Marathon County Tax Records

Welcome to this comprehensive guide on Marathon County's tax records. In this article, we will delve into the intricacies of Marathon County's property tax system, exploring the various aspects that impact taxpayers and property owners. From understanding the assessment process to exploring available exemptions and appealing procedures, this article aims to provide a thorough understanding of the tax landscape in Marathon County.

Unraveling Marathon County’s Tax Assessment Process

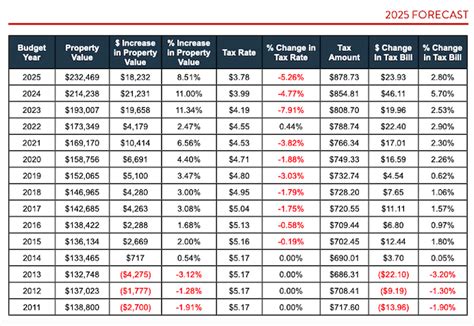

The tax assessment process in Marathon County is a meticulous procedure aimed at determining the value of properties for tax purposes. This process is critical as it forms the basis for calculating property taxes, which are a significant source of revenue for the county. Here’s a breakdown of the key steps involved:

Data Collection and Property Inspection

The first phase involves gathering extensive data about each property in the county. This includes physical inspections, where assessors visit properties to assess their condition, features, and any recent improvements. They also consider factors such as location, size, and the property’s intended use.

Additionally, assessors utilize public records, including previous sales data, building permits, and any available property surveys, to ensure an accurate valuation. This data collection phase is crucial for establishing a fair and consistent assessment process.

Valuation Methods and Market Analysis

Once the data is gathered, assessors employ various valuation methods to determine the property’s assessed value. These methods include the cost approach, which estimates the replacement cost of the property, and the sales comparison approach, which compares the property to similar recent sales in the area. The income approach is also used for income-producing properties, where the property’s value is determined based on its potential income generation.

Assessors also conduct thorough market analyses to understand the current economic climate, property trends, and any factors that may influence property values, ensuring that assessments are up-to-date and reflective of the market.

Assessment Notices and Property Owner Feedback

After the assessment process is complete, property owners receive assessment notices, detailing the assessed value of their property. This notice is an essential communication tool, allowing property owners to understand the basis for their tax liability.

Marathon County encourages property owners to review these notices carefully and provide feedback if they believe the assessed value is inaccurate. This feedback loop is vital for maintaining transparency and ensuring fairness in the assessment process.

Exploring Marathon County’s Tax Exemptions

Marathon County recognizes the importance of providing tax relief to certain groups and properties, and as such, offers a range of tax exemptions. These exemptions can significantly reduce a property owner’s tax burden, making them an essential aspect of the county’s tax landscape.

Homestead Exemptions: Protecting Homeowners

One of the most significant tax exemptions in Marathon County is the homestead exemption, which provides tax relief to homeowners who use their property as their primary residence. This exemption can significantly reduce the assessed value of a property, resulting in lower property taxes.

To qualify for the homestead exemption, homeowners must meet specific residency requirements and complete an application process. This exemption is a key way Marathon County supports its residents and encourages homeownership.

Veterans and Senior Citizens: Special Exemptions

Marathon County shows its appreciation for veterans and senior citizens by offering special tax exemptions tailored to their unique needs. These exemptions can provide substantial savings, helping these individuals maintain their financial stability.

Veterans may be eligible for a veterans' exemption, which can reduce their property taxes based on their service record and disability status. Senior citizens, on the other hand, can benefit from the senior citizen exemption, which provides a reduced tax rate for those over a certain age.

Agricultural and Nonprofit Exemptions

Marathon County also recognizes the importance of agriculture and nonprofit organizations to the local community. As such, it offers exemptions for agricultural properties and nonprofit entities, promoting their vital roles in the county’s economy and social fabric.

Agricultural properties can be exempted from certain taxes if they are actively used for agricultural purposes, while nonprofit organizations, such as schools, churches, and charities, are often exempt from property taxes altogether.

Understanding the Tax Appeal Process

Despite the county’s efforts to ensure fair assessments, there may be instances where property owners disagree with the assessed value of their property. In such cases, Marathon County provides a detailed tax appeal process, allowing property owners to challenge their assessments and seek a more accurate valuation.

