Ira Beneficiary Tax

When planning for retirement, it's essential to understand the tax implications that come with different types of retirement accounts, including Individual Retirement Accounts (IRAs). One key aspect to consider is the tax treatment of IRA beneficiaries, especially when it comes to distributions and potential tax liabilities.

In this comprehensive guide, we will delve into the world of IRA beneficiary tax, exploring the rules, regulations, and strategies to navigate this complex topic. By the end, you'll have a clear understanding of how IRA beneficiary tax works and the steps you can take to optimize your financial planning.

Understanding IRA Beneficiary Designations

Before diving into the tax implications, let’s establish a foundation by understanding IRA beneficiary designations. An IRA beneficiary is an individual or entity designated to receive the assets or benefits from an IRA after the account owner’s death.

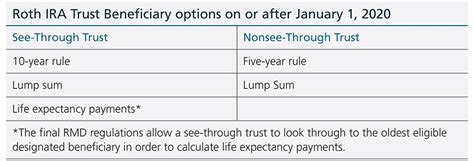

The IRA owner has the flexibility to name one or more beneficiaries, and these designations can be made through a trust, a spouse, children, or even a charity. The choice of beneficiary has significant tax implications, so it's crucial to make informed decisions during the planning process.

Traditional IRA vs. Roth IRA Beneficiaries

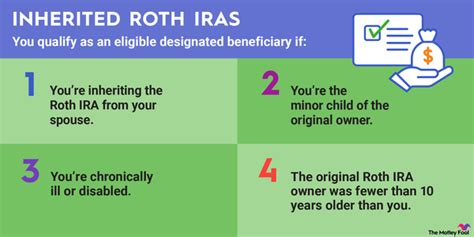

It’s important to distinguish between the tax treatment of beneficiaries for traditional IRAs and Roth IRAs. While both account types offer tax advantages during the owner’s lifetime, the rules for beneficiaries differ.

For traditional IRAs, beneficiaries generally face tax obligations on the distributions they receive. In contrast, Roth IRA beneficiaries often enjoy tax-free distributions, making it a potentially more advantageous choice for legacy planning.

| IRA Type | Beneficiary Tax Implications |

|---|---|

| Traditional IRA | Distributions to beneficiaries are typically taxable. |

| Roth IRA | Beneficiaries may receive tax-free distributions. |

Tax Rules for IRA Beneficiaries

Now, let’s explore the specific tax rules that apply to IRA beneficiaries. These rules can vary based on factors such as the beneficiary’s relationship to the deceased, the type of IRA, and the distribution options chosen.

Spousal Beneficiaries

If the IRA owner’s spouse is named as the beneficiary, they have the most flexible options. A spouse can:

- Treat the IRA as their own, rolling it over into their own IRA.

- Defer distributions and continue to grow the IRA tax-free until they reach 72.

- Take distributions based on their life expectancy, stretching out the tax liability.

By choosing the appropriate distribution option, a spouse can minimize their tax burden and maximize the growth potential of the IRA.

Non-Spouse Beneficiaries

For non-spouse beneficiaries, the tax rules are more stringent. They must begin taking required minimum distributions (RMDs) within one year of the IRA owner’s death.

The RMDs are calculated based on the beneficiary's life expectancy using IRS-provided tables. These distributions are subject to income tax, and failing to take the required distributions can result in significant penalties.

Non-spouse beneficiaries cannot simply roll over the IRA into their own account; they must follow the distribution rules set by the IRS.

Strategies for IRA Beneficiary Planning

Given the complex tax rules surrounding IRA beneficiaries, it’s essential to develop a well-thought-out strategy. Here are some key considerations and strategies to optimize your IRA beneficiary planning:

Choose Beneficiaries Wisely

The choice of beneficiary can significantly impact the tax treatment and potential growth of your IRA. Consider the following when naming beneficiaries:

- If you have a spouse, understand their options and the potential tax advantages.

- For non-spouse beneficiaries, weigh the tax implications and the beneficiary’s financial needs.

- Explore the use of trusts as beneficiaries to provide additional control and flexibility.

Utilize Stretching Strategies

Stretching an IRA refers to the practice of taking distributions over an extended period, typically based on the beneficiary’s life expectancy. This strategy can minimize tax liabilities and maximize the growth potential of the IRA.

