tax would be calculated as follows: 6.5% (state tax) + 0.4% (King County tax) + 2.4% (Seattle local tax) = 9.3%. This means that for every $100 spent on the laptop, you would pay an additional $9.30 in sales tax.

| Tax Component | Rate |

|---|---|

| State Tax | 6.5% |

| King County Tax | 0.4% |

| Seattle Local Tax | 2.4% |

| Total Sales Tax in Seattle | 9.3% |

Sales Tax Exemptions and Special Considerations

While the sales tax in King County applies to a wide range of goods and services, there are certain exemptions and special considerations that businesses and consumers should be aware of. Understanding these nuances can help ensure compliance and avoid unnecessary tax burdens.

One notable exemption is for qualifying food products. In Washington state, including King County, certain food items are exempt from sales tax. This exemption applies to food intended for human consumption that is not served, such as groceries purchased at a supermarket. However, it's important to note that this exemption does not extend to prepared foods, meals at restaurants, or certain types of snacks and beverages.

Another important consideration is the treatment of manufacturing and wholesale businesses. In King County, these types of businesses are often subject to a different tax structure known as the B&O (Business & Occupation) Tax. The B&O tax is a gross receipts tax that is levied on the value of products produced, the gross proceeds of sales, or the gross income of the business. This tax is calculated and reported separately from sales tax and is specific to manufacturing and wholesale operations.

Additionally, certain types of businesses, such as nonprofit organizations, may be eligible for sales tax exemptions or reduced rates. These exemptions are typically granted based on the nature of the organization's mission and its impact on the community. It's crucial for businesses to understand their eligibility and navigate the process of applying for such exemptions to minimize their tax obligations.

The Impact of Sales Tax on the King County Economy

Sales tax is a vital source of revenue for local governments in King County, funding a wide range of essential services and initiatives. The revenue generated from sales tax contributes to maintaining and improving infrastructure, supporting public safety, and providing crucial social services to residents.

For instance, the sales tax revenue in King County helps fund transportation projects, such as road maintenance, public transit improvements, and the construction of new highways. This ensures that the county's transportation network remains efficient and reliable, benefiting both residents and businesses. Additionally, sales tax revenue is directed towards public safety initiatives, including law enforcement, emergency response services, and community safety programs.

Furthermore, sales tax plays a significant role in supporting social services and community development. The revenue generated helps fund programs that address homelessness, provide healthcare services to underserved communities, and offer educational support to students. By investing in these areas, King County aims to create a thriving and resilient community, ensuring that all residents have access to the resources they need to succeed.

In conclusion, understanding the intricacies of sales tax in King County, WA, is essential for both businesses and consumers. The cumulative nature of the sales tax structure, including the state, county, and local tax rates, can impact the overall cost of goods and services. Additionally, being aware of exemptions, such as those for qualifying food products and manufacturing businesses, can help businesses navigate their tax obligations effectively. The revenue generated from sales tax plays a critical role in funding essential services and initiatives that shape the future of King County.

What is the current sales tax rate in King County, WA?

+The current sales tax rate in King County, WA, is composed of three components: the state tax rate (6.5%), the county tax rate (0.4%), and the optional local tax rate (varies by municipality). For example, in Seattle, the total sales tax rate is 9.3% (6.5% + 0.4% + 2.4%).

Are there any sales tax exemptions in King County?

+Yes, there are certain sales tax exemptions in King County. Qualifying food products intended for human consumption are exempt from sales tax. Additionally, manufacturing and wholesale businesses are subject to the Business & Occupation (B&O) Tax instead of sales tax.

How does sales tax revenue benefit the King County community?

+Sales tax revenue in King County funds essential services and initiatives. It supports transportation projects, public safety, and community development efforts, including programs addressing homelessness, healthcare, and education. The revenue ensures a thriving and resilient community.