Scottsdale City Sales Tax

Welcome to Scottsdale, Arizona, a vibrant city known for its luxury resorts, vibrant art scene, and stunning desert landscapes. As you explore the city and indulge in its many attractions, one aspect that might pique your interest is the city's sales tax system. Understanding how sales tax works in Scottsdale is essential for both residents and visitors, as it impacts everyday purchases and contributes to the city's revenue. In this comprehensive guide, we will delve into the intricacies of Scottsdale's sales tax, providing you with a thorough understanding of the rates, exemptions, and real-world examples to help you navigate your financial obligations seamlessly.

The Basics of Scottsdale's Sales Tax

Scottsdale, like many other cities in Arizona, imposes a sales tax on various goods and services purchased within its boundaries. This tax is a crucial revenue source for the city, funding essential services, infrastructure development, and community initiatives. Let's break down the key components of Scottsdale's sales tax system.

Sales Tax Rate in Scottsdale

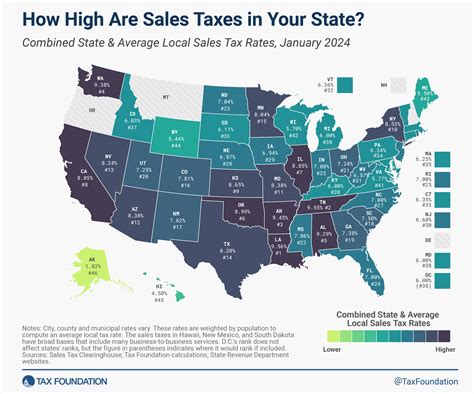

As of [current year], the total sales tax rate in Scottsdale is [XX]%, which is composed of several components. Here's a breakdown of the tax rates:

| Tax Component | Rate |

|---|---|

| Arizona State Sales Tax | [AZ State Rate]% |

| Maricopa County Sales Tax | [County Rate]% |

| Scottsdale City Sales Tax | [City Rate]% |

| Special District Taxes | [District Rate]% |

The combined rate of these taxes results in the [XX]% sales tax that you see reflected in your purchases. It's important to note that these rates are subject to change, so it's always advisable to check the official sources for the most up-to-date information.

How Sales Tax is Calculated

The sales tax in Scottsdale is calculated as a percentage of the purchase price of taxable goods and services. When you make a purchase, the seller is responsible for collecting the appropriate sales tax and remitting it to the Arizona Department of Revenue. Here's a simple example to illustrate how sales tax is calculated:

Let's say you buy a new laptop for $1,000 in Scottsdale. The total sales tax rate is [XX]%. To calculate the sales tax, you multiply the purchase price by the tax rate:

Sales Tax = Purchase Price x Sales Tax Rate

Sales Tax = $1,000 x [XX]%

Sales Tax = $[XX.XX]

So, for this laptop purchase, you would pay an additional $[XX.XX] in sales tax, bringing the total cost of the laptop to $1,000 + $[XX.XX] = $[Total Cost].

Sales Tax Exemptions and Special Cases

While sales tax is a standard part of most transactions, there are certain items and scenarios where sales tax is not applicable or is subject to special considerations. Understanding these exemptions and special cases is crucial to avoid any unnecessary financial burdens.

Sales Tax Exemptions

Scottsdale, like many other jurisdictions, offers sales tax exemptions for specific goods and services. These exemptions are designed to alleviate the financial burden on certain essential items or to promote specific industries. Here are some common sales tax exemptions in Scottsdale:

- Groceries and Food Items: Many staple food items, including groceries, are exempt from sales tax. This exemption aims to reduce the tax burden on households, especially for basic necessities.

- Prescription Medications: Sales tax is often waived on prescription medications, making essential healthcare more affordable for residents.

- Clothing and Footwear: In some cases, clothing and footwear below a certain price threshold may be exempt from sales tax, especially during designated tax-free shopping events.

- Educational Materials: Sales tax exemptions often apply to textbooks, school supplies, and other educational resources to support students and their families.

- Manufacturing and Resale: Goods purchased for manufacturing or resale purposes are typically exempt from sales tax, as they will be subject to further taxation down the supply chain.

It's important to consult the official guidelines provided by the Arizona Department of Revenue and the City of Scottsdale to stay updated on the specific items and conditions that qualify for sales tax exemptions.

Special Sales Tax Scenarios

In addition to exemptions, there are certain scenarios where sales tax is handled differently. Here are a few examples:

- Online Sales: When purchasing items online and having them shipped to Scottsdale, the sales tax is typically calculated based on the destination of the shipment. This ensures that online retailers collect the appropriate tax for Scottsdale residents.

- Construction and Home Improvement: Sales tax may apply differently to construction materials and home improvement projects. Some states and cities offer specific tax incentives or exemptions for these types of purchases.

