When Are Corporate Taxes Due 2025

Tax obligations are an essential aspect of doing business, and staying on top of deadlines is crucial for any corporation. In this comprehensive guide, we will delve into the due dates for corporate taxes in the year 2025, providing you with the necessary information to ensure timely compliance.

Understanding Corporate Tax Deadlines in 2025

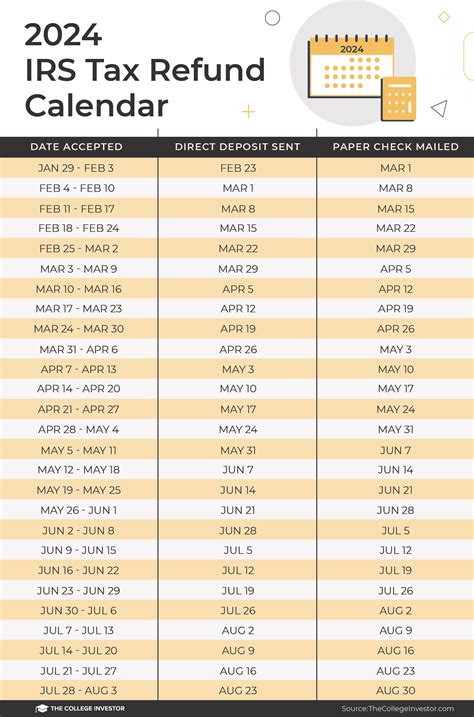

The Internal Revenue Service (IRS) sets specific dates for corporations to file their tax returns and make corresponding payments. For the tax year ending on December 31, 2025, here’s what you need to know about the upcoming corporate tax deadlines.

Key Dates for Corporate Tax Filing and Payment

The standard deadline for corporate tax returns is March 15, 2026. This date applies to most C corporations, including those operating on a calendar year basis. However, it’s essential to note that certain types of corporations and specific circumstances may have different due dates.

For instance, if your corporation has a fiscal year ending on a date other than December 31, the due date for filing tax returns will be the 15th day of the third month following the end of the fiscal year. This flexibility allows corporations with non-calendar year financial periods to align their tax obligations accordingly.

In addition to the standard deadline, corporations must also be mindful of the payment due dates. The IRS requires payments to be made by the 15th day of the fourth month following the end of the tax year. For calendar year corporations, this payment deadline falls on April 15, 2026. It's crucial to remember that failure to meet these deadlines may result in penalties and interest charges.

| Corporate Tax Due Dates for 2025 | Deadline |

|---|---|

| Standard Filing Deadline | March 15, 2026 |

| Standard Payment Deadline | April 15, 2026 |

| Alternative Fiscal Year End | Varies based on fiscal year end |

Extensions for Corporate Tax Filing

In certain circumstances, corporations may need additional time to prepare and file their tax returns. The IRS provides the option to request an extension for filing corporate tax returns. By filing Form 7004, corporations can extend their filing deadline by six months, pushing it to September 15, 2026 for calendar year corporations.

However, it's important to note that requesting an extension only extends the filing deadline, not the payment deadline. Corporations must still make their tax payments by the standard payment due date to avoid penalties. Failure to pay the estimated tax liability by the payment deadline will result in interest and penalties.

Quarterly Estimated Tax Payments

Corporations are generally required to make quarterly estimated tax payments throughout the year. These payments are due on specific dates to ensure the IRS receives a portion of the tax liability in advance. For the tax year 2025, the quarterly estimated tax payment dates are as follows:

- April 15, 2025: First quarterly estimated tax payment due.

- June 15, 2025: Second quarterly estimated tax payment due.

- September 15, 2025: Third quarterly estimated tax payment due.

- January 15, 2026: Fourth and final quarterly estimated tax payment due.

Failing to make these payments on time may result in penalties and interest, similar to the standard tax payment deadline. It's crucial to stay on top of these quarterly obligations to avoid any unnecessary financial burdens.

Preparing for Corporate Tax Deadlines in 2025

With the knowledge of the upcoming tax deadlines, it’s essential to start preparing early to ensure a smooth and stress-free process. Here are some key steps to help you navigate the corporate tax landscape in 2025.

Gathering Financial Records and Documentation

The first step in preparing for tax deadlines is to gather all relevant financial records and documentation. This includes income statements, balance sheets, invoices, receipts, and any other documents that may impact your tax obligations. By organizing these records, you can ensure an accurate and efficient tax preparation process.

Consider utilizing accounting software or engaging the services of a professional accountant to streamline the data collection and organization process. This will not only save you time but also reduce the risk of errors and missed deductions.

Reviewing Tax Strategies and Deductions

Tax planning is an essential aspect of corporate finance. Take the time to review your tax strategies and explore potential deductions and credits that may be applicable to your business. This could include research and development credits, depreciation methods, or tax-efficient investment strategies.

Consult with tax professionals or financial advisors who specialize in corporate taxation to ensure you're taking advantage of all available opportunities. A well-planned tax strategy can significantly impact your bottom line and overall financial health.

Communicating with Tax Authorities

Stay in touch with the IRS and relevant state tax authorities to ensure you’re aware of any changes or updates to tax regulations. Subscribing to their newsletters or following their official social media accounts can provide valuable insights and notifications about upcoming changes or new tax laws.

Additionally, if you have specific questions or concerns, don't hesitate to reach out to the tax authorities directly. Their websites often provide helpful resources, and you can also contact their support lines for personalized assistance.

Conclusion: Navigating Corporate Tax Deadlines

Understanding and adhering to corporate tax deadlines is crucial for maintaining compliance and avoiding penalties. By marking the key dates on your calendar, gathering financial records, and implementing effective tax strategies, you can navigate the corporate tax landscape with confidence.

Remember, staying informed and seeking professional advice when needed is essential. The tax landscape can be complex, and seeking guidance from experts can ensure you make the most of your tax obligations while minimizing financial risks.

Frequently Asked Questions

What happens if I miss the corporate tax filing deadline?

+Missing the corporate tax filing deadline can result in penalties and interest charges. The IRS may impose a late filing penalty, which is typically 5% of the unpaid taxes for each month or part of a month the return is late, up to a maximum of 25%. Additionally, interest may accrue on any unpaid tax balance from the original due date until the date the tax is paid in full.

Can I request an extension for both filing and payment deadlines?

+Yes, corporations can request an extension for both filing and payment deadlines. However, it’s important to note that requesting an extension for filing does not automatically extend the payment deadline. Corporations must still make their estimated tax payments by the standard payment due date to avoid penalties. To extend the payment deadline, corporations must make estimated tax payments and request an extension using Form 7004.

Are there any exceptions to the standard corporate tax deadlines?

+Yes, there are certain exceptions to the standard corporate tax deadlines. For example, if your corporation has a fiscal year ending on a date other than December 31, the filing and payment deadlines may vary based on the fiscal year-end date. Additionally, corporations affected by natural disasters or other emergencies may be eligible for extended deadlines or relief programs. It’s crucial to stay informed about any applicable exceptions or special circumstances.

How can I stay updated on tax law changes for 2025?

+To stay updated on tax law changes for 2025, it’s advisable to regularly check the IRS website and subscribe to their newsletters or alerts. They provide valuable resources and updates on tax law changes, new regulations, and important deadlines. Additionally, consider consulting tax professionals or joining industry associations that offer timely updates and insights on tax-related matters.