Billonaire Taxes

The taxation of billionaires is a topic of significant interest and debate, particularly in the context of wealth inequality and societal responsibility. As the wealth gap continues to widen, the discussion around effective taxation strategies for the ultra-rich gains momentum. This article delves into the complex world of billionaire taxes, exploring the current landscape, potential reforms, and the implications for both individuals and society as a whole.

Understanding Billionaire Taxation

Billionaires, individuals with a net worth exceeding $1 billion, represent a unique segment of the global economy. Their immense wealth, often derived from successful business ventures, investments, or inheritance, raises important questions about the fair distribution of wealth and the role of taxation in addressing income disparities.

The Current Landscape

Taxation policies for billionaires vary widely across jurisdictions, with some countries implementing specific taxes targeting ultra-high-net-worth individuals while others rely on more general income and wealth tax structures. In the United States, for instance, the federal income tax system applies progressive rates to personal income, including capital gains and dividends, with the highest bracket currently set at 37%.

However, the complexity of billionaire tax strategies goes beyond income tax. Wealth taxes, which are levied on an individual's net worth rather than their income, have gained attention as a potential solution to wealth inequality. Countries like France, Spain, and Switzerland have implemented wealth taxes, albeit with varying degrees of success and challenges.

| Country | Wealth Tax Rate | Threshold |

|---|---|---|

| France | 0.5% - 1.5% | €1.3 million |

| Spain | 0.2% - 2.5% | €700,000 |

| Switzerland | 0.1% - 0.9% | Varies by Canton |

Challenges and Evasion

Implementing effective taxation on billionaires is not without its challenges. Billionaires often have access to sophisticated tax planning strategies and offshore accounts, making it difficult for governments to accurately assess and collect taxes. Additionally, the global nature of many billionaires’ businesses and investments further complicates tax jurisdiction and enforcement.

Tax evasion and avoidance strategies employed by the ultra-rich have been well-documented, ranging from complex corporate structures to the utilization of tax havens. These practices not only deprive governments of much-needed revenue but also exacerbate wealth inequality by allowing the wealthy to accumulate wealth at a disproportionate rate.

Proposed Reforms and Their Implications

Addressing the challenges of billionaire taxation requires innovative and comprehensive reforms. Several proposals have emerged, each with its own set of advantages and potential drawbacks.

The Wealth Tax Debate

Advocates of wealth taxes argue that they provide a more accurate representation of an individual’s financial standing and can help bridge the wealth gap. By taxing net worth, rather than income, wealth taxes capture the accumulated wealth of billionaires, including assets like real estate, stocks, and private businesses.

However, critics argue that wealth taxes can discourage investment, reduce incentives for entrepreneurship, and potentially lead to capital flight. Additionally, the administrative burden and challenges of valuing diverse assets pose practical implementation challenges.

Progressive Income Tax Rates

Another approach is to focus on progressive income tax rates, increasing the burden on higher earners. This strategy aims to capture a larger share of income from the ultra-rich, particularly from capital gains and dividends, which are often taxed at lower rates than regular income.

Proponents of this method argue that it is a more straightforward and administratively feasible approach, as income is easier to track and tax. However, critics argue that it may discourage investment and that the mobility of high-net-worth individuals could lead to a brain drain as they seek more tax-friendly jurisdictions.

Global Minimum Tax

The concept of a global minimum tax has gained traction as a potential solution to tax evasion and the race to the bottom in corporate tax rates. By setting a minimum tax rate that all countries must adhere to, the global minimum tax aims to prevent multinational corporations and individuals from exploiting tax havens.

This reform could significantly impact billionaires who derive income from global operations. While it would address tax avoidance, critics argue that it may not effectively target the ultra-rich, as it primarily focuses on corporate taxation rather than individual wealth.

The Impact on Society and the Economy

The taxation of billionaires has far-reaching implications for society and the economy. Effective taxation strategies can help fund critical public services, reduce wealth inequality, and promote social mobility.

Funding Public Goods

Tax revenue from billionaires can be a significant source of funding for essential public goods and services, such as education, healthcare, and infrastructure. By contributing their fair share, the ultra-rich can help alleviate the tax burden on middle- and lower-income individuals, ensuring a more equitable distribution of resources.