- Business-to-Business Transactions: Sales tax rules can vary for businesses buying goods for their operations. Understanding these rules is crucial for businesses to ensure compliance and avoid overpaying taxes.

Navigating these special scenarios requires a good understanding of the local tax laws and regulations. It's always recommended to consult tax professionals or the relevant government agencies for accurate guidance.

Real-World Examples and Scenarios

Let's explore some real-world examples to help you better understand how sales tax applies in various situations in Scottsdale.

Dining Out and Entertainment

Scottsdale is renowned for its vibrant dining scene, offering a wide range of restaurants and entertainment options. When dining out or attending events, sales tax is applicable to the total bill, including food, beverages, and any applicable service charges.

For instance, if you decide to indulge in a fine dining experience at a popular Scottsdale restaurant, the sales tax will be added to your bill. Let's say the pre-tax cost of your meal is $150. With the [XX]% sales tax, you would pay an additional $[XX.XX] in tax, bringing the total cost of your meal to $150 + $[XX.XX] = $[Total Cost].

Retail Shopping

Scottsdale is home to numerous retail shops, from luxury boutiques to discount stores. When making purchases at these establishments, sales tax is applied to the retail price of the goods.

Consider buying a new pair of shoes at a Scottsdale mall. The retail price of the shoes is $120. With the [XX]% sales tax, you would pay an additional $[XX.XX] in tax, resulting in a total cost of $120 + $[XX.XX] = $[Total Cost].

Service Providers

Sales tax is also applicable to various services provided within Scottsdale, such as hair salons, spas, and professional services.

Imagine you visit a local spa for a relaxing massage. The pre-tax cost of the massage is $80. With the [XX]% sales tax, you would pay an additional $[XX.XX] in tax, making the total cost of the massage $80 + $[XX.XX] = $[Total Cost].

Online Shopping and Shipping

Online shopping is a popular option for many residents and visitors in Scottsdale. When purchasing items online and having them shipped to Scottsdale, the sales tax is typically calculated based on the destination of the shipment.

If you order a new smartphone online, and the retailer ships it to your Scottsdale address, the sales tax will be applied based on the Scottsdale sales tax rate. Let's say the pre-tax cost of the smartphone is $500. With the [XX]% sales tax, you would pay an additional $[XX.XX] in tax, resulting in a total cost of $500 + $[XX.XX] = $[Total Cost].

Impact on Local Businesses and Residents

Scottsdale's sales tax system plays a vital role in shaping the local economy and the well-being of its residents. Let's explore some of the key impacts.

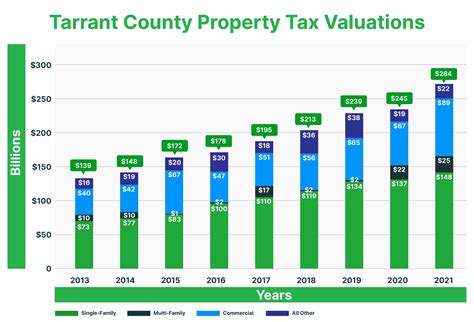

Revenue Generation

The sales tax collected in Scottsdale is a significant source of revenue for the city. This revenue is utilized for various purposes, including:

- Funding essential city services such as police, fire, and emergency response.

- Maintaining and improving infrastructure, including roads, parks, and public facilities.

- Supporting education and community initiatives.

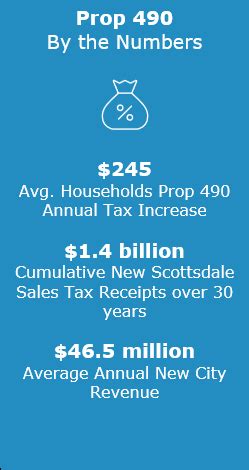

- Investing in economic development and tourism promotion.

By collecting sales tax, Scottsdale ensures that its residents and visitors contribute to the city's growth and prosperity.

Economic Development

The sales tax system can also impact the economic development of Scottsdale. A well-structured and competitive sales tax rate can attract businesses and investors, leading to job creation and economic growth. On the other hand, excessive sales tax rates may discourage business growth and impact consumer spending.

Resident Impact

For residents of Scottsdale, the sales tax system directly affects their daily lives and financial planning. Understanding the sales tax rates and exemptions can help residents make informed purchasing decisions and manage their budgets effectively.

Additionally, sales tax exemptions and reduced rates on essential items, such as groceries, can provide much-needed relief for households, especially those with lower incomes.

Sales Tax Compliance and Reporting

Compliance with sales tax regulations is crucial for both businesses and individuals in Scottsdale. Let's delve into the compliance and reporting processes.

Businesses and Sales Tax Registration

Businesses operating in Scottsdale are required to register with the Arizona Department of Revenue to obtain a sales tax license. This license allows them to collect and remit sales tax on behalf of the city.

