Colorado Tax Payment

Navigating the intricacies of tax payment is a crucial aspect of financial management, and understanding the specific processes and regulations within different states can be a complex endeavor. In this comprehensive guide, we will delve into the world of Colorado tax payment, offering an expert overview of the key aspects, processes, and considerations for individuals and businesses alike.

Understanding Colorado’s Tax Landscape

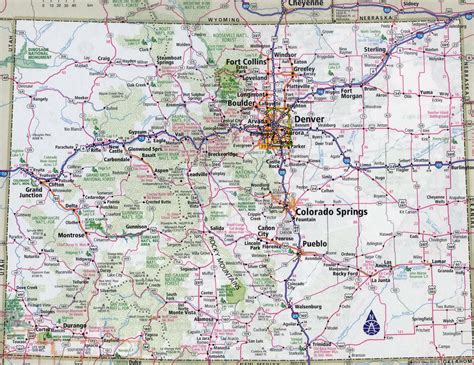

Colorado, nestled in the heart of the American West, boasts a unique tax system that reflects its diverse economy and cultural landscape. The state’s tax structure is designed to support a range of industries, from tourism and outdoor recreation to technology and aerospace. As such, it’s essential to grasp the fundamental principles that underpin Colorado’s tax framework.

At its core, Colorado's tax system is characterized by a balanced approach, aiming to generate sufficient revenue for state operations while maintaining a competitive business environment. This equilibrium is achieved through a combination of income, sales, and property taxes, each with its own set of rules and regulations.

Income Tax: A Pillar of Colorado’s Revenue Stream

Colorado’s income tax is a cornerstone of its fiscal strategy, contributing significantly to the state’s revenue stream. As of 2023, the state imposes a flat income tax rate of 4.55% on all taxable income, a structure that simplifies the tax filing process for individuals and businesses alike. This rate applies to both personal and corporate income, creating a straightforward and predictable tax environment.

To illustrate, consider a hypothetical scenario where an individual with an annual income of $75,000 resides in Colorado. Based on the flat tax rate, they would owe the state a total of $3,412.50 in income tax. This simplicity is a key advantage for taxpayers, as it streamlines the tax calculation process and reduces the complexity often associated with progressive tax systems.

| Income Level | Taxable Income | Estimated Tax Owed |

|---|---|---|

| $30,000 | $30,000 | $1,365 |

| $50,000 | $50,000 | $2,275 |

| $100,000 | $100,000 | $4,550 |

However, it's important to note that Colorado's income tax system also includes certain deductions and credits that can reduce the overall tax liability. For instance, the state offers a standard deduction of $6,800 for single filers and $13,600 for joint filers, providing a measure of relief for lower-income taxpayers. Additionally, Colorado allows for the deduction of certain expenses, such as student loan interest and contributions to retirement accounts, further enhancing the tax benefits available to residents.

Sales Tax: A Dynamic Component of Colorado’s Economy

In addition to income tax, Colorado relies heavily on sales tax as a revenue generator. The state’s sales tax rate stands at 2.9%, which is relatively low compared to many other states. However, it’s important to recognize that local governments and special districts often add their own sales taxes, creating a more complex landscape for consumers and businesses.

For instance, the city of Denver imposes an additional sales tax of 4.62%, bringing the total sales tax rate within the city limits to 7.52%. This variation in sales tax rates across the state can significantly impact the cost of goods and services for both residents and tourists. As such, understanding the local sales tax rates is crucial for accurate budgeting and financial planning.

| Location | State Sales Tax | Local Sales Tax | Total Sales Tax |

|---|---|---|---|

| Denver | 2.9% | 4.62% | 7.52% |

| Boulder | 2.9% | 3.93% | 6.83% |

| Colorado Springs | 2.9% | 3.10% | 6.00% |

Moreover, it's worth noting that certain items are exempt from sales tax in Colorado. These exemptions include most groceries, prescription drugs, and non-prepared food items. This unique aspect of Colorado's sales tax system can provide significant savings for residents, particularly those with larger families or specific dietary needs.

Navigating the Payment Process

Now that we’ve explored the foundational elements of Colorado’s tax system, let’s delve into the practical aspects of tax payment. Understanding the payment process is crucial for ensuring timely and accurate submissions, thereby avoiding potential penalties and interest charges.

Payment Due Dates and Deadlines

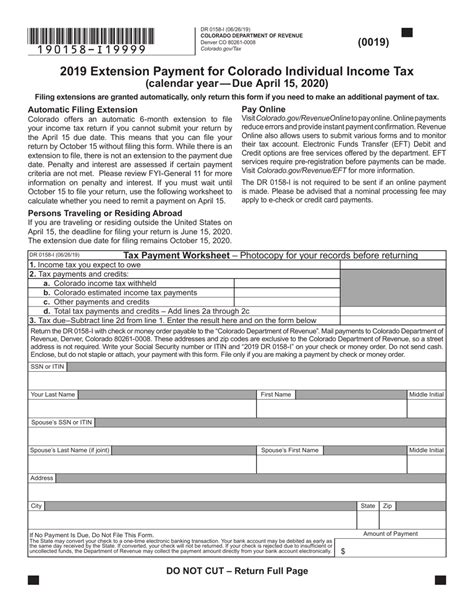

In Colorado, tax payment due dates align with the federal tax calendar, providing a level of consistency for taxpayers. For individuals, the deadline for filing and paying income taxes is typically April 15th of each year. This date is also the cutoff for making estimated tax payments for the previous year.

