After Tax 401K Vs Roth 401K

Choosing the right retirement savings plan is crucial for securing your financial future. One common dilemma faced by individuals is deciding between an after-tax 401(k) and a Roth 401(k). Both options offer unique advantages and considerations, and understanding their differences is essential for making an informed decision. This comprehensive guide will delve into the specifics of these retirement plans, exploring their features, tax implications, and suitability for various income levels.

Understanding the After-Tax 401(k)

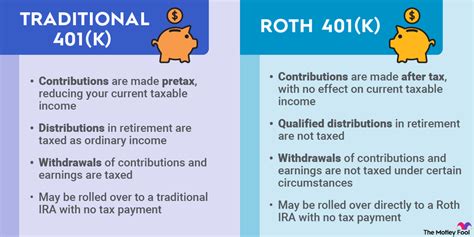

The after-tax 401(k), often referred to as a traditional 401(k), is a popular retirement savings vehicle. Here’s a breakdown of its key characteristics:

Tax Treatment

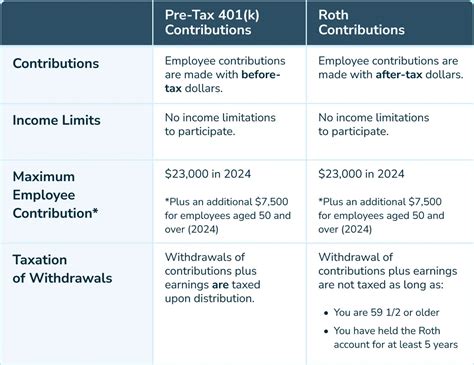

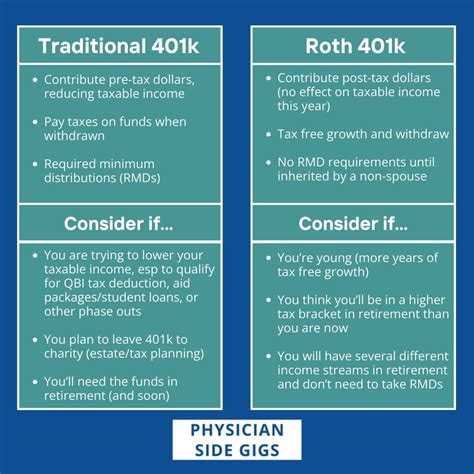

Contributions to an after-tax 401(k) are made with pre-tax dollars, which means they are deducted from your taxable income. This tax-deferred feature allows you to reduce your taxable income in the year of contribution. When you withdraw funds during retirement, you will pay income taxes on both the principal and the earnings.

Suitability

The after-tax 401(k) is particularly advantageous for individuals in higher tax brackets during their working years. By deferring taxes, they can potentially save a substantial amount in the short term. However, it’s essential to consider the tax implications upon withdrawal, especially if your tax bracket remains high during retirement.

Benefits

- Tax-Deferred Growth: Your investments grow tax-free until withdrawal, maximizing returns.

- Immediate Tax Savings: Reduces taxable income in the contribution year.

- Flexibility: Offers the option to convert to a Roth 401(k) later.

Drawbacks

- Taxes Upon Withdrawal: All funds, including earnings, are subject to income tax.

- Limited Contribution Options: May not be suitable for those in lower tax brackets.

Exploring the Roth 401(k) Option

The Roth 401(k) is an alternative retirement savings plan with a different tax structure. Let’s explore its key aspects:

Tax Treatment

In contrast to the after-tax 401(k), contributions to a Roth 401(k) are made with after-tax dollars. This means you pay taxes on the income in the year it’s earned, but withdrawals during retirement are tax-free, including both the principal and earnings.

Suitability

The Roth 401(k) is ideal for individuals who anticipate being in a higher tax bracket during retirement. By paying taxes upfront, they can avoid the tax burden during their retirement years when their income may be lower.