Businesses must calculate and remit sales tax on a regular basis, typically monthly or quarterly, depending on their sales volume. They are also responsible for keeping accurate records of sales and tax payments.

Sales Tax Audits

The Arizona Department of Revenue may conduct audits to ensure compliance with sales tax regulations. These audits can involve reviewing sales records, tax returns, and other financial documents.

It's important for businesses to maintain accurate records and comply with sales tax laws to avoid penalties and legal issues.

Individuals and Sales Tax Obligations

While individuals are not typically responsible for collecting and remitting sales tax, they do have an obligation to pay the applicable sales tax on their purchases. It's important for individuals to understand the sales tax rates and ensure they are paying the correct amount.

In some cases, individuals may be required to file sales tax returns if they engage in certain business activities or make specific types of purchases. It's always advisable to consult tax professionals or the Arizona Department of Revenue for guidance on individual sales tax obligations.

Future Outlook and Potential Changes

Sales tax rates and regulations are subject to change over time, often influenced by economic factors, political decisions, and community needs. Let's explore some potential future developments regarding Scottsdale's sales tax system.

Economic Factors

Economic conditions can significantly impact sales tax rates. During economic downturns, cities may consider adjusting sales tax rates to generate additional revenue or provide relief to residents. Conversely, in times of economic prosperity, cities may explore reducing sales tax rates to stimulate consumer spending.

Political Decisions

Political decisions at the state and local levels can lead to changes in sales tax rates and regulations. Elected officials may propose amendments to sales tax laws, introduce new exemptions, or adjust existing ones to align with their policy priorities.

Community Needs

The needs and priorities of the Scottsdale community can also influence sales tax decisions. For example, if there is a growing demand for improved infrastructure or enhanced public services, the city may consider increasing sales tax rates to fund these initiatives.

Additionally, community feedback and public engagement play a crucial role in shaping sales tax policies. Residents and stakeholders have the opportunity to voice their opinions and influence the direction of sales tax regulations through public hearings, town hall meetings, and other consultative processes.

Potential Sales Tax Reforms

In recent years, there has been a growing discussion about sales tax reforms at both the state and national levels. Some proposed reforms include:

- Streamlining Sales Tax Rates: Simplifying the sales tax structure by reducing the number of tax rates or harmonizing rates across jurisdictions can make compliance easier for businesses and consumers.

- Expanding Sales Tax Exemptions: Some proposals aim to expand sales tax exemptions to cover a wider range of goods and services, especially those considered essential or beneficial to society.

- Implementing Remote Seller Laws: With the rise of e-commerce, many states are considering implementing laws that require online retailers to collect and remit sales tax on purchases made by their residents.

- Sales Tax Holidays: Certain states have introduced sales tax holidays, where specific items are exempt from sales tax for a limited period, typically during peak shopping seasons.

While these reforms may not directly impact Scottsdale's sales tax system, they highlight the ongoing evolution of sales tax policies and the potential for future changes.

Frequently Asked Questions (FAQ)

Are there any special sales tax rates for tourists visiting Scottsdale?

+No, there are no separate sales tax rates for tourists. Tourists and residents alike are subject to the same sales tax rates in Scottsdale. However, it's always a good idea for tourists to be aware of the tax implications of their purchases to budget accordingly.

How often do sales tax rates change in Scottsdale?

+Sales tax rates can change periodically, typically as a result of legislative decisions or economic factors. It's advisable to check the official sources or consult tax professionals for the most current rates.

Are there any online resources to calculate sales tax in Scottsdale?

+Yes, there are several online sales tax calculators available that can help you estimate the sales tax for your purchases in Scottsdale. These tools consider the combined state, county, and city sales tax rates. It's always a good practice to double-check the calculations with official sources.

Can I claim a refund for overpaid sales tax in Scottsdale?

+In general, sales tax is not refundable. However, there may be specific circumstances where you can claim a refund, such as overpayments or errors in tax calculations. It's best to consult the Arizona Department of Revenue or a tax professional for guidance on refund eligibility and the refund process.

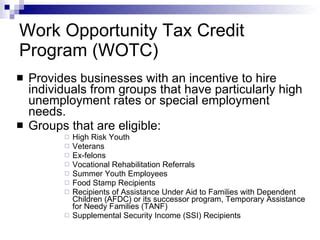

Are there any sales tax incentives for businesses in Scottsdale?

+Scottsdale, like many other cities, offers various incentives and tax breaks to attract and support businesses. These incentives can include reduced sales tax rates, tax credits, or grants. It's recommended that businesses research and consult with local economic development agencies or tax professionals to explore these opportunities.

Scottsdale’s sales tax system is a vital component of the city’s financial landscape, impacting residents, visitors, and businesses alike. By understanding the sales tax rates, exemptions, and real-world applications, you can navigate your financial obligations