By stretching the IRA, beneficiaries can receive tax-efficient distributions, allowing the IRA to continue growing tax-deferred.

Consider Roth Conversions

Converting a traditional IRA to a Roth IRA can offer significant tax advantages for beneficiaries. While there may be a tax hit during the conversion, the Roth IRA provides tax-free distributions to beneficiaries, making it an attractive legacy planning tool.

By converting a portion of your traditional IRA to a Roth IRA, you can provide tax-free benefits to your beneficiaries while also enjoying tax-free growth during your lifetime.

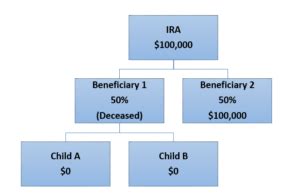

Use Multiple Beneficiaries

Naming multiple beneficiaries can provide flexibility and control. You can allocate specific percentages of your IRA to different beneficiaries, allowing for customized distributions based on their needs and tax situations.

This strategy can be particularly beneficial when you have multiple dependents or want to provide for multiple generations.

Real-World Examples and Case Studies

To illustrate the concepts and strategies discussed, let’s explore some real-world examples and case studies:

Case Study 1: Spousal Beneficiary

Imagine John, a retired teacher, who has a traditional IRA worth $500,000. He names his wife, Mary, as the sole beneficiary. Mary, being under 70.5 years old, has the option to treat the IRA as her own and defer distributions until she reaches 72.

By doing so, Mary can allow the IRA to continue growing tax-deferred, and she can strategically time her distributions to minimize her tax liability.

Case Study 2: Non-Spouse Beneficiary

Consider Sarah, a successful businesswoman who passes away, leaving a Roth IRA worth $250,000 to her daughter, Emily. As a non-spouse beneficiary, Emily must begin taking RMDs within one year of Sarah’s death.

By understanding the tax rules and working with a financial advisor, Emily can optimize her distributions to minimize taxes and maximize the growth potential of the Roth IRA.

Expert Insights and Tips

Additionally, consider the following expert tips:

- Review and update your beneficiary designations regularly to reflect life changes and your financial goals.

- Explore the use of trusts to provide additional control and asset protection for your beneficiaries.

- Understand the tax implications of different distribution options and choose the strategy that aligns with your financial plan.

Future Implications and Considerations

As retirement planning and tax laws evolve, it's essential to stay informed and adaptable. Here are some future implications and considerations to keep in mind:

Potential Changes in Tax Laws

Tax laws are subject to change, and future legislative actions could impact the tax treatment of IRA beneficiaries. Stay updated on any proposed changes and work with professionals to adapt your planning accordingly.

Longevity and Health Considerations

When planning for IRA beneficiaries, consider the potential lifespan of your beneficiaries. Stretching strategies can be particularly beneficial if your beneficiaries have a longer life expectancy.

Additionally, health considerations can impact the choice of beneficiary. If a beneficiary has significant health issues, they may benefit from receiving distributions sooner rather than later.

Inheritance and Estate Planning

IRA beneficiary planning is an integral part of your overall estate planning. Ensure that your IRA beneficiary designations align with your broader estate plan to avoid any conflicts or unintended consequences.

Conclusion

Navigating the world of IRA beneficiary tax can be complex, but with the right knowledge and strategies, you can optimize your retirement planning and provide for your loved ones effectively.

By understanding the rules, exploring flexible options, and seeking professional guidance, you can make informed decisions to minimize tax liabilities and maximize the growth potential of your IRA. Remember, proper planning today can lead to a more secure financial future for your beneficiaries.

Can a beneficiary roll over an inherited IRA into their own account?

+For non-spouse beneficiaries, a direct rollover is not allowed. They must take distributions based on their life expectancy or the 5-year rule. Spouses have more flexibility and can roll over the inherited IRA into their own account.

What happens if a beneficiary fails to take the required minimum distributions (RMDs)?

+Failing to take the required minimum distributions can result in a 50% penalty on the amount that should have been distributed. It’s crucial to adhere to the RMD rules to avoid these significant penalties.

Can a beneficiary convert an inherited traditional IRA to a Roth IRA?

+Yes, a beneficiary can convert an inherited traditional IRA to a Roth IRA. This can provide tax advantages, but it’s essential to consider the potential tax implications and consult a professional.