However, it's important to note that in the event April 15th falls on a weekend or holiday, the due date is extended to the next business day. This flexibility ensures that taxpayers are not penalized for circumstances beyond their control. For instance, if April 15th falls on a Saturday, the deadline would be extended to the following Monday.

For businesses, the payment due dates can vary based on the type of business entity and the specific taxes involved. Generally, businesses are required to remit sales and use taxes on a monthly, quarterly, or annual basis, depending on their estimated tax liability. The due date for these payments is typically the 25th of the month following the reporting period.

For example, if a business's reporting period ends on March 31st, the sales tax payment for that period would be due on April 25th. However, it's crucial for businesses to consult the Colorado Department of Revenue's guidelines to ensure compliance with the specific payment deadlines applicable to their operations.

Payment Methods and Options

Colorado offers a range of payment methods to accommodate the diverse needs of taxpayers. The state recognizes that different individuals and businesses have varying preferences and requirements when it comes to tax payment, and as such, provides several options to ensure a seamless and convenient process.

- Electronic Payments: Colorado strongly encourages taxpayers to utilize electronic payment methods, which offer a secure and efficient way to remit taxes. The state accepts payments through its online payment portal, which can be accessed through the Colorado Department of Revenue's website. This method allows taxpayers to pay using a credit or debit card, or by direct withdrawal from a bank account.

- Check or Money Order: For those who prefer a more traditional approach, Colorado also accepts payments by check or money order. Taxpayers can mail their payments, along with the appropriate forms and remittance vouchers, to the address specified by the Department of Revenue. It's crucial to ensure that the payment is received by the due date to avoid any late payment penalties.

- Payment Plans: In recognition of the financial challenges that taxpayers may face, Colorado offers payment plan options for those who are unable to pay their tax liability in full by the due date. These plans allow taxpayers to make periodic payments over an extended period, with terms and conditions outlined by the Department of Revenue. It's important to note that interest and penalties may still apply, but the payment plan can provide a manageable solution for those facing temporary financial difficulties.

Online Resources and Support

To assist taxpayers in navigating the payment process, the Colorado Department of Revenue provides a wealth of online resources and support. The department’s website offers a user-friendly interface, where taxpayers can find detailed information on tax laws, payment deadlines, and specific requirements for different types of taxes. Additionally, the website provides access to tax forms, instructions, and helpful guides to ensure a smooth and accurate filing process.

For those who prefer personalized assistance, the Department of Revenue offers a dedicated helpline where taxpayers can speak directly with tax professionals. These experts can provide guidance on payment options, answer specific questions, and offer tailored advice based on individual circumstances. The helpline is a valuable resource for taxpayers who may be facing complex tax situations or simply prefer the reassurance of speaking to a knowledgeable representative.

Conclusion: A Comprehensive Approach to Tax Payment

In conclusion, understanding and navigating Colorado’s tax payment process is a crucial aspect of financial management for individuals and businesses alike. The state’s tax system, characterized by a flat income tax rate and a dynamic sales tax structure, offers a unique landscape that requires careful consideration and planning.

By grasping the fundamentals of Colorado's tax landscape, taxpayers can ensure compliance with state regulations and take advantage of the various deductions and credits available. The payment process, with its range of options and due dates, provides flexibility and convenience, ensuring that taxpayers can meet their obligations efficiently and effectively.

As we've explored in this comprehensive guide, Colorado's tax system, while complex, is designed to support the state's diverse economy and vibrant culture. By staying informed and utilizing the resources provided by the Department of Revenue, taxpayers can navigate the tax landscape with confidence, ensuring timely and accurate payments that contribute to the state's prosperity.

What are the tax rates for businesses in Colorado?

+Businesses in Colorado are subject to a corporate income tax rate of 4.63%, which applies to their net income. Additionally, they must also comply with sales and use tax regulations, with rates varying based on the location of the business and the specific goods or services provided.

Are there any tax incentives or credits available in Colorado?

+Yes, Colorado offers a range of tax incentives and credits to support specific industries and promote economic development. These include the Enterprise Zone Tax Credit, the Research and Development Tax Credit, and the New Markets Tax Credit, among others. Each incentive has its own eligibility criteria and requirements, so it’s essential to consult the Department of Revenue’s guidelines for detailed information.

How can I calculate my estimated tax payments in Colorado?

+To calculate your estimated tax payments in Colorado, you’ll need to estimate your taxable income for the year and apply the appropriate tax rates. The state’s flat income tax rate of 4.55% simplifies this calculation. However, it’s crucial to consider any applicable deductions, credits, and exemptions to ensure an accurate estimate. The Department of Revenue provides online tools and resources to assist with this process, ensuring a more precise estimation of your tax liability.