Reducing Wealth Inequality

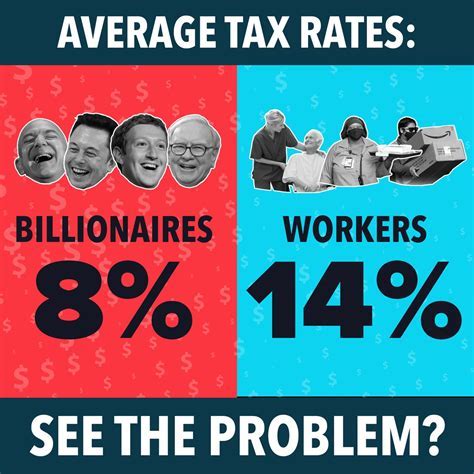

Wealth inequality is a pressing issue, with the top 1% of earners often controlling a disproportionate share of wealth. Progressive taxation strategies, including wealth taxes, can help redistribute wealth, providing opportunities for economic mobility and reducing the concentration of wealth at the top.

Economic Growth and Investment

While taxation is essential for societal well-being, it must also consider the impact on economic growth and investment. Excessive taxation on billionaires may discourage investment, innovation, and entrepreneurship, potentially slowing economic growth and job creation. Finding the right balance is crucial to ensure a healthy economy while addressing wealth disparities.

Case Studies: Billionaire Taxation in Practice

Examining real-world examples provides valuable insights into the effectiveness and challenges of billionaire taxation. Let’s explore a few case studies.

France: The Wealth Tax Experiment

France implemented a wealth tax, known as the Impôt de solidarité sur la fortune (ISF), in 1982. This tax applied to individuals with net assets exceeding €1.3 million. However, the tax was abolished in 2018 due to concerns over its impact on investment and the potential for capital flight.

The French experience highlights the delicate balance between taxation and economic incentives. While the wealth tax aimed to address wealth inequality, it may have inadvertently discouraged investment and contributed to a brain drain.

Norway: A Progressive Income Tax Model

Norway has a progressive income tax system with a top marginal rate of 46.4%. This tax structure captures a significant portion of income from the country’s wealthiest individuals, including billionaires. Additionally, Norway has implemented a wealth tax on certain assets, such as real estate.

Norway's approach demonstrates that a well-designed progressive income tax system can effectively capture revenue from the ultra-rich without deterring investment. The country's strong social safety net and robust public services further illustrate the potential benefits of progressive taxation.

Singapore: Low Taxes, High Growth

Singapore is known for its low tax rates, including a top marginal income tax rate of 22% and no wealth tax. Despite this, the city-state has a thriving economy and has attracted numerous high-net-worth individuals and multinational corporations.

Singapore's success highlights the complexity of the billionaire tax debate. While low taxes may attract investment and foster economic growth, they can also exacerbate wealth inequality and limit funding for public services. Finding the right balance is essential for long-term societal and economic prosperity.

Conclusion: Navigating the Complex World of Billionaire Taxation

The taxation of billionaires is a multifaceted issue that requires careful consideration and innovative solutions. While the potential for reducing wealth inequality and funding public goods is significant, policymakers must also consider the impact on economic growth and investment.

Effective taxation strategies should aim to strike a balance between societal well-being and economic incentives. By learning from both successful and unsuccessful case studies, policymakers can develop tailored approaches that address the unique challenges and opportunities presented by billionaire taxation.

As the debate continues, it is crucial to remember that billionaire taxes are not a panacea for all societal ills. However, when implemented thoughtfully, they can play a vital role in creating a more equitable and prosperous society.

What is the current global trend in billionaire taxation?

+The global trend leans towards more progressive taxation of the ultra-rich, with an increasing number of countries considering or implementing wealth taxes. However, the effectiveness and long-term sustainability of these taxes are still being evaluated.

How do billionaires respond to higher tax rates?

+Billionaires may respond to higher tax rates by engaging in tax planning strategies, moving their assets to tax havens, or even changing their residency to lower-tax jurisdictions. Effective taxation policies must consider these potential responses to ensure revenue collection.

What are the potential benefits of a global minimum tax?

+A global minimum tax could prevent tax avoidance and the race to the bottom in corporate tax rates. It could also ensure that multinational corporations and individuals pay their fair share, contributing to public goods and services in their host countries.