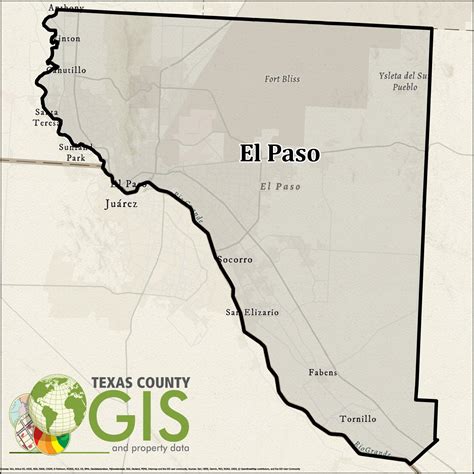

El Paso Property Tax Search

El Paso, Texas, is a vibrant city known for its rich cultural heritage and diverse population. As property ownership is a significant aspect of financial planning and community involvement, understanding the property tax landscape in El Paso is essential for both residents and potential investors. This comprehensive guide will delve into the intricacies of the El Paso Property Tax Search, offering a detailed exploration of the process, key considerations, and its implications.

Unveiling the El Paso Property Tax Search: A Comprehensive Guide

The El Paso Property Tax Search is a powerful tool designed to provide transparency and accessibility to property tax information. Whether you’re a homeowner, a real estate professional, or simply curious about the tax landscape, this guide will equip you with the knowledge to navigate the system effectively.

Understanding Property Taxes in El Paso

Property taxes are a vital source of revenue for local governments, including the city of El Paso. These taxes contribute to funding essential services such as public schools, emergency services, and infrastructure development. The tax system in El Paso operates within the parameters set by the Texas Property Tax Code, which outlines the assessment and collection process.

In El Paso, property taxes are calculated based on the appraised value of the property and the tax rate set by various taxing authorities, including the city, county, and school districts. The appraised value is determined by the El Paso Central Appraisal District (EPCAD), an independent entity responsible for assessing the value of properties within the county.

The El Paso Property Tax Search: A Step-by-Step Process

- Accessing the Search Portal: The first step in conducting an El Paso Property Tax Search is to visit the official website of the City of El Paso or the El Paso Central Appraisal District (EPCAD). These websites provide dedicated portals for property tax information.

- Property Search Options: On the search portal, you’ll find various ways to locate a property. These include searching by owner name, address, account number, or even by parcel number. This flexibility ensures that you can find the information you need, regardless of the details you have on hand.

- Entering Property Details: Once you’ve selected your preferred search method, enter the relevant information accurately. Double-check your input to avoid errors that may lead to incorrect results.

- Reviewing Property Information: After submitting your search, the portal will display detailed information about the property. This typically includes the owner’s name, property address, appraised value, taxable value, and the tax rate applicable to the property.

- Understanding Tax Assessments: The appraised value of the property is a critical component in calculating property taxes. It represents the estimated market value of the property as determined by the EPCAD. This value is then used to calculate the taxable value, which is the basis for tax assessments.

- Tax Rate Determination: The tax rate applied to a property is a combination of rates set by multiple taxing authorities. These rates are expressed as a percentage and are used to calculate the actual tax amount owed. The tax rate is typically a combination of city, county, and school district rates.

- Tax Calculation: To calculate the property tax, multiply the taxable value of the property by the applicable tax rate. This calculation provides the total tax amount owed for the property. It’s important to note that tax rates can vary significantly between different areas within El Paso County.

- Payment Options and Deadlines: The El Paso Property Tax Search portal often provides information on payment options and due dates. Property owners can choose from various payment methods, including online payments, mail-in payments, or in-person payments at designated locations. Understanding the payment deadlines is crucial to avoid penalties and late fees.

Key Considerations for Property Owners

Understanding the property tax landscape is crucial for property owners in El Paso. Here are some key considerations to keep in mind:

- Assessment Appeals: If you believe the appraised value of your property is inaccurate, you have the right to appeal the assessment. The EPCAD provides a process for property owners to challenge the appraised value. It’s essential to gather supporting evidence and follow the appeal procedures outlined by the appraisal district.

- Tax Exemptions and Discounts: El Paso offers various tax exemptions and discounts to eligible property owners. These may include homestead exemptions, disability exemptions, or senior citizen discounts. Understanding the eligibility criteria and applying for these benefits can significantly reduce your tax liability.