Benefits

- Tax-Free Withdrawals: No taxes on withdrawals, making it suitable for long-term retirement planning.

- Potential Tax Savings: Especially beneficial for those expecting higher tax rates in the future.

- Flexibility: Offers access to contributions without penalty after 5 years.

Drawbacks

- Upfront Tax Payment: Contributions are taxed in the year they are made.

- Limited Contribution Flexibility: May not be suitable for those in higher tax brackets during their working years.

Comparative Analysis: After-Tax vs. Roth

When deciding between the after-tax and Roth 401(k), it’s crucial to consider your current and future financial situation:

Income Tax Brackets

If you’re currently in a higher tax bracket and anticipate a similar or lower bracket during retirement, the after-tax 401(k) might be more suitable. However, if you expect your tax bracket to increase in the future, the Roth 401(k) could provide significant tax advantages.

Financial Goals and Timeframe

Consider your retirement goals and the timeframe you have to save. The Roth 401(k) may be more appealing if you’re starting your retirement savings later in life and aim to minimize taxes during retirement. On the other hand, the after-tax 401(k) can be a strategic choice for those with a longer investment horizon.

Tax Implications

Understand the tax implications of both options. The after-tax 401(k) provides an immediate tax benefit, but it’s crucial to assess your tax situation during retirement. The Roth 401(k), while requiring upfront taxes, offers tax-free withdrawals, making it an attractive long-term option.

Performance and Investment Considerations

Both the after-tax and Roth 401(k) offer a range of investment options, allowing you to diversify your portfolio. Here’s a glimpse at their performance and investment features:

Investment Options

Both plans typically provide access to a variety of investment choices, including stocks, bonds, and mutual funds. The specific options may vary depending on your employer’s 401(k) provider.

Performance and Growth

The performance of your 401(k) will depend on the specific investments you choose. Both plans have the potential for substantial growth over time, especially when invested in a well-diversified portfolio.

Fee Structure

It’s essential to review the fee structure associated with your 401(k) plan. Fees can vary between providers and plans, so understanding these costs is crucial for maximizing your retirement savings.

Making the Right Choice

Selecting between an after-tax and Roth 401(k) is a significant decision that can impact your financial future. Here are some key considerations to guide your choice:

Tax Bracket Analysis

Evaluate your current and future tax brackets. If you’re in a higher tax bracket now and expect it to remain high during retirement, the after-tax 401(k) might be favorable. Conversely, if you anticipate a higher tax bracket in the future, the Roth 401(k) could offer more benefits.

Long-Term Planning

Consider your retirement timeline and goals. The Roth 401(k) can be an excellent choice for long-term retirement planning, especially if you’re starting later in life. The after-tax 401(k) may be more suitable if you have a longer investment horizon and aim to defer taxes.

Diversification

Utilize the investment options available to create a diversified portfolio. This strategy can help mitigate risk and maximize potential returns over time.

FAQs

Can I have both an after-tax and Roth 401(k)?

+Yes, many employers offer the flexibility to contribute to both types of 401(k) plans simultaneously. This allows you to diversify your retirement savings strategy and potentially benefit from the advantages of both options.

Are there any income limits for contributing to a Roth 401(k)?

+Yes, there are income limits for contributing to a Roth 401(k). For the 2023 tax year, the income limits are 144,000 for single filers and 214,000 for married couples filing jointly. If your income exceeds these limits, you may not be able to contribute to a Roth 401(k) directly, but you may still have other retirement savings options.

What happens if I change jobs and my new employer doesn’t offer a Roth 401(k)?

+If you change jobs and your new employer doesn’t offer a Roth 401(k), you can roll over your existing Roth 401(k) balance into a Roth IRA. This allows you to maintain the tax-free benefits of the Roth contribution. Alternatively, you can leave the funds in your previous employer’s plan or roll them into a traditional IRA, which would be subject to different tax rules upon withdrawal.