Informal Review: An Initial Step

The tax appeal process typically begins with an informal review, where property owners can meet with the assessor’s office to discuss their concerns. This step provides an opportunity to clarify any misunderstandings and potentially resolve the issue without proceeding to a formal appeal.

During the informal review, property owners can present evidence, such as recent appraisals or comparable sales data, to support their case. The assessor's office will carefully consider this information and may adjust the assessment if warranted.

Formal Appeal: A Detailed Process

If the informal review does not lead to a satisfactory resolution, property owners can initiate a formal appeal. This process involves a more detailed review, often requiring the submission of extensive documentation and evidence to support the claim.

The formal appeal process may include a hearing before a review board, where the property owner presents their case and the assessor's office provides its rationale for the assessment. This board will then make a decision, which can be further appealed if necessary.

The Role of Professional Appraisers

For complex cases or those involving significant value differences, property owners may benefit from hiring a professional appraiser. These appraisers are trained to conduct thorough property evaluations, providing an independent assessment that can be used as evidence during the appeal process.

Professional appraisers consider a range of factors, including market conditions, property features, and recent sales data, to determine a fair market value for the property. Their expertise can be invaluable in ensuring a fair and accurate assessment.

The Impact of Tax Policies on Marathon County’s Economy

Marathon County’s tax policies have a significant impact on the local economy, influencing property values, investment trends, and the overall financial health of the community. Understanding these impacts is crucial for policymakers, investors, and residents alike.

Encouraging Homeownership and Business Growth

The county’s tax landscape, particularly the homestead and business exemptions, plays a vital role in encouraging homeownership and business growth. By providing tax relief, Marathon County makes it more affordable for individuals and families to own homes and for businesses to establish and expand their operations.

This, in turn, stimulates economic growth, creates jobs, and attracts further investment, contributing to the county's overall prosperity.

Maintaining a Balanced Budget and Community Services

While tax exemptions and relief measures benefit taxpayers, they also impact the county’s budget. Marathon County must carefully manage its tax revenue to ensure it can provide essential community services, such as education, public safety, and infrastructure maintenance.

A balanced approach to tax policies ensures that the county can both support its residents and businesses while also funding the vital services that contribute to the community's well-being and quality of life.

The Role of Tax Records in Real Estate Transactions

Marathon County’s tax records are a crucial component of real estate transactions, providing valuable insights into a property’s history and potential liabilities. Buyers, sellers, and real estate professionals rely on these records to make informed decisions, ensuring smooth and transparent transactions.

Tax records offer a comprehensive overview of a property's tax history, including any exemptions, assessments, and appeals. This information is vital for understanding a property's true value and potential tax obligations, helping parties negotiate fair deals.

Conclusion: A Comprehensive Guide to Marathon County’s Tax Landscape

In this article, we’ve explored Marathon County’s tax assessment process, the various exemptions available, and the appeal procedures in place. By understanding these aspects, property owners can navigate the tax landscape with confidence, ensuring they are treated fairly and accurately.

Marathon County's commitment to transparency, fairness, and community support is evident in its tax policies and processes. As the county continues to evolve and adapt to changing economic conditions, its tax system will remain a vital tool for promoting growth, stability, and prosperity.

How often are property assessments conducted in Marathon County?

+Property assessments in Marathon County are conducted annually to ensure that property values remain up-to-date and accurate. This process helps maintain fairness and consistency in the tax system.

What documentation is required for the homestead exemption application?

+To apply for the homestead exemption, homeowners typically need to provide proof of residency, such as a driver’s license or utility bills, along with a completed application form. The specific requirements may vary, so it’s advisable to check with the assessor’s office.

Can I appeal my property tax assessment if I disagree with the value?

+Yes, Marathon County provides a detailed tax appeal process for property owners who believe their assessment is inaccurate. The process involves an informal review and, if necessary, a formal appeal, allowing property owners to present their case and seek a fair assessment.

How does Marathon County’s tax system impact the local real estate market?

+Marathon County’s tax system, with its various exemptions and fair assessment process, helps stabilize the local real estate market. It encourages homeownership, attracts businesses, and ensures a balanced budget, all of which contribute to a healthy and vibrant market.