- Tax Payment Plans: For property owners facing financial difficulties, the city of El Paso offers tax payment plans. These plans allow property owners to pay their taxes in installments, making it more manageable to meet their tax obligations.

- Tax Lien Sales: In cases of delinquent property taxes, the city may initiate a tax lien sale. This process involves selling the property’s tax lien to a third party, who then has the right to collect the outstanding taxes and potentially initiate foreclosure proceedings. Property owners should stay informed about their tax obligations to avoid such scenarios.

Real-World Examples: Navigating the El Paso Property Tax Search

Let’s illustrate the process with a real-world example. Imagine you’re a homeowner in El Paso, and you want to understand your property tax obligations. Here’s how you can utilize the El Paso Property Tax Search portal:

- Access the EPCAD Portal: Visit the official website of the El Paso Central Appraisal District (EPCAD) and navigate to the property tax search section.

- Search by Address: Enter your property address in the search bar. Ensure you provide the correct street name, number, and city.

- Review Property Details: The search results will display essential information about your property, including the appraised value, taxable value, and the tax rate applicable to your area.

- Calculate Tax Amount: Use the tax rate and taxable value to calculate your estimated tax amount. This gives you a clear idea of your annual tax obligation.

- Explore Payment Options: Review the payment options available on the portal. You can choose to pay online, by mail, or in person. Take note of the payment deadlines to avoid any penalties.

Future Implications and Developments

The El Paso Property Tax Search system is continually evolving to meet the needs of property owners and taxpayers. Here are some potential future developments and their implications:

- Online Payment Integration: As technology advances, the integration of secure online payment systems could streamline the tax payment process, making it more convenient for property owners.

- Data Analytics and Insights: The EPCAD may leverage data analytics to provide property owners with personalized insights and comparisons, helping them understand their tax obligations in relation to similar properties.

- Improved Appeal Processes: Ongoing efforts to simplify and expedite the assessment appeal process could enhance transparency and encourage more property owners to challenge inaccurate appraisals.

- Community Engagement: The city of El Paso may explore ways to engage with taxpayers through educational workshops or online resources, ensuring a better understanding of property taxes and available exemptions.

Conclusion: Empowering Property Owners with Knowledge

The El Paso Property Tax Search is a powerful tool that empowers property owners with the knowledge to navigate the complex world of property taxes. By understanding the assessment process, tax rates, and available exemptions, homeowners and investors can make informed decisions about their financial obligations and plan for the future.

As El Paso continues to thrive and grow, staying informed about property taxes is essential for contributing to the community's prosperity and ensuring a fair and transparent tax system. This comprehensive guide aims to provide a solid foundation for navigating the El Paso Property Tax Search, offering a deeper understanding of the process and its implications.

Frequently Asked Questions

¿Qué es el Impuesto Predial en El Paso, Texas?

+

El Impuesto Predial en El Paso, Texas, es un impuesto que se aplica a las propiedades inmobiliarias dentro de la ciudad. Sirve como fuente de ingresos para financiar servicios públicos como escuelas, servicios de emergencia y desarrollo de infraestructura.

¿Cómo puedo encontrar información sobre el Impuesto Predial de mi propiedad en El Paso?

+

Puede acceder al portal de búsqueda de impuestos prediales de El Paso visitando el sitio web oficial de la Ciudad de El Paso o el Distrito de Avalúos Central de El Paso (EPCAD). Allí encontrará opciones para buscar por nombre del propietario, dirección, número de cuenta o número de parcela.

¿Cuál es la diferencia entre el valor de tasación y el valor imponible en el Impuesto Predial de El Paso?

+

El valor de tasación es la estimación del valor de mercado de su propiedad según el EPCAD. El valor imponible, por otro lado, es el valor sobre el cual se calcula el impuesto predial y puede ser menor que el valor de tasación si se aplican exenciones o deducciones.

¿Existen exenciones o descuentos en el Impuesto Predial de El Paso?

+

Sí, El Paso ofrece varias exenciones y descuentos a propietarios elegibles. Esto puede incluir exenciones de residencia principal, exenciones para personas con discapacidad o descuentos para personas mayores. Es importante investigar y solicitar estas exenciones si